2025 AA Price Prediction: Expert Analysis and Market Outlook for the Year Ahead

Introduction: Market Position and Investment Value of AA

ARAI (AA) is building the next-generation interaction layer for Web3, powered by autonomous AI agents. Since its launch in 2025, ARAI has emerged as an innovative project combining artificial intelligence with blockchain technology. As of January 2026, ARAI has achieved a market capitalization of approximately $8.97 million, with a circulating supply of 14.45 million tokens and a current price hovering around $0.00897. This technology-driven asset is increasingly playing a crucial role in automating complex operations across gaming and onchain finance through its modular Co-Pilot Agents with real-time perception, strategic reasoning, and adaptive decision-making capabilities.

This article will provide a comprehensive analysis of ARAI's price trajectory from 2026 through 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to offer investors professional price forecasts and practical investment strategies.

ARAI (AA) Market Analysis Report

I. AA Price History Review and Current Market Status

AA Historical Price Trajectory

Based on available data, ARAI has experienced significant price volatility since its launch:

- September 16, 2025: All-time high of $0.20146 was achieved, marking the peak of market enthusiasm for the project.

- December 26, 2025: All-time low of $0.007723 was recorded, reflecting substantial market correction.

- Recent 30-Day Period: The token declined 85.28% from previous levels, indicating pronounced downward pressure over the past month.

- Year-to-Date Performance: ARAI has declined 83.61% since its inception, demonstrating significant long-term depreciation.

AA Current Market Status

As of January 3, 2026, ARAI is trading at $0.00897 with a 24-hour trading volume of $23,664.49. The token exhibits short-term bearish momentum, declining 3.86% in the past hour and 2.59% over the last 24 hours. However, the 7-day performance shows a modest recovery of 7.19%, suggesting some stabilization efforts.

The fully diluted market valuation stands at approximately $8,970,000, with a circulating supply of 14.45 million tokens out of a total supply of 1 billion tokens. The circulating supply ratio of 1.44% indicates substantial token dilution potential as more tokens enter circulation. The project maintains a market dominance of 0.00027%, reflecting its relatively modest position in the broader cryptocurrency ecosystem.

ARAI currently ranks 4,624 among cryptocurrencies by market capitalization and is listed on 10 exchanges. The token maintains an active community of 30,680 holders and operates on the BSC (Binance Smart Chain) network as a BEP-20 token.

Click to view current AA market price

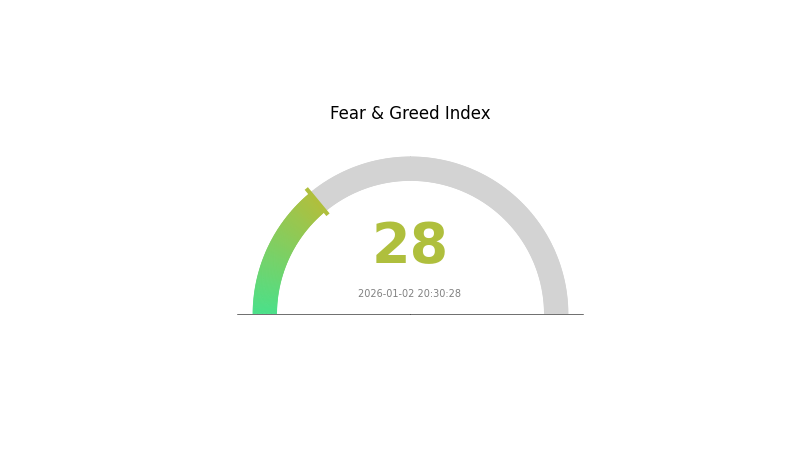

Crypto Market Sentiment Indicator

2026-01-02 Fear and Greed Index: 28 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 28. This low reading indicates heightened anxiety among investors, reflecting concerns about market volatility and potential downside risks. When fear dominates, it often creates both challenges and opportunities for traders. Risk-averse investors may prefer to hold positions, while contrarian traders might see buying opportunities in oversold assets. Monitor market developments closely on Gate.com to make informed investment decisions during this period of elevated market uncertainty.

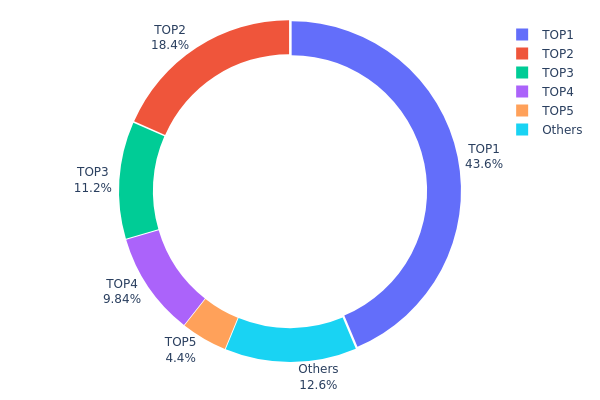

AA Holdings Distribution

The address holdings distribution refers to the concentration pattern of token ownership across blockchain addresses, serving as a critical metric for assessing decentralization levels and potential market risks. By analyzing the top holders and their respective share of total supply, this distribution provides insights into whether tokens are widely dispersed among participants or concentrated among a few entities.

