GateUser-4c2ae961

Belum ada konten

GateUser-4c2ae961

DI DALAM LEDGER 🇮🇷🇮🇱

Iran telah memperingatkan bahwa mereka bisa menyerang reaktor nuklir Dimona di Israel jika AS dan Israel berusaha menggulingkan rezimnya.

Lihat AsliIran telah memperingatkan bahwa mereka bisa menyerang reaktor nuklir Dimona di Israel jika AS dan Israel berusaha menggulingkan rezimnya.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

16 agen AI.

$400/bulan.

Perusahaan berjalan saat dia tidur.

Buat bookmark ini. 👇

Lihat Asli$400/bulan.

Perusahaan berjalan saat dia tidur.

Buat bookmark ini. 👇

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

DI BUKU BESAR 💥

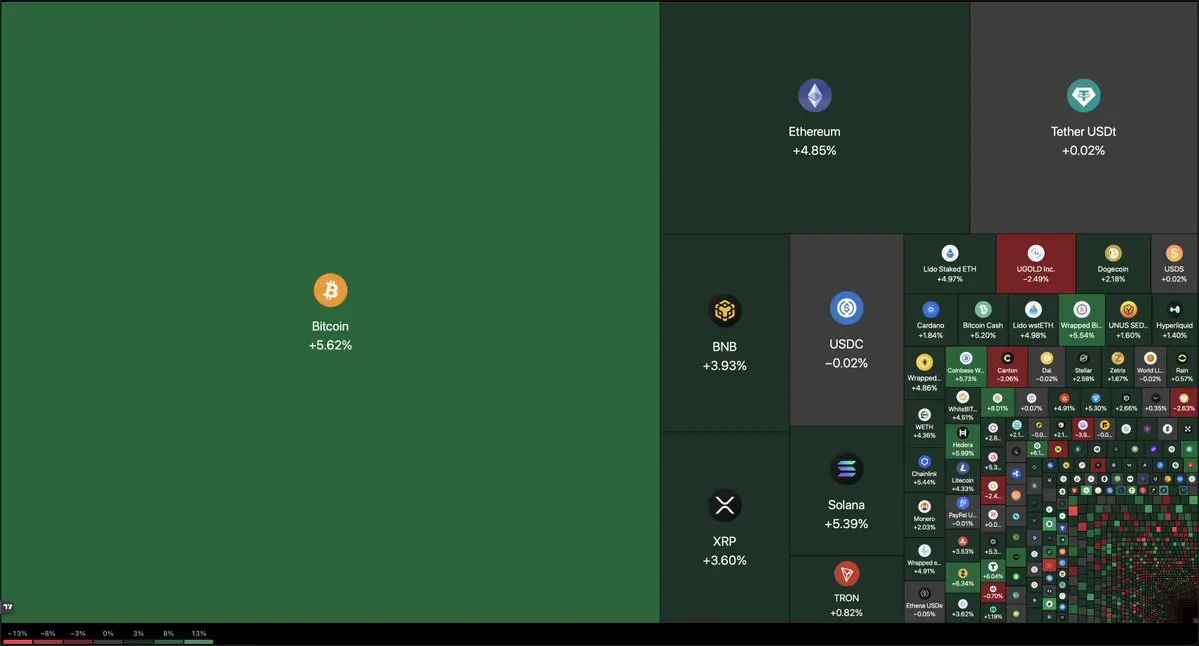

$120.000.000.000 telah ditambahkan ke pasar kripto hari ini.

Lihat Asli$120.000.000.000 telah ditambahkan ke pasar kripto hari ini.

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

INI SANGAT KEJAM 🚨

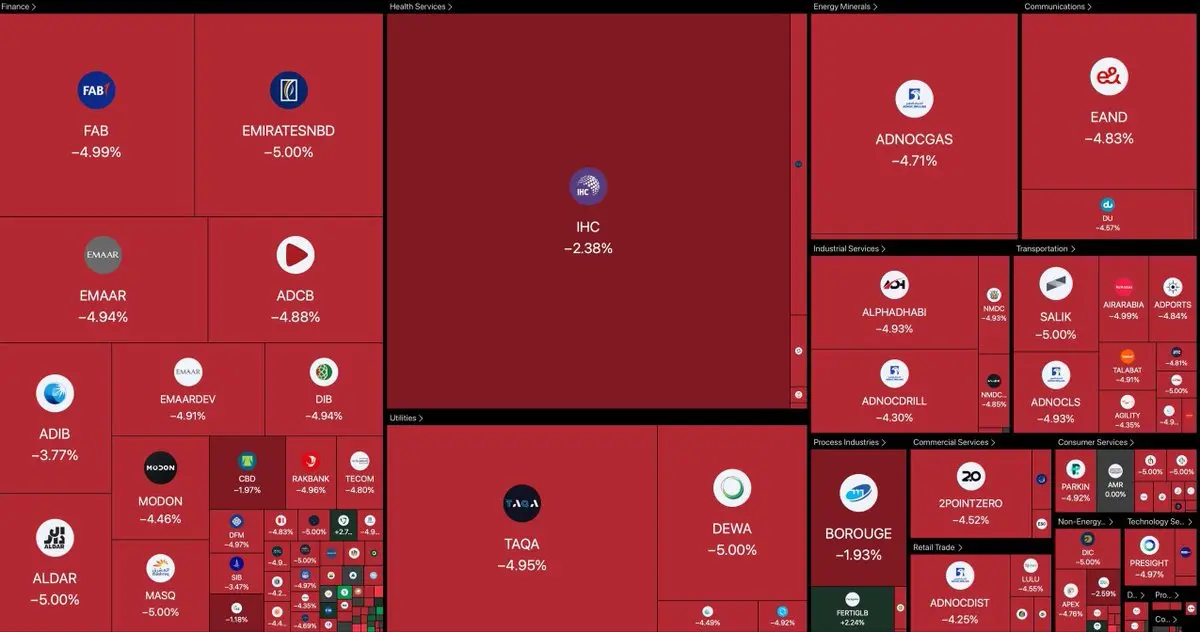

$35.000.000.000 telah dihapus dari pasar saham UAE hari ini.

