MoonGirl

Контент поки що відсутній

MoonGirl

https://gate.com/live/video?stream_id=49626f2df9eb46449d3b9ece0aec2482&session_id=49626f2df9eb46449d3b9ece0aec2482-1770012657&ref=VGQRAVLDVQ&ref_type=104

Поспішайте приєднатися до прямого ефіру, друзі 🤝

Переглянути оригіналПоспішайте приєднатися до прямого ефіру, друзі 🤝

- Нагородити

- 8

- 10

- Репост

- Поділіться

EagleEye :

:

Це чудово!Дізнатися більше

#TokenizedSilverTrend #TokenizedSilverTrend

Нова ера фінансів починається з цифрового срібла

Ми стоїмо на порозі історичної зміни у глобальних фінансах. Традиційні активи зливаються з технологією блокчейн, і серед них токенізоване срібло тихо стає одним із найпотужніших реальних активів (RWA) наступного десятиліття.

Вже століттями срібло вважається надійним засобом збереження вартості, промисловою необхідністю та захистом від інфляції. Тепер, через токенізацію, срібло входить у цифрову економіку — забезпечуючи миттєве володіння, глобальну доступність і децентралізовану торгівлю.

Це не просто

Переглянути оригіналНова ера фінансів починається з цифрового срібла

Ми стоїмо на порозі історичної зміни у глобальних фінансах. Традиційні активи зливаються з технологією блокчейн, і серед них токенізоване срібло тихо стає одним із найпотужніших реальних активів (RWA) наступного десятиліття.

Вже століттями срібло вважається надійним засобом збереження вартості, промисловою необхідністю та захистом від інфляції. Тепер, через токенізацію, срібло входить у цифрову економіку — забезпечуючи миттєве володіння, глобальну доступність і децентралізовану торгівлю.

Це не просто

- Нагородити

- 8

- 9

- Репост

- Поділіться

EagleEye :

:

Це чудово!Дізнатися більше

#MiddleEastTensionsEscalate

Оновлення впливу на ринок

Постійне загострення геополітичної напруги на Близькому Сході поглиблює напруженість на ринках криптовалют, перетворюючи ситуацію з стандартної корекції у структуроване середовище ризик-оф. Спочатку здавалося, що це контрольоване відкотування, але воно перетворилося у цикл волатильності, зумовлений новинами, при цьому погіршення ліквідності посилює кожен рух.

Оновлення цінової динаміки: Посилення тиску знизу

Зі зростанням геополітичної невизначеності:

Bitcoin (BTC) продовжував втрати у високих однозначних до низьких двозначних значеннях, в

Переглянути оригіналОновлення впливу на ринок

Постійне загострення геополітичної напруги на Близькому Сході поглиблює напруженість на ринках криптовалют, перетворюючи ситуацію з стандартної корекції у структуроване середовище ризик-оф. Спочатку здавалося, що це контрольоване відкотування, але воно перетворилося у цикл волатильності, зумовлений новинами, при цьому погіршення ліквідності посилює кожен рух.

Оновлення цінової динаміки: Посилення тиску знизу

Зі зростанням геополітичної невизначеності:

Bitcoin (BTC) продовжував втрати у високих однозначних до низьких двозначних значеннях, в

- Нагородити

- 8

- 10

- Репост

- Поділіться

EagleEye :

:

Це чудово!Дізнатися більше

Приєднуйтесь до прямого ефіру з друзями 🤝 💯 🔥 ♥️

Переглянути оригінал

- Нагородити

- 9

- 7

- Репост

- Поділіться

EagleEye :

:

Це чудово!Дізнатися більше

https://gate.com/live/video?stream_id=49626f2df9eb46449d3b9ece0aec2482&session_id=49626f2df9eb46449d3b9ece0aec2482-1769950596&ref=VGQRAVLDVQ&ref_type=104

Поспішайте приєднатися до прямого ефіру з друзями

Переглянути оригіналПоспішайте приєднатися до прямого ефіру з друзями

- Нагородити

- 10

- 10

- Репост

- Поділіться

EagleEye :

:

Це чудово!Дізнатися більше

#GateLiveMiningProgramPublicBeta 🚀🔥

Правила заробітку у криптовалюті змінюються.

