2025 EPT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: EPT's Market Position and Investment Value

Balance (EPT) is an AI-focused Web3 user experience infrastructure that seamlessly integrates artificial intelligence with blockchain technology and decentralized applications. Since its launch in 2025, the project has established itself as a next-generation protocol for social and gaming ecosystems. As of December 2025, EPT's fully diluted valuation stands at $13,990,000, with a circulating supply of approximately 2.44 billion tokens, currently trading at $0.001399 per token. This innovative asset, recognized for its unique approach to combining AI Agents with decentralized infrastructure, is increasingly playing a pivotal role in the emerging intersection of artificial intelligence and Web3 entertainment.

This article will comprehensively analyze EPT's price trends through 2030, integrating historical market patterns, supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and practical investment strategies. Whether you're evaluating entry points on Gate.com or assessing long-term portfolio allocation, this guide offers evidence-based insights into Balance's market trajectory and potential opportunities.

Balance (EPT) Market Analysis Report

I. EPT Price History Review and Current Market Status

EPT Historical Price Evolution

Based on available data, Balance (EPT) demonstrates the following price trajectory:

- April 2025: ATH (All-Time High) reached $0.03, marking the peak valuation since token launch.

- December 23, 2025: ATL (All-Time Low) recorded at $0.00139, representing significant downward pressure.

- December 24, 2025: Current trading price stands at $0.001399, reflecting a -3.38% decline over the past 24 hours.

EPT Current Market Position

As of December 24, 2025, Balance (EPT) exhibits the following market metrics:

Price and Volatility:

- Current price: $0.001399

- 24-hour change: -3.38%

- 7-day change: -15.8%

- 30-day change: -45.21%

- 1-hour change: -0.36%

Market Capitalization:

- Circulating market cap: $3,415,775.08

- Fully diluted valuation (FDV): $13,990,000

- Market cap to FDV ratio: 24.42%

Supply Metrics:

- Circulating supply: 2,441,583,333 EPT

- Total/Max supply: 10,000,000,000 EPT

- Circulation ratio: 24.42%

Trading Activity:

- 24-hour trading volume: $137,484.46

- Token holders: 141

- Market dominance: 0.00044%

- Market ranking: 1,776

Network and Infrastructure:

- Supported blockchains: ERC-20 (Ethereum) and BEP-20 (BSC)

- Listed on: Gate.com and select other venues (1 exchange total)

Visit current EPT market price on Gate.com

EPT Market Sentiment Indicator

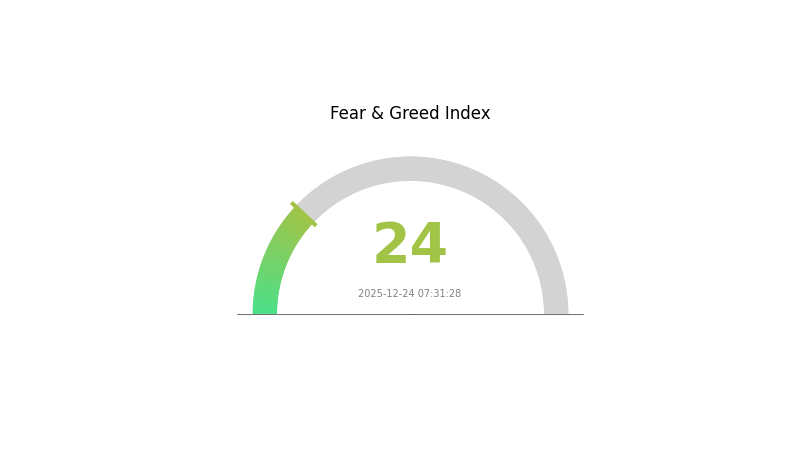

2025-12-24 Fear and Greed Index: 24(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 24. This indicates significant market pessimism and heightened uncertainty among investors. During periods of extreme fear, markets often present contrarian opportunities for long-term investors. Risk-averse traders should maintain caution, while experienced investors may consider accumulating quality assets at depressed valuations. Monitor market developments closely and ensure proper risk management. Visit Gate.com to track real-time sentiment indicators and make informed trading decisions based on comprehensive market data.