Current data reveals a pronounced concentration in AA's holder structure. The top four addresses collectively control 83.04% of the total supply, with the leading address alone commanding 43.64%. This extreme concentration at the upper tier represents a significant structural concern. The second-largest holder maintains an 18.40% stake, while the third and fourth positions hold 11.16% and 9.84% respectively. Only the fifth-ranked address drops notably to 4.39%, indicating a steep hierarchical distribution pattern rather than a gradual dispersal of holdings.

The remaining distributed addresses account for merely 12.57% of the total supply, further underscoring the centralized nature of the current token distribution. Such high concentration levels typically correlate with elevated market vulnerability, as concentrated stakeholders possess considerable influence over price movements and network governance decisions. The substantial gap between top holders and the broader holder base suggests limited decentralization, which may impede organic market development and increase susceptibility to coordinated actions that could destabilize token valuation or create artificial trading patterns.

Click to view current AA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd128...184cc9 | 436452.37K | 43.64% |

| 2 | 0x61bf...698c04 | 184000.00K | 18.40% |

| 3 | 0xd78a...befd6f | 111600.00K | 11.16% |

| 4 | 0x4005...d8ce0c | 98400.00K | 9.84% |

| 5 | 0x5292...071626 | 43999.00K | 4.39% |

| - | Others | 125548.63K | 12.57% |

Core Factors Influencing AA Token Future Price

AI and Web3 Track Development

-

Technology Integration: AA is a native utility token within the ARAI ecosystem, which integrates artificial intelligence with Web3 through its core engine, Arai Systems. This platform features modular Co-Pilot agents with real-time perception, strategic reasoning, and adaptive decision-making capabilities.

-

Market Attention and Capital Inflow: The combination of AI and blockchain technology represents a current industry trend. Market focus and capital allocation toward such projects directly impact AA's price trajectory. ARAI's collaboration with Google on AR glasses projects has generated significant market attention.

-

Historical Performance: As of September 17, 2025, AA demonstrated strong momentum: 40.13% price increase over 24 hours, 53.23% gain over 7 days, and maintained 53.23% growth over 30 days, indicating sustained positive market sentiment.

Trading Platform Support and Market Dynamics

-

Exchange Infrastructure: Gate.com's comprehensive support plays a crucial role in price dynamics. The platform has launched AA spot trading, USDT perpetual contracts with 1 to 20x leverage support, and CandyDrop airdrop activities (Round 84), collectively enhancing market liquidity and investor engagement.

-

Trading Volume and Accessibility: AA achieved $53.96 million in trading volume, demonstrating robust market participation. The availability of multiple trading instruments on Gate.com—including spot and leveraged contracts—facilitates price discovery and market efficiency.

-

Community Incentives: Gate.com's CandyDrop campaign offers 1,100,000 $AA tokens in rewards, including an incentive pool of 550,000 $AA for successful friend referrals, which strengthens ecosystem participation and price stability through increased network effects.

Market Sentiment and Volatility Considerations

Note: Cryptocurrency prices exhibit extreme volatility, and any predictions carry inherent uncertainty and should not serve as investment advice.

-

Speculative Dynamics: Recent strong price performance suggests positive market sentiment, though the cryptocurrency market remains subject to rapid sentiment shifts driven by news cycles, regulatory announcements, and macroeconomic factors.

-

Project Fundamentals: Long-term price sustainability depends on technological implementation success, ecosystem development, actual application expansion, and the project's ability to deliver on its Web3 and AI integration promises.

III. 2026-2031 Price Forecast Analysis

2026 Outlook

- Conservative Forecast: $0.00502 - $0.00897

- Base Case Forecast: $0.00897

- Optimistic Forecast: $0.01337 (requires sustained market recovery and increased adoption)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with accumulating positive momentum, transitioning toward mid-cycle expansion

- Price Range Predictions:

- 2027: $0.00759 - $0.0163 (24% upside potential)

- 2028: $0.00975 - $0.02019 (53% upside potential)

- 2029: $0.01289 - $0.01747 (89% upside potential)

- Key Catalysts: Ecosystem development milestones, institutional adoption signals, macroeconomic stabilization, and increased utility integration across DeFi platforms

2030-2031 Long-term Outlook

- Base Case Scenario: $0.01136 - $0.02514 (assumes continued network growth and moderate market expansion)

