# CryptoMarketPullback

378.42K

Major assets declined over the last 24 hours as cascading liquidations intensified volatility. Are you focusing on drawdown control or scanning for structural opportunities?

Anclado

Gate广场_Official

Gate Plaza|2/2 Temas candentes de hoy: #加密市场回调

🎁【Beneficios por apoyar a la comunidad】Publica con un tema y participa en el sorteo de 5 cupones de experiencia en $100 posición!

En las últimas 24 horas, el mercado ha experimentado una fuerte “desleveraging”. BTC ha caído por debajo de $76,000, ETH, SOL y otros activos principales también han bajado. Cuando la volatilidad se amplifica de repente, ¿cómo actúas ahora?

💬 Tema de discusión de esta edición:

1️⃣ Gestión de posición: ante una caída continua, ¿prefieres “mantener una posición ligera” o “mantener una posición completa y resistir”?

2️

Ver originales🎁【Beneficios por apoyar a la comunidad】Publica con un tema y participa en el sorteo de 5 cupones de experiencia en $100 posición!

En las últimas 24 horas, el mercado ha experimentado una fuerte “desleveraging”. BTC ha caído por debajo de $76,000, ETH, SOL y otros activos principales también han bajado. Cuando la volatilidad se amplifica de repente, ¿cómo actúas ahora?

💬 Tema de discusión de esta edición:

1️⃣ Gestión de posición: ante una caída continua, ¿prefieres “mantener una posición ligera” o “mantener una posición completa y resistir”?

2️

- Recompensa

- 9

- 14

- Republicar

- Compartir

GateUser-37edc23c :

:

GOGOGO 2026 👊Ver más

No es la moneda, es la entrada. La paciencia paga. El mercado premia al que espera y ejecuta con precisión quirúrgica.😎🍀🐳

$ME #CryptoMarketPullback 🎯📈🐳

$ME #CryptoMarketPullback 🎯📈🐳

ME-0,92%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

#CryptoMarketPullback

📉 Caída del Mercado: ¿Es este el fondo o un

cambio estructural?

El mercado de criptomonedas está atravesando una importante

limpieza. En los últimos días, más de $2.5 mil millones en liquidaciones han eliminado el apalancamiento excesivo,

reiniciando la euforia del mercado y poniendo a prueba la convicción incluso de los HODLers más experimentados.

Al 2 de febrero de

2026, Bitcoin ha perdido el soporte psicológico de $80,000, cayendo hasta $75,700 antes de registrar un modesto rebote.

Ethereum enfrentó una presión de venta aún mayor, actuando como la “válvula de presió

Ver originales📉 Caída del Mercado: ¿Es este el fondo o un

cambio estructural?

El mercado de criptomonedas está atravesando una importante

limpieza. En los últimos días, más de $2.5 mil millones en liquidaciones han eliminado el apalancamiento excesivo,

reiniciando la euforia del mercado y poniendo a prueba la convicción incluso de los HODLers más experimentados.

Al 2 de febrero de

2026, Bitcoin ha perdido el soporte psicológico de $80,000, cayendo hasta $75,700 antes de registrar un modesto rebote.

Ethereum enfrentó una presión de venta aún mayor, actuando como la “válvula de presió

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

🚨 #CryptoMarketPullback es el tema principal en los activos digitales hoy en día, mientras el mercado cripto en general extiende sus pérdidas y entra en una fase de corrección más profunda.

🔥 Movimientos del mercado:

Bitcoin (BTC) ha estado bajo presión de venta, retrocediendo hacia los $70,000 y comerciando brevemente por debajo de $75,000 — marcando uno de sus niveles más débiles desde abril de 2025 en medio de una menor apetito por el riesgo.

Ethereum (ETH) también ha caído bruscamente, bajando más del 7–9% en las últimas operaciones, reflejando un aumento en el sentimiento bajista en los

Ver originales🔥 Movimientos del mercado:

Bitcoin (BTC) ha estado bajo presión de venta, retrocediendo hacia los $70,000 y comerciando brevemente por debajo de $75,000 — marcando uno de sus niveles más débiles desde abril de 2025 en medio de una menor apetito por el riesgo.

