CoinFixedProfitTrade

Practical players specialize in low-risk arbitrage for BTC short-term trading, relying on market tools and precise stop-losses to steadily capture small fluctuations. I have a short-term trading point table that updates support and resistance levels daily. Follow me, and let's make money together in a volatile market!

Today's second long position is again successful!

The market has no good or bad, only profit or loss depends on your strategy.

Uncertain about the market? Welcome to exchange ideas and discuss.

View OriginalThe market has no good or bad, only profit or loss depends on your strategy.

Uncertain about the market? Welcome to exchange ideas and discuss.

- Reward

- like

- Comment

- Repost

- Share

Morning outlook, reaching around 88,000, with a 3,000 room for movement. Will look for opportunities to trade KONG based on market conditions later.

View Original

- Reward

- like

- Comment

- Repost

- Share

Will the market manipulation happen for the third time?

The Bitcoin manipulation isn't intentional; learn to follow the big players to profit. Waiting for a double kill of bulls and bears. 😉

The Bitcoin manipulation isn't intentional; learn to follow the big players to profit. Waiting for a double kill of bulls and bears. 😉

BTC1.25%

- Reward

- like

- Comment

- Repost

- Share

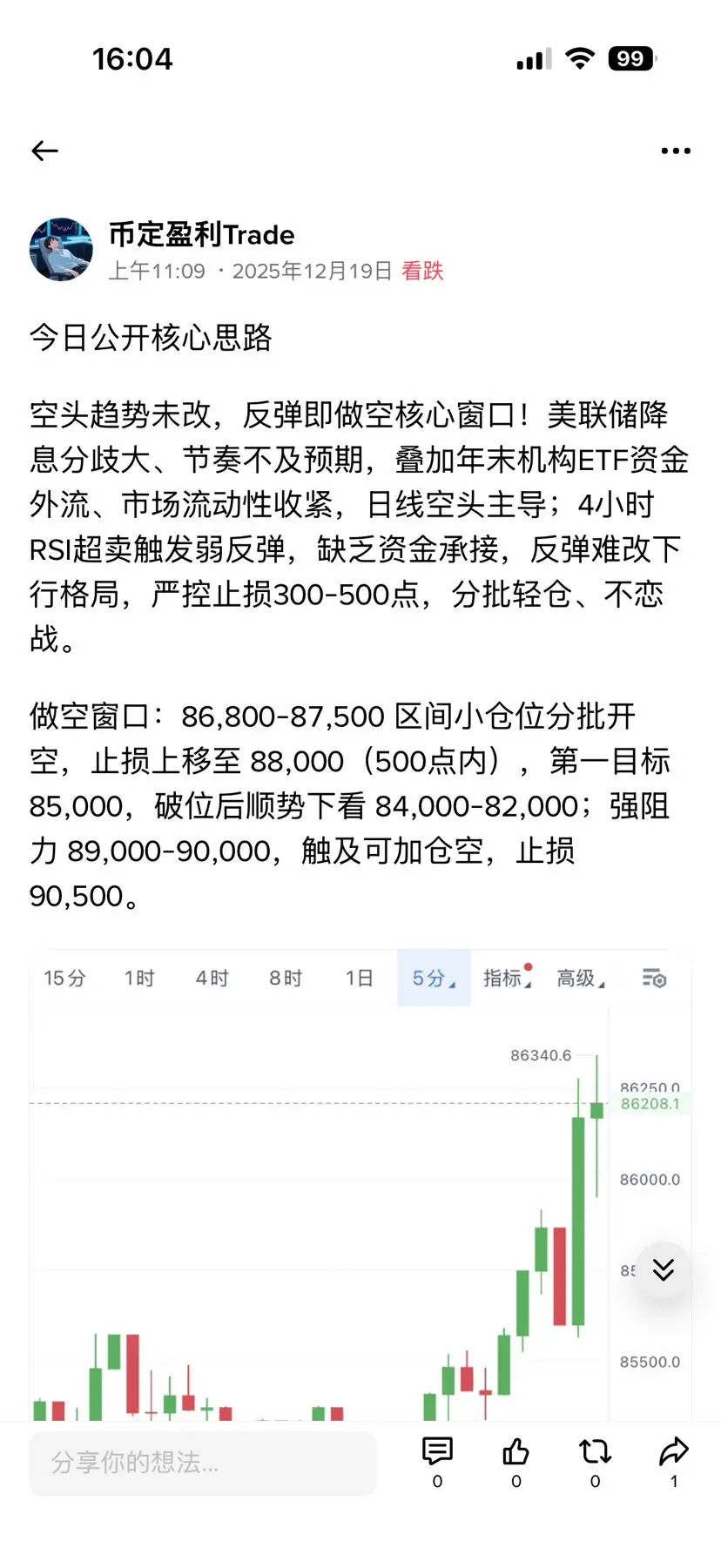

Today’s Core Strategy

The bearish trend remains unchanged; use rebounds as a core window for shorting! The Federal Reserve’s divergence on interest rate cuts and slower pace than expected, combined with year-end institutional ETF fund outflows and tightening market liquidity, lead to daily chart dominance by bears; the 4-hour RSI is oversold, triggering a weak rebound, but lack of capital support makes it difficult to change the downward trend. Strictly control stop-losses at 300-500 points, take small positions in batches, and avoid fighting the trend.