- Optimistic Scenario: $0.02118 - $0.02817 (assumes accelerated enterprise adoption and strengthened market infrastructure)

- Transformative Scenario: $0.02817+ (requires breakthrough technological advancement, mainstream regulatory clarity, and exponential user base expansion)

- 2031-12-31: Price targets $0.02817 as peak potential (136% cumulative gain from 2026 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.01337 | 0.00897 | 0.00502 | 0 |

| 2027 | 0.0163 | 0.01117 | 0.00759 | 24 |

| 2028 | 0.02019 | 0.01374 | 0.00975 | 53 |

| 2029 | 0.01747 | 0.01696 | 0.01289 | 89 |

| 2030 | 0.02514 | 0.01722 | 0.01136 | 91 |

| 2031 | 0.02817 | 0.02118 | 0.01377 | 136 |

ARAI (AA) Investment Strategy and Risk Management Report

IV. AA Professional Investment Strategy and Risk Management

AA Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Patient capital allocators with 2+ year investment horizons; believers in AI agent infrastructure for Web3; investors seeking exposure to emerging autonomous agent technologies.

-

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Implement systematic monthly purchases to mitigate volatility impact, particularly given AA's significant 30-day (-85.28%) and 1-year (-83.61%) declines.

- Staggered Entry Points: Accumulate during market weakness while monitoring technical support levels; establish clear accumulation targets between current price ($0.00897) and historical lows ($0.007723).

- Storage Solution: Secure AA tokens on BSC (Binance Smart Chain) through Gate.com's Web3 Wallet, leveraging multi-signature security and cold storage options for medium to long-term holdings.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Relative Strength Index (RSI): Monitor oversold conditions (RSI < 30) for potential reversal opportunities; current market conditions warrant close observation given recent downtrend.

- Moving Average Crossovers: Employ 50-day and 200-day moving averages to identify trend reversals; watch for bullish crosses as potential entry signals.

-

Swing Trading Key Points:

- Volatility Monitoring: Leverage 24-hour trading volume ($23,664.49) patterns; higher volume during price rallies may indicate genuine buying interest.

- Resistance Testing: Track historical high price of $0.20146 (January 16, 2025) as long-term resistance; identify intermediate resistance at previous support breakpoints.

AA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.5% portfolio allocation; AA should represent speculation capital only, given current market position (#4,624 ranking) and volatility profile.

- Aggressive Investors: 2-5% portfolio allocation; appropriate for investors with higher risk tolerance and conviction in AI agent infrastructure thesis.

- Professional Investors: 1-3% allocation within specialized emerging technology portfolios; implement hedging strategies and regular rebalancing protocols.

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance AA exposure with established Layer 1/Layer 2 blockchain assets and AI-focused tokens with stronger market validation and higher liquidity.

- Stablecoin Reserves: Maintain 50-70% of allocated trading capital in stablecoins for opportunistic rebalancing during volatile price swings; enables rapid position adjustments without market timing pressure.

(3) Secure Storage Solutions

- Self-Custody Approach: Gate.com Web3 Wallet provides institutional-grade security for BSC-based token holdings with real-time portfolio tracking and seamless trading integration.

- Cold Storage Strategy: For holdings exceeding $5,000 value, consider hardware-based custody solutions to minimize smart contract and exchange counterparty risks.

- Security Critical Points:

- Private Key Management: Never share seed phrases; store recovery phrases in physically separate, secured locations.

- Smart Contract Risk: Verify token contract address (0x01bf3d77cd08b19bf3f2309972123a2cca0f6936) on BSCScan before any transaction.

- Phishing Prevention: Access Gate.com and BSCScan exclusively through verified bookmarks or direct URL entry; never click email links for wallet connections.

V. AA Potential Risks and Challenges

AA Market Risks

-

Extreme Volatility & Drawdown Exposure: The token has experienced an 85.28% monthly decline and 83.61% yearly decline, indicating high vulnerability to market sentiment shifts and potential liquidity crises. Retail investors face substantial capital loss probability.

-

Liquidity Constraints: With 24-hour volume of only $23,664.49 and 10 exchange listings, AA exhibits limited trading depth. Large position exits could trigger significant slippage and price impact, constraining institutional participation.

-

Early-Stage Market Position: Ranked #4,624 by market cap with $129,616.50 circulating market value and 0.00027% market dominance, AA remains highly speculative with limited proven product-market fit validation.

AA Regulatory Risks

-

Jurisdictional Uncertainty: AI agents and autonomous systems face evolving regulatory scrutiny globally. Potential future regulations targeting autonomous trading agents or on-chain decision-making systems could impact ARAI's utility and token value.

-

Securities Classification Risk: If ARAI's Co-Pilot agents are deemed to provide investment advice or securities-like services, AA token could face regulatory reclassification as a security, triggering compliance requirements.