Ethereum (ETH) también ha caído bruscamente, bajando más del 7–9% en las últimas operaciones, reflejando un aumento en el sentimiento bajista en los

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Aspectos Clave

El desbloqueo del airdrop de LMTS podría indeed desencadenar algunas ventas, especialmente a corto plazo, a medida que los traders elegibles reclamen y potencialmente vendan sus LMTS recién desbloqueados. El sentimiento actual del mercado es de “Miedo Extremo”, reflejando una alta cautela.

Datos Destacados

- **Precio**: -$0.12 USDT, cambio en 24h: +51.96% (impulsado, ahora corrigiendo)

- **Oferta Circulante vs. Oferta Total**: Solo el 13.1% de LMTS está en circulación; se esperan desbloqueos importantes de asignaciones del equipo, inversores y tesorería.

- **Incentivos por Desbl

El desbloqueo del airdrop de LMTS podría indeed desencadenar algunas ventas, especialmente a corto plazo, a medida que los traders elegibles reclamen y potencialmente vendan sus LMTS recién desbloqueados. El sentimiento actual del mercado es de “Miedo Extremo”, reflejando una alta cautela.

Datos Destacados

- **Precio**: -$0.12 USDT, cambio en 24h: +51.96% (impulsado, ahora corrigiendo)

- **Oferta Circulante vs. Oferta Total**: Solo el 13.1% de LMTS está en circulación; se esperan desbloqueos importantes de asignaciones del equipo, inversores y tesorería.

- **Incentivos por Desbl

LMTS51,64%

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

#CryptoMarketPullback

En las últimas 24 horas, el mercado de criptomonedas ha visto grandes velas rojas en todos los frentes. Bitcoin cotiza alrededor de $77.4K con una volatilidad intradía que muestra picos por encima y por debajo de este nivel, mientras que Ethereum ha caído por debajo de $2.3K. Estas caídas no son aisladas — reflejan una cascada más amplia de liquidaciones y una volatilidad intensificada a medida que las posiciones se cerraron a la fuerza en los intercambios.

Este flujo en cascada — a menudo llamado el río de liquidaciones — actúa como un río financiero que rompe los banco

En las últimas 24 horas, el mercado de criptomonedas ha visto grandes velas rojas en todos los frentes. Bitcoin cotiza alrededor de $77.4K con una volatilidad intradía que muestra picos por encima y por debajo de este nivel, mientras que Ethereum ha caído por debajo de $2.3K. Estas caídas no son aisladas — reflejan una cascada más amplia de liquidaciones y una volatilidad intensificada a medida que las posiciones se cerraron a la fuerza en los intercambios.

Este flujo en cascada — a menudo llamado el río de liquidaciones — actúa como un río financiero que rompe los banco

BTC-0,57%

¿Estás de acuerdo?

Sí

No

0 participantesends in 21 hour

- Recompensa

- 2

- 4

- Republicar

- Compartir

DragonFlyOfficial :

:

¡Qué hermoso día! La naturaleza nos ofrece paisajes impresionantes y momentos inolvidables. Disfruta cada instante y comparte la belleza que te rodea con quienes amas. La vida está llena de sorpresas y oportunidades para aprender y crecer. Aprovecha cada momento para ser feliz y agradecer por lo que tienes.Ver más

🐻 90% ARRASADO EN HORAS — ¡COLAPSO DE LA MONEDA MEME!

La moneda meme BULLA pasó de $400M 🚀 a casi CERO 💀 — rápidamente.

¡Más del 90% arrasado en una noche!

Entonces…

¿Quién está retirando sus ganancias? 🤔

🔹 Cazadores de liquidez inteligentes?

🔹 Ballenas tempranas acumulando beneficios?

🔹 Compradores tardíos quedando con las manos vacías?

Esta es la dura realidad de los mercados impulsados por el hype:

Rally explosivos → colapsos violentos.

La capitulación no es bonita,

pero revela las manos débiles.

Las lecciones aquí son más fuertes que las pérdidas.

Sigue para análisis crudos y en tie

La moneda meme BULLA pasó de $400M 🚀 a casi CERO 💀 — rápidamente.

¡Más del 90% arrasado en una noche!

Entonces…

¿Quién está retirando sus ganancias? 🤔

🔹 Cazadores de liquidez inteligentes?

🔹 Ballenas tempranas acumulando beneficios?

🔹 Compradores tardíos quedando con las manos vacías?

Esta es la dura realidad de los mercados impulsados por el hype:

Rally explosivos → colapsos violentos.

La capitulación no es bonita,

pero revela las manos débiles.

Las lecciones aquí son más fuertes que las pérdidas.

Sigue para análisis crudos y en tie

BTC-0,57%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

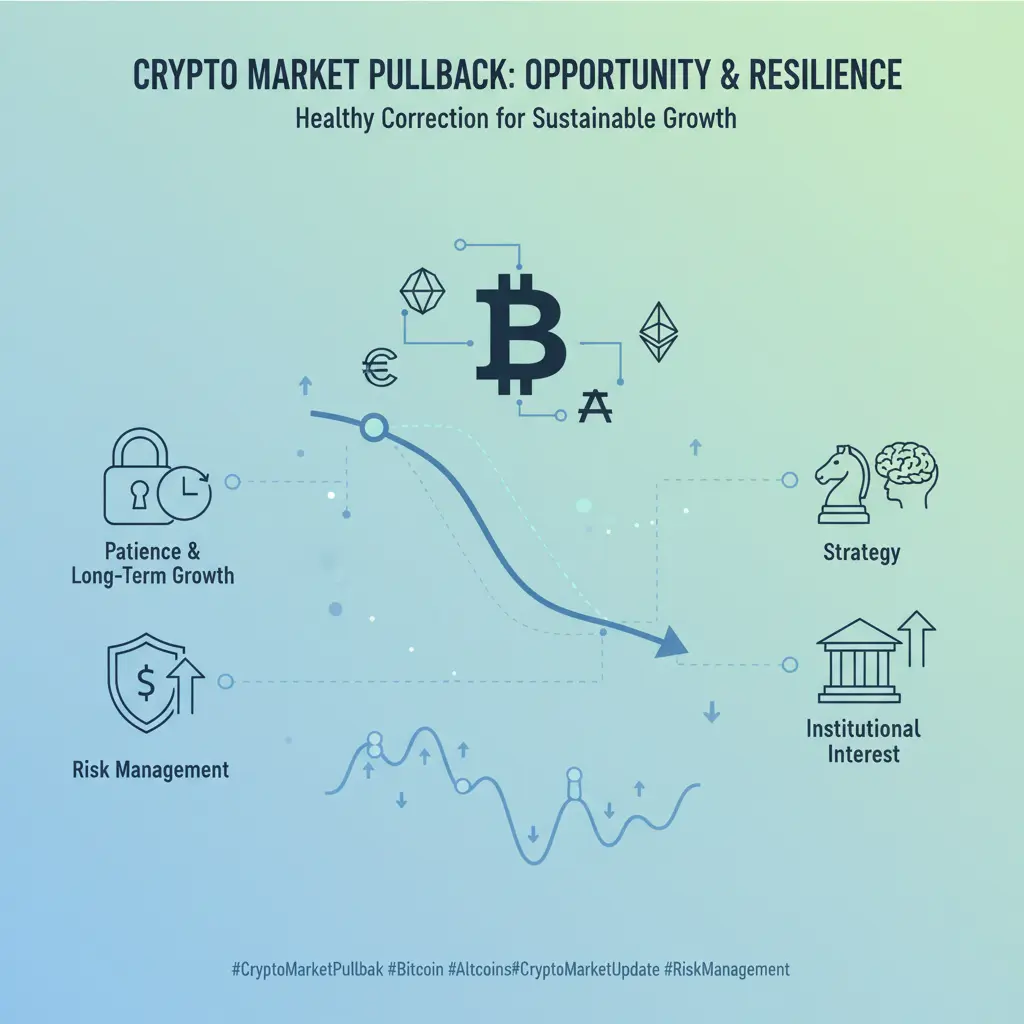

#CryptoMarketPullback 📉 — Enfriamiento del mercado, no colapso del mercado

El mercado de criptomonedas está experimentando una corrección saludable después de una fuerte tendencia alcista, recordando a los inversores que la volatilidad es una parte natural de esta clase de activos. Las correcciones de precios a corto plazo suelen ocurrir cuando los traders toman ganancias, se reajustan los apalancamientos y el mercado digiere las noticias recientes y los desarrollos macroeconómicos.