Торгівля вже не є єдиним джерелом доходу.

Зараз знання + вплив = реальний дохід у мережі.

Gate Live офіційно оновив свою систему знижок на майнинг — і цей етап Public Beta — перший крок для розумних творців.

💰 Знижки на торгові комісії до 30%

• 20% базова комісія

• +10% бонус за завдання

• Нові стримери: 30% безпосередньо на перші 30 днів

Це не просто невелика зміна.

Це структурний зсув у тому, як творці монетизують свою аудиторію.

⚡ Що робить це потужним?

• Інтерактивні тегами токенів у прямому ефірі

• Миттєва

Переглянути оригіналПравила заробітку у криптовалюті змінюються.

Торгівля вже не є єдиним джерелом доходу.

Зараз знання + вплив = реальний дохід у мережі.

Gate Live офіційно оновив свою систему знижок на майнинг — і цей етап Public Beta — перший крок для розумних творців.

💰 Знижки на торгові комісії до 30%

• 20% базова комісія

• +10% бонус за завдання

• Нові стримери: 30% безпосередньо на перші 30 днів

Це не просто невелика зміна.

Це структурний зсув у тому, як творці монетизують свою аудиторію.

⚡ Що робить це потужним?

• Інтерактивні тегами токенів у прямому ефірі

• Миттєва

- Нагородити

- 10

- 8

- Репост

- Поділіться

Discovery :

:

З Новим роком! 🤑Дізнатися більше

#TokenizedSilverTrend 🪙⚡

Срібло більше не просто метал.

Воно стає програмованим.

Зростання токенізованого срібла тихо набирає обертів — поєднуючи активи реального світу (RWA) з інфраструктурою блокчейну. Фізична цінність. Цифрова ліквідність.

Чому ця тенденція важлива 👇

🔗 24/7 торгова експозиція до срібла

🏦 Нижчі бар’єри для глобальних інвесторів

💎 Фракційна власність без проблем з зберіганням

⚡ Швидше розрахунки порівняно з традиційними ринками

Поки золото домінує у заголовках, срібло позиціонує себе як альтернативу з високим бета — і токенізація підсилює цю розповідь.

У 2026 році капіта

Переглянути оригіналСрібло більше не просто метал.

Воно стає програмованим.

Зростання токенізованого срібла тихо набирає обертів — поєднуючи активи реального світу (RWA) з інфраструктурою блокчейну. Фізична цінність. Цифрова ліквідність.

Чому ця тенденція важлива 👇

🔗 24/7 торгова експозиція до срібла

🏦 Нижчі бар’єри для глобальних інвесторів

💎 Фракційна власність без проблем з зберіганням

⚡ Швидше розрахунки порівняно з традиційними ринками

Поки золото домінує у заголовках, срібло позиціонує себе як альтернативу з високим бета — і токенізація підсилює цю розповідь.

У 2026 році капіта

- Нагородити

- 7

- 7

- Репост

- Поділіться

AylaShinex :

:

З Новим роком! 🤑Дізнатися більше

#GateLiveMiningProgramPublicBeta

Великий крок уперед для спільноти Gate Live 🚀

Програма майнінгу Gate Live тепер доступна у публічній бета-версії, відкриваючи нові можливості для стримерів і глядачів для спільного зростання.

Ця програма нагороджує творців, які стабільно з’являються, приносять реальну цінність і активно взаємодіють з аудиторією. Це не просто про вихід у прямий ефір — це про навчання, обмін ідеями та побудову довіри в межах спільноти.

💡 Що робить це особливим

Нагороди залежать від зусиль, послідовності та залученості

Творці отримують більш чіткий і справедливий шлях до зростан

Переглянути оригіналВеликий крок уперед для спільноти Gate Live 🚀

Програма майнінгу Gate Live тепер доступна у публічній бета-версії, відкриваючи нові можливості для стримерів і глядачів для спільного зростання.

