2025 MONPRO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: MONPRO's Market Position and Investment Value

Pixelmon (MONPRO) operates as a blockchain-native gaming IP developer and publisher, positioning itself at the forefront of mass-adoption gaming within the Web3 ecosystem. Since its token generation event (TGE) in May 2024, MONPRO has established a substantial community exceeding 1 million Web3-savvy gamers and fans. As of December 24, 2025, MONPRO's market capitalization stands at approximately $7.04 million, with a circulating supply of approximately 593.78 million tokens, trading at around $0.007043 per token. This asset represents a bridge between traditional gaming and blockchain technology, serving as a medium of value exchange within the Mon Protocol ecosystem.

This article will provide a comprehensive analysis of MONPRO's price movements and market dynamics, incorporating historical performance patterns, market supply-demand fundamentals, ecosystem development, and macroeconomic factors. Through this multifaceted examination, we aim to deliver professional price forecasts and actionable investment guidance for investors considering MONPRO as part of their digital asset portfolio.

MONPRO Market Analysis Report

I. MONPRO Price History Review and Current Market Status

MONPRO Historical Price Evolution Trajectory

-

May 27, 2024: Token launch at TGE with initial price of $0.12, marking the beginning of Pixelmon's market entry following the successful community building phase with over 1 million web3-savvy gamers and fans.

-

May 27, 2024 - December 23, 2025: Extended bear market cycle, with price declining from the all-time high of $0.90 (historical peak) to $0.006951 (all-time low), representing a catastrophic decline of approximately 99.23% over this period.

MONPRO Current Market Posture

Price Performance (as of December 24, 2025):

- Current Trading Price: $0.007043

- 24-Hour Change: -2.88%

- 7-Day Change: -23.35%

- 30-Day Change: -33.87%

- Year-to-Date Change: -94.24%

- 24-Hour Trading Range: $0.006951 - $0.007267

Market Capitalization Metrics:

- Fully Diluted Valuation (FDV): $7,039,601.27

- Current Market Cap: $4,182,009.38

- Market Cap to FDV Ratio: 59.38%

- 24-Hour Trading Volume: $12,761.42

- Market Dominance: 0.00022%

Token Distribution:

- Circulating Supply: 593,782,391.18 MONPRO (59.38% of total supply)

- Total Supply: 999,517,431 MONPRO

- Maximum Supply: Unlimited

- Active Token Holders: 72,004

Market Sentiment: Current market sentiment indicates "Extreme Fear" with a VIX reading of 24, reflecting heightened risk aversion across the cryptocurrency market. MONPRO's trading volume remains relatively modest at approximately $12.76K in 24-hour volume.

View current MONPRO market price

MONPRO Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at just 24. This indicates significant market pessimism and heightened risk aversion among investors. During periods of extreme fear, asset prices often reach attractive levels, creating potential buying opportunities for long-term investors with strong conviction. However, caution is warranted as market volatility may persist. Traders should carefully assess their risk tolerance and employ proper risk management strategies. Keep monitoring market developments closely on Gate.com for the latest insights and trading opportunities.

MONPRO Holdings Distribution

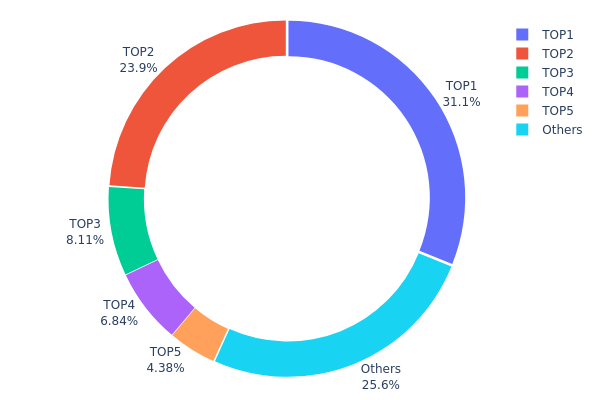

The address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, providing critical insights into the decentralization level and market structure of the MONPRO ecosystem. By examining the proportion of tokens held by top addresses relative to the total supply, this metric serves as a key indicator of potential market concentration risks and the sustainability of the project's tokenomics.

Current analysis of MONPRO's holdings distribution reveals significant concentration among top holders. The top two addresses collectively control 55.06% of the total supply, with the leading address alone holding 31.13%. When including the top five addresses, cumulative ownership reaches 74.36% of all tokens in circulation. This distribution pattern suggests a pronounced concentration of token ownership, where decision-making power and price influence are concentrated among a limited number of stakeholders. While the remaining 25.64% distributed across other addresses provides some degree of decentralization, the dominance of the top-tier holders presents material considerations for market dynamics and governance structure.