Shorting window: 86,800-87,500 range, op

View OriginalThe bearish trend remains unchanged; use rebounds as a core window for shorting! The Federal Reserve’s divergence on interest rate cuts and slower pace than expected, combined with year-end institutional ETF fund outflows and tightening market liquidity, lead to daily chart dominance by bears; the 4-hour RSI is oversold, triggering a weak rebound, but lack of capital support makes it difficult to change the downward trend. Strictly control stop-losses at 300-500 points, take small positions in batches, and avoid fighting the trend.

Shorting window: 86,800-87,500 range, op

- Reward

- like

- Comment

- Repost

- Share

What truly influences Bitcoin is not the Federal Reserve.

Currently, the market is focused on the Fed's rate cut pace and inflation data, but what can genuinely change the flow of global capital is Japan, which has been overlooked.

The Bank of Japan is about to start raising interest rates. Don't be fooled by the small 0.25 percentage point increase; this is not just a normal rate adjustment but a major shift away from decades of easing policies.

The key is not how much they raise rates but who is raising them. The Fed's rate hikes are now familiar, but Japan is different—its near-zero interes

Currently, the market is focused on the Fed's rate cut pace and inflation data, but what can genuinely change the flow of global capital is Japan, which has been overlooked.

The Bank of Japan is about to start raising interest rates. Don't be fooled by the small 0.25 percentage point increase; this is not just a normal rate adjustment but a major shift away from decades of easing policies.

The key is not how much they raise rates but who is raising them. The Fed's rate hikes are now familiar, but Japan is different—its near-zero interes

BTC1.25%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Double Coin Today Public Thinking

2025-12-18 16:15 (ETH ≈ $2,837)

Daily bearish, 4H oversold or weak rebound, difficult to change the downward trend; do not chase longs without volume above $2,900.

• Daily: MACD death cross + KDJ downward, clear bearish signal.

• 4H: RSI oversold, weak rebound but difficult to reverse the trend.

• Support: $2,800 (strong), $2,750, $2,700.

• Resistance: $2,900 (strong), $3,000, $3,050.

Rebound to $2,880-$2,900 with light positions short; if $2,800 breaks, look down to $2,750.

$ETH

2025-12-18 16:15 (ETH ≈ $2,837)

Daily bearish, 4H oversold or weak rebound, difficult to change the downward trend; do not chase longs without volume above $2,900.

• Daily: MACD death cross + KDJ downward, clear bearish signal.

• 4H: RSI oversold, weak rebound but difficult to reverse the trend.

• Support: $2,800 (strong), $2,750, $2,700.

• Resistance: $2,900 (strong), $3,000, $3,050.

Rebound to $2,880-$2,900 with light positions short; if $2,800 breaks, look down to $2,750.

$ETH

ETH3.93%

- Reward

- like

- Comment

- Repost

- Share

The impact of Japan's rate hike on the crypto market: Understand in one sentence

1. Short-term decline: The cost of borrowing yen to trade cryptocurrencies skyrockets, leading to margin calls and capital fleeing, with BTC/ETH leading the sell-off. Leverage traders beware of liquidation!

2. After all negative news is out, a rebound follows: Once the rate hike is implemented and selling pressure subsides, market sentiment gradually recovers, and high-quality mainstream coins will recover first. $BTC #加密市场观察

1. Short-term decline: The cost of borrowing yen to trade cryptocurrencies skyrockets, leading to margin calls and capital fleeing, with BTC/ETH leading the sell-off. Leverage traders beware of liquidation!

2. After all negative news is out, a rebound follows: Once the rate hike is implemented and selling pressure subsides, market sentiment gradually recovers, and high-quality mainstream coins will recover first. $BTC #加密市场观察

BTC1.25%

- Reward

- like

- Comment

- Repost

- Share

$BTC Today’s Bitcoin Public Outlook

BTC is currently around 86,500, with short-term fluctuations between 85,000-87,500, dominated by a bearish trend, with a lack of rebound strength.

85,000 is a key support level (breaking below accelerates the decline), 84,800 is the stop-loss line (breaking below requires reducing positions);

To push higher, it must first break 87,000, and only when it stabilizes above 88,000 is it a true rebound.

The Bank of Japan’s interest rate decision and Federal Reserve speeches set the direction: hawkish signals lead to declines, while moderate tones lead to rebounds

BTC is currently around 86,500, with short-term fluctuations between 85,000-87,500, dominated by a bearish trend, with a lack of rebound strength.

85,000 is a key support level (breaking below accelerates the decline), 84,800 is the stop-loss line (breaking below requires reducing positions);

To push higher, it must first break 87,000, and only when it stabilizes above 88,000 is it a true rebound.

The Bank of Japan’s interest rate decision and Federal Reserve speeches set the direction: hawkish signals lead to declines, while moderate tones lead to rebounds

BTC1.25%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin's public outlook today:

Bitcoin's third retest of the 85,000-86,000 key support zone, which overlaps with the November low and multiple long-term trendline supports; early session rebound of about 3%, short-term recovery to around 88,000, with an intraday increase of approximately 1.8%, and stable support levels laying the foundation for a bullish outlook.

Bitcoin: Range around 87,250-86,700, targeting 89,000-90,000$BTC $ETH #美联储降息预测 #ETH走势分析 #比特币

View OriginalBitcoin's third retest of the 85,000-86,000 key support zone, which overlaps with the November low and multiple long-term trendline supports; early session rebound of about 3%, short-term recovery to around 88,000, with an intraday increase of approximately 1.8%, and stable support levels laying the foundation for a bullish outlook.

Bitcoin: Range around 87,250-86,700, targeting 89,000-90,000$BTC $ETH #美联储降息预测 #ETH走势分析 #比特币

- Reward

- like

- Comment

- Repost

- Share