2025 DOGA Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: DOGA's Market Position and Investment Value

Dogami (DOGA) operates as an IP-centered Web3 entertainment platform backed by industry leaders including Ubisoft and Animoca Brands. Since its inception, the project has established itself as the largest gaming project on Tezos with over 200,000 community members and 24,000 NFTs sold, while expanding into the Polygon ecosystem. As of January 2, 2026, DOGA maintains a market capitalization of approximately $206,282, with circulating supply of 774,966,997.82 tokens and a current price hovering around $0.0002323. This Web3 gaming token is recognized for its ambitious cross-platform entertainment strategy and robust investor backing totaling $14 million from renowned names in gaming and blockchain industries.

This article will provide a comprehensive analysis of DOGA's price trajectory through 2031, integrating historical price patterns, market supply dynamics, ecosystem development milestones, and broader economic factors. By examining these multifaceted elements, we aim to deliver professional price forecasts and practical investment strategies for participants seeking to understand DOGA's potential within the evolving Web3 entertainment landscape.

I. DOGA Price History Review and Market Status

DOGA Historical Price Evolution

- March 22, 2022: All-time high of $0.413535 reached, marking the peak of DOGA's market performance during the initial bull market phase.

- November 15, 2025: All-time low of $0.00018041 recorded, reflecting significant downward pressure over the extended bear market period.

- 2022-2025: Sustained decline from peak to trough, with DOGA experiencing a year-over-year depreciation of 95.11%, indicating substantial long-term value erosion.

DOGA Current Market Status

As of January 2, 2026, DOGA is trading at $0.0002323, reflecting ongoing bearish sentiment in the market. The token has experienced short-term pressure with a 24-hour decline of 3.31%, while the 7-day and 30-day periods show steeper losses of 13.96% and 39.83% respectively. The 24-hour trading volume stands at $14,699.23, demonstrating limited liquidity and relatively modest trading activity.

The token's circulating supply comprises 774,966,997.82 DOGA out of a maximum supply of 888,000,000 tokens, with a circulating ratio of 87.27%. The fully diluted market capitalization is $206,282.40, while the current market cap is $180,024.83. With only 2,551 token holders and a market dominance of 0.0000064%, DOGA occupies a highly niche position within the broader cryptocurrency ecosystem. The current market sentiment indicator stands at "Extreme Fear," suggesting widespread apprehension among market participants.

View the current DOGA market price

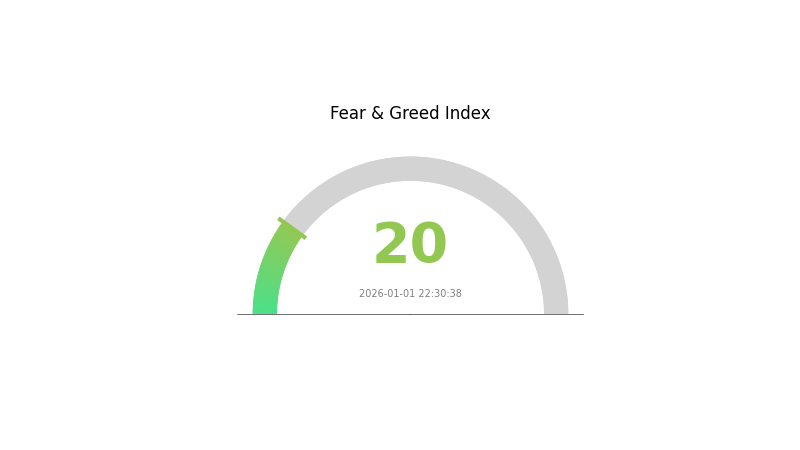

DOGA Market Sentiment Index

2026-01-01 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The DOGA market is currently experiencing extreme fear with an index reading of 20. This indicates heightened market anxiety and pessimistic sentiment among investors. During periods of extreme fear, risk-averse traders typically reduce positions while contrarian investors may view it as a potential buying opportunity. Market volatility tends to increase under such conditions. Monitor key support levels and market indicators closely. Consider your risk tolerance and investment strategy carefully before making trading decisions on Gate.com.