-

Gaming & Finance Compliance: Operations spanning both gaming and on-chain finance create complex cross-jurisdictional compliance obligations; regulatory divergence across markets may limit deployment capabilities.

AA Technology Risks

-

Unproven Core Technology: ARAI Systems' modular Co-Pilot agents remain in early development stages with limited real-world production deployment data; the claimed "real-time perception" and "adaptive decision-making" capabilities require extensive security auditing.

-

Smart Contract Vulnerability Exposure: AI agent interactions with blockchain protocols introduce novel attack surface areas and potential exploit vectors; comprehensive security audits and formal verification remain critical prerequisites.

-

Scalability & Performance Constraints: Autonomous agent transactions across games and DeFi require high-speed, low-cost execution; current BSC throughput and cost structure may limit practical deployment at scale.

VI. Conclusion and Action Recommendations

AA Investment Value Assessment

ARAI represents a speculative play on emerging autonomous AI agent infrastructure for Web3, operating at the intersection of artificial intelligence and decentralized finance. The project's value proposition—providing modular Co-Pilot agents for gamified and financial automation—addresses a legitimate market need. However, the token's extreme price decline (-83.61% annually, -85.28% monthly), minimal trading liquidity, and early development stage create substantial execution risk. Investors should approach AA as a high-risk, high-reward emerging technology investment, suitable only for capital that can withstand complete loss without material impact. The project's differentiation, ecosystem adoption rates, and regulatory navigation capabilities will prove critical to medium and long-term value realization.

AA Investment Recommendations

✅ Newcomers: Allocate only 0.5-1% of total crypto portfolio; implement strict dollar-cost averaging over 6-12 months; establish clear stop-loss discipline at 20-30% below entry point; prioritize risk education on early-stage AI infrastructure projects before committing capital.

✅ Experienced Investors: Consider 2-4% speculative allocation if conviction exists in autonomous agent infrastructure adoption; employ technical analysis to identify entry points near support levels ($0.007723-$0.008500 range); maintain hedging positions in established AI or blockchain infrastructure tokens.

✅ Institutional Investors: Conduct comprehensive technical due diligence on ARAI Systems' core algorithms, smart contract audits, and AI agent decision-making frameworks; evaluate governance participation and long-term tokenomics alignment; consider position building only after verified mainnet deployment and demonstrated user traction metrics.

AA Trading Participation Methods

-

Direct Token Trading: Trade AA/USDT pairs on Gate.com with limit orders to control execution prices; utilize Gate.com's advanced order types for risk management and position automation.

-

BSC Network Interaction: Swap tokens using BSC-based protocols; verify all transaction parameters on BSCScan before confirmation; maintain awareness of network gas fees and slippage tolerance settings.

-

Portfolio Monitoring: Utilize Gate.com's portfolio tracking dashboard to monitor AA position performance relative to broader market indices; set price alerts at key technical levels ($0.010, $0.015, $0.020) for proactive rebalancing decisions.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial situation. Consultation with professional financial advisors is strongly recommended. Never invest capital you cannot afford to lose completely.

FAQ

What is AA's historical price trend? What are the key price highs and lows?

AA reached its peak around 60 USD in 2006 and its lowest point near 40 USD in 2020. Recent price movements show volatility between 45-55 USD range, reflecting market fluctuations and aluminum industry cycles.

What are the main factors affecting AA price?

AA price is primarily influenced by domestic money supply, domestic price levels, foreign interest rates, and expected exchange rate changes. Market sentiment, trading volume, and macroeconomic conditions also play significant roles in price movements.

How to predict AA's price? What are common analysis methods?

Use technical indicators like moving averages, RSI, MACD, and pivot points to predict AA price movements. Analyze trading volume and market trends. Combine multiple indicators for better accuracy by identifying support/resistance levels and momentum shifts.

What are the risks and limitations of AA price prediction?

AA price predictions face risks from market volatility, economic fluctuations, and data dependency. Predictions have limitations as they rely on historical data and specific timepoints. External factors and unforeseen events may significantly impact accuracy and reliability.

How does AA's price performance compare to similar assets?

AA demonstrates competitive price performance among similar assets, with moderate volatility reflecting its lower trading volume in over-the-counter markets. The asset has maintained stable net asset value, positioning it favorably within its category.

What is GTAI: A Comprehensive Guide to Generative AI Technology and Its Real-World Applications

What is FET: Understanding Field-Effect Transistors and Their Applications in Modern Electronics

How to Copy Trade Crypto in 2025: A Beginner's Guide

The next-generation DEX vision of Aster

What is SkyAI ($SKYAI)? Exploring its MCP infrastructure and role in on-chain AI.

WhiteBridge Network (WBAI): AI-Powered Trust Layer for People-Data Intelligence

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps