"MORE"的搜索結果

HBAR 在關鍵趨勢線下盤整:多頭必須“證明自己”

加密圖表分析師及YouTube創作者More Crypto Online表示,Hedera的HBAR仍處於修正型態,尚未有技術證據顯示底部已經確立。儘管近期反彈,該代幣仍在主要趨勢線以下交易,維持整體下行趨勢並

DailyCoin·2025-12-30 15:34

Arthur Hayes談重倉ZEC邏輯:最優秀的投資者要在腦內左右互搏

原文標題:Arthur Hayes: BTC Price Targets, Trading Advice, Bear Market and More原文來源:CounterParty TV原文編譯:Ethan,Odaily 星球日報

原文作者:Arthur Hayes

原文來源:

轉載:火星財經

編者按:如果你想知道一個真正「活在市場裏的人」如何判斷當下的加密世界,Arthur Hayes 值得傾聽。

在加密市場持續震蕩的這幾天裏,BTC 從跌破 10 萬到三天後再度跌破 9 萬美元,而 ZEC 卻在 Hayes 的「連環喊單」推動下逆勢創下新高。11 月 17

ZEC-12.01%

MarsBit News·2025-11-19 06:56

藍籌 NFT CyberKongz 推出 $KONG 新代幣取代 $BANANA,將空投 2% 給以太坊社群

老牌 NFT CyberKongz 宣布推出新代幣 $KONG ,相關細節及代幣經濟學整理。 (前情提要:比特幣儲備公司:為何要花 2 美元買 1 美元的 BTC? ) (背景補充:台灣第一家比特幣儲備公司誕生!大大寬頻 / 大豐電會成台版微策略嗎? ) 還記得曾經的藍籌 NFT - CyberKongz 嗎?官方 X 帳號在今(20)零點後發文,介紹了他們即將推出的新代幣 $KONG。 Introducing: $KONG A token that represents CyberKongz and NFT culture. Launching very soon, read more be

動區BlockTempo·2025-08-20 03:46

Moonveil 代幣創下新高,隨着遊戲生態系統的擴展

Moonveil的代幣$MORE在平台擴展到七個多樣化遊戲的過程中,衝鋒超過$0.128。其生態系統結合了獨特的遊戲開發和對第三方項目的支撐,提升了投資者信心和用戶參與度。

Crypto Daily·2025-07-24 12:07

生態多元助推Hedera:HBAR如何贏得市場青睞?

Author: Zen, PANews

As the overall crypto market fluctuates, Hedera network native token HBAR has bucked the trend: since the low point in 2024 (about $0.043), the price has risen more than 6 times, and once reached the annual high of $0.29 in mid-July 2025. As of July 23, the price of HBAR

HBAR-1.7%

PANews·2025-07-23 07:13

Conflux代幣價格單日翻倍,要參與離岸人民幣穩定幣試點?

Author: 1912212.eth, Foresight News

On July 20, the price of Conflux public chain token CFX started to rise sharply, rising from around $0.11 to $0.25, with a single-day increase of more than 100%. In July this year, it recorded a monthly increase of 202%. If calculated based on the bottom of $0.0

CFX-2.15%

PANews·2025-07-21 23:08

對話Solana創始人Anatoly:市場對穩定幣過度追捧卻低估其真正潛力

主持人:Sam,Rosa

嘉賓:Anatoly Yakovenko,Solana 創始人

來源:Crypto Isn’t for Everyone (And That’s a Good Thing) with Anatoly Yakovenko

播客日期: 2025 年 7 月 12 日

整理&編譯:Lenaxin,ChainCatcher

摘要:

本文整理自 More or Less 播客欄目與 Solana 創始人 Anatoly Yakovenko 的深度對話,他解析了“朋克、連帽衫、西裝”的行業週期律,指出