Es importante destacar que una corrección no significa el fin de la tendencia general. Los datos en cadena sigu

El mercado de criptomonedas está experimentando una corrección saludable después de una fuerte tendencia alcista, recordando a los inversores que la volatilidad es una parte natural de esta clase de activos. Las correcciones de precios a corto plazo suelen ocurrir cuando los traders toman ganancias, se reajustan los apalancamientos y el mercado digiere las noticias recientes y los desarrollos macroeconómicos.

Es importante destacar que una corrección no significa el fin de la tendencia general. Los datos en cadena sigu

BTC-0,57%

- Recompensa

- 2

- 5

- Republicar

- Compartir

HighAmbition :

:

Observando de cerca 🔍️Ver más

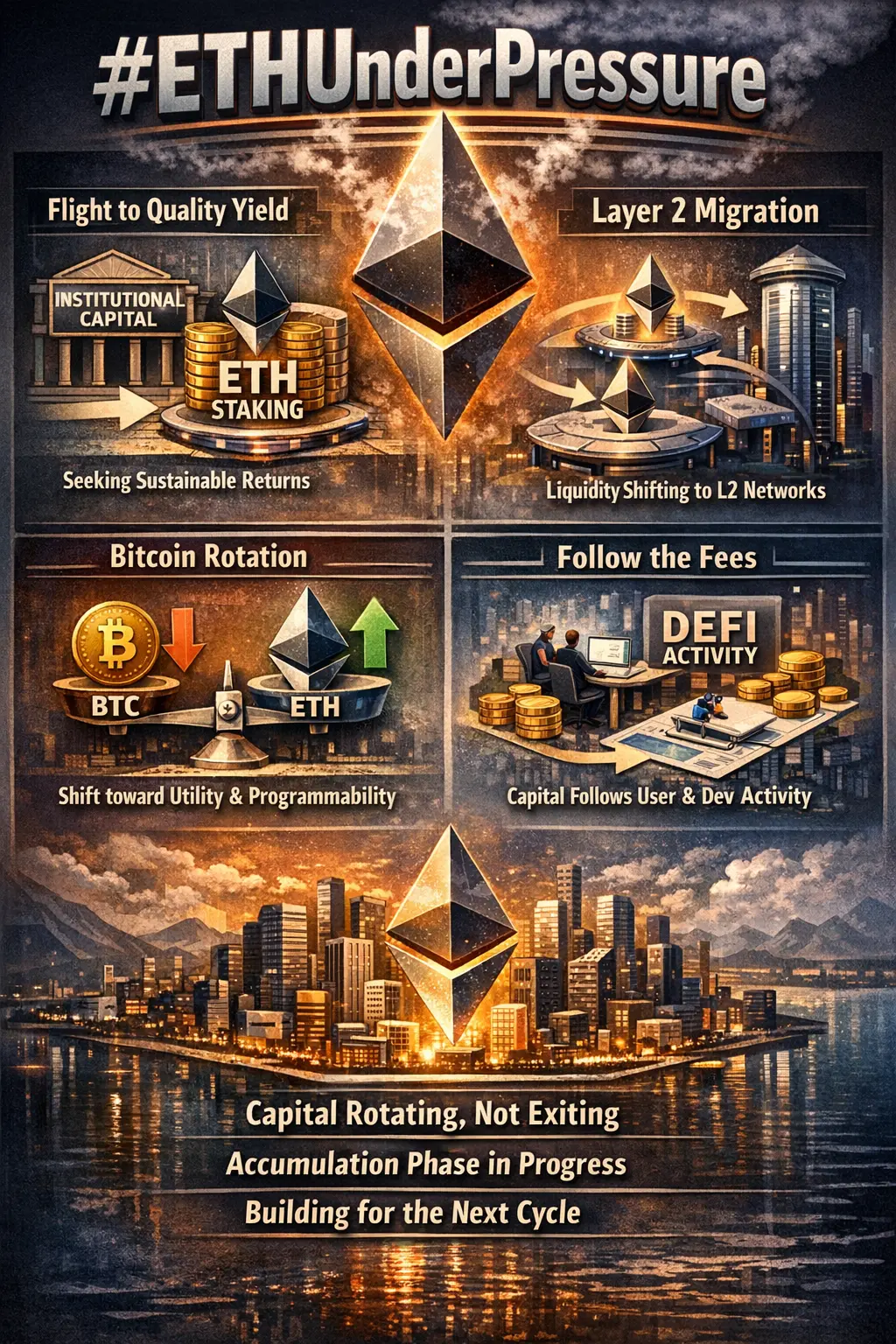

La rotación de capital es una de las fuerzas más malinterpretadas en el mercado de criptomonedas. No se trata de capital abandonando el ecosistema, sino de capital cambiando de ubicación en función del riesgo, el rendimiento y la fortaleza del relato. En este momento, el mercado está experimentando una rotación en múltiples capas que explica gran parte de la presión actual, especialmente en Ethereum, mientras silenciosamente sienta las bases para la próxima fase de expansión.

El primer cambio importante es un renovado interés por el rendimiento de calidad. A medida que las tasas globales se es

Ver originalesEl primer cambio importante es un renovado interés por el rendimiento de calidad. A medida que las tasas globales se es

- Recompensa

- 2

- 2

- Republicar

- Compartir

cryptoKnowledge :

:

HODL fuerte 💪Ver más

#CryptoMarketPullback Análisis de Retroceso del Mercado Cripto y Qué Deben Observar los Traders a Continuación

El mercado cripto está experimentando actualmente un retroceso saludable después de una fase de expansión fuerte. Este tipo de corrección es común en todos los mercados financieros y a menudo juega un papel crucial en restablecer las estructuras de precios. Después de semanas de movimientos alcistas agresivos en Bitcoin, Ethereum y las principales altcoins, la toma de ganancias ha aumentado y los traders a corto plazo están asegurando beneficios. Esto ha provocado una debilidad tempor