The concentration observed in MONPRO's address distribution carries implications for market stability and token price dynamics. Concentrated holdings increase the potential for significant price volatility, as decisions by major holders regarding token sales or transfers could substantially impact market conditions. Additionally, the elevated concentration level may influence liquidity patterns and could create scenarios where coordinated actions by top holders drive market movements. Such structural characteristics warrant ongoing monitoring, as they reflect the current state of tokenomics distribution and the degree to which the network exhibits genuine decentralization features typical of mature blockchain ecosystems.

Visit MONPRO Holdings Distribution on Gate.com for real-time updates.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x65a8...a59780 | 311182.55K | 31.13% |

| 2 | 0x6094...846cf0 | 239192.67K | 23.93% |

| 3 | 0xeae2...4b5bde | 81037.67K | 8.10% |

| 4 | 0x9dc0...026bb8 | 68333.33K | 6.83% |

| 5 | 0xf3de...b1e245 | 43750.00K | 4.37% |

| - | Others | 256021.21K | 25.64% |

II. Core Factors Influencing MONPRO's Future Price

Supply Mechanism

- Fixed Supply Model: MONPRO features a fixed supply structure that provides enhanced inflation-resistant advantages compared to other tokens, contributing to long-term value preservation.

- Historical Pattern: The fixed supply mechanism has historically supported price stability during market downturns, demonstrating resilience in challenging economic environments.

- Current Impact: The constrained supply is expected to support upward price pressure as adoption rates increase, particularly in scenarios where market sentiment turns positive.

Macroeconomic Environment

- Monetary Policy Impact: MONPRO demonstrates high correlation with broader cryptocurrency market movements during periods of significant monetary policy shifts, such as interest rate changes. The token's price movements are closely tied to major central bank decisions and their effects on overall risk appetite.

- Inflation Hedge Characteristics: With its fixed supply structure, MONPRO exhibits improved performance as an inflation hedge compared to traditional assets, particularly during periods of elevated economic uncertainty and currency devaluation concerns.

- Geopolitical Factors: International geopolitical developments influence market sentiment and capital flows into alternative assets, thereby affecting MONPRO price volatility.

Market Sentiment and Adoption Dynamics

- Investor Confidence: Market sentiment and investor confidence have direct impacts on MONPRO price movements. Announcements regarding widespread adoption or major technological breakthroughs can significantly influence price direction and trading volume.

- Adoption Rate Growth: Expansion in MONPRO adoption across platforms and user bases represents a key driver of long-term price appreciation, with mainstream integration scenarios offering breakthrough potential.

- Regulatory Environment: Regulatory changes and policy announcements materially impact MONPRO's price trajectory, with regulatory clarity potentially supporting adoption acceleration and market confidence.

Price Forecast Outlook

Based on available market analysis, MONPRO's price predictions through 2028 present the following scenarios:

- Conservative Scenario (2025): $0.00549 – $0.01077

- Base Case Scenario (2025): $0.01077 – $0.01287

- Optimistic Scenario (2025): $0.01287 – $0.01497 (requiring favorable market conditions)

Multi-Year Projections:

- 2026: $0.00914 – $0.01892

- 2027: $0.01176 – $0.02082

- 2028: $0.01193 – $0.02405 (conservative to optimistic range)

These forecasts reflect scenarios ranging from steady market growth through breakthrough technological innovation and mainstream integration.

Disclaimer: This article does not constitute investment advice provided by Gate.com or any other type of recommendation. Cryptocurrency investments carry risk. Please invest cautiously and conduct thorough due diligence before making any investment decisions.

III. 2025-2030 MONPRO Price Forecast

2025 Outlook

- Conservative Forecast: $0.00661-$0.00703

- Base Case Forecast: $0.00703

- Optimistic Forecast: $0.0085

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation and gradual recovery phase with increasing adoption momentum

- Price Range Forecast:

- 2026: $0.00598-$0.01141

- 2027: $0.00892-$0.01074

- 2028: $0.00549-$0.01423

- Key Catalysts: Ecosystem expansion, improved liquidity on platforms like Gate.com, increased institutional interest, and strengthening of fundamental use cases

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01086-$0.01598 by 2029 (steady adoption and market maturation)

- Optimistic Scenario: $0.01268-$0.01507 by 2030 (accelerated ecosystem growth and mainstream recognition)

- Transformative Scenario: $0.01598 and above (breakthrough in user adoption, major partnerships, or significant protocol upgrades)

- Cumulative Growth Projection: MONPRO is expected to achieve approximately 100% appreciation by 2030, reflecting moderate but sustained value appreciation over the five-year period

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0085 | 0.00703 | 0.00661 | 0 |

| 2026 | 0.01141 | 0.00776 | 0.00598 | 10 |

| 2027 | 0.01074 | 0.00959 | 0.00892 | 36 |

| 2028 | 0.01423 | 0.01016 | 0.00549 | 44 |

| 2029 | 0.01598 | 0.0122 | 0.01086 | 73 |

| 2030 | 0.01507 | 0.01409 | 0.01268 | 100 |

Pixelmon (MONPRO) Professional Investment Analysis Report

IV. MONPRO Professional Investment Strategy and Risk Management

MONPRO Investment Methodology

(1) Long-Term Hold Strategy

- Suitable for: Gaming enthusiasts and Web3-native gamers seeking exposure to blockchain gaming IP ecosystem; investors with multi-year investment horizon aligned with Mon Protocol's game development roadmap.

- Operational Recommendations:

- Accumulate positions during market downturns, particularly when price sentiment is negative; current 7-day decline of -23.35% and 30-day decline of -33.87% may present entry opportunities for long-term believers.

- Dollar-cost averaging (DCA) approach: regularly invest fixed amounts to mitigate timing risk, given the token's high volatility and 94.24% one-year decline.

- Monitor game releases and community growth milestones; track announcements of new gaming IPs to identify catalysts for potential price recovery.

(2) Active Trading Strategy

-

Price Analysis Instruments:

- 24-hour volatility monitoring: Current price of $0.007043 with intraday range of $0.006951-$0.007267 indicates tight trading bands; traders should watch for breakouts beyond these levels.

- Multi-timeframe trend analysis: One-hour decline of -0.22% suggests short-term consolidation; seven-day decline of -23.35% signals sustained downtrend requiring confirmation before reversal trades.

-

Wave Trading Key Points:

- Identify support levels at historical low prices ($0.006951 reached on December 23, 2025) and resistance at recent highs ($0.007267 within 24 hours).

- Execute counter-trend positions cautiously given the extreme one-year drawdown (-94.24%); confirm reversal signals with volume confirmation before entering long positions.

MONPRO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto allocation; focus on small, diversified positions within gaming and metaverse subcategory.

- Active Investors: 3-5% of total crypto allocation; can increase exposure if fundamental developments materialize and technical confirmations appear.

- Professional Investors: Up to 10% of alternative asset allocation; implement structured position sizing with defined stop-loss levels and profit-taking thresholds.

(2) Risk Hedging Approaches

- Position scaling hedge: Due to the token's extreme volatility and 99.37% circulation ratio, maintain smaller position sizes than comparable market-cap tokens; consider selling into strength rather than buying weakness.

- Portfolio diversification: MONPRO should represent only a small allocation within a broader gaming and Web3 portfolio; balance against more established gaming protocols and infrastructure tokens.

(3) Safe Storage Solutions

- Cold Storage Plan: For holdings exceeding exchange thresholds, transfer MONPRO tokens to self-custody solutions with private key control to mitigate exchange counterparty risk.

- Exchange-Based Management: For active trading, utilize Gate.com's secure infrastructure; maintain only necessary working capital on exchanges and withdraw the remainder to secure storage.

- Security Considerations: Given ERC-20 token status, ensure wallet compatibility with Ethereum network standards; use hardware-secured signing for large transfers; enable two-factor authentication on exchange accounts; verify contract address (0xc555d625828c4527d477e595ff1dd5801b4a600e) before any transactions to avoid phishing.

V. MONPRO Potential Risks and Challenges

MONPRO Market Risk

- Extreme price volatility: The token experienced a 94.24% decline over one year and currently trades 99.22% below all-time high ($0.9 on May 27, 2024), indicating severe loss of investor confidence and liquidity concentration risk.

- Limited trading liquidity: 24-hour volume of $12,761.42 on a $7.04 million fully diluted valuation suggests thin order books and potential slippage during significant trading activity.

- Community sentiment deterioration: The persistent downtrend across all measured timeframes (1H: -0.22%, 24H: -2.88%, 7D: -23.35%, 30D: -33.87%, 1Y: -94.24%) indicates ongoing negative market perception despite the underlying gaming ecosystem development.

MONPRO Regulatory Risk

- Blockchain gaming classification uncertainty: Regulatory authorities globally continue clarifying treatment of gaming tokens and NFT-based assets; adverse regulatory developments could impact adoption trajectories for blockchain gaming IPs.

- Securities law considerations: Depending on jurisdiction, MONPRO's tokenomics and governance structure may face scrutiny regarding whether tokens constitute securities under local regulations.

- Geographic restrictions: Some regions may impose restrictions on gaming-related tokens; players and investors should verify compliance with local legal frameworks before participation.

MONPRO Technical Risk

- Game development execution risk: Mon Protocol's business model depends on successful development and launch of Pixelmon games (Pixelpals, Warriors of Nova Thera, Hunting Grounds) and the promised second gaming IP; any delays or technical failures in game development directly impact token utility and adoption.

- Smart contract vulnerability: As an ERC-20 token, security depends on underlying Ethereum network and contract code quality; potential vulnerabilities could expose token holders to fund loss.

- Player adoption challenges: Achieving mass market adoption of blockchain-native games remains unproven at scale; if games fail to attract and retain non-crypto-native players, the token's fundamental value proposition deteriorates significantly.

VI. Conclusion and Action Recommendations

MONPRO Investment Value Assessment

MONPRO represents a speculative investment in the blockchain gaming ecosystem with significant execution risks balanced against potential upside if Mon Protocol successfully delivers on its game development roadmap. The token's current 99.22% drawdown from all-time high suggests either severe overvaluation at launch or genuine technical/market challenges. Fundamental value depends entirely on successful game launches, player adoption metrics, and demonstrated monetization from the Pixelmon gaming IP portfolio. The promised second exclusive gaming IP announcement could serve as a near-term catalyst, but investors should remain cautious given the extreme historical volatility and ongoing negative price trends across all timeframes.

MONPRO Investment Recommendations

✅ Beginners: Approach with extreme caution; consider MONPRO only as a micro-allocation (0.5-1%) within a diversified gaming portfolio after understanding gaming industry fundamentals and blockchain technology; prioritize learning about the Pixelmon game ecosystem before investing capital.

✅ Experienced Investors: Monitor game development progress and community metrics as leading indicators; consider tactical positions during extreme capitulation phases if technical confirmations appear, but implement strict stop-loss discipline given historical volatility; utilize dollar-cost averaging to reduce timing risk.

✅ Institutional Investors: Conduct comprehensive due diligence on Mon Protocol's game development pipeline, team track record, and monetization strategies before allocation; structure positions within defined risk budgets; require clear governance, tokenomics transparency, and audited smart contract standards.

MONPRO Trading Participation Methods

- Gate.com Spot Trading: Execute direct MONPRO/USDT trading pairs for standard buy-and-hold or swing trading strategies; leverage Gate.com's advanced charting tools and real-time order execution.

- Gate.com Margin Trading: For experienced traders, conditional margin positions with predetermined stop-loss levels can magnify returns during confirmed uptrends, though this approach dramatically increases liquidation risk given the token's volatility.

- DCA Strategy through Gate.com: Implement automated recurring purchases over extended periods to reduce single-entry timing risk and accumulate positions during prolonged downtrends without attempting to time market bottoms.

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and are strongly encouraged to consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

Will Monero reach $10,000?

Monero is unlikely to reach $10,000. Based on current market analysis and price prediction algorithms, the highest estimated price is around $2,422.19. This projection considers existing market trends and technical indicators.

Does Monero have a future?

Yes, Monero has a strong future. Its advanced privacy technology addresses growing demand for secure transactions. With an active development community and increasing adoption, Monero is well-positioned for long-term growth in the decentralized finance ecosystem.

How high could Monero go?

Monero could potentially reach $882.64 in 2025 and surge to $5,828.30 by 2030, based on current market trend analysis and growth projections.

Is Monero a good investment now?

Monero demonstrates strong privacy fundamentals and consistent market demand. With growing adoption and stable technical development, it presents promising investment potential for those seeking privacy-focused digital assets in the current crypto landscape.

2025 ELDE Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

2025 CATI Price Prediction: Expert Analysis and Market Forecast for Catizen Token

2025 GUN Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 ALICE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 CATI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 MCRT Price Prediction: Analyzing Market Trends and Future Prospects for Microcrystalline Cellulose Token

SoSoValue Airdrop: Complete Guide to Claiming Free SOSO Tokens

Shitcoin

Noda (node) — cái gì vậy trong blockchain?

What is DRAC Network (DRAC)

What is Bitcoin Pizza Day? The Complete Story of the 10,000 BTC Pizza Purchase