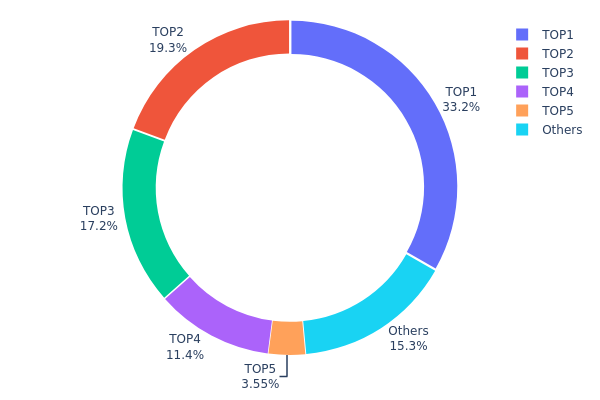

DOGA Holdings Distribution

The address holdings distribution represents the concentration of DOGA tokens across the top wallet addresses on the blockchain. This metric reveals the tokenomics structure and capital distribution, providing critical insights into the asset's decentralization level and potential market vulnerability to whale activities.

DOGA exhibits significant concentration risk, with the top three addresses controlling approximately 69.73% of total token supply. The leading address (0x0529...c553b7) alone accounts for 33.21% of holdings, while the second and third addresses hold 19.32% and 17.20% respectively. The dead address (0x0000...00dead) contains 11.39% of tokens, which are permanently removed from circulation. This distribution pattern indicates a moderately concentrated tokenomics structure where a small number of entities wield considerable influence over token supply dynamics. While the remaining addresses collectively hold 15.33%, demonstrating some degree of decentralization, the concentration among top holders remains notable.

This holding structure poses implications for market stability and price dynamics. The substantial stakes held by top addresses could amplify volatility during periods of large-scale token movements or liquidations. However, the presence of a significant dead address allocation suggests intentional supply management through token burning mechanisms, which may serve to reduce future dilution risks. The distribution pattern indicates that DOGA's on-chain governance and price behavior remain susceptible to decisions made by major stakeholders, warranting close monitoring of their transaction patterns and market activities.

Click to view current DOGA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0529...c553b7 | 323865.41K | 33.21% |

| 2 | 0xf086...4c10cf | 188433.04K | 19.32% |

| 3 | 0x0d07...b492fe | 167820.16K | 17.20% |

| 4 | 0x0000...00dead | 111111.11K | 11.39% |

| 5 | 0xf067...b98e47 | 34635.02K | 3.55% |

| - | Others | 149290.22K | 15.33% |

II. Core Factors Influencing DOGE's Future Price

Supply Mechanism

-

Unlimited Supply Model: Unlike Bitcoin, Dogecoin has no supply cap. The token experiences fixed annual inflation of approximately 5 billion new DOGE tokens minted per year.

-

Historical Pattern: The unlimited supply structure has historically created inflationary pressure during periods of weak demand, constraining long-term price appreciation potential.

-

Current Impact: Continued annual token issuance may limit sustained price growth if market demand does not expand proportionally, though the impact remains moderated by strong community engagement and use case adoption.

Institutions and Major Holders

-

Celebrity and Entrepreneur Support: Elon Musk has been a prominent advocate for DOGE, mentioning it on Twitter and in media appearances. Other notable supporters include Mark Cuban, whose Dallas Mavericks NBA team accepts DOGE as payment, and Snoop Dogg. Musk's Boring Company also accepts DOGE for merchandise purchases.

-

Community Leadership: The project is governed by a board including co-founder Billy Markus (managing community and memes), core developer Max Keller (technical oversight), Ethereum founder Vitalik Buterin (crypto advisor), and Jared Birchall representing Elon Musk (legal and financial guidance).

Macro Economic Environment

-

Bitcoin Cycle Correlation: DOGE's primary price driver has historically been Bitcoin's performance. Market analysts note that DOGE price movements are heavily synchronized with broader cryptocurrency market dynamics and Bitcoin cycle phases.

-

Market Sentiment and Risk Appetite: During bull market conditions with elevated risk appetite, analysts project DOGE could challenge the $1 USD historical level previously reached in May 2021 ($0.7376). However, price movements are expected to remain volatile throughout market cycles.

-

Meme Narrative and Social Media Dynamics: Key driving factors include meme culture narratives, celebrity endorsements, and viral social media momentum. Community-driven narratives on platforms like Reddit and Twitter significantly influence short-term price movements.

III. 2026-2031 DOGA Price Forecast

2026 Outlook

- Conservative Forecast: $0.0002 - $0.00023

- Neutral Forecast: $0.00023

- Optimistic Forecast: $0.00028 (requires sustained market interest and community engagement)

2027-2029 Mid-term Outlook

- Market Stage Expectations: Gradual accumulation phase with potential for moderate growth as market conditions stabilize and adoption expands.

