2025 NAKA Price Prediction: Expert Analysis and Market Forecast for Nakamoto (NAKA) Token

Introduction: Market Position and Investment Value of NAKA

Nakamoto Games (NAKA) serves as a core utility token within an expansive Web3 infrastructure layer designed to redefine the Web3 gaming landscape. Since its launch in October 2021, NAKA has established itself as an essential asset for ecosystem participation and governance. As of December 2025, NAKA maintains a market capitalization of approximately $4.64 million with a circulating supply of around 64.98 million tokens, trading at approximately $0.0714. This token, which functions as the "core heartbeat" of the Nakamoto Games ecosystem, continues to play an increasingly vital role in Web3 gaming infrastructure and utility access.

This article provides a comprehensive analysis of NAKA's price trajectory through 2030, incorporating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

I. NAKA Price History Review and Market Status

NAKA Historical Price Evolution

- October 2021: Nakamoto Games launched with an initial price of $0.18.

- March 2024: Reached an all-time high (ATH) of $3.2721 on March 10, 2024, representing significant price appreciation from the project's inception.

- December 2025: Experienced a sharp decline, reaching an all-time low (ATL) of $0.07093 on December 21, 2025, marking a devastating 92.84% decline over the one-year period.

NAKA Current Market Snapshot

As of December 23, 2025, NAKA is trading at $0.07138, reflecting extreme downward pressure in the market. The token has experienced significant deterioration across multiple timeframes:

- 1-Hour Change: -0.72%

- 24-Hour Change: -2.41%

- 7-Day Change: -10.32%

- 30-Day Change: -23.08%

- 1-Year Change: -92.84%

The 24-hour trading volume stands at $89,197.12, indicating relatively low liquidity. NAKA's fully diluted market capitalization is $12,848,400, with a circulating supply of 64,984,277.5 tokens out of a maximum supply of 180,000,000 tokens (36.1% of total supply in circulation). The token currently ranks at #1,574 by market capitalization, with a market dominance of just 0.0004%.

The project maintains 29,172 token holders across the Polygon (MATIC) blockchain network. The contract address is 0x311434160d7537be358930def317afb606c0d737.

Check current NAKA market price

NAKA Market Sentiment Index

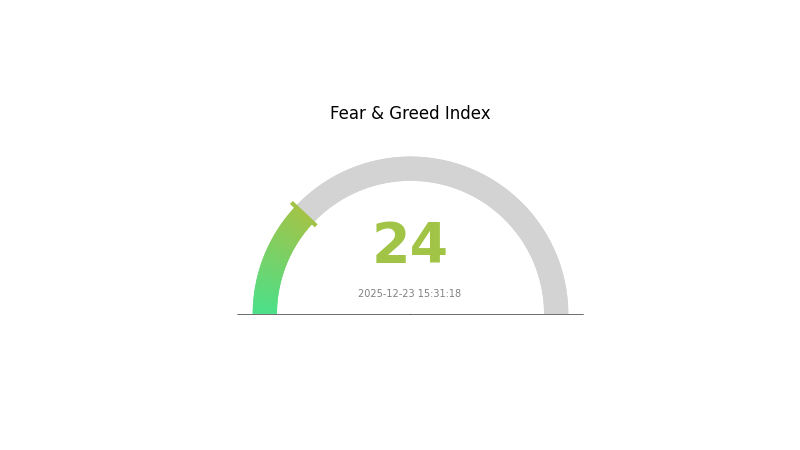

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and risk aversion among investors. When the index reaches such low levels, it often signals oversold conditions and potential buying opportunities for contrarian traders. However, extreme fear can also suggest continued downward pressure and volatility. Market participants should exercise caution and conduct thorough risk management. This sentiment reading reflects broader market concerns and uncertainty. Consider your investment strategy carefully during periods of extreme fear, as market conditions may present both risks and opportunities for informed investors monitoring the sentiment closely.

NAKA Holdings Distribution

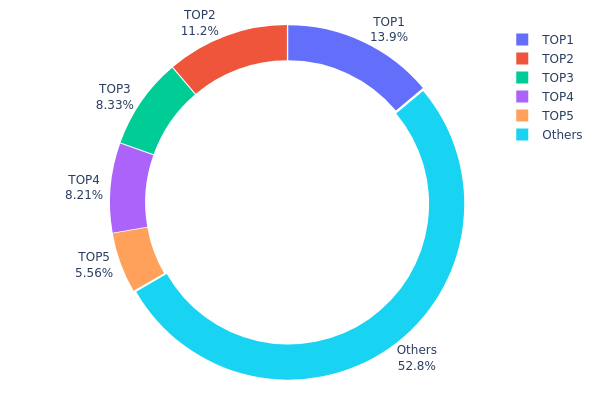

The address holdings distribution chart illustrates the concentration of NAKA tokens across blockchain addresses, revealing the degree of wealth centralization within the token ecosystem. This metric serves as a critical indicator for assessing market structure, decentralization status, and potential systemic risks associated with token concentration.