Ця програма нагороджує творців, які стабільно з’являються, приносять реальну цінність і активно взаємодіють з аудиторією. Це не просто про вихід у прямий ефір — це про навчання, обмін ідеями та побудову довіри в межах спільноти.

💡 Що робить це особливим

Нагороди залежать від зусиль, послідовності та залученості

Творці отримують більш чіткий і справедливий шлях до зростан

- Нагородити

- 9

- 11

- Репост

- Поділіться

AylaShinex :

:

Купуй, щоб Заробляти 💎Дізнатися більше

#MiddleEastTensionsEscalate

Огляд ринку від Yusfirah

Зростаюча напруга між США та Іраном спричинила значний сплеск попиту на активи-укриття, піднявши ціну золота вище позначки $5,000, тоді як Bitcoin та інші активи з високим ризиком відкотилися від недавніх максимумів через обережність інвесторів і зниження апетиту до ризику. Рух золота відображає як реальний попит на безпеку в умовах геополітичної невизначеності, так і спекулятивні позиції, що очікують подальших потоків у активи-укриття. Поточна технічна підтримка для золота знаходиться біля рівня $4,950–$5,000, а негайний опір — близько $5,

Огляд ринку від Yusfirah

Зростаюча напруга між США та Іраном спричинила значний сплеск попиту на активи-укриття, піднявши ціну золота вище позначки $5,000, тоді як Bitcoin та інші активи з високим ризиком відкотилися від недавніх максимумів через обережність інвесторів і зниження апетиту до ризику. Рух золота відображає як реальний попит на безпеку в умовах геополітичної невизначеності, так і спекулятивні позиції, що очікують подальших потоків у активи-укриття. Поточна технічна підтримка для золота знаходиться біля рівня $4,950–$5,000, а негайний опір — близько $5,

BTC1,73%

- Нагородити

- 6

- 7

- Репост

- Поділіться

AylaShinex :

:

Купуй, щоб Заробляти 💎Дізнатися більше

#PreciousMetalsPullBack

Ринки зазнають різкого корекційного зниження як у дорогоцінних металах, так і у криптовалютах після історичних ралі наприкінці 2025 та на початку січня 2026 року. Золото короткочасно торкнулося ~$5,595/oz, а срібло ~$121/oz, у той час як Біткоїн досяг піку близько $90,000, а Ethereum — понад $3,000. На початку лютого 2026 року спостерігається виразне зниження на цих ринках, що відображає фіксацію прибутків, перенасиченість позицій та переоцінку очікувань, а не фундаментальне змінення довгострокових трендів.

Розуміння корекції

Корекція — це значне зниження ціни після си

Переглянути оригіналРинки зазнають різкого корекційного зниження як у дорогоцінних металах, так і у криптовалютах після історичних ралі наприкінці 2025 та на початку січня 2026 року. Золото короткочасно торкнулося ~$5,595/oz, а срібло ~$121/oz, у той час як Біткоїн досяг піку близько $90,000, а Ethereum — понад $3,000. На початку лютого 2026 року спостерігається виразне зниження на цих ринках, що відображає фіксацію прибутків, перенасиченість позицій та переоцінку очікувань, а не фундаментальне змінення довгострокових трендів.

Розуміння корекції

Корекція — це значне зниження ціни після си

- Нагородити

- 7

- 5

- Репост

- Поділіться

AylaShinex :

:

GOGOGO 2026 👊Дізнатися більше

#PreciousMetalsPullBack #PreciousMetalsPullBack 📉✨

Після досягнення агресивних максимумів цього тижня золото та срібло нарешті охолоджуються.

Ринки не рухаються по прямій —

Навіть найсильніші ралі потребують паузи.

🔹 Золото зафіксувало прибутки після досягнення рекордних рівнів

🔹 Срібло слідувало тим самим шляхом з короткостроковою корекцією

🔹 Стабільність долара + очікування ставок спричинили тимчасове відкат

Але давайте будемо чесними…

Відкат — це не поворот тренду.