SOL2.28%

星球日报·2025-07-21 02:58

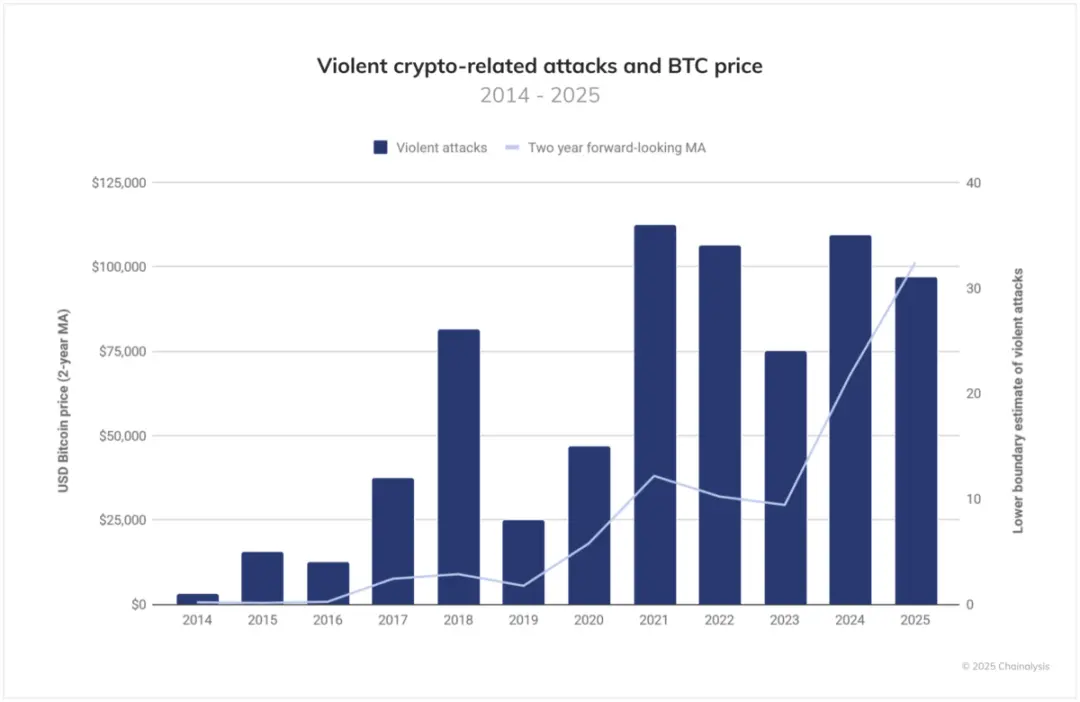

2025年加密犯罪年中報告:被盜資金激增至21.7億美元,個人錢包被盜佔比逐步上升

Written by: Chainalysis

Compiled by AididiaoJP, Foresight News

Key findings

Stolen funds

Cryptocurrency services have suffered more than $2.17 billion in thefts so far in 2025, far more than in all of 2024. North Korea’s $1.5 billion hack of ByBit (the largest single theft in

PANews·2025-07-21 00:35

Cardano 價格準備突破 $2 嗎?這裏是圖表所顯示的內容

Cardano再次開始顯得強勁。在經歷了長時間的窄幅波動後,ADA終於突破了一條關鍵趨勢線。這個動作可能是更大局面的開始。根據More Crypto Online的視頻分析,目前的動量可能會導致一次重大推動。

CaptainAltcoin·2025-07-11 19:34

BitMart即將上線 Moonveil(MORE)

火星財經消息, 據官方公告,BitMart 將於 6 月 27 日 21:00 (東八區時間)上線 Moonveil (MORE),此次上線開通 MORE/USDT 交易對。 Moonveil 是一個全棧 Web3 遊戲生態系統,融合了原創及第三方遊戲、發行和 L2 基礎設施。它將用戶身分錨定在其原生 L2 上,同時支持多鏈互操作性。Moonveil 秉承產品至上、實用性驅動的理念,從真正的中核遊戲開始擴展,利用模塊化基礎設施和實時運營賦能,構建一個具有高彈性、可互操作的網路。

MarsBit News·2025-06-27 04:36

幣安阿爾法推出關鍵的Moonveil (MORE) 以支持早期階段的加密貨幣項目

你是否一直在尋找幣圈的下一個大事件?你是否在關注那些有前景但尚未成熟的數字資產,在它們進入主流交易所之前?如果是這樣,那麼來自幣安的最新公告

BitcoinWorld Media·2025-06-25 12:53

Hotcoin熱幣交易所即將上線NEWT、UPTOP、MORE、H等交易對

深潮 TechFlow 消息,6 月 25 日,據官方消息,Hotcoin熱幣交易所將於6月25-27日上線以下交易對:

現貨交易對

UPTOP/USDT(6月25日12:00 UTC+8):$UPTOP是Uptop迷因代幣項目的原生代幣,爲其社區生態系統提供實用功能。

MORE/USDT(6月27日20:20 UTC+8):$MORE是Moonveil遊戲項目的原生代幣,爲其遊戲生態系統提供支持。

合約交易對

NEWT/USDT(6月25日15:00 UTC+8):支持最高50倍槓杆,$NEWT是Newton

深潮 TechFlow·2025-06-25 02:31

Pudgy Penguins 宣布代幣可累積航空里程點數、分析師認為 PENGU 價格處於支撐區間

Pudgy Penguins 與漢莎航空的 Miles & More 旅遊獎勵計畫合作,使用戶在 Pudgy Shop 購物時可以累積航空里程,擴展 PENGU 幣的應用場景。分析師指出 PENGU 價格目前位於支撐區,若能突破近期高點,有機會反彈,否則可能回落至更低支撐位。此合作讓數位資產帶來現實世界的價值回報,吸引旅行愛好者參與。

PENGU-0.98%

鏈新聞abmedia·2025-06-18 14:14

胖胖企鵝與漢莎航空合作,PENGU測試關鍵支撐

Pudgy Penguins與漢莎航空的Miles and More合作,允許用戶通過購物獲得航空裏程,在PENGU價格波動中正在下探關鍵支撐位。

PENGU-0.98%

TheNewsCrypto·2025-06-13 02:13

Buidlpad 對 Solayer 翡翠卡與 $LAYER 持有者開啟 Sahara 分發優先權限

Solayer 宣布,持有 Emerald Card 以及曾參與 $LAYER 銷售的用戶,將在 Buidlpad 最新一輪社群分發活動中,獲得搶先參與 AI 協議項目 Sahara 的專屬資格。這場合作旨在獎勵 Solayer 社群的早期參與者,同時也讓更多 Web3 使用者透過真實身份與鏈上行為,享有更公平且去中心化的參與機會。

Emerald Card and LAYER holders for a special occasion

read more below:

— Solayer (@solayer\_labs) June 9, 2025

打造高品質初期社群參與,Sola

LAYER-5.1%

鏈新聞abmedia·2025-06-09 13:23

a16z 加密營銷指南:從開發者生態到代幣發行,創始人如何避免踩坑?