Current analysis of NAKA's top holder distribution reveals moderate concentration characteristics. The top five addresses collectively hold approximately 47.18% of total token supply, with the leading address commanding 13.88% and the second-largest holder maintaining 11.22% of circulating tokens. While this concentration level demonstrates a multi-stakeholder distribution pattern rather than extreme centralization, it remains a notable consideration for market dynamics. The remaining 52.82% dispersed among other addresses suggests a reasonably fragmented holder base, which provides some resilience against potential market manipulation through coordinated large-scale token movements.

The existing distribution pattern presents a balanced risk profile. The top five holders, while substantial individually, do not collectively represent overwhelming control, and the significant portion held by dispersed addresses (52.82%) indicates meaningful decentralization. However, the concentration among leading addresses remains sufficient to influence short-term price movements should coordinated selling or strategic accumulation occur. This structure reflects a maturing market where institutional or large strategic holders coexist with a distributed retail and smaller holder base, creating a dynamic that favors both liquidity provision and market participation opportunities across different investor tiers.

Click to view current NAKA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe162...7fdd1a | 25000.00K | 13.88% |

| 2 | 0x3d4a...944147 | 20200.00K | 11.22% |

| 3 | 0xd637...88995e | 15000.00K | 8.33% |

| 4 | 0x2933...fa4625 | 14772.45K | 8.20% |

| 5 | 0x2233...dc734f | 10000.00K | 5.55% |

| - | Others | 95027.55K | 52.82% |

II. Core Factors Affecting NAKA's Future Price

Supply Mechanism

-

PIPE Financing Unlock: PIPE (Private Investment in Public Equity) shares registered via S-3 form entered the public market, causing immediate supply shock. This represented a massive increase in available shares without corresponding demand growth, creating significant downward pressure on stock price.

-

Historical Pattern: The company had completed $742 million in financing and merger transactions since launching its Bitcoin strategy, establishing a Bitcoin treasury exceeding 5,700 BTC. However, the PIPE unlock revealed market fragility in valuation models dependent on continuous premium pricing.

-

Current Impact: The dilution effect has been severe. KindlyMD's market valuation to Net Asset Value (mNAV) ratio collapsed below 0.4x, indicating the market now views the stock as a high-risk bearer trading significantly below its underlying asset base value.

Institutional and Major Holder Dynamics

-

Corporate Positioning: KindlyMD merged with Nakamoto Holdings in May 2025 to create a publicly-traded Bitcoin treasury management company. The company held 5,700+ BTC as its primary asset.

-

Market Valuation Crisis: Unlike Strategy (MSTR), which maintained stronger institutional confidence with an mNAV near 0.8x and established cash reserves of approximately $1.44 billion to cover future dividends and debt service, NAKA faced rapid institutional retreat. Among approximately 100 Bitcoin treasury companies tracked, approximately 65 purchased Bitcoin above current price levels, reflecting industry-wide unrealized losses.

-

Regulatory Pressure: Nasdaq issued minimum stock price compliance warnings to KindlyMD, triggering financing discounts, liquidity contraction, and valuation repricing across the Bitcoin treasury sector.

Macroeconomic Environment

-

Monetary Policy Impact: The U.S. Federal Reserve maintained elevated interest rates, with January 2026 rate maintenance probability at 77.9% according to CME FedWatch data. This sustained high-rate environment constrained financing flexibility for leveraged asset acquisition strategies.

-

Bitcoin Price Correlation: NAKA's valuation contains multiple layers: underlying Bitcoin asset value, alpha return expectations from active management, and narrative premium during market euphoria. When Bitcoin entered high-volatility trading ranges in Q4, narrative premium compressed first, causing NAKA stock declines to substantially exceed Bitcoin's downside. The stock declined 95% from its peak while Bitcoin's corresponding drawdown was far smaller.