EPT Holdings Distribution

Click to view current EPT Holdings Distribution

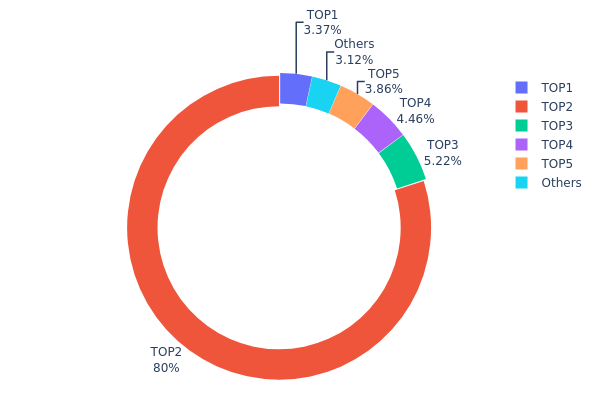

The address holdings distribution chart provides a comprehensive overview of how EPT tokens are concentrated across blockchain addresses, revealing the concentration patterns and decentralization characteristics of the token's supply. This metric is essential for assessing market structure stability, identifying potential manipulation risks, and evaluating the token's resilience against large-scale sell-off scenarios.

EPT exhibits a notably skewed distribution pattern, with significant concentration risks concentrated in a limited number of addresses. The second-ranked address holds 79.97% of the total supply, representing an exceptionally high concentration level. This dominant position substantially exceeds typical decentralization thresholds and suggests potential centralization concerns. When combined with the top five addresses, which collectively control 96.86% of all tokens, the distribution becomes increasingly concerning. Only 3.14% of the token supply remains distributed across all remaining addresses, indicating an extremely fragmented long-tail structure.

This pronounced concentration creates meaningful implications for market dynamics and price discovery mechanisms. The majority holder possesses overwhelming influence over supply dynamics, with the capacity to significantly impact market price through concentrated position movements. The remaining addresses hold minimal influence over market outcomes, resulting in a market structure that heavily depends on the decisions and actions of a few key holders. Such distribution patterns typically correlate with elevated volatility potential and reduced market liquidity depth, as the absence of distributed stakeholder involvement limits organic price discovery mechanisms.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 73913.88K | 3.36% |

| 2 | 0x15ec...dc74b0 | 1754525.05K | 79.97% |

| 3 | 0xa312...4ab647 | 114491.85K | 5.21% |

| 4 | 0xe809...6f74a7 | 97901.06K | 4.46% |

| 5 | 0x1ab4...8f8f23 | 84785.62K | 3.86% |

| - | Others | 68357.10K | 3.14% |

II. Core Factors Affecting EPT's Future Price

Regulatory Policy Environment

-

Impact of Unfavorable Regulations: Any adverse regulatory policies could have a significant impact on platform development and EPT's value. Regulatory uncertainty remains a key factor that investors must closely monitor.

-

Policy Continuity: Consistent and supportive regulatory frameworks are essential for sustainable growth. Discontinuity or frequent policy changes can undermine investor and user confidence in the project's future development potential.

Market Information Aggregation

-

Core Value Mechanism: The fundamental value of EPT lies not in speculation, but in information aggregation. Through financial incentives, market participants are incentivized to express their judgments about future events more honestly. Market prices ultimately become a "collective consensus probability."

-

Price Discovery: This information aggregation function helps establish more accurate market pricing mechanisms, reflecting the collective wisdom of all market participants.

Supply and Demand Dynamics

-

Supply Chain Stability: The stability of the supply chain is a critical factor influencing EPT's price trajectory. Disruptions in supply or imbalances in supply-demand relationships could potentially impact the token's valuation.

-

Market Sentiment: Investor attention to supply dynamics and market sentiment shifts can drive significant price movements based on changing expectations about future availability and utility.