- Price Range Forecasts:

- 2027: $0.00023 - $0.00034

- 2028: $0.0003 - $0.0004

- 2029: $0.00032 - $0.00045

- Key Catalysts: Increased utility adoption, community expansion, strategic partnerships, and broader cryptocurrency market recovery momentum.

2030-2031 Long-term Outlook

- Base Case Scenario: $0.0029 - $0.00059 (assuming steady ecosystem development and moderate market growth)

- Optimistic Scenario: $0.00043 - $0.00071 (contingent on successful protocol upgrades and significant market adoption)

- Transformational Scenario: $0.00071+ (under conditions of exceptional community growth, major integration partnerships, and favorable macroeconomic environment for digital assets)

- 2026-01-02: DOGA remains stable in early year consolidation phase

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00028 | 0.00023 | 0.0002 | 0 |

| 2027 | 0.00034 | 0.00025 | 0.00023 | 9 |

| 2028 | 0.0004 | 0.0003 | 0.00018 | 27 |

| 2029 | 0.00045 | 0.00035 | 0.00032 | 49 |

| 2030 | 0.00059 | 0.0004 | 0.00029 | 71 |

| 2031 | 0.00071 | 0.00049 | 0.00043 | 112 |

DOGAMI (DOGA) Investment Analysis Report

IV. DOGA Professional Investment Strategy and Risk Management

DOGA Investment Methodology

(1) Long-term Holding Strategy

-

Suitable Investors: Investors with high risk tolerance interested in emerging Web3 gaming IP projects and early-stage ecosystem participation.

-

Operational Recommendations:

- Establish a position gradually during market downturns rather than all-at-once purchases, as DOGA has experienced significant volatility (down 95.11% over 1 year).

- Monitor ecosystem development milestones including game launches, IP expansions (merchandise, comics, TV series), and blockchain network expansions.

- Set realistic return expectations based on project maturity stage and competitive positioning within the Web3 gaming sector.

-

Storage Solutions:

- Use Gate Web3 Wallet for secure asset custody with institutional-grade security protocols.

- Ensure private keys are properly backed up and stored in a secure location.

- Consider hardware-based backup solutions for significant holdings.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Candlestick Pattern Analysis: Track 1H, 24H, and 7D price movements to identify support/resistance levels; DOGA is currently trading at $0.0002323 with recent 24H decline of -3.31%.

- Volume Analysis: Monitor the 24H trading volume of $14,699.23 USD relative to market cap ($180,024.83) to assess liquidity conditions and price discovery mechanisms.

-

Swing Trading Key Points:

- Current price remains significantly below all-time high of $0.413535 (reached March 22, 2022), creating potential reversal opportunities if project fundamentals improve.

- The 7-day decline of -13.96% and 30-day decline of -39.83% indicate sustained bearish pressure; traders should wait for clear bullish reversal signals before entry.

V. DOGA Potential Risks and Challenges

DOGA Market Risks

-

Extreme Valuation Decline: DOGA has experienced a catastrophic -95.11% decline over the past year, indicating severe loss of market confidence or failed project execution.

-

Low Liquidity: With only $14,699.23 in 24H volume against a market cap of $180,024.83, the token exhibits poor liquidity, making large position entries/exits extremely difficult.

-

Community and User Adoption Risk: Success depends on sustained user engagement with DOGAMÍ Academy game and mainstream IP development; any slowdown in game adoption or player retention directly impacts token demand.

DOGA Regulatory Risks

-

Multi-Chain Regulatory Uncertainty: Operating across Tezos and Polygon blockchains exposes the project to varying regulatory frameworks across different jurisdictions where these networks operate.

-

Gaming and NFT Compliance: As a Web3 gaming project with NFT components, DOGA faces evolving regulatory scrutiny around gaming mechanics, NFT classification, and potential securities law implications.

-

IP and Entertainment Regulations: Planned mainstream TV series, merchandise, and other entertainment products require compliance with traditional media and consumer protection regulations.

DOGA Technology Risks

-

Cross-Chain Execution Risk: Expanding across multiple blockchains (Tezos and Polygon) introduces technical complexity, potential smart contract vulnerabilities, and cross-chain bridge risks.

-

Game Development and Launch Risks: DOGAMÍ Academy requires continuous technical updates, bug fixes, and feature development; any major technical failures could severely damage user trust.

-

Blockchain Network Dependency: The project's performance is dependent on the stability and adoption of underlying blockchains; issues with Tezos or Polygon ecosystems directly impact DOGA's viability.