Це часто перезавантаження перед наступним рухом.

Коли активи зростають занадто швидко, розумні інвестори фіксують прибутки.

Після досягнення агресивних максимумів цього тижня золото та срібло нарешті охолоджуються.

Ринки не рухаються по прямій —

Навіть найсильніші ралі потребують паузи.

🔹 Золото зафіксувало прибутки після досягнення рекордних рівнів

🔹 Срібло слідувало тим самим шляхом з короткостроковою корекцією

🔹 Стабільність долара + очікування ставок спричинили тимчасове відкат

Але давайте будемо чесними…

Відкат — це не поворот тренду.

Це часто перезавантаження перед наступним рухом.

Коли активи зростають занадто швидко, розумні інвестори фіксують прибутки.

BTC1,73%

- Нагородити

- 8

- 8

- Репост

- Поділіться

AngelEye :

:

З Новим роком! 🤑Дізнатися більше

#USGovernmentShutdownRisk 🚨 Часткове припинення роботи уряду США — ринки на межі 🇺🇸

Вашингтон увійшов у часткове припинення роботи після глухого затримки в Сенаті щодо фінансування DHS. Хоча переглянута угода була прийнята наприкінці п’ятниці, Палата представників не повернеться до роботи до 2 лютого — залишаючи прогалину у фінансуванні на вихідні.

🔎 Що насправді відбувається?

• Основні задіяні департаменти: оборона, казначейство, HHS, транспорт, DHS

• Робота IRS може сповільнитися з початком податкового сезону

• Необхідні послуги продовжують працювати, але неосновний персонал може бути ві

Вашингтон увійшов у часткове припинення роботи після глухого затримки в Сенаті щодо фінансування DHS. Хоча переглянута угода була прийнята наприкінці п’ятниці, Палата представників не повернеться до роботи до 2 лютого — залишаючи прогалину у фінансуванні на вихідні.

🔎 Що насправді відбувається?

• Основні задіяні департаменти: оборона, казначейство, HHS, транспорт, DHS

• Робота IRS може сповільнитися з початком податкового сезону

• Необхідні послуги продовжують працювати, але неосновний персонал може бути ві

BTC1,73%

- Нагородити

- 8

- 8

- Репост

- Поділіться

AngelEye :

:

Купуй, щоб Заробляти 💎Дізнатися більше

#MyWeekendTradingPlan

Ринки у вихідні можуть бути хиткими, тому я тримаю все просто та дисципліновано.

Увага на BTC для короткострокової слабкості, при цьому залишаюся відкритим до довгих можливостей в ETH та SOL, якщо сила продовжиться.

Фокус на вихідних: ✔️ Легкі позиції

✔️ Тільки сильні підтвердження

✔️ Захист капіталу перш за все

✔️ Не гонитись за пампами

Іноді найкраща торгівля — це терпіння. Нехай ринок прийде до вас.

#CryptoWeekend

#TradingMindset

#BTC

#SOL

Переглянути оригіналРинки у вихідні можуть бути хиткими, тому я тримаю все просто та дисципліновано.

Увага на BTC для короткострокової слабкості, при цьому залишаюся відкритим до довгих можливостей в ETH та SOL, якщо сила продовжиться.

Фокус на вихідних: ✔️ Легкі позиції

✔️ Тільки сильні підтвердження

✔️ Захист капіталу перш за все

✔️ Не гонитись за пампами

Іноді найкраща торгівля — це терпіння. Нехай ринок прийде до вас.

#CryptoWeekend

#TradingMindset

#BTC

#SOL

- Нагородити

- 10

- 13

- Репост

- Поділіться

AngelEye :

:

GOGOGO 2026 👊Дізнатися більше

Вплив соціальних мереж викликає волатильність у токені MOLT

Недавній пост у соціальних мережах від Хе І, посилаючись на Moltbook, викликав сильний інтерес на крипторинку і призвів до підвищеної волатильності в екосистемі Base. Незабаром після того, як пост набрав популярності, мем-токен Base-chain MOLT зріс майже на 30%, знову підкреслюючи значний вплив впливових осіб на цифрові активи з низькою капіталізацією.

