Результаты поиска для "THINK"

Маленькая прибыль? Нет, протоколы DeFi-кредитования — это недооценённые «короли ценности»

原文标题:Why the defi lending moat is bigger than you think

原文作者:Silvio,加密研究员

原文编译:叮当,Odaily 星球日报

随着 DeFi 世界中金库(Vault)与策展人(Curator)的市场份额不断提升,市场开始质疑:借贷协议是否正在被不断压缩利润空间?借贷不再是一门好生意?

但如果将视角放回到整个链上信用价值链中,结论恰恰相反。借贷协议依然占据着这条价值链中最坚固的护城河。我们可以用数据来量化这一点。

在 Aave 和

PANews·2025-12-25 11:08

Отчет: Как think tank Министерства финансов США смотрит на стейблкоины?

Автор: TechFlow

Стейблкоины, безусловно, стали горячей темой крипторынка за последнюю неделю.

Сначала в США был принят законопроект о стабильной валюте GENIUS голосованием в Сенате, затем Законодательный совет Гонконга принял в третьем чтении проект закона о стабильных монетах. Стабильные монеты теперь стали важным переменным элементом в глобальной финансовой системе.

Будущее развития стейблкоинов в США затрагивает не только процветание рынка цифровых активов, но и может оказать глубокое влияние на спрос на государственные облигации, ликвидность банковских депозитов и гегемонию доллара.

За месяц до принятия закона GENIUS «мозговой центр» Министерства финансов США — Комитет по консультациям по заимствованию (Treasury Borrowing Advisory Committee, сокращенно TBAC) — в своем отчете углубленно рассмотрел потенциальное влияние расширения стейблкоинов на финансовую и бюджетную стабильность США.

В качестве долгового финансирования, разработанного Министерством финансов

DeepFlowTech·2025-05-22 14:01

CoinVoice недавно узнал, что, по данным Zero One Think Tank, JD Technology Group недавно опубликовала ряд информации о наборе сотрудников, связанных с RWA, на BOSS Zhipin, что ознаменовало ее официальный выход в область токенизации реальных активов (RWA) со стратегическим направлением, сосредоточенным на новых энергетических активах, и явно требующим, чтобы дизайн системы поддерживал стыковку со стейблкоинами и цифровым юанем.

JD в настоящее время вошел в гонконгский песочницу стейблкоинов и стал одной из первых технологических компаний, участвующих в пилотном проекте цифрового юаня на материковом рынке, что может стать первым случаем, когда RWA и цифровой юань будут взаимодействовать.

RWA2,4%

CoinVoice·2025-05-12 16:48

Arbitrum и Yuga Labs поддерживают Thinkagents.ai для создания пользовательских AI-агентов на разных Блокчейнах

В знаковом шаге более 70 ведущих криптоорганизаций, включая Arbitrum, Yuga Labs и Magic Eden, поддержали открытый фреймворк Thinkagents.ai, разработанный для децентрализации искусственного интеллекта и противодействия контролю крупных технологий. Новый стандарт Think Agent наделяет ИИ-агентов возможностями о

Coinfomania·2025-05-03 11:39

Американский think tank жестко критикует Трампа и Пауэлла: Федеральная резервная система (ФРС) слишком сильно снизила процентные ставки, "инфляция вскоре ликвидирована", экономика полностью вышла из строя.

Адам Позен, директор Института международной экономики Петерсона, предупредил, что, исходя из конкретных моделей политики, независимо от показателей экономического роста, Соединенные Штаты могут столкнуться с высокой инфляцией или даже попасть под угрозу экономической стагнации и высокой инфляции. (Синопсис: Неразорвавшаяся бомба этим летом: Трамп имеет право «уволить Пауэлла» после мая, чтобы контролировать Федеральную резервную систему США для снижения процентных ставок? (Справочное дополнение: Болл разрушает надежды на снижение процентных ставок + чип Huida регулируется, биткоин падает до 84 000, а американские акции сталкиваются с очередной резкой распродажей) Институт международной экономики Петерсона (PIIE), один из двух беспартийных аналитических центров в Соединенных Штатах, недавно выпустил предупреждение о тарифной политике Трампа. Адам С. Позен, который считает, что Соединенные Штаты, возможно, движутся к разрушительной «стагнирующей инфляции» из-за взаимной тарифной политики администрации Трампа, и считает, что нынешняя ФРС чрезмерно снизила процентные ставки и может нуждаться в более длительном периоде наблюдения или других интервенциях. Волна речевого контента

TRUMP3,67%

動區BlockTempo·2025-04-18 10:08

Массивный прорыв Solana может быть ближе, чем вы думаете, но лучшие трейдеры предсказывают движение на 15 000% для этого токена ИИ до 4 квартала 2025 года

