2025 SCR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of SCR

Scroll (SCR) is a Layer 2 rollup solution leveraging zero knowledge proof technology to scale the Ethereum blockchain. Since its launch in October 2024, Scroll has established itself as a secure and trusted scaling solution within the Ethereum ecosystem. As of December 2025, Scroll's market capitalization has reached approximately $73.69 million, with a circulating supply of 190 million tokens and a current price hovering around $0.0737. This innovative technology is increasingly playing a critical role in expanding Ethereum's capacity to process trillions of dollars on-chain.

This article will provide a comprehensive analysis of Scroll's price trends and market dynamics, incorporating historical data, supply and demand factors, ecosystem development, and macroeconomic conditions. We aim to deliver professional price forecasts and practical investment strategies for investors seeking to understand SCR's potential through 2030.

I. SCR Price History Review and Market Status

SCR Historical Price Evolution

-

October 2024: Scroll token launched with initial listing price of $1.80. The token reached its all-time high (ATH) of $2.45 on October 11, 2024, reflecting strong market interest in the Layer 2 scaling solution.

-

December 2024 - Present: Significant price correction phase. SCR has experienced a prolonged downtrend, declining approximately 93.87% over the past year from its peak. The token recently touched an all-time low (ATL) of $0.0662 on December 19, 2025, indicating extreme market weakness.

SCR Current Market Status

As of December 21, 2025, SCR is trading at $0.07369, representing a modest intraday gain of 0.17% over the past 24 hours. However, the token continues to exhibit significant bearish pressure with a -20.78% decline over the past 7 days and a -31.43% drop over the past 30 days.

Market Metrics:

- 24-hour trading volume: $397,442.25

- Market capitalization: $14,001,100

- Fully diluted valuation: $73,690,000

- Circulating supply: 190,000,000 SCR (19% of total supply)

- Total supply: 1,000,000,000 SCR

- Market dominance: 0.0023%

- Token holders: 164,623

- Exchange listings: 32 platforms

The 24-hour price range fluctuates between $0.07272 (low) and $0.07546 (high), indicating relatively tight trading bands. Current market sentiment registers extreme fear (VIX reading of 20), reflecting broader cryptocurrency market weakness and investor apprehension.

Check current SCR market price

SCR Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates significant market pessimism and heightened investor anxiety. During periods of extreme fear, opportunities often emerge for long-term investors. Market volatility is likely to remain elevated as investors reassess positions. Consider dollar-cost averaging strategies and monitor key support levels on Gate.com. Such conditions typically create entry points for those with long-term conviction in the crypto market fundamentals.

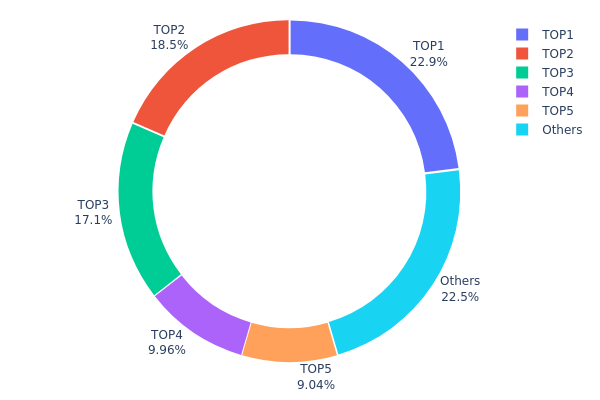

SCR Holdings Distribution

The address holdings distribution chart illustrates the concentration of SCR tokens across the top wallet addresses on the blockchain. This metric serves as a critical indicator for assessing token decentralization, market structure integrity, and potential risks associated with wealth concentration. By analyzing the percentage allocation among major holders, investors and analysts can evaluate the resilience of the project against potential market manipulation and the sustainability of its decentralized ecosystem.

Current data reveals a moderately concentrated distribution pattern, with the top five addresses collectively holding 77.44% of all SCR tokens in circulation. The largest holder commands 22.94% of the total supply, while the second and third holders maintain 18.46% and 17.05% respectively. This tier-based concentration, while significant, demonstrates a somewhat fragmented leadership structure rather than extreme centralization. The remaining 22.56% distributed across other addresses provides a meaningful cushion against single-entity dominance, suggesting that no individual actor possesses overwhelming control over the token's supply dynamics.

The current distribution presents a balanced risk profile with nuanced implications for market structure. While the top five holders represent substantial concentration, their relatively distributed positioning—with no single address exceeding 23%—mitigates extreme centralization concerns. However, the substantial minority stake held by these major holders could theoretically facilitate coordinated market movements or price influence. The preservation of approximately one-quarter of tokens among dispersed addresses indicates a foundational commitment to decentralization, though continued monitoring of holder behavior and acquisition patterns remains essential for assessing long-term protocol health and market fairness.