來源:Marketing 101 for Startups:Token Launches,Memes,Reaching Devs & More

整理&編譯:lenaxin,ChainCatcher

編者按:

本文編譯自a16z出品的《Web3前沿》節目,聚焦加密領域與傳統科技行業的營銷差異。

節目嘉賓包括:Amanda Tyler、Claire Kart、Kim

A-2.41%

深潮 TechFlow·2025-06-03 03:28

狗狗幣可以達到0.60美元嗎?這個價格現在非常重要

在最新的YouTube摘要中,針對292,000名註冊用戶,分析師“More Crypto Online” (MCO)論證了狗狗幣從5月初的支撐位反彈,保持了模因幣更大波浪的進程,並且重要的是爲進一步的發展留出了空間。

DOGE-2.77%

blotienso·2025-05-09 16:49

直面加密新現實:HODL已死,DAO是笑話,向DeFi說再見

> 原文標題:Crypto's New Realities: HODL is Dead, DAOs are LMAOs, Bye DeFi and More

> 原文作者:Ignas,DeFi Research

> 原文編譯:深潮 TechFlow

作爲金融和交易的一部分,加密市場讓我着迷的原因是,它能清晰地告訴你對與錯。尤其是在這個充滿混亂的世界中,無論是政治、藝術、新聞業還是其他許多行業,真相與謊言的界限模糊不清。而加密貨幣卻簡單直接: 如果你是對的,你就賺錢;如果你錯了,你就虧錢。就是這麼簡單。

但即便如此,我還是掉進了一個非常基礎的陷阱:當市場條件發生變化時,我沒有重新評估我

DEFI4.93%

世链财经_·2025-05-08 07:10

交易員成功的秘密是什麼?為什麼牛熊市都能賺

市場不會獎勵那些猜對最多的人,它獎勵那些能在遊戲中堅持足夠久、抓住最大機會的人。本文源自 @YashasEdu 所著研究文章《Why Your Mindset Matters More Than Finding Perfect Trades?》,由律動小 deep 整理、編譯及重新撰稿。 (前情提要:Arthur

動區BlockTempo·2025-04-18 11:14

加拿大跨境電商平台 Shopify 執行長對員工警告:不懂得使用 AI 完成任務就沒有工作!

Shopify 執行長 Tobi Lütke 在 X 上分享了他發給 8,000 多名員工的內部備忘錄。這份備忘錄為內部使用,要求 Shopify 員工有效且頻繁地使用人工智慧,卻因為其中一句直接辛辣的話而迅速引發軒然大波,他要求工作同仁在要求擴增人員和要求公司給予資源之前,必須先證明為什麼他們無法使用人工智慧完成工作。(Before asking for more headcount and resources, teams must demonstrate why they cannot get what they want done using AI.)

Tobi Lütke 為第一間

WHY0.05%

鏈新聞abmedia·2025-04-13 04:07

邁克爾·塞勒的成功模式:上市公司紛紛效仿比特幣儲備戰略

> 比特幣價格徘徊在 85,000 美元左右,但新的公司仍在不斷入場,而已有的比特幣儲備公司也在繼續增加其持倉量。

原文標題:《Beyond Strategy: 11 More Publicly Traded Companies That Are Stockpiling Bitcoin》

撰文:Liz NapolitanoandLogan Hitchcock

編譯:Daisy, 火星財經

越來越多的上市公司開始囤積比特幣,效仿

BTC-0.03%

ForesightNews·2025-03-24 12:34

Michael Saylor 再次發佈比特幣 Tracker 相關信息,或將繼續增持BTC

深潮 TechFlow 消息,3 月 23 日,Strategy(原 MicroStrategy)創始人 Michael Saylor 再度發佈比特幣 Tracker 相關信息,或將繼續增持BTC。

他表示:“需要更多橙色(Needs more Orange.)”。

根據此前規律,Strategy 總是在相關消息發佈之後的第二天增持比特幣。

深潮 TechFlow·2025-03-24 08:44

百萬美金的交易反思:Less is More

作者經歷了從情緒交易到數據交易再到迴歸交易情緒的三個階段。最終意識到交易並非知識比拼,而在於適應市場,簡化交易方式,專注核心因素。交易是一場不斷對話,關鍵在於知道忽略什麼。強調重要性不在於掌握所有信息,而是在於專注重要事物,相信自己的決定,敢於承認對錯。通過經驗,作者強調了交易的殘酷現實和簡化關鍵因素的重要性。

FOMO-7.5%

深潮 TechFlow·2025-03-04 03:41

Less Is More: XYZVerse燃燒10億代幣,為$XYZ的價值注入動力

在幣圈中,銷燬代幣與火焰無關——這完全是點燃價值的問題。代幣銷燬的機制會永久性地將代幣從流通中移除,從而使剩下的代幣變得更加稀缺。基本經濟學會發揮作用:隨著可用代幣減少,每個代幣的價值自然會增長

Cryptopolitan·2025-03-03 12:34

交易員在LIBRA上賺取了672萬美元的利潤; 關於被阿根廷總統推廣的跑路的更多細節

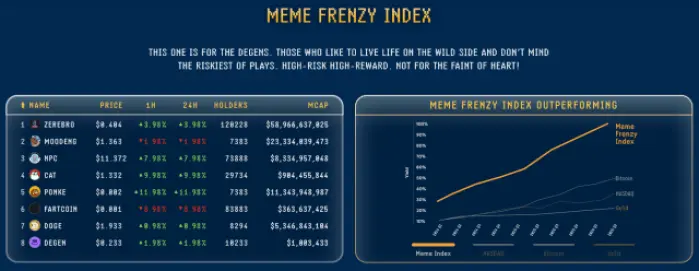

以色列批准比特幣基金,新的加密貨幣MEME指數擾亂交易

以色列證券管理局(ISA)批准了六隻比特幣($BTC)共同基金,由當地公司Migdal Capital Markets、More、Ayalon、Phoenix Investment、Meitav和IBI管理。

$BTC mutual funds與2024年在美國推出的交易所交易基金(ETFs)不同。然而,這一舉措顯示

Bitcoinistcom·2025-02-13 11:06

加密貨幣 ETF 提交引發 艾達, 萊特, & More 的上漲

萊特幣和Cardano在ETF獲批傳聞增多之際衝鋒。市場樂觀情緒隨著強勁的看漲信號助長了潛在的山寨行情預期。

CryptosHeadlines·2025-02-12 18:49

2025年的頂級加密貨幣選擇: 萊特幣, Rollblock, Stellar, and More – 準備好了!