Three、2025-2030 EPT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00131-$0.00141

- Neutral Forecast: $0.00141-$0.00171

- Optimistic Forecast: $0.00171-$0.00204 (requires sustained market demand and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual accumulation, characterized by moderate volatility and incremental price discovery as the project establishes stronger market presence.

- Price Range Forecast:

- 2026: $0.00145-$0.00183

- 2027: $0.00148-$0.00238

- 2028: $0.00119-$0.00256

- Key Catalysts: Enhanced protocol adoption, strategic partnerships, improved liquidity mechanisms on platforms such as Gate.com, and overall market sentiment recovery in the digital assets sector.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00220-$0.00253 (assumes steady ecosystem growth and mainstream institutional interest in mid-cap digital assets)

- Optimistic Scenario: $0.00253-$0.00347 (assumes significant protocol utility expansion and broader market capitalization increase)

- Transformative Scenario: $0.00347+ (assumes breakthrough adoption metrics, major ecosystem milestones, and substantial institutional capital inflows into the asset class)

- December 24, 2025: EPT trading at $0.00131-$0.00204 (current year-end consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00204 | 0.00141 | 0.00131 | 0 |

| 2026 | 0.00183 | 0.00173 | 0.00145 | 23 |

| 2027 | 0.00238 | 0.00178 | 0.00148 | 27 |

| 2028 | 0.00256 | 0.00208 | 0.00119 | 48 |

| 2029 | 0.00253 | 0.00232 | 0.0022 | 65 |

| 2030 | 0.00347 | 0.00242 | 0.00233 | 73 |

Balance (EPT) Token Investment Analysis Report

IV. EPT Professional Investment Strategy and Risk Management

EPT Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Risk-averse investors with 1-3 year investment horizons who believe in AI+Web3 integration potential

- Operational Recommendations:

- Accumulate EPT during market downturns, particularly when price falls below historical support levels

- Hold tokens through market cycles to capture potential upside as the Balance ecosystem matures

- Establish dollar-cost averaging (DCA) purchases over 3-6 months to reduce timing risk

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the recent all-time low of $0.00139 (December 23, 2025) as a critical support level and all-time high of $0.03 (April 21, 2025) as resistance

- Volume Analysis: Track 24-hour trading volume trends on Gate.com to identify potential breakout opportunities

- Wave Trading Key Points:

- Enter positions when momentum indicators show oversold conditions during downtrends

- Exit positions near identified resistance levels to capture gains during upward movements

EPT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation

- Active Investors: 3-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance EPT holdings with established blockchain assets and traditional investments to reduce concentration risk

- Stop-Loss Implementation: Set stop-loss orders at 15-20% below entry price to limit downside exposure

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading and active portfolio management

- Cold Storage Best Practice: For long-term holdings beyond 3 months, consider transferring EPT to self-custody solutions with proper backup procedures

- Security Considerations: Enable two-factor authentication on all exchange accounts, use hardware-based security keys, never share private keys or seed phrases, and verify contract addresses before token transfers

V. EPT Potential Risks and Challenges

EPT Market Risk

- Early Stage Project Risk: Balance operates as an emerging AI+Web3 infrastructure platform with limited historical trading data; the project's long-term viability remains unproven

- High Volatility Risk: EPT has experienced significant price fluctuations, declining 45.21% over the past 30 days and 15.8% over the past 7 days, indicating substantial market volatility

- Liquidity Risk: With relatively low trading volume of $137,484 in 24 hours across only one exchange listing, EPT faces limited liquidity that could impact execution on large orders

EPT Regulatory Risk

- Regulatory Uncertainty: AI-focused tokens and Web3 applications face evolving regulatory frameworks across different jurisdictions that could negatively impact token utility or adoption

- Geographic Restrictions: Changes in cryptocurrency regulations in major markets could restrict access or trading opportunities for certain investor classes

- Compliance Requirements: Balance's integration of AI technology may trigger additional regulatory scrutiny related to data privacy and AI governance standards

EPT Technology Risk

- Smart Contract Risk: As an ERC-20 and BEP-20 token, EPT depends on the underlying Ethereum and Binance Smart Chain networks; vulnerabilities in these protocols could affect token security