Илон Маск открыл для пользователей бесплатный доступ к самому мощному ИИ на планете Grok 3: пока сервер не упадет! (включая руководство)

Подразделение искусственного интеллекта во главе с Маском, новая стартап-компания XAI, запустила новую модель искусственного интеллекта Grok 3, которая претендует на звание "самого мощного искусственного интеллекта на планете", обладающую мощными способностями рассуждения и новыми функциями DeepSearch и Think. Grok 3 бесплатно доступен всем пользователям, однако существуют ограничения на использование, требуется подписка на услуги X Premium+ и SuperGrok для разблокировки всех функций. Корпоративное API будет доступно через несколько недель. Способы использования включают прямое использование на платформе X, выбор модели на официальном сайте и мобильное приложение. В общем и целом, Grok 3 демонстрирует выдающуюся производительность и ранее невиданные функции, что делает его значимым инновационным продуктом в области искусственного интеллекта.

動區BlockTempo·2025-02-21 02:48

GROK 3 теперь доступен: вы можете бесплатно пользоваться функциями DeepSearch и Think до тех пор, пока нагрузка не станет слишком высокой!

Grok 3 будет доступен для глобального использования с 19 февраля 2025 года, предоставляя передовое взаимодействие с искусственным интеллектом. Функция DeepSearch может быстро собирать и анализировать информацию, а режим Think моделирует пошаговое логическое мышление. Grok 3 изменит повседневность, помогая контент-мейкерам и профессионалам. Вы можете бесплатно попробовать функции DeepSearch и Think до тех пор, пока нагрузка не станет слишком высокой.

ChainNewsAbmedia·2025-02-20 07:28

Трейдер говорит, что XRP отправится в гонку, как только будет преодолен основной уровень сопротивления - вот его цель по цене - The Daily Hodl

Analyst and trader Ali Martinez is leaning bullish on the third-largest crypto asset by market cap, XRP.

Martinez tells his 100,500 followers on the social media platform X that XRP is flashing a bullish signal on the four-hour time frame and could soar by around 57% from the current level.

*“XRP has been consolidating in this bull flag for a while, but once it clears the $2.60 resistance, I think it’s off to the races, heading toward $4!”*

Source: Ali Martinez/XXRP is trading at $2.55 at time of writing.

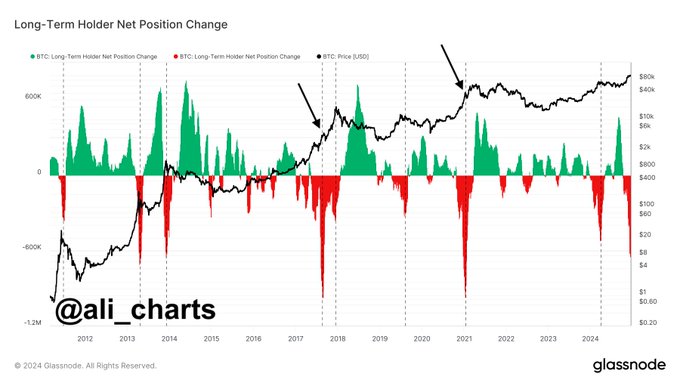

Next up is Bitcoin (BTC). According to Martinez, long-term holders of Bitcoin are reducing their positions, a phenomenon that coincided with a market top during the last two BTC cycles.

*“Long-term Bitcoin holders often sell near market tops. Interestingly, in 2017 and 2021, their biggest sell-offs occurred right before the final leg up.*

*Could we be on the verge of a similar pattern? Is this the start of a market top?”*

Source: Ali Martinez/XBitcoin is trading at $104,919 at time of writing.

Next up is Ethereum (ETH). The crypto trader and analyst says that Ethereum could be on the cusp of a massive rally.

*“In the past two bull cycles, Ethereum went parabolic when long-term holders shifted into greed mode. Right now, they’re only in the early stages of the belief phase. The big move could still be ahead!”*

Source: Ali Martinez/XEthereum is trading at $3,866 at time of writing.

*Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox*

*Check Price Action*

*Follow us on X, Facebook and Telegram*

*Surf The Daily Hodl Mix*

*Generated Image: Midjourney*

GateUser-299f2bac·2024-12-19 07:30

Федеральный судья только что отверг SEC. Вот что это означает. - BlockTelegraph

*

*

*

*

*

If the SEC were a sports team measured by its “win” rate, it would be a runaway champ.

But that win-loss record suffered a mild hit — and its first ever loss in an “ICO” case — one that refers to the controversial method of crowd fundraising and that borrows from the public company “IPO” or initial public offering.

A federal judge denied the SEC a preliminary injunction against Blockvest after he granted a temporary restraining order on the same issue. We chat with Amit Singh, attorney and shareholder in Stradling’s corporate and securities practice group about the SEC’s fresh loss.

His take? They’ll be out for blood, next.

**For those not in the know, share the legal background leading up to this case.**

In October of this year, the Securities Exchange Commission filed a complaint against Blockvest LLC and its founder, Reginald Buddy Ringgold III. According to the complaint, Blockvest falsely claimed its planned December initial coin offering was “registered” and “approved” by the SEC and created a fake regulatory agency, the Blockchain Exchange Commission, which included a phony logo that was nearly identical to that of the SEC. The SEC also alleged Blockvest conducted pre-sales of its digital token, BLV, ahead of the ICO and raised more than $2.5 million.

The SEC’s complaint alleged violations of the anti-fraud provisions of the Securities Exchange and the Securities Act and violations of the Securities Act’s prohibitions against the offer and sale of unregistered securities in the absence of an exemption from the registration requirements.

U.S. District Judge Gonzalo Curiel issued a temporary restraining order “freezing assets, prohibiting the destruction of documents, granting expedited discovery, requiring accounting and order to show cause why a preliminary injunction should not be granted” on October 5, 2018.

On Tuesday, November 27, in the SEC’s first loss in stopping an ICO, judge Gonzalo Curiel stated that the SEC had not shown at this stage of the case that the BLV tokens were securities under the Howey Test, a decades-old test established by the U.S. Supreme Court for determining whether certain transactions are investment contracts and thus securities. If the tokens weren’t securities, all the SEC’s other allegations automatically fail Under the Howey Test, a transaction is an investment contract (or security) if:

– It is an investment of money;

– There is an expectation of profits from the investment;

– The investment of money is in a common enterprise; and

– Any profit comes from the efforts of a promoter or third party

Later cases have expanded the term “money” in the Howey Test to include investment assets other than money.

The judge said that the SEC failed to show investors had an expectation of profits. “While defendants claim that they had an expectation in Blockvest’s future business, no evidence is provided to support the test investors’ expectation of profits,” the judge wrote. Blockvest argued that the pre-ICO money came from 32 “test investors” and said the BLV tokens were only designed for testing its platform. It presented statements from several investors who said they either did not buy BLV tokens or rely on any representations that the SEC has alleged are false. The SEC responded by noting that various individuals wrote “Blockvest” or “coins” on their checks and were provided with a Blockvest ICO white paper describing the project and the terms of the ICO. Judge Curiel said that evidence, by itself, wasn’t enough: “Merely writing ‘Blockvest or coins’ on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments. Accordingly, plaintiff has not demonstrated that ‘securities’ were sold to [these] individuals.”

**Won’t the case proceed? Why is the denial of an injunction important here?**

This does not mean that the SEC cannot pursue an action against the defendants Rather it just means that the SEC didn’t meet the high burden required to receive a preliminary injunction of proving “(1) a prima facie case of previous violations of federal securities laws, and (2) a reasonable likelihood that the wrong will be repeated.”

The court determined that, at this stage, without full discovery and disputed issues of material facts, the Court could not decide whether the BLV token were securities. Since the SEC didn’t meet its burden of proving the tokens were securities in the first place, it couldn’t have shown that there was a previous violation of the federal securities laws So, the first prong was not met Further, the defendants agreed to stop the ICO and provide 30 days’ prior notice to the SEC if they intend to move forward with the ICO So, the court determined that there was not a reasonable likelihood that the wrong will be repeated As a result, the SEC’s motion for a preliminary injunction was denied.

Nonetheless, this is an important case as it is the first time the SEC went after an ICO issuer and the issuer pushed back and won (if only temporarily) It reminds us that, though most people think of the SEC as judge and jury in securities actions, that isn’t the case Ultimately, an issuer that pushes back may have a chance if it has the wherewithal to fight and if it has good arguments However, this does not mean that the SEC is done with them and we may very well see this case continue.

**Won’t media coverage of this case ultimately impair Blockvest’s ability to raise funds — its ultimate goal?**

That may very well be the case.

Unfortunately, unsophisticated investors could ultimately merely remember the Blockvest name and decide that it must be a good investment since they’ve heard of it (ala PT Barnum – “I don’t care what the newspapers say about me as long as they spell my name right.”). But I may be too cynical (hopefully I am). In any case, I would be surprised if Blockvest attempts to pursue an ICO without either registering the tokens or utilizing an exemption from the registration requirements. They clearly have a target on their back, so the SEC would love another crack at them I’m sure.

Plus, even though a preliminary injunction was denied here, the SEC still got what it wanted as Blockvest agreed not to pursue the ICO without giving the SEC 30 days’ prior notice of its intent to do so. So, the investing public was ultimately protected.

**What is the SEC’s current stance on what constitutes a security based on this case?**

The SEC will still point to the Howey Test Further, as stated in recent speeches by Hinman and others, the SEC seems to be focused not only on the utility of any tokens (i.e., they can be used on the platform for which they were created), but also on decentralization (that the efforts of the promoters are no longer required to maintain the value/utility of the tokens/platform).

However, the court in this case looked at the investment of money prong differently than has historically been the case Normally, the investment of money prong is assumed with little analysis as any consideration is considered “money” for purposes of the test But this case looked at the investment not from the purchaser’s subjective intent when committing funds, but instead based the analysis on what was offered to prospective purchasers and what information they relied on So, issuers are well advised to be very careful in how they advertise an offering.

Further, the expectation of profits prong wasn’t met because, according to Blockvest, these were just test investors So, it wasn’t clear these folks invested for a profit The tokens were never even used or sold outside the platform.

**Where does the Ninth Circuit sit in regards to what is a security?**

The Ninth Circuit follows the Howey Test.

However, the common enterprise element has received extensive and varied analysis in the federal circuit courts For example, while all circuits accept “horizontal” commonality as satisfying the common enterprise prong of the Howey Test, a minority of circuits (including the ninth) also accept “vertical” commonality in this analysis.

Horizontal commonality involves the pooling of assets, profits and risks in a unitary enterprise, while vertical commonality requires that profits of investors be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties” (narrow verticality), or “that the well-being of all investors be dependent upon the promoter’s expertise” (broad commonality). SEC v. SG Ltd., 265 F.3d 42, 49 (1st Cir. 2001).

The Ninth Circuit is the only one to accept the narrow vertical approach (though it also accepts horizontal commonality), which finds a common enterprise if there is a correlation between the fortunes of an investor and a promoter.” Sec. & Exch. Comm’n v. Eurobond Exchange, Ltd., 13 F.3d 1334, 1339 (9th Cir., 1994). Under this approach a common enterprise is a venture “in which the ‘fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment….'” Investors’ funds need not be pooled; rather the fortunes of the investors must be linked with those of the promoters, which suffices to establish vertical commonality. So, a common enterprise exists if a direct correlation has been established between success or failure of the promoter’s efforts and success or failure of the investment.

**Which Federal Circuits might offer an equal or even bigger split with the SEC?**

I wouldn’t really say that any courts split with the SEC as the SEC’s decisions take precedent over any decisions of those courts. However, there is a split among the circuits as described above with respect to what type of commonality is sufficient to find a common enterprise.

**What impact could the outcome of this case have on ICOs at large?**

This case may embolden companies who have already conducted ICOs to push back on any SEC actions that they might not otherwise fight as it shows that the SEC will always have to meet the burden of proving all factors of the Howey Test are met before the SEC has jurisdiction over the offering in the first place.

**Has the Supreme Court addressed anything crypto, crypto related, or analogous?**

The only case I know of where the Supreme court has addressed crypto currencies is Wisconsin Central Ltd. v. United States.

That was a case about whether stock counts as “money remuneration” The dissent in that case talked about how our concept of money has changed over time and said that perhaps “one day employees will be paid in bitcoin or some other type of cryptocurrency.” This goes against the IRS’s position that cryptocurrencies are property and should be taxed as such But, it was just a passing comment in the dissent. So, it has no precedential value. But, it may embolden someone to fight the IRS’s position.

BlockTelegraph·2024-12-19 05:53

Решетка: Блокчейн — это само компьютерное оборудование

来源: MetaCat

По причинам, которые вы скоро поймете, в Lattice мы обсуждали знаменитую цитату Алана Кея: «Люди, которые действительно серьезно относятся к программному обеспечению, должны создавать свое собственное оборудование».

Эта фраза стала именем нарицательным в эпоху графических процессоров после iOS/Tesla/Bitcoin ASIC/NVIDIA AI GPU, в которой мы живем, и ее происхождение на самом деле трудно точно проследить. После некоторых поисков я нашел эту статью ( ) Энди Херцфельда, одного из первых сотрудников Apple, в которой содержались заметки из выступления Алана Кея на конференции Creative Think в 1982 году. Насколько мне известно, полной расшифровки речи нет, но эта цитата цитируется в записках Херцфилда, а также других знаменитых Алана Кея...

BTC2,8%

金色财经_·2023-11-14 04:03

Загрузить больше