Завдяки швидкому руху ціни, ринкова капіталізація MOLT короткочасно перевищила $100 мільйонів доларів, що стало важливим короткостроковим досягненням для проекту. Однак цей імпульс вия

Переглянути оригіналНедавній пост у соціальних мережах від Хе І, посилаючись на Moltbook, викликав сильний інтерес на крипторинку і призвів до підвищеної волатильності в екосистемі Base. Незабаром після того, як пост набрав популярності, мем-токен Base-chain MOLT зріс майже на 30%, знову підкреслюючи значний вплив впливових осіб на цифрові активи з низькою капіталізацією.

Завдяки швидкому руху ціни, ринкова капіталізація MOLT короткочасно перевищила $100 мільйонів доларів, що стало важливим короткостроковим досягненням для проекту. Однак цей імпульс вия

- Нагородити

- 8

- 8

- Репост

- Поділіться

AngelEye :

:

Купуй, щоб Заробляти 💎Дізнатися більше

#PreciousMetalsPullBack #PreciousMetalsPullBack 🟡📉

Після агресивного ралі дорогоцінні метали нарешті починають виявляти ознаки вичерпання. Золото та срібло відступають від недавніх максимумів, оскільки короткострокове фіксування прибутку починається, а імпульс охолоджується.

Коли метали рухаються занадто швидко, корекція — це не слабкість, а структура.

Ця корекція може означати:

• Тимчасове полегшення у ризикових активів

• Охолодження попиту на безпечне притулок

• Перерозподіл позицій трейдерами після прориву

Головне питання зараз:

Чи це просто здорове відновлення… чи початок глибшої корекці

Переглянути оригіналПісля агресивного ралі дорогоцінні метали нарешті починають виявляти ознаки вичерпання. Золото та срібло відступають від недавніх максимумів, оскільки короткострокове фіксування прибутку починається, а імпульс охолоджується.

Коли метали рухаються занадто швидко, корекція — це не слабкість, а структура.

Ця корекція може означати:

• Тимчасове полегшення у ризикових активів

• Охолодження попиту на безпечне притулок

• Перерозподіл позицій трейдерами після прориву

Головне питання зараз:

Чи це просто здорове відновлення… чи початок глибшої корекці

- Нагородити

- 8

- 11

- Репост

- Поділіться

AylaShinex :

:

GOGOGO 2026 👊Дізнатися більше

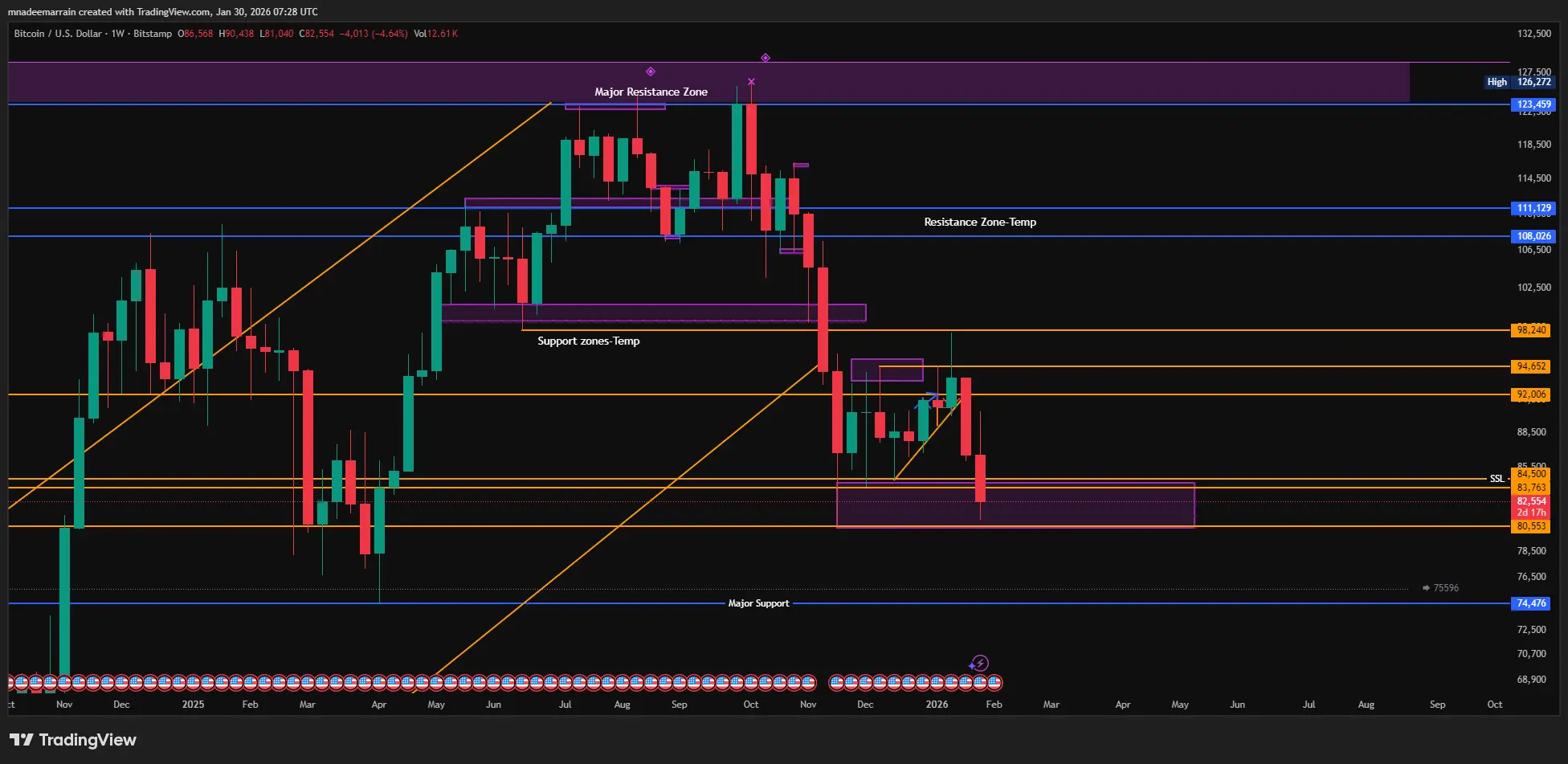

Bitcoin торгується приблизно за $82,000. Як я вже казав, щотижнева 99 EMA є найсильнішою підтримкою. Ми бачимо чітку спробу прориву вниз, але щотижнева свічка ще має два дні для закриття. Підтвердження настане лише при закритті тижня нижче цього рівня.Я все ще тримаю свою коротку позицію. Як я вже говорив раніше, для мене це ринок на короткий бік. Я додав більше шортів приблизно в районі $97,000, як я неодноразово зазначав. З того часу BTC знизився майже на $16,000. Я залишаюся терплячим. $72,000 готується.Як ви знаєте, я залишаюся сильним бичачим настроєм щодо золота і срібла, водночас залиш

Переглянути оригінал

- Нагородити

- 13

- 13

- Репост

- Поділіться

DragonFlyOfficial :

:

GOGOGO 2026 👊Дізнатися більше

#CryptoMarketPullback

Ринки охолоджуються після сильного зростання — і це цілком нормально. 📉

Відкат у криптовалюті не означає, що тренд зламано; це часто означає, що ринок перезавантажується, позбавляється слабких рук і створює більш здорову базу.

Для терплячих інвесторів відкат — це час для переоцінки, а не паніки. Розумні гроші стежать за структурою, рівнями підтримки та ончейн-сигналами, поки емоції зашкалюють.

Корекції створюють можливості. Дисципліна створює результати. 🚀

#CryptoMarketPullback

#PreciousMetalsPullBack

Переглянути оригіналРинки охолоджуються після сильного зростання — і це цілком нормально. 📉

Відкат у криптовалюті не означає, що тренд зламано; це часто означає, що ринок перезавантажується, позбавляється слабких рук і створює більш здорову базу.

Для терплячих інвесторів відкат — це час для переоцінки, а не паніки. Розумні гроші стежать за структурою, рівнями підтримки та ончейн-сигналами, поки емоції зашкалюють.

Корекції створюють можливості. Дисципліна створює результати. 🚀

#CryptoMarketPullback

#PreciousMetalsPullBack

- Нагородити

- 12

- 12

- Репост

- Поділіться

MrFlower_ :

:

GOGOGO 2026 👊Дізнатися більше

#SEConTokenizedSecurities

#SEConTokenizedSecurities

Глобальний фінансовий ландшафт швидко змінюється, і одним із найважливіших розвитку, що формують його майбутнє, є зростання токенізованих цінних паперів. Нещодавно Комісія з цінних паперів і бірж США (SEC) зробила значущі кроки для реагування на цю нову тенденцію, сигналізуючи про зростаюче визнання фінансових інструментів на основі блокчейну в рамках традиційного регулювання. Цей крок є критичним моментом як для інституційних інвесторів, так і для ширшої криптоекосистеми.

Токенізовані цінні папери — це традиційні фінансові активи, такі як а

Переглянути оригінал#SEConTokenizedSecurities

Глобальний фінансовий ландшафт швидко змінюється, і одним із найважливіших розвитку, що формують його майбутнє, є зростання токенізованих цінних паперів. Нещодавно Комісія з цінних паперів і бірж США (SEC) зробила значущі кроки для реагування на цю нову тенденцію, сигналізуючи про зростаюче визнання фінансових інструментів на основі блокчейну в рамках традиційного регулювання. Цей крок є критичним моментом як для інституційних інвесторів, так і для ширшої криптоекосистеми.

Токенізовані цінні папери — це традиційні фінансові активи, такі як а

- Нагородити

- 10

- 12

- Репост

- Поділіться

MrFlower_ :

:

GOGOGO 2026 👊Дізнатися більше

Поспішайте приєднатися до прямого ефіру з друзями

Переглянути оригінал

- Нагородити

- 9

- 10

- Репост

- Поділіться

AylaShinex :

:

GOGOGO 2026 👊Дізнатися більше

Світова слабкість долара сигналізує про стратегічний зсув, оскільки ринки демонструють впевненість

Аналізуючи ринок, експерти відзначають, що трейдери останнім часом продають долар США, тоді як облігації казначейства США залишаються стабільними, а фондові ринки продовжують встановлювати нові рекорди. Ця комбінація свідчить про те, що інвестори не висловлюють значної тривоги щодо ширшого економічного прогнозу США, незважаючи на тривалу слабкість валюти.

Відкат долара здається більш стратегічним, ніж оборонним. М'якший долар зазвичай вважається сприятливим для адміністрації Трампа, оскільки він

Переглянути оригіналАналізуючи ринок, експерти відзначають, що трейдери останнім часом продають долар США, тоді як облігації казначейства США залишаються стабільними, а фондові ринки продовжують встановлювати нові рекорди. Ця комбінація свідчить про те, що інвестори не висловлюють значної тривоги щодо ширшого економічного прогнозу США, незважаючи на тривалу слабкість валюти.

Відкат долара здається більш стратегічним, ніж оборонним. М'якший долар зазвичай вважається сприятливим для адміністрації Трампа, оскільки він

- Нагородити

- 12

- 11

- Репост

- Поділіться

AylaShinex :

:

GOGOGO 2026 👊Дізнатися більше

Популярні теми

Дізнатися більше383.67K Популярність

254 Популярність

4.8K Популярність

127 Популярність

123.46K Популярність

Популярні активності Gate Fun

Дізнатися більше- Рин. кап.:$2.87KХолдери:10.00%

- Рин. кап.:$2.87KХолдери:10.00%

- Рин. кап.:$0.1Холдери:00.00%

- Рин. кап.:$0.1Холдери:10.00%

- Рин. кап.:$2.87KХолдери:10.00%

Закріпити