Click to view current SCR holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2124...469233 | 229481.27K | 22.94% |

| 2 | 0xee19...3b03df | 184696.54K | 18.46% |

| 3 | 0x2063...6eebb7 | 170518.73K | 17.05% |

| 4 | 0x4cb0...9ada0c | 99628.12K | 9.96% |

| 5 | 0xff12...a78c13 | 90372.83K | 9.03% |

| - | Others | 225302.51K | 22.56% |

II. Core Factors Influencing SCR's Future Price

Supply Mechanism

- Token Distribution and Release Schedule: SCR's price movements are influenced by its token supply mechanism and release schedule. Changes in circulating supply and unlock events can impact market dynamics and price volatility.

- Historical Patterns: Supply changes have historically affected SCR's price performance, with market reactions varying based on the magnitude and timing of supply events.

- Current Impact: Ongoing supply adjustments are expected to continue influencing price discovery mechanisms in the market.

Macroeconomic Environment

- Monetary Policy Impact: Cryptocurrency markets, including SCR, are sensitive to global monetary policy decisions. Interest rate changes and liquidity conditions set by major central banks can significantly affect investor sentiment and capital allocation toward digital assets.

- Inflation Hedge Properties: SCR may serve as an alternative asset class in inflationary environments, though its effectiveness as a hedge depends on broader market conditions and investor confidence in cryptocurrency markets.

- Geopolitical Factors: International geopolitical developments and trade dynamics can influence overall market sentiment toward cryptocurrencies and alternative assets.

Note: Based on the provided materials, specific information regarding institutional holdings, enterprise adoption, country-level policies, and particular technological upgrades for SCR could not be clearly verified. These sections have been omitted from this analysis to maintain accuracy and reliability.

Three、2025-2030 SCR Price Forecast

2025 Outlook

- Conservative Forecast: $0.06246 - $0.07436

- Base Case Forecast: $0.07436

- Bullish Forecast: $0.07957 (requires sustained market confidence and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with consolidation patterns, transitioning from bear market recovery to early growth cycle

- Price Range Forecast:

- 2026: $0.05387 - $0.09774

- 2027: $0.06726 - $0.09521

- 2028: $0.06207 - $0.1278

- Key Catalysts: Protocol upgrades, institutional adoption growth, ecosystem expansion, and improved market sentiment in the broader cryptocurrency sector

2029-2030 Long-term Outlook

- Base Scenario: $0.06463 - $0.1424 (assumes steady adoption and moderate market cycles)

- Bullish Scenario: $0.10954 - $0.18518 (requires accelerated mainstream adoption and positive macroeconomic conditions)

- Transformative Scenario: Above $0.18518 (requires breakthrough technological innovations, enterprise-level partnerships, and significant market capitalization growth)

- 2030-12-31: SCR reaches potential peak of $0.18518 (represents approximately 135% growth from 2025 levels under favorable market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07957 | 0.07436 | 0.06246 | 0 |

| 2026 | 0.09774 | 0.07696 | 0.05387 | 4 |

| 2027 | 0.09521 | 0.08735 | 0.06726 | 18 |

| 2028 | 0.1278 | 0.09128 | 0.06207 | 23 |

| 2029 | 0.1424 | 0.10954 | 0.06463 | 48 |

| 2030 | 0.18518 | 0.12597 | 0.11967 | 70 |

Scroll (SCR) Professional Investment Strategy and Risk Management Report

IV. SCR Professional Investment Strategy and Risk Management

SCR Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Institutional investors and retail participants focused on Layer 2 infrastructure growth

- Operation Recommendations:

- Dollar-cost averaging (DCA) approach to accumulate SCR positions over time, reducing the impact of price volatility

- Hold positions for a minimum of 12-24 months to capture the long-term value appreciation potential of the Scroll ecosystem

- Monitor network adoption metrics and zero-knowledge proof technology development milestones

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Identify trend reversals and momentum shifts in SCR price action

- Relative Strength Index (RSI): Determine overbought and oversold conditions to optimize entry and exit points

- Wave Trading Key Points:

- Trade within established support and resistance levels, currently ranging between $0.0662 and $2.45 historically

- Pay attention to short-term price trends: 7-day decline of -20.78% and 30-day decline of -31.43% indicate downward pressure

SCR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation

- Aggressive Investors: 3-8% portfolio allocation

- Professional Investors: 5-15% portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Correlation-based hedging: Pair SCR holdings with established Layer 1 assets to reduce concentration risk

- Stablecoin reserves: Maintain 30-50% of crypto portfolio in stablecoins to enable opportunistic buying during downturns

(3) Secure Storage Solutions

- Hardware wallet options: Secure SCR tokens in hardware wallets for long-term holdings exceeding one year

