EncryptedVoyagerFlying

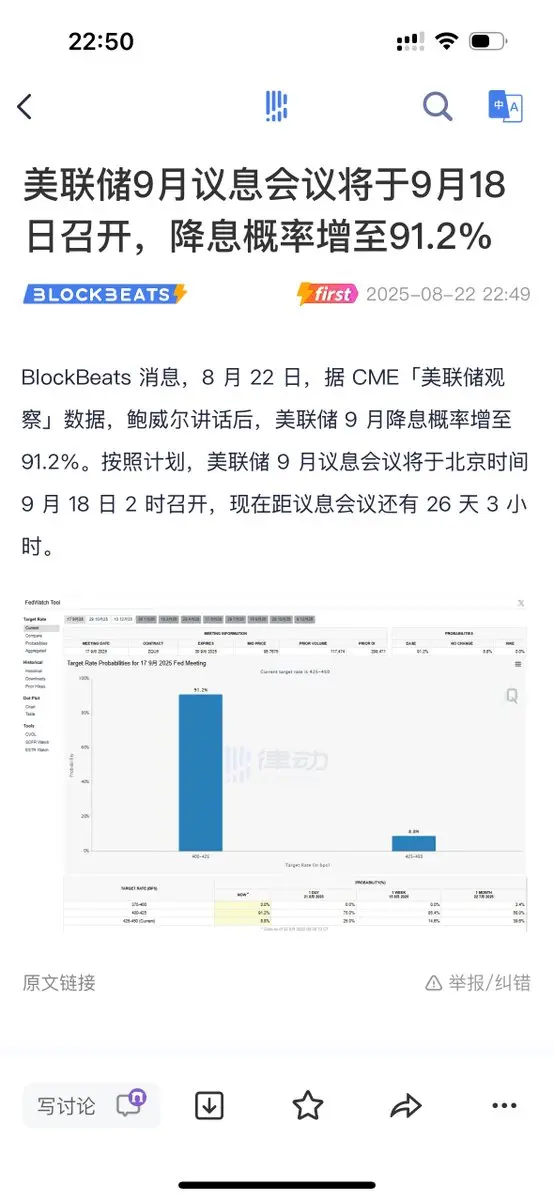

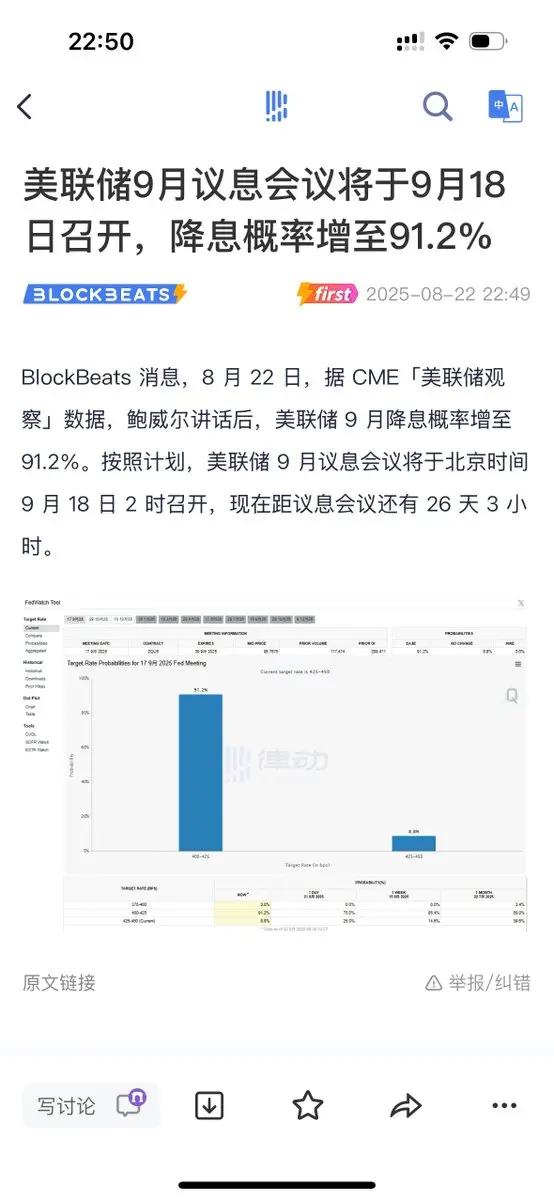

📊 【Important Updates Overview on the Evening of September 19 | Encryption Voyager Flying Fish】

12:00-21:00 Keywords: Scroll DAO, Federal Reserve, Bank of Italy, European Union, stablecoin, ETF

🤖 1. Scroll DAO will pause its daily operations, but retain veto power. The decentralized autonomous organization (DAO) of the Ethereum Layer 2 network Scroll has announced a significant governance adjustment: it will pause its daily operations, but the core team will retain veto power over community proposals.

Background and Interpretation: This action usually occurs in the early stages of a proje

View Original12:00-21:00 Keywords: Scroll DAO, Federal Reserve, Bank of Italy, European Union, stablecoin, ETF

🤖 1. Scroll DAO will pause its daily operations, but retain veto power. The decentralized autonomous organization (DAO) of the Ethereum Layer 2 network Scroll has announced a significant governance adjustment: it will pause its daily operations, but the core team will retain veto power over community proposals.

Background and Interpretation: This action usually occurs in the early stages of a proje