VI. Conclusion and Action Recommendations

DOGA Investment Value Assessment

DOGAMI represents an ambitious IP-centered Web3 entertainment project backed by notable investors including Ubisoft and Animoca Brands. However, the token's 95.11% year-over-year decline and minimal liquidity suggest significant market skepticism regarding execution. The project's success depends on successful game adoption, mainstream IP development, and sustained ecosystem growth. Current valuations may present contrarian opportunities for risk-tolerant investors, but the token remains highly speculative with substantial downside risks.

DOGA Investment Recommendations

✅ Beginners: Exercise extreme caution; allocate only a small percentage of total portfolio (less than 1%) if participating at all. Focus on understanding game mechanics and ecosystem development before committing capital.

✅ Experienced Investors: Consider accumulating small positions only if you can tolerate total loss of investment. Monitor key milestones including game user metrics, IP partnership announcements, and network activity before scaling positions.

✅ Institutional Investors: DOGA's minimal liquidity and market cap ($180K) make it unsuitable for institutional allocation. Only participate through strategic partnerships or direct project investment rather than token market purchases.

DOGA Trading Participation Methods

-

Gate.com Spot Trading: Buy/sell DOGA directly through Gate.com's spot trading platform; ensure you understand current bid-ask spreads and the limited liquidity before executing large orders.

-

Accumulation Strategy: Use Gate.com's limit order functionality to set purchase prices at psychological support levels rather than executing market orders that could result in significant slippage.

-

Ecosystem Participation: Beyond token trading, engage with DOGAMÍ Academy gameplay to generate DOGA rewards through competitive PVP events, though this requires time investment and actual gameplay participation.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and are strongly advised to consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is DOGA? What are its uses and value?

DOGA is a utility token powering its ecosystem economy. Distributed to team, investors, and community, it facilitates transactions and service participation. Its value derives from supporting network participants and incentivizing ecosystem engagement.

How to predict the future price trend of DOGA tokens?

DOGA price prediction depends on analyzing trading volume, market sentiment, blockchain adoption, and technical indicators. Monitor community activity, on-chain metrics, and macroeconomic factors. Historical patterns suggest potential movements between support and resistance levels based on market cycles and investor interest trends.

DOGA price prediction involves several key factors. Supply and demand dynamics, market sentiment driven by news and social media, regulatory developments like ETF approvals, institutional adoption rates, and macroeconomic trends including inflation and interest rates all significantly influence DOGA's price trajectory.

DOGA price prediction involves several key factors. Supply and demand dynamics, market sentiment driven by news and social media, regulatory developments like ETF approvals, institutional adoption rates, and macroeconomic trends including inflation and interest rates all significantly influence DOGA's price trajectory.

What are the main risks of investing in DOGA tokens?

DOGA token investments face market volatility, project execution risks, and regulatory uncertainty. Liquidity may be limited, and the gaming ecosystem's success is unproven. Price fluctuations can be significant in this emerging sector.

What are the differences between DOGA and other meme coins such as DOGE and SHIB?

DOGA distinguishes itself through unique tokenomics and community-driven initiatives. Unlike DOGE's simplistic design, DOGA offers enhanced utility features. Compared to SHIB, DOGA provides faster transaction capabilities and stronger ecosystem development, positioning it as a next-generation meme coin with real value proposition.

DOGA代币的长期前景和发展潜力如何?

DOGA拥有强劲的长期潜力。随着元宇宙和游戏生态的扩展,虚拟资产需求持续增长。DOGA凭借创新机制和生态扩张,有望在Web3游戏领域占据重要地位,价值稳步上升。

Is Adventure Gold (AGLD) a Good Investment?: Analyzing the Long-Term Potential of this Gaming Token in the NFT Ecosystem

Is Dogami (DOGA) a good investment?: Analyzing the Potential and Risks of this NFT Gaming Token

Is CeluvPlay (CELB) a good investment?: Analyzing the potential of this emerging entertainment platform in the Korean market

Is WORLDSHARDS (SHARDS) a good investment?: Analyzing the potential and risks of this new blockchain gaming token

2025 LWA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Nifty Island (ISLAND) a good investment?: A Comprehensive Analysis of Risk, Market Potential, and Long-term Viability for Crypto Investors

Samsung Q4 Profit Jumps 160 Percent, How the AI Chip Boom Is Reshaping Markets

How to Find My BNB Smart Chain Address

What Is Official Platform Verification Tool?

Copper Hits Record Above $13,000, What the US Import Rush Means for Traders

Understanding Profit and Loss (PnL) – Evaluating Your Financial Health