- Exchange custody: Use Gate.com's professional custody services for active trading positions requiring frequent liquidity access

- Security Considerations: Enable two-factor authentication on all exchange accounts, use strong password management practices, and maintain private key backups in secure offline locations

V. SCR Potential Risks and Challenges

SCR Market Risk

- Price Volatility: SCR has experienced severe downturn of -93.87% over the past year, demonstrating extreme price fluctuation and market instability

- Low Trading Liquidity: 24-hour trading volume of $397,442 combined with a $14 million market capitalization indicates potential liquidity constraints for large position executions

- Market Sentiment Deterioration: Current market emotion index at 1 suggests weak sentiment and potential further downside pressure

SCR Regulatory Risk

- Regulatory Uncertainty: Layer 2 solutions face evolving regulatory frameworks across different jurisdictions, creating compliance uncertainty

- Securities Classification Risk: Regulatory bodies may classify SCR tokens as securities, subjecting them to stricter compliance requirements

- Cross-border Restrictions: Ongoing regulatory tightening in major markets could limit accessibility and trading venues

SCR Technology Risk

- Zero Knowledge Proof Unproven at Scale: While innovative, zero-knowledge proof technology for Layer 2 solutions requires continued real-world validation and optimization

- Smart Contract Vulnerability: Any bugs or exploits in Scroll's Layer 2 infrastructure could result in significant losses and user fund risks

- Ethereum Network Dependency: Scroll's success is entirely dependent on Ethereum's continued dominance and network security

VI. Conclusion and Action Recommendations

SCR Investment Value Assessment

Scroll represents a technically sophisticated Layer 2 solution leveraging zero-knowledge proof technology to scale Ethereum. However, the cryptocurrency currently faces significant headwinds, including a -93.87% one-year decline, weak market sentiment, and relatively low trading liquidity. While the long-term vision of bringing billions of users to Ethereum is compelling, the short-term technical and market challenges suggest investors should exercise considerable caution. The 19% circulation ratio indicates potential inflation pressure, and the token's sharp decline suggests market participants have reassessed the near-term growth trajectory.

SCR Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) through dollar-cost averaging via Gate.com, focusing on understanding Scroll's technology and ecosystem development before scaling positions. Avoid large single purchases during volatile periods.

✅ Experienced Investors: Consider tactical accumulation during severe downturns after technical analysis confirms support levels. Use 3-5% portfolio allocation with clear stop-loss orders set at -15% from entry points. Monitor ecosystem metrics and competitive positioning within the Layer 2 landscape.

✅ Institutional Investors: Evaluate Scroll as part of a diversified Layer 2 infrastructure portfolio, potentially using options strategies to manage downside risk. Conduct thorough technical and regulatory due diligence before committing significant capital.

SCR Trading Participation Methods

- Gate.com Spot Trading: Purchase SCR directly on Gate.com's spot market with competitive trading fees and professional-grade tools

- DCA Programs: Set up automatic recurring purchases through Gate.com to systematically build positions while averaging down price exposure

- Limit Orders: Use Gate.com's advanced order types to establish positions at predetermined price levels, reducing emotional decision-making

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are strongly advised to consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is the price prediction for SCR in 2030?

Based on current market analysis, SCR is predicted to reach approximately $0.001231 by 2030. This projection reflects potential growth trends in the Scorum Coin ecosystem over the next five years.

What is the max supply of SCR coin?

The maximum supply of SCR coin is 1,000,000,000 tokens. The circulating supply is currently 190,000,000 SCR coins.

What is SCR cryptocurrency?

SCR is Scroll's native cryptocurrency used for transactions and governance within the Scroll ecosystem. It powers the network and enables user participation in the decentralized platform.

What is the Current Market Overview for ZK Token in November 2025?

2025 APT Price Prediction: Key Factors That Could Drive Aptos Token to New Heights

2025 KAS Price Prediction: Analyzing Key Factors Driving the Future Value of Kaspa

2025 ZKPrice Prediction: Analyzing Market Trends and Growth Potential for Zero-Knowledge Protocols

2025 MOVE Price Prediction: Analyzing Growth Factors and Market Trends in the Evolving Cryptocurrency Landscape

2025 ZKCPrice Prediction: Market Analysis and Growth Potential of ZKC in the Zero-Knowledge Cryptography Ecosystem

Understanding Crypto Debit Cards: Benefits and Usage for Secure Payments

Comparing Modern and Conventional Debit Cards for Your Financial Needs in 2025

A Beginner’s Guide to AI Governance Tokens Revolutionizing DAOs

2025 TOWNS Price Prediction: Expert Analysis and Market Forecast for the Next Year

2025 TRU Price Prediction: Expert Analysis and Market Forecast for the Coming Year