Lihat Asli$35.000.000.000 telah dihapus dari pasar saham UAE hari ini.

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

KURSUS PENUH Claude (1 Jam).

Bangun & otomatisasi apa saja.

Buat penanda buku ini. 👇

Lihat AsliBangun & otomatisasi apa saja.

Buat penanda buku ini. 👇

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

DI ATAS LEDGER 🇺🇸

Presiden Donald Trump telah mendesak Kongres untuk mengesahkan undang-undang struktur pasar kripto.

Lihat AsliPresiden Donald Trump telah mendesak Kongres untuk mengesahkan undang-undang struktur pasar kripto.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

DI ATAS BUKU 🇮🇳

India memiliki persediaan minyak mentah selama 25 hari.

Total cadangan sekitar 8 minggu minyak mentah dan produk petroleum.

Hanya 40% dari impor yang melalui Selat Hormuz.

Belum ada rencana kenaikan harga bensin atau solar secara langsung untuk saat ini.

Lihat AsliIndia memiliki persediaan minyak mentah selama 25 hari.

Total cadangan sekitar 8 minggu minyak mentah dan produk petroleum.

Hanya 40% dari impor yang melalui Selat Hormuz.

Belum ada rencana kenaikan harga bensin atau solar secara langsung untuk saat ini.

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

Dia membangun sistem video properti mewah 🤯

dengan biaya di bawah $10.

Dari tautan Zillow.

Agen membayar $1K–$5K per video.

Ini mengubah permainan.

Lihat Aslidengan biaya di bawah $10.

Dari tautan Zillow.

Agen membayar $1K–$5K per video.

Ini mengubah permainan.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

5 NICHES YANG MEMBOSANKAN YANG DAPAT MENGHASILKAN $50K+ DI 2026 🤯

TIDAK ADA KILAUAN.

TIDAK ADA HYPE.

HANYA ARUS KAS.

Lihat AsliTIDAK ADA KILAUAN.

TIDAK ADA HYPE.

HANYA ARUS KAS.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

DI LEMBARAN 🇺🇸

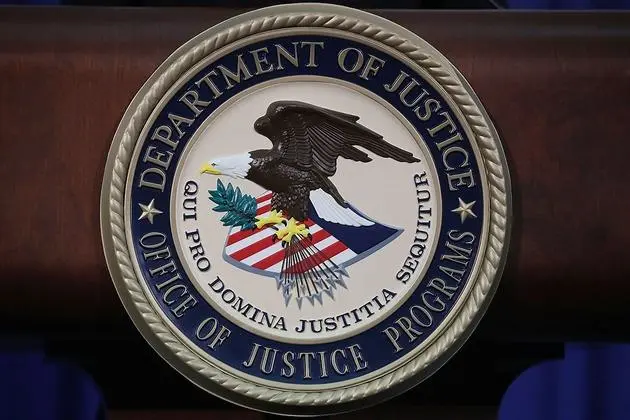

Departemen Kehakiman AS telah menutup materi terkait berkas Epstein. kata CBS

Lihat AsliDepartemen Kehakiman AS telah menutup materi terkait berkas Epstein. kata CBS

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

DI LEMBAR 🇵🇱

Poland mengatakan akan melanjutkan pengembangan senjata nuklirnya sendiri, menurut Bloomberg.

Lihat AsliPoland mengatakan akan melanjutkan pengembangan senjata nuklirnya sendiri, menurut Bloomberg.

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

Bisakah seseorang mengonfirmasi apakah antrean panjang di pompa bensin hanya terjadi di kota saya atau di seluruh India?

Lihat Asli- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

PEWDIEPIE BARU SAJA MENDOKUMENTASIKAN PELATIHAN MODEL AI-NYA SENDIRI. 🤯

- Dimulai sebagai tantangan belajar

- Diuji pada tolok ukur pengkodean

- Mengklaim mengungguli ChatGPT

Apakah para pembuat konten sekarang menjadi pembuat model?

Lihat Asli- Dimulai sebagai tantangan belajar

- Diuji pada tolok ukur pengkodean

- Mengklaim mengungguli ChatGPT

Apakah para pembuat konten sekarang menjadi pembuat model?

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

Topik Trending

Lihat Lebih Banyak130.87K Popularitas

9.96K Popularitas

192.53K Popularitas

19.24K Popularitas

416.7K Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$2.54KHolder:20.00%

- MC:$2.69KHolder:40.80%

- MC:$0.1Holder:10.00%

- 4

zy

zy

MC:$2.48KHolder:10.00% - MC:$0.1Holder:00.00%

Sematkan