"發現2025年具有可靠性、未來潛力和強大基本面的頂級加密貨幣投資選擇,為激動人心的投資機會。"

Bitcoincom News·2025-02-03 08:29

數字刀/美元對外匯交易和美元貨幣波動率的影響-BlockTelegraph

*

*

*

*

*

Policymakers on Capitol Hill continue to discuss the practicality of a digital dollar. Electronic currency makes money transfers faster and less expensive, yet the topic continues to cause controversy and debate between the political parties. The advent of inflation and a number of other economic factors has led certain financial experts to examine the possible shift from the dollar’s global dominance, which has given rise to even more discussion about the need for a digital dollar. Sydney Maidza, CEO of XTrend Speed, an award-winning forex mobile trading platform, follows this arena closely and shares insights for those following this area of the industry.

“There are three main areas to track as they pertain to the volatility of the U.S. dollar,” says Maidza:

* **Federal Reserve Policy:** The Federal Reserve’s interest rate decisions significantly impact the dollar’s value. Anticipation of rate hikes or changes in monetary policy will lead to fluctuations.

* **Global Economic Conditions:** A weakening global economy or geopolitical tensions could trigger investors to seek safe-haven assets, potentially strengthening the dollar.

* **Trade Wars and Tariffs:** Trade disputes between the US and other countries can create uncertainty and impact currency valuations.

“Thus, traders can expect heightened volatility in the forex market,” he shares. “This means there will be more opportunities for profit but also higher risks. Major currency pairs involving the U.S. dollar, such as EUR/USD, GBP/USD, and USD/JPY, will likely see increased price fluctuations.”

He continues, “Besides, forex traders will pay close attention to market sentiment, which can shift rapidly based on news and economic reports. Sentiment-driven trades can lead to sudden and sharp movements in currency prices. Furthermore, changes in U.S. interest rates relative to other countries will impact the carry trade, where traders borrow in low-interest currencies to invest in higher-interest ones. This will influence demand for the U.S. dollar.”

Maidza’s XTrend Speed team is laser-focused on being able to support traders in this space as they face the high winds of volatile market conditions. The suite of offerings now includes:

* **Real-Time Market Analysis:** XTrend Speed provides live-streaming analysis and real-time market updates, helping traders stay informed about the latest developments that could impact the forex market. Access to timely information is crucial for making informed trading decisions.

* **Advanced Analytical Tools:** We offer a suite of analytical tools such as AI-powered market monitoring that can help traders identify trends and patterns amidst market volatility. It manages risk by continuously evaluating and adjusting strategies to mitigate potential losses.

* **Risk Management Features:** XTrend Speed includes features such as stop-loss orders and risk management tools that help traders limit their losses and protect their investments during volatile periods.

* **Educational Resources:** The platform provides extensive educational resources, including tutorials and articles, to help traders understand market dynamics and develop effective trading strategies.

* **Community Engagement:** XTrend Speed’s community forums and discussion groups allow traders to share insights, strategies, and experiences. Engaging with a community of traders can provide valuable perspectives and support.

As traders and other experts in this area of finance continue to track the intersection of policy, technology, and global economics. New titans will be those armed with the best information and tools to manage the volatility of the dollar and its power on the world stage.

BlockTelegraph·2024-12-27 14:58

一位聯邦法官剛剛對證券交易委員會進行了打擊。這意味著什麼。- BlockTelegraph

*

*

*

*

*

If the SEC were a sports team measured by its “win” rate, it would be a runaway champ.

But that win-loss record suffered a mild hit — and its first ever loss in an “ICO” case — one that refers to the controversial method of crowd fundraising and that borrows from the public company “IPO” or initial public offering.

A federal judge denied the SEC a preliminary injunction against Blockvest after he granted a temporary restraining order on the same issue. We chat with Amit Singh, attorney and shareholder in Stradling’s corporate and securities practice group about the SEC’s fresh loss.

His take? They’ll be out for blood, next.

**For those not in the know, share the legal background leading up to this case.**

In October of this year, the Securities Exchange Commission filed a complaint against Blockvest LLC and its founder, Reginald Buddy Ringgold III. According to the complaint, Blockvest falsely claimed its planned December initial coin offering was “registered” and “approved” by the SEC and created a fake regulatory agency, the Blockchain Exchange Commission, which included a phony logo that was nearly identical to that of the SEC. The SEC also alleged Blockvest conducted pre-sales of its digital token, BLV, ahead of the ICO and raised more than $2.5 million.

The SEC’s complaint alleged violations of the anti-fraud provisions of the Securities Exchange and the Securities Act and violations of the Securities Act’s prohibitions against the offer and sale of unregistered securities in the absence of an exemption from the registration requirements.

U.S. District Judge Gonzalo Curiel issued a temporary restraining order “freezing assets, prohibiting the destruction of documents, granting expedited discovery, requiring accounting and order to show cause why a preliminary injunction should not be granted” on October 5, 2018.

On Tuesday, November 27, in the SEC’s first loss in stopping an ICO, judge Gonzalo Curiel stated that the SEC had not shown at this stage of the case that the BLV tokens were securities under the Howey Test, a decades-old test established by the U.S. Supreme Court for determining whether certain transactions are investment contracts and thus securities. If the tokens weren’t securities, all the SEC’s other allegations automatically fail Under the Howey Test, a transaction is an investment contract (or security) if:

– It is an investment of money;

– There is an expectation of profits from the investment;

– The investment of money is in a common enterprise; and

– Any profit comes from the efforts of a promoter or third party

Later cases have expanded the term “money” in the Howey Test to include investment assets other than money.