-

Market Sentiment Deterioration: The sector experienced systematic repricing as investors withdrew from valuation premiums. Comparable firms like American Bitcoin (ABTC) declined approximately 68% and ProCap Financial (BRR) fell nearly 70%, reflecting broader market skepticism toward Bitcoin treasury companies' ability to maintain premium valuations.

Debt and Leverage Risks

The company's business model relied heavily on continuous low-cost financing capability and precise market timing. However, when stock price declined below convertible debt conversion prices, these debt instruments could not convert to equity, increasing real debt burden and triggering potential financial distress. This leverage dynamic represented a critical vulnerability during market downturns, as the model depended on sustained Bitcoin appreciation and reliable capital market access rather than fundamental operational cash generation.

III. 2025-2030 NAKA Price Forecast

2025 Outlook

- Conservative Forecast: $0.04999 - $0.07142

- Neutral Forecast: $0.07142

- Optimistic Forecast: $0.10427 (requires sustained market momentum and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with strengthening fundamentals and increasing institutional interest

- Price Range Forecast:

- 2026: $0.04919 - $0.10278 (23% upside potential)

- 2027: $0.061 - $0.11247 (33% upside potential)

- 2028: $0.08207 - $0.13714 (45% upside potential)

- Key Catalysts: Ecosystem development progress, strategic partnerships, improved market sentiment, and broader cryptocurrency adoption trends

2029-2030 Long-term Outlook

- Base Case Scenario: $0.10726 - $0.15426 (assumes stable market conditions and moderate growth trajectory through 2029)

- Optimistic Scenario: $0.12051 - $0.17998 (assumes accelerated ecosystem adoption and positive macroeconomic conditions by 2030)

- Transformative Scenario: $0.13739 reaching toward $0.17998 (assumes breakthrough innovations, significant institutional adoption, and major technological milestones)

- 2030-12-31: NAKA demonstrates 92% cumulative growth potential from 2025 baseline, reflecting substantial appreciation across the forecast period

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10427 | 0.07142 | 0.04999 | 0 |

| 2026 | 0.10278 | 0.08785 | 0.04919 | 23 |

| 2027 | 0.11247 | 0.09531 | 0.061 | 33 |

| 2028 | 0.13714 | 0.10389 | 0.08207 | 45 |

| 2029 | 0.15426 | 0.12051 | 0.10726 | 68 |

| 2030 | 0.17998 | 0.13739 | 0.0893 | 92 |

Nakamoto Games (NAKA) Professional Investment Analysis Report

IV. NAKA Professional Investment Strategy and Risk Management

NAKA Investment Methodology

(1) Long-Term Holding Strategy

- Target Investor Profile: Web3 gaming enthusiasts and infrastructure believers with medium to high risk tolerance

- Operational Recommendations:

- Accumulate NAKA during market downturns, particularly when the token is trading near historical lows

- Hold for extended periods (12+ months) to benefit from ecosystem maturation and adoption growth

- Reinvest any staking rewards or ecosystem incentives back into NAKA positions

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 0.07093 (ATL) support and 0.07418 (24H high) resistance levels for entry and exit signals

- Volume Analysis: Track the 24-hour trading volume of approximately $89,197 to identify breakout opportunities and liquidity conditions

- Trading Operation Key Points:

- Execute scalping strategies during high volatility periods, targeting 2-5% gains on short-term fluctuations

- Utilize dollar-cost averaging (DCA) to mitigate the impact of extreme price volatility, given the token's -92.84% one-year performance

NAKA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Aggressive Investors: 3-7% of portfolio allocation

- Professional Investors: 5-15% of portfolio allocation (with sophisticated hedging strategies)

(2) Risk Hedging Solutions

- Diversification Strategy: Balance NAKA holdings with established cryptocurrencies and traditional assets to reduce concentration risk

- Position Sizing: Implement strict position limits based on individual risk tolerance, never exceeding funds that can be safely lost

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 wallet for frequent trading and ecosystem interactions

- Cold Storage Method: Transfer long-term NAKA holdings to offline storage solutions for enhanced security

- Security Best Practices: Enable two-factor authentication (2FA), use strong passwords, regularly audit wallet activity, and never share private keys

V. NAKA Potential Risks and Challenges

NAKA Market Risk

- Severe Price Volatility: NAKA has experienced a -92.84% decline over the past year, demonstrating extreme price instability that may lead to substantial losses

- Liquidity Risk: With only 15 trading pairs and a relatively modest 24-hour volume of $89,197, traders may face significant slippage on large orders

- Low Market Capitalization: At $12.85 million fully diluted valuation, NAKA remains a micro-cap token vulnerable to market manipulation and sudden price swings

NAKA Regulatory Risk

- Gaming Industry Compliance: Web3 gaming platforms face increasing regulatory scrutiny across multiple jurisdictions regarding consumer protection and fair play standards

- Token Classification Uncertainty: Regulatory bodies may classify NAKA as a security, potentially triggering compliance requirements and trading restrictions

- Cross-Border Restrictions: Gaming platforms may face restrictions in certain jurisdictions, limiting ecosystem expansion and user adoption

NAKA Technical Risk

- Smart Contract Vulnerabilities: As an ERC-20/Polygon token, NAKA depends on the security of underlying smart contracts, which could be subject to exploits or bugs

- Blockchain Dependency: The token's functionality relies on Polygon network stability; network congestion or failures could impact trading and utility

- Ecosystem Execution Risk: Successful adoption depends on the development team's ability to build and maintain a competitive gaming infrastructure layer

VI. Conclusions and Action Recommendations

NAKA Investment Value Assessment

Nakamoto Games positions itself as a Web3 infrastructure layer for gaming, with NAKA serving as the core utility token. However, the project faces significant headwinds: a -92.84% annual decline, limited market liquidity, and micro-cap status. The token has declined from its $3.27 all-time high (March 2024) to current levels, reflecting market skepticism about the project's execution capability. While the Web3 gaming sector remains nascent with potential long-term value creation, NAKA currently presents as a highly speculative, high-risk investment suitable only for risk-tolerant participants with deep due diligence capabilities.

NAKA Investment Recommendations

✅ Beginners: Avoid direct NAKA investment; instead, explore established gaming or infrastructure tokens to learn ecosystem dynamics before considering speculative positions ✅ Experienced Investors: Consider small, non-critical positions only after comprehensive technical and fundamental analysis; utilize dollar-cost averaging to reduce timing risk ✅ Institutional Investors: Conduct extensive due diligence on team credentials, tokenomics, and competitive positioning before any allocation; maintain strict position limits below 1% of total assets

NAKA Trading and Participation Methods

- On-Chain Trading: Access NAKA through Gate.com's spot trading pairs with competitive fee structures

- Direct Purchase: Use Gate.com's user-friendly interface to acquire NAKA directly with fiat or other cryptocurrencies

- Ecosystem Participation: Engage with Nakamoto Games platform activities if available, earning NAKA through gameplay or governance contributions

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions aligned with their risk tolerance and financial situations. Professional financial consultation is strongly recommended. Never invest funds you cannot afford to lose completely.

FAQ

How high will Nak go?

NAKA's price potential depends on market conditions and adoption growth. Based on current momentum and ecosystem developments, analysts suggest potential targets ranging from $0.5 to $2.0 in the medium term, though actual performance will vary based on broader market trends.

Why is NAKA going up?

NAKA is rising due to increased trading volume, growing market capitalization, and positive market sentiment. Strong demand and investor interest are driving the upward price momentum.

What is NAKA coin and what is its use case?

NAKA is a Web3 coin built on Solana blockchain, enabling fast and low-cost transactions. It powers decentralized applications and services within the Web3 ecosystem, facilitating seamless user interactions.

What are the key factors that influence NAKA price movements?

NAKA price movements are primarily influenced by market demand and trading volume, investor sentiment, broader cryptocurrency market trends, blockchain adoption rates, macroeconomic conditions, and platform development updates. These factors collectively determine price fluctuations.

What are the risks and volatility concerns when investing in NAKA?

NAKA carries high volatility risk due to market uncertainty and regulatory factors. Price fluctuations can be extreme, influenced by broader crypto market sentiment and macroeconomic conditions. Investors should carefully assess their risk tolerance.

2025 MORE Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 TRALA Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 MLC Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 LEGION Price Prediction: Analyzing Market Trends and Future Prospects for the Gaming Cryptocurrency

2025 FPS Price Prediction: Analyzing Market Trends and Future Projections for First-Person Shooter Games

2025 GM Price Prediction: Navigating the Future of Automotive Stocks in a Shifting Market Landscape

SoSoValue Airdrop: Complete Guide to Claiming Free SOSO Tokens

Shitcoin

Noda (node) — cái gì vậy trong blockchain?

What is DRAC Network (DRAC)

What is Bitcoin Pizza Day? The Complete Story of the 10,000 BTC Pizza Purchase