Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Trending Topics

View More12.8K Popularity

39.72K Popularity

52.43K Popularity

14.23K Popularity

10.06K Popularity

Pin

Bitcoin around $92,000... Fluctuates amid US-Europe trade war

Source: DecenterKorea Original Title: Bitcoin in the $92,000 range… Fluctuations due to US-Europe trade war [Decenter Market Overview] Original Link:

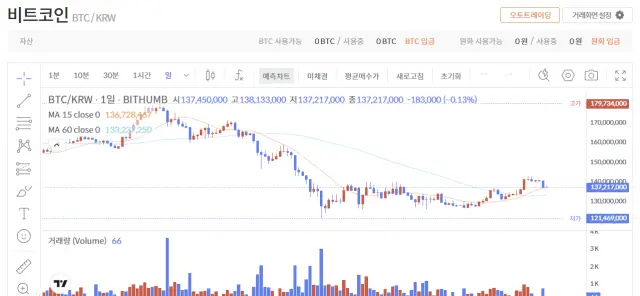

As of 8 a.m. on the 20th, based on Bithumb, Bitcoin(BTC) is trading at 137,217,000 KRW, down 0.10% from the previous day.

Bitcoin(BTC) is trading in the $92,000 range. The trade conflict between the US and Europe, triggered by President Donald Trump’s Greenland annexation plan and tariff pressures, has emerged as a short-term market variable.

According to CoinMarketCap, a global cryptocurrency market data site, at 8 a.m. on the 20th, BTC was at $92,836.69, down 2.71% from the previous day. Ethereum(ETH) is trading at $3,203.69, down 4.27%. BNB(BNB) is down 2.67% at $924.46, XRP(XRP) is down 3.28% at $1.988, and Solana(SOL) is down 6.34% at $133.49.

The domestic market shows a similar picture. As of the same time, based on Bithumb, BTC is at 13,721,700 KRW, down 0.10% from the previous day. ETH is down 0.67% at 4,723,000 KRW, XRP is up 0.27% at 2,937 KRW, and SOL is down 0.15% at 197,500 KRW.

As tensions between the US and Europe escalate, risk asset caution is spreading across the market. When the US president mentioned the possibility of additional tariffs on European countries over Greenland, the European Union(EU) is preparing immediate retaliatory measures. The EU is reportedly reviewing retaliatory tariffs or trade threat response measures(ACI). There are also forecasts that mutual trade sanctions could materialize as early as February.

Kraken Vice President said, “Since the sharp decline on October 10 last year, cryptocurrencies have been in an asymmetric downside risk phase, reacting more sensitively to bad news than good news.” Although Bitcoin was in a price range that could have attempted further gains early this week, news related to geopolitical risks dampened the upward momentum.

However, the limited extent of the decline is noteworthy. There is some expectation that the US president might actually ease the tariff threats. “As the World Economic Forum(WEF) annual meeting begins in Davos, Switzerland, there could be significant volatility in the cryptocurrency market whenever statements are made that suggest either easing or escalation of tariffs between the EU and the US in the coming days,” analysts say.

The fear and greed index from a cryptocurrency data analysis firm is down 5 points from the previous day to 44 points, indicating a ‘fear’ state. The index approaches 0 when investor sentiment is subdued and approaches 100 when the market is overheated.