The judge said that the SEC failed to show investors had an expectation of profits. “While defendants claim that they had an expectation in Blockvest’s future business, no evidence is provided to support the test investors’ expectation of profits,” the judge wrote. Blockvest argued that the pre-ICO money came from 32 “test investors” and said the BLV tokens were only designed for testing its platform. It presented statements from several investors who said they either did not buy BLV tokens or rely on any representations that the SEC has alleged are false. The SEC responded by noting that various individuals wrote “Blockvest” or “coins” on their checks and were provided with a Blockvest ICO white paper describing the project and the terms of the ICO. Judge Curiel said that evidence, by itself, wasn’t enough: “Merely writing ‘Blockvest or coins’ on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments. Accordingly, plaintiff has not demonstrated that ‘securities’ were sold to [these] individuals.”

**Won’t the case proceed? Why is the denial of an injunction important here?**

This does not mean that the SEC cannot pursue an action against the defendants Rather it just means that the SEC didn’t meet the high burden required to receive a preliminary injunction of proving “(1) a prima facie case of previous violations of federal securities laws, and (2) a reasonable likelihood that the wrong will be repeated.”

The court determined that, at this stage, without full discovery and disputed issues of material facts, the Court could not decide whether the BLV token were securities. Since the SEC didn’t meet its burden of proving the tokens were securities in the first place, it couldn’t have shown that there was a previous violation of the federal securities laws So, the first prong was not met Further, the defendants agreed to stop the ICO and provide 30 days’ prior notice to the SEC if they intend to move forward with the ICO So, the court determined that there was not a reasonable likelihood that the wrong will be repeated As a result, the SEC’s motion for a preliminary injunction was denied.

Nonetheless, this is an important case as it is the first time the SEC went after an ICO issuer and the issuer pushed back and won (if only temporarily) It reminds us that, though most people think of the SEC as judge and jury in securities actions, that isn’t the case Ultimately, an issuer that pushes back may have a chance if it has the wherewithal to fight and if it has good arguments However, this does not mean that the SEC is done with them and we may very well see this case continue.

**Won’t media coverage of this case ultimately impair Blockvest’s ability to raise funds — its ultimate goal?**

That may very well be the case.

Unfortunately, unsophisticated investors could ultimately merely remember the Blockvest name and decide that it must be a good investment since they’ve heard of it (ala PT Barnum – “I don’t care what the newspapers say about me as long as they spell my name right.”). But I may be too cynical (hopefully I am). In any case, I would be surprised if Blockvest attempts to pursue an ICO without either registering the tokens or utilizing an exemption from the registration requirements. They clearly have a target on their back, so the SEC would love another crack at them I’m sure.

Plus, even though a preliminary injunction was denied here, the SEC still got what it wanted as Blockvest agreed not to pursue the ICO without giving the SEC 30 days’ prior notice of its intent to do so. So, the investing public was ultimately protected.

**What is the SEC’s current stance on what constitutes a security based on this case?**

The SEC will still point to the Howey Test Further, as stated in recent speeches by Hinman and others, the SEC seems to be focused not only on the utility of any tokens (i.e., they can be used on the platform for which they were created), but also on decentralization (that the efforts of the promoters are no longer required to maintain the value/utility of the tokens/platform).

However, the court in this case looked at the investment of money prong differently than has historically been the case Normally, the investment of money prong is assumed with little analysis as any consideration is considered “money” for purposes of the test But this case looked at the investment not from the purchaser’s subjective intent when committing funds, but instead based the analysis on what was offered to prospective purchasers and what information they relied on So, issuers are well advised to be very careful in how they advertise an offering.

Further, the expectation of profits prong wasn’t met because, according to Blockvest, these were just test investors So, it wasn’t clear these folks invested for a profit The tokens were never even used or sold outside the platform.

**Where does the Ninth Circuit sit in regards to what is a security?**

The Ninth Circuit follows the Howey Test.

However, the common enterprise element has received extensive and varied analysis in the federal circuit courts For example, while all circuits accept “horizontal” commonality as satisfying the common enterprise prong of the Howey Test, a minority of circuits (including the ninth) also accept “vertical” commonality in this analysis.

Horizontal commonality involves the pooling of assets, profits and risks in a unitary enterprise, while vertical commonality requires that profits of investors be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties” (narrow verticality), or “that the well-being of all investors be dependent upon the promoter’s expertise” (broad commonality). SEC v. SG Ltd., 265 F.3d 42, 49 (1st Cir. 2001).

The Ninth Circuit is the only one to accept the narrow vertical approach (though it also accepts horizontal commonality), which finds a common enterprise if there is a correlation between the fortunes of an investor and a promoter.” Sec. & Exch. Comm’n v. Eurobond Exchange, Ltd., 13 F.3d 1334, 1339 (9th Cir., 1994). Under this approach a common enterprise is a venture “in which the ‘fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment….'” Investors’ funds need not be pooled; rather the fortunes of the investors must be linked with those of the promoters, which suffices to establish vertical commonality. So, a common enterprise exists if a direct correlation has been established between success or failure of the promoter’s efforts and success or failure of the investment.

**Which Federal Circuits might offer an equal or even bigger split with the SEC?**

I wouldn’t really say that any courts split with the SEC as the SEC’s decisions take precedent over any decisions of those courts. However, there is a split among the circuits as described above with respect to what type of commonality is sufficient to find a common enterprise.

**What impact could the outcome of this case have on ICOs at large?**

This case may embolden companies who have already conducted ICOs to push back on any SEC actions that they might not otherwise fight as it shows that the SEC will always have to meet the burden of proving all factors of the Howey Test are met before the SEC has jurisdiction over the offering in the first place.

