2025 KAIA Price Prediction: Market Analysis and Growth Potential for the Rising Digital Asset

Introduction: KAIA's Market Position and Investment Value

Kaia (KAIA), as a Layer 1 blockchain based on EVM, has made significant strides since its inception. As of 2025, KAIA's market capitalization has reached $937,765,476, with a circulating supply of approximately 5,856,641,747 tokens, and a price hovering around $0.16012. This asset, hailed as the "Web 3.0 enabler," is playing an increasingly crucial role in empowering technology, business, and individuals in the Web 3.0 era.

This article will comprehensively analyze KAIA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. KAIA Price History Review and Current Market Status

KAIA Historical Price Evolution

- 2024: KAIA reached its all-time high of $0.406698 on December 3rd, marking a significant milestone in its price history.

- 2025: The market experienced a downturn, with KAIA hitting its all-time low of $0.090737 on April 7th.

- 2025: KAIA has shown resilience, recovering from its low point and currently trading at $0.16012.

KAIA Current Market Situation

As of September 19, 2025, KAIA is trading at $0.16012, with a market capitalization of $937,765,476.55. The token has seen a slight decrease of 0.14% in the past 24 hours, but it has shown positive growth over longer periods. KAIA has experienced a 1.43% increase over the past week and a substantial 10.63% gain over the last 30 days. The yearly performance is even more impressive, with a 20.38% increase. The token's trading volume in the last 24 hours stands at $1,749,906.25, indicating moderate market activity. KAIA's current price is positioned between its all-time high and low, suggesting a potential for further growth while also highlighting the volatility of the crypto market.

Click to view the current KAIA market price

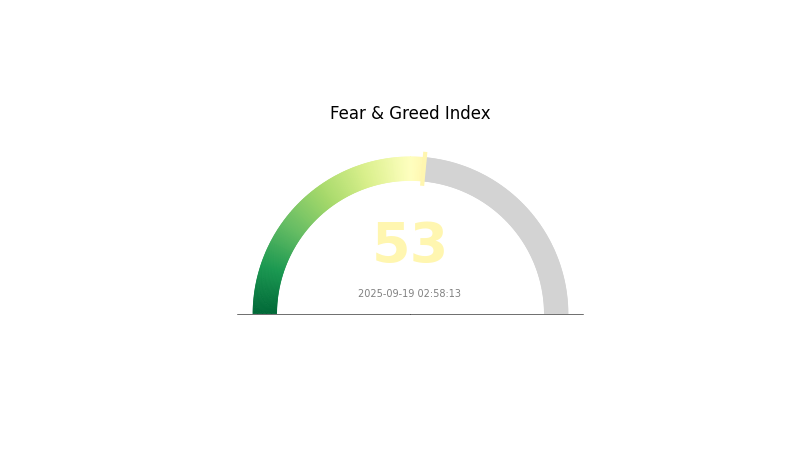

KAIA Market Sentiment Indicator

2025-09-19 Fear and Greed Index: 53 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of equilibrium, with the Fear and Greed Index hovering at 53, indicating a neutral sentiment. This balanced mood suggests that investors are neither overly fearful nor excessively optimistic. It's a time for cautious optimism, where market participants should remain vigilant and make informed decisions based on thorough research and analysis. While the neutral sentiment provides a stable foundation, it's crucial to stay updated on market trends and potential catalysts that could sway the sentiment in either direction.

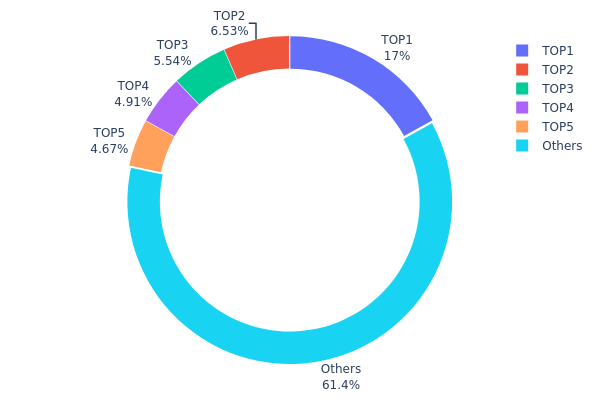

KAIA Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of KAIA tokens among various wallet addresses. Analysis of this data reveals a moderate level of concentration, with the top address holding 16.99% of the total supply, followed by four addresses holding between 4.67% and 6.53% each. Collectively, the top five addresses control 38.64% of KAIA tokens, while the remaining 61.36% is distributed among other addresses.

This distribution pattern suggests a relatively balanced ecosystem, avoiding extreme centralization. However, the significant holdings of the top addresses, particularly the 16.99% held by the largest holder, could potentially influence market dynamics. While not alarming, this concentration level warrants monitoring, as large holders may have the capacity to impact price movements or liquidity if they decide to make substantial trades.

Overall, the current KAIA holdings distribution reflects a moderate level of decentralization, which contributes to a relatively stable on-chain structure. This distribution pattern may help mitigate extreme volatility and reduce the risk of market manipulation by any single entity, fostering a more resilient and balanced market ecosystem for KAIA tokens.

Click to view the current KAIA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7f59...88f4c7 | 1040006.23K | 16.99% |

| 2 | 0xf208...02ae10 | 400000.01K | 6.53% |

| 3 | 0xdc41...d833c6 | 339173.00K | 5.54% |

| 4 | 0xd443...4a6f1f | 300505.59K | 4.91% |

| 5 | 0xdada...b94281 | 285714.29K | 4.67% |

| - | Others | 3756861.19K | 61.36% |

II. Key Factors Affecting KAIA's Future Price

Supply Mechanism

- Current Impact: The total supply of KAIA is 6,122,392,031.797905, with 6,122,392,041.38125 in circulation. This suggests a fully diluted supply, which may limit upward price pressure from scarcity.

Institutional and Whale Dynamics

-

Corporate Adoption: Kaia blockchain, developed through the merger of Klaytn and Finschia (created by Kakao and LINE respectively), has gained significant traction. It has generated over 38 million wallets, integrated with 80+ mini-programs, and achieves 100,000-150,000 daily active addresses.

-

National Policies: South Korea's regulatory environment has been evolving:

- 2024: Implementation of cryptocurrency gains taxation, enhancing revenue collection.

- Kakao Pay, a major payment provider, has announced plans to enter the Korean won stablecoin market.

Macroeconomic Environment

- Geopolitical Factors: Recent geopolitical tensions, particularly involving Iran, have impacted the crypto market, causing volatility and affecting KAIA's price movements.

Technical Development and Ecosystem Building

-

Performance Enhancements: Kaia blockchain, as an EVM-compatible Layer 1, boasts extremely low transaction latency, 1-second block time, and instant transaction finality. These features provide a solid foundation for applications requiring real-time responses and smooth user experiences.

-

Ecosystem Applications: Kaia is focusing on distributed credentials and points systems. The network has already integrated with over 80 mini-programs, indicating a growing ecosystem of decentralized applications.

-

Stablecoin Development: Kaia is planning to launch a Korean won stablecoin, with the CEO suggesting that a "stablecoin summer" is imminent. This move could significantly enhance the utility and adoption of the Kaia network.

"The stablecoin summer is coming." - Kaia CEO

- Market Expansion: Kaia is leveraging its strong user base in South Korea, with industry analysts predicting that the market could reach 20 million users by the end of 2025, accounting for nearly 40% of the population.

III. KAIA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.12616 - $0.14000

- Neutral prediction: $0.15970 - $0.18000

- Optimistic prediction: $0.18000 - $0.20282 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential consolidation followed by gradual growth

- Price range forecast:

- 2027: $0.11139 - $0.22497

- 2028: $0.12637 - $0.27712

- Key catalysts: Technology improvements, expanding use cases, and overall crypto market sentiment

2029-2030 Long-term Outlook

- Base scenario: $0.24941 - $0.26063 (assuming steady growth and adoption)

- Optimistic scenario: $0.27185 - $0.29000 (with accelerated market penetration)

- Transformative scenario: $0.29000 - $0.33100 (with breakthrough applications and mainstream acceptance)

- 2030-12-31: KAIA $0.331 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.20282 | 0.1597 | 0.12616 | 0 |

| 2026 | 0.25558 | 0.18126 | 0.14138 | 13 |

| 2027 | 0.22497 | 0.21842 | 0.11139 | 36 |

| 2028 | 0.27712 | 0.22169 | 0.12637 | 38 |

| 2029 | 0.27185 | 0.24941 | 0.21948 | 55 |

| 2030 | 0.331 | 0.26063 | 0.25281 | 62 |

IV. Professional Investment Strategies and Risk Management for KAIA

KAIA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate KAIA tokens during market dips

- Set price targets and stick to your investment plan

- Store tokens in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profit at predetermined levels

KAIA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for KAIA

KAIA Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Other Layer 1 blockchains may outperform KAIA

- Market sentiment: Negative news can significantly impact price

KAIA Regulatory Risks

- Regulatory uncertainty: Changing regulations may affect KAIA's operations

- Compliance costs: Adapting to new regulations could be expensive

- Geographic restrictions: Some countries may restrict or ban KAIA trading

KAIA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability challenges: May face issues with increased network usage

- Technological obsolescence: Newer blockchain technologies could emerge

VI. Conclusion and Action Recommendations

KAIA Investment Value Assessment

KAIA shows potential as an EVM-compatible Layer 1 blockchain, but faces significant competition and market risks. Long-term value depends on adoption and technological development, while short-term volatility remains a concern.

KAIA Investment Recommendations

✅ Beginners: Start with small investments, focus on learning ✅ Experienced investors: Consider a balanced approach with careful risk management ✅ Institutional investors: Conduct thorough due diligence and consider KAIA as part of a diversified crypto portfolio

KAIA Trading Participation Methods

- Spot trading: Buy and sell KAIA tokens on Gate.com

- Staking: Participate in KAIA staking programs if available

- DeFi: Explore decentralized finance opportunities within the KAIA ecosystem

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Kaia in 2025?

Based on market analysis, Kaia's price is predicted to reach $0.3200 in 2025, representing a 100.75% increase from its current value.

How much is the Kaia coin worth today?

As of September 19, 2025, the Kaia coin is worth $0.1606. This price represents a slight increase from the previous day's value.

What does Kaia Coin do?

Kaia Coin supports the Kaia blockchain platform, which aims to drive Web3 adoption in Asia through enterprise-grade solutions and optimized infrastructure.

What is the old name of the Kaia token?

The old name of the Kaia token was Klay. It was renamed before the release of 3.86 billion units.

2025 SKL Price Prediction: Analyzing Potential Growth and Market Trends for Skale Network's Token

How Does Particle Network's PARTI Token Address Web3 Fragmentation?

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

Web3 Alpha Crypto: Top Investment Strategies for 2025

What is ONT: A Comprehensive Guide to Optical Network Terminals and Ontology Blockchain

What is USDP: Understanding the USD Coin Stablecoin and Its Role in Decentralized Finance

What is TRB: A Comprehensive Guide to The Republic of the Blockchain Token

What is BAND: A Comprehensive Guide to Understanding the Decentralized Social Platform

What is SNT: A Comprehensive Guide to Status Network Token and Its Role in the Ethereum Ecosystem