Ver originalesEl mercado cripto está experimentando actualmente un retroceso saludable después de una fase de expansión fuerte. Este tipo de corrección es común en todos los mercados financieros y a menudo juega un papel crucial en restablecer las estructuras de precios. Después de semanas de movimientos alcistas agresivos en Bitcoin, Ethereum y las principales altcoins, la toma de ganancias ha aumentado y los traders a corto plazo están asegurando beneficios. Esto ha provocado una debilidad tempor

- Recompensa

- 1

- 2

- Republicar

- Compartir

Vortex_King :

:

GOGOGO 2026 👊Ver más

Cargar más

Únete a 40M usuarios en nuestra comunidad en crecimiento.

⚡️ Únete a 40M usuarios en el debate sobre la fiebre cripto

💬 Interactúa con tus creadores favoritos

👍 Explora lo que te interesa

Temas de actualidad

378.42K Popularidad

7.05K Popularidad

7.02K Popularidad

4.2K Popularidad

2.81K Popularidad

4.81K Popularidad

2.48K Popularidad

3.24K Popularidad

2.17K Popularidad

23 Popularidad

54.45K Popularidad

72.4K Popularidad

20.38K Popularidad

26.61K Popularidad

219.69K Popularidad

Noticias

Ver másEl precio del oro al contado supera brevemente los 4.800 dólares por onza.

9 m

Análisis: La brecha de precios evidente en los futuros de Bitcoin de CME trae una pequeña esperanza para los alcistas

12 m

La Autoridad Monetaria de Hong Kong: planea emitir las primeras licencias para emisores de stablecoins en marzo

21 m

Medios extranjeros: La acción de ICE provoca turbulencias en la Cámara de Representantes de EE. UU., el cierre del gobierno podría afectar el informe de empleo no agrícola de esta semana

23 m

El proveedor de infraestructura del mercado de activos digitales Prometheum completa una financiación adicional de 23 millones de dólares

24 m

Anclado