Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Bitcoin is consolidating sideways, Strategy has once again made a large purchase of 13,627 BTC

Source: DecenterKorea Original Title: Bitcoin Consolidates, Strategy Purchases 13,627 More [Decenter Market] Original Link: https://www.decenter.kr/NewsView/2K7ACC2RIC/GZ03

Bitcoin(BTC) is consolidating around $91,000. Even during the price correction phase, the world’s largest BTC holding publicly listed company Strategy made a large-scale additional purchase last week, continuing to take proactive actions.

According to data from global cryptocurrency market tracking websites, at 8:04 AM on January 13, BTC increased by 0.75% compared to 24 hours ago, with a trading price of $90,23.58. Ethereum(ETH) fell 0.37% to $3,088.74. Ripple(XRP) decreased 0.34% to $2.050, and Binance Coin(BNB) rose 0.40% to $904.41.

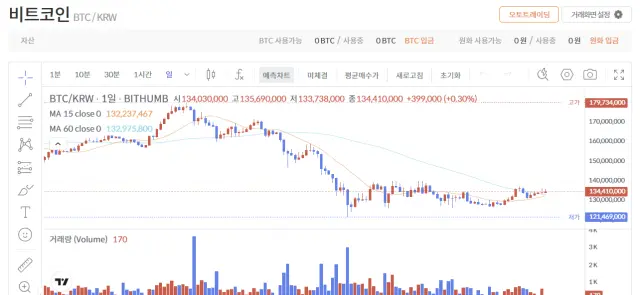

The domestic market shows a similar trend. On a leading exchange, BTC increased by 0.30% compared to 24 hours ago, quoted at 134.41 million Korean Won. ETH fell 0.35% to 4.56 million Won, and XRP dropped 0.98% to 3,023 Won.

According to reports from professional cryptocurrency media, Strategy has increased its Bitcoin holdings for the third consecutive week. This purchase is the largest since July last year. Last week, Strategy added 13,627 BTC at a total cost of $1.25 billion, with an average purchase price of approximately $91,519. After this purchase, Strategy’s total Bitcoin holdings expanded to 687,410 BTC, with a total investment of $51.8 billion, and an average buy-in price of about $75,353.

The funds for the purchase were raised through the issuance of $1.1 billion in common stock and $119.1 million in perpetual preferred stock “STRC.” Perpetual preferred stock is a type of capital security without maturity or mandatory redemption clauses, allowing funds to be raised without increasing debt burden.

The cryptocurrency data analysis company’s Fear & Greed Index decreased by 2 points from the previous day to 27, indicating a “fear” state. The closer the index is to 0, the more pessimistic investor sentiment; the closer to 100, the more overheated the market.