**Has the Supreme Court addressed anything crypto, crypto related, or analogous?**

The only case I know of where the Supreme court has addressed crypto currencies is Wisconsin Central Ltd. v. United States.

That was a case about whether stock counts as “money remuneration” The dissent in that case talked about how our concept of money has changed over time and said that perhaps “one day employees will be paid in bitcoin or some other type of cryptocurrency.” This goes against the IRS’s position that cryptocurrencies are property and should be taxed as such But, it was just a passing comment in the dissent. So, it has no precedential value. But, it may embolden someone to fight the IRS’s position.

BlockTelegraph·2024-12-19 05:53

美聯儲議息會議筆記:鷹派降息(2024年12月)

來源:智堡投研

摘要

本次會議,美聯儲降息25bp,至4.25%-4.5%水平,符合預期。隔夜逆回購工具進行技術性調整至聯邦基金利率的區間下沿。

會議聲明的措辭有調整,體現出FOMC考慮後續政策的實施“節奏”和“幅度”都產生了變化。票型也出現了分歧,有委員反對12月降息。

經濟預測明顯體現出對通脹風險的擔憂,聯儲的風險平衡顯然再度倒向通脹。點陣圖僅暗示明年兩次降息,展現出絕對的鷹派傾向。

發佈會開場白中,鮑威爾提及“more neutral setting”以及對進一步降息的“Cautious”,表態偏鷹派。

美元/VIX暴漲,美債、美股、黃金、比特幣大幅下跌。

BTC-0.03%

金色财经_·2024-12-19 03:18

比特幣價格上漲引發對一種預計在2025年1月1日之前超過2美元的山寨幣的FOMO

The recent Bitcoin price rally has reignited investor interest and market momentum. Surpassing key resistance levels and hitting a historic all-time high (ATH), the Bitcoin price resurgence is driving a renewed focus on the flagship crypto asset and sparking enthusiasm for the general altcoin market.

A particular altcoin, PCHAIN, has captured significant attention, with analysts and investors predicting it could surpass $2 by January 1, 2025. This rising star is becoming a hot topic in crypto communities, spurred by the growing fear of missing out (FOMO) as its value trajectory aligns with broader market optimism.

As the Bitcoin price continues to dominate headlines, this altcoin’s potential hinges on its unique use case, robust community backing, and strategic partnerships, which set it apart in an increasingly competitive market. Investors are monitoring its upward trend, fueled by bullish sentiment and the projected 18,081.8% rally by January 1, 2025.

With many analysts predicting further exponential growth, this altcoin appears poised to capitalize on the momentum of the Bitcoin price. This makes it a promising contender for investors seeking low-risk, high-reward investments and high returns in the ever-evolving crypto market.

## The Influence of the Bitcoin Price Rally on the Market

The Bitcoin price movement remains the cornerstone of the crypto market, often setting the tone for broader market sentiment. The BTC’s recent rally, which saw it break the $103,679 mark, fueled by institutional interest, declining inflation, and hopes of regulatory clarity in the United States, has sent shockwaves through the industry.

As the Bitcoin price surged, trading volumes rose, and investor confidence returned after a prolonged bear market. Historically, a BTC rally tends to act as a catalyst for the altcoin market. Altcoins, which refer to crypto assets other than BTC, often experience heightened activity as traders seek opportunities to maximize returns.

## The Altcoin Stealing the Show as Bitcoin Price Rises

The altcoin in question, PCHAIN, is often called a “hidden gem” by market analysts Its unique value proposition and growing adoption in the real-world asset tokenization market have positioned it as a strong contender in the crypto space.

PCHAIN’s parent project, PropiChain, is a blockchain-powered real estate platform poised to utilize cutting-edge technologies to power the future of the $600 trillion global real estate market.

Currently priced at $0.011 for its ongoing second round of presale, top market analysts are projecting a massive 18,081.8% price rally to over $2 by January 1, 2025, for this altcoin.

While the recent Bitcoin price rally has contributed to the FOMO for this PCHAIN RWA token, analysts attribute its potential to surpass $2 by early 2025 to several factors, including increased utility, strategic partnerships, expanding user base, and growing global demand.

## Factors Behind the $2 Prediction for PCHAIN Amid the Bitcoin Price Surge

While other crypto tokens solely rely on the upward momentum of the Bitcoin price to make significant moves in the market, PCHAIN’s solid fundamentals are the key factors driving its price surge to $2.

* Increased Token Utility

As PropiChain’s utility token, PCHAIN offers real estate investors early access to the future of the $600 trillion global real estate market. PCHAIN also serves as an RWA token, bridging the gap between the real estate market and the blockchain.

With an increased utility comes increased demand, which further translates to an increase in price for the token.

* Growing Market Demand

The RWA tokenization market is projected to grow to a staggering $16 trillion, with real estate the biggest beneficiary. As an RWA altcoin, investors understand that the token is positioned to enjoy the first-mover advantage in real estate tokenization, which will undoubtedly drive its value.

* PCHAIN’s Underlying Technology

PropiChain’s cutting-edge technology addresses critical pain points in the $600 trillion real estate market. By offering a more efficient and user-friendly real estate investment platform, the altcoin has positioned itself as a viable investment opportunity for real estate investors seeking high-profit potential assets.

## PropiChain Set To Power the Future of Real Estate

PropiChain uses four cutting-edge technological innovations, such as the Metaverse, AI, smart contracts, and RWA tokenization, to reshape the real estate investment landscape.

With its integration of the Metaverse, the platform revolutionizes how users engage with real estate properties by providing immersive virtual experiences. Through state-of-the-art 3D technology, potential buyers can explore properties from anywhere worldwide, effectively removing geographical barriers.

The Metaverse also serves as a global marketplace, fostering real-time interactions between property buyers and sellers in an engaging digital environment. PropiChain offers round-the-clock support to assist investors in their real estate investment journey by using AI-powered virtual assistants and chatbots.

This personalized guidance ensures a seamless and efficient investment experience, simplifying processes for both new and experienced investors.

Additionally, a standout feature of PropiChain is its advanced AI-driven predictive market analysis. This technology provides investors with actionable insights into emerging market trends within the real estate sector. The AI tool analyzes market patterns and future developments and helps investors strategize for emerging opportunities

In addition, PropiChain integrates smart contracts to help property owners automate critical property management tasks, such as lease agreements and renewals. This feature eliminates inefficiencies and reduces reliance on intermediaries like brokers and leasing agents.

Another groundbreaking feature of this revolutionary platform is its use of Real World Asset (RWA) tokenization. This technology transforms real estate properties into digital tokens, allowing fractional ownership.

PropiChain allows investors with limited capital to acquire portions of high-value real estate assets by breaking down traditional financial barriers. This democratized approach to property investment is reshaping the real estate sector, making it more inclusive and accessible.

## Conclusion

The recent Bitcoin price rally has reaffirmed its dominance and paved the way for other crypto tokens to shine. With its projected 18,081.8% price rally by January 1, 2025, your $1000 investment in the ongoing PCHAIN presale at $0.011 would be worth approximately $181,818. Join the presale now to enjoy massive gains.

At the end of this second presale round, the token price will increase by over 109% for the final round. Join now to avoid buying the token at an increased $0.023, potentially impacting your profit margin. BlockAudit, a leading blockchain security firm, has audited the project’s smart contract and found zero vulnerabilities.

PCHAIN is listed on CoinMarketCap, increasing the token’s visibility and accessibility to potential investors.

**For more information about PropiChain presale:**

Website: PropiChain Join Community:

BTC-0.03%

BlockchainReporter·2024-12-15 18:00

加密貨幣 Ban No More?摩洛哥起草法律歡迎數字資產 | Bitcoinist.com

隨著快速到來的牛市,世界各國政府正在做出驚人的決定,以從蓬勃發展的幣圈中獲取最大利益。而摩洛哥政府也不例外,結束了長達七年的加密貨幣禁令!

在歐洲國家發出歡迎公告之後,市場

Bitcoinistcom·2024-12-05 18:36

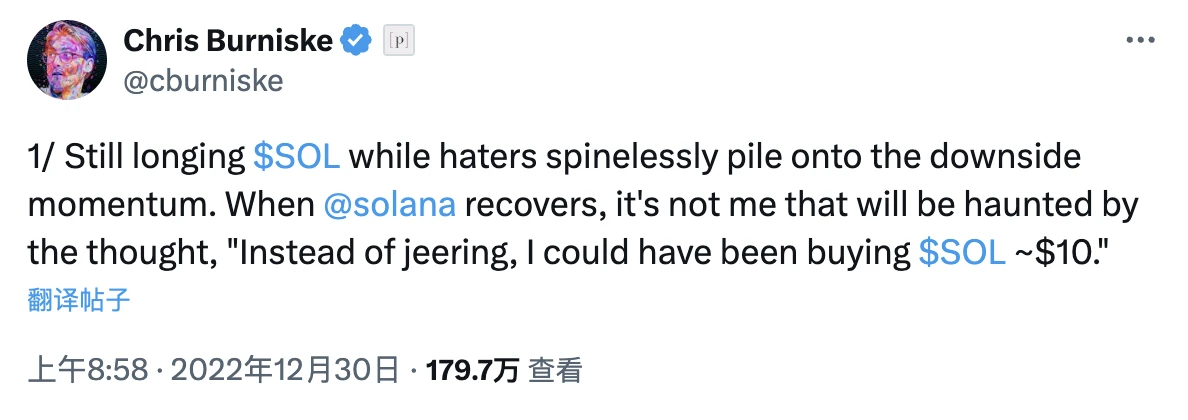

8美元谷底時狂奶SOL的大佬,開始“喊單”ETH了

Cryptocurrency investor and Placeholder associate Chris Burniske has reaffirmed his support for Ethereum in a recent tweet. Despite losing market share to Solana, Burniske believes that Ethereum will reassert its position in the Internet Financial System (IFS) by continuing to attract more users and offer more liquidity. The Ethereum community is showing signs of introspection and could be on the verge of a rebirth, he said. The mainstream evolution of blockchain is a long game, and he expects a lot more competition among big chains, including Bitcoin and Solana, in the years to come.

星球日报·2024-11-18 03:34

Miracle Cash & More在熱門的雪崩幣區塊鏈上推出了新的流動性池 | Bitcoinist.com

Miracle Cash & More,作為去中心化金融創新的龍頭,自豪地宣佈在雪崩幣區塊鏈上推出其新的流動性池。這個創新的池子被稱為Phoenic Leveller,是第一個能夠讓用戶利用他們的流動性倉位的平臺。

Bitcoinistcom·2024-10-07 10:38

模塊化借貸:不僅僅是一個 meme? - ChainCatcher

原文標題:《Modular lending: More than a meme?》

原文作者:Chris Powers

原文編譯:Luccy,BlockBeats

編者按:

DeFi 研究員 Chris Powers 探討了借貸領域的新趨勢——模塊化借貸,並舉例說明了模塊化借貸在應對市場挑戰和提供更好服務方面的潛力。

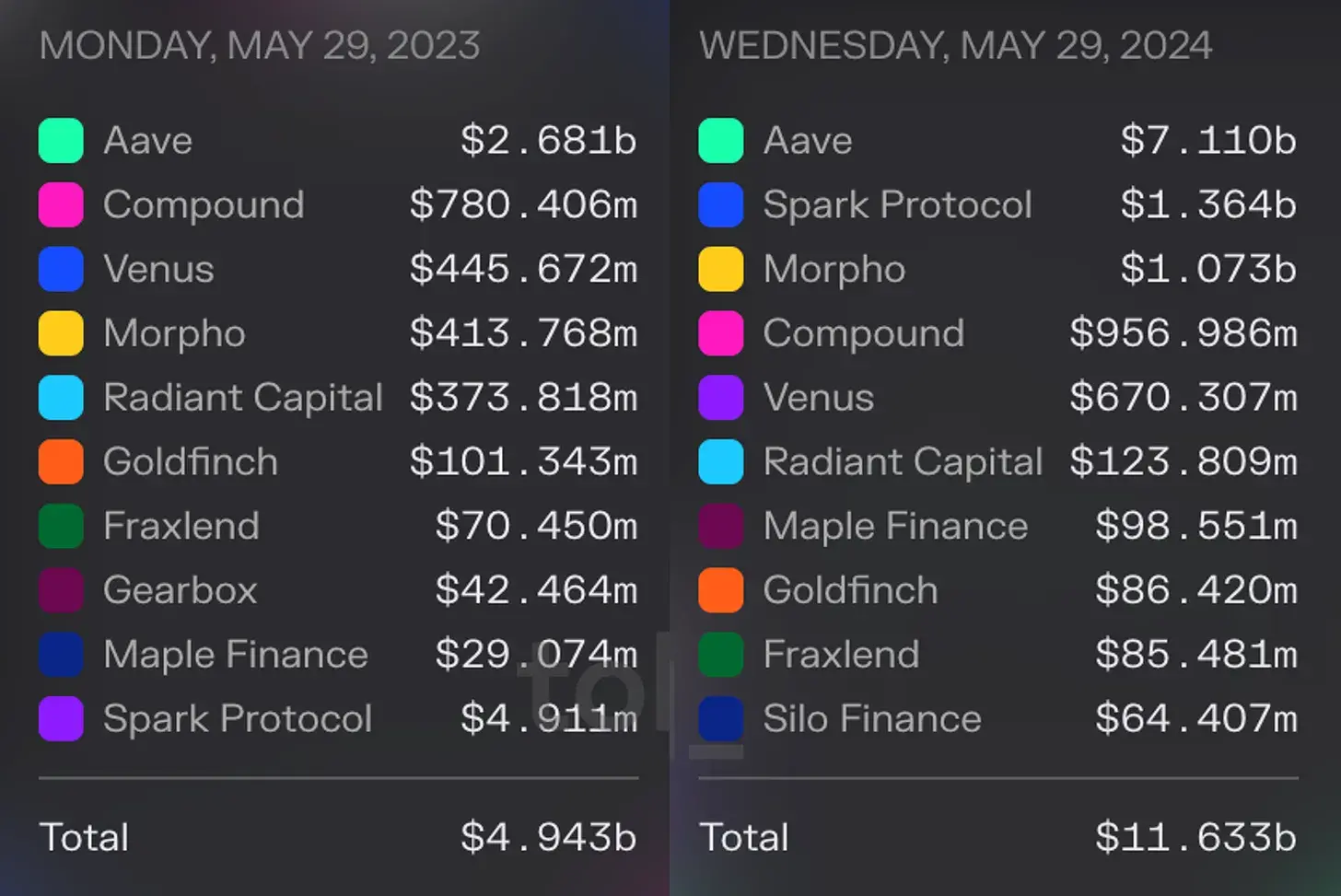

Chris Powers 對比了傳統 DeFi 借貸領軍者(MakerDAO、Aave 和 Compound),以及幾個主要的模塊化借貸項目,包括 Morpho、Euler 和 Gearbox 等,指出 DeFi

链捕手·2024-06-01 06:29

PEPE幣創下新高!PEPE替代品WienerAI正在飛奔至400萬美元

PEPE, a frog-themed meme coin, reached a new record level on the first day of the week. According to Coinmarketcap, the asset has gained more than 70% in value in a week as of the time of writing this news.

幾乎每天都創下了有史以來最高水平(ATH)的PEPE,這是一個積極的鏈。

Kriptokoin·2024-05-27 23:41

銘文禁用風波落定:Luke Dashjr 提案被否決,爭議何去何從?

> 1 月7 日,Bitcoin Core 用戶端開發者Luke Dashjr 發起提案「datacarriersize: Match more datacarrying 28408」。本文對支持者和反對者的觀點進行了整理總結。

撰文:LINDABELL

1 月7 日,Bitcoin Core 用戶端開發者Luke Dashjr 發起的提案「datacarriersize: Match more datacarrying 28408」在經過多位Bitcoin Core 開發者討論後被否決。該提案由Luke Dashjr 於2023 年9

ForesightNews·2024-01-12 09:10

為什麼Base和OP要做利益共同體?

作者:Haotian-CryptoInsight

昨晚,OP Stack當紅炸子雞@BuildOnBase鏈發布了與@optimismFND合作聲明,信息量很大,解答了不少Rumor和疑惑。 layer2的升級合約如何擺脫單體化控制嫌疑?利潤分紅有沒有傳言中30%那麼高?為啥Base不自立門戶,要和OP做利益共同體?我來給大家一一解讀下:

開篇,Base就解釋了和OP Stack合作的原因,和之前我解讀的長文觀點一致:OP足夠開放且吸引開發者。原話是“the more hands on the code,the more chances to spot and secure the fo...

金色财经_·2023-08-25 08:26

加載更多