- Protocol Development Risk: The Balance ecosystem's multi-layer architecture (application, platform, protocol, token, and infrastructure layers) introduces complexity that could lead to technical implementation challenges

- Scalability Concerns: As adoption increases, the Balance network must effectively scale to maintain performance and user experience across gaming and entertainment applications

VI. Conclusion and Action Recommendations

EPT Investment Value Assessment

Balance represents a speculative investment opportunity at the intersection of artificial intelligence and decentralized finance. The project's focus on AI agents for gaming and entertainment addresses a significant market opportunity, with the fully diluted market capitalization of $13.99 million indicating substantial room for growth. However, the token's 45.21% decline over the past 30 days and limited exchange coverage reflect both market skepticism and early-stage volatility typical of emerging protocols. The current circulating supply of 2.44 billion EPT tokens (24.42% of total supply) suggests significant future dilution risks. Investors should evaluate Balance's technological differentiation, ecosystem adoption rates, and community engagement metrics before committing capital.

EPT Investment Recommendations

✅ Beginners: Start with small positions (1-2% of portfolio) purchased gradually through Gate.com, focus on understanding the Balance ecosystem fundamentals before increasing exposure, and prioritize capital preservation over maximizing returns

✅ Experienced Investors: Deploy tactical positions around identified support levels near $0.00139, use technical analysis to identify accumulation zones, and maintain strict position sizing discipline given the token's volatility profile

✅ Institutional Investors: Conduct comprehensive due diligence on Balance's development roadmap and team credentials, evaluate market adoption metrics for AI agents in gaming applications, and structure investments with appropriate risk controls and hedge positions

EPT Trading Participation Methods

- Direct Purchase: Buy EPT directly on Gate.com using major cryptocurrency pairs or fiat on-ramps, ensuring you verify the correct contract address (0x3dc8e2d80b6215a1bccae4d38715c3520581e77c on both ETH and BSC)

- Portfolio Integration: Use Gate.com Web3 wallet to manage EPT holdings alongside other digital assets with integrated portfolio tracking and risk analysis tools

- Educational Research: Monitor the Balance project website (https://balance.fun), review the whitepaper (https://balancefun.gitbook.io/balance), and follow official updates via Twitter (https://x.com/RealBalanceFun) to stay informed on ecosystem developments

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before making investment decisions. Never invest more than you can afford to lose completely.

FAQ

Is an ellipsis coin a good investment?

Ellipsis coin shows strong potential with growing trading volume and solid fundamentals. Market analysts project positive price momentum, making it an attractive option for crypto investors seeking growth opportunities in the DeFi space.

What is the balance EPT coin price prediction?

Based on technical indicators, Balance EPT is predicted to reach $0.001098 by January 21, 2026, representing a -25.46% decline from current levels.

What factors could influence EPT price in 2025?

EPT price in 2025 will be influenced by market sentiment, adoption growth, blockchain developments, regulatory environment, trading volume, macroeconomic conditions, and competitive landscape within the crypto ecosystem.

What is Ellipsis (EPT) and what is its use case?

Ellipsis (EPT) is a decentralized stablecoin protocol built on Arbitrum, designed to provide efficient stablecoin swaps and liquidity solutions. Its primary use case is enabling low-slippage trading and yield generation for stablecoin holders through an automated market maker (AMM) mechanism.

How does EPT compare to other DeFi tokens in terms of price potential?

EPT demonstrates strong price potential with projections reaching $0.0694 by 2030. Backed by consistent DeFi adoption and market growth, EPT outperforms many comparable tokens, driven by increased TVL and ecosystem development.

2025 QORPO Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 BRIC Price Prediction: Expert Analysis and Market Forecast for the Next Year

2025 AWE Price Prediction: Comprehensive Analysis of Market Trends and Future Growth Potential

Is Sleepless AI (AI) a good investment?: Analyzing the Long-Term Growth Potential and Risks in the Emerging AI Market

2025 VVV Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 MORE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps