2025 ELIX Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: ELIX's Market Position and Investment Value

Elixir Games (ELIX) stands as the largest gaming platform in the Web3 ecosystem, providing end-to-end distribution and fintech enterprise-grade solutions. Since its launch in May 2024, ELIX has established itself as a dynamic player in the gaming industry. As of December 31, 2025, ELIX maintains a market capitalization of approximately $285,028, with a circulating supply of around 245.93 million tokens, currently trading at $0.001159 per token. This asset is gaining increasing prominence in Web3 gaming infrastructure and monetization solutions.

The project leverages a multifaceted business model powered by diverse revenue streams, including In-Game Assets Marketplace fees, In-App Purchase commissions from game partners, Subscription Passes with referral fees for premium users, and Software as a Service (SaaS) solutions tailored for enterprises and game publishers. This strategic combination of monetization avenues positions ELIX as a vital participant in driving sustainable growth and innovation within the gaming sector.

This comprehensive analysis examines ELIX's price trajectory through 2030, integrating historical performance data, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for stakeholders considering positions on platforms like Gate.com.

ELIX Price History Review and Market Status

I. ELIX Price History Review and Current Market Situation

ELIX Historical Price Evolution Trajectory

-

May 2024: Project launched on Gate.com at an initial price of $0.05, marking the entry point for early investors in the Web3 gaming platform.

-

May 30, 2024: ELIX reached its all-time high of $0.16569, representing a significant 231% appreciation from the launch price as the project gained market traction.

-

December 8, 2025: ELIX recorded its all-time low of $0.001037, reflecting substantial market correction and consolidation over the extended period.

ELIX Current Market Status

As of December 31, 2025, ELIX is trading at $0.001159, maintaining relatively stable price action with a 0% change in the last 24 hours. The token has experienced significant long-term depreciation, declining 96.71% year-over-year from its peak valuations. Over the past 30 days, ELIX has declined 20.66%, though short-term momentum shows slight recovery with a 0.61% gain in the past hour and a modest -0.51% adjustment over the 7-day period.

The current market capitalization stands at approximately $285,028, with a fully diluted valuation of $1,738,493. The 24-hour trading volume reaches $48,893.57, reflecting modest liquidity. ELIX maintains a circulating supply of 245,925,876.77 tokens out of a maximum supply of 1,500,000,000, representing approximately 16.4% circulation. With 5,279 active holders, the token operates on the Solana blockchain as an SPL-20 standard token.

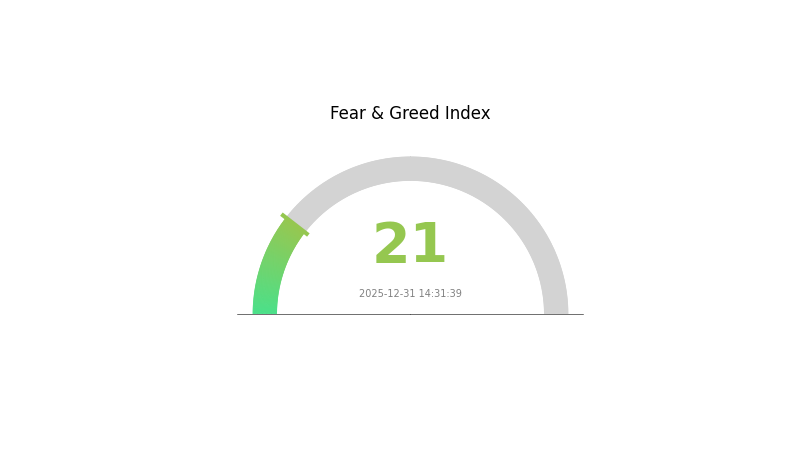

Market sentiment remains at extreme fear levels (VIX: 21), indicating heightened caution among investors despite the project's position as a Web3 gaming distribution platform offering enterprise-grade fintech solutions, in-game asset marketplace services, and Software-as-a-Service offerings for game publishers and enterprises.

Click to view current ELIX market price

ELIX Market Sentiment Index

2025-12-31 Fear and Greed Index: 21 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an ELIX index of 21. This historically low reading suggests significant market pessimism and risk aversion among investors. During such periods, panic selling often intensifies, creating substantial volatility across digital assets. Experienced traders typically view extreme fear as a potential contrarian signal, as markets often recover from these deeply oversold conditions. However, caution remains warranted as negative sentiment can persist. Monitoring market developments closely and maintaining a disciplined investment strategy remains essential for navigating these challenging market conditions.

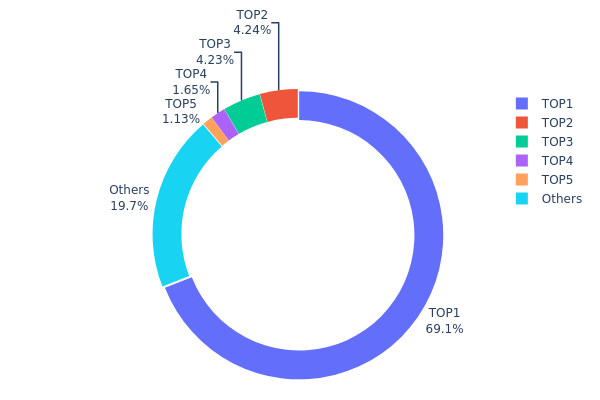

ELIX Holdings Distribution

The address holdings distribution map illustrates the concentration of ELIX tokens across different wallet addresses, providing critical insights into the token's decentralization level and market structure. By analyzing the top holders and their respective ownership percentages, we can assess the potential risks associated with token concentration, market manipulation vulnerability, and the overall health of the project's tokenomics.

The ELIX token exhibits significant concentration risk, with the top holder commanding 69.08% of total supply, representing over two-thirds of all tokens in circulation. The top five addresses collectively control approximately 80.32% of the token supply, while the remaining addresses hold only 19.68%. This highly skewed distribution pattern indicates pronounced centralization characteristics. The dominant position of the largest holder is particularly noteworthy, as it substantially exceeds typical threshold levels for institutional holdings and raises considerable concerns regarding potential market manipulation and governance concentration.

This extreme concentration structure creates notable implications for market dynamics and stability. With such a high proportion of tokens concentrated in a single address, the market faces elevated volatility risk and potential liquidity concerns during large-scale selling events. The current distribution suggests limited decentralization, which may hinder organic price discovery mechanisms and create dependency on large holder sentiment. Such concentration patterns typically characterize projects in early stages or those with significant allocations reserved for team, investors, or treasury functions, warranting careful monitoring of future unlock schedules and holder behavior.

Click to view current ELIX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | A6qS9p...QaGXnP | 1036190.88K | 69.08% |

| 2 | AC5RDf...CWjtW2 | 63534.49K | 4.23% |

| 3 | ASTyfS...g7iaJZ | 63449.79K | 4.23% |

| 4 | u6PJ8D...ynXq2w | 24797.32K | 1.65% |

| 5 | Bv3w4x...BfiRRw | 16978.92K | 1.13% |

| - | Others | 295033.55K | 19.68% |

II. Core Factors Influencing ELIX's Future Price

Technology Development and Ecosystem Building

-

Sustainable Packaging Innovation: ELIX Group has launched eco-friendly air freshener containers made from post-consumer recycled (PCR) glass and biodegradable polymers, positioning the company as a sustainability leader in the automotive scent delivery system industry.

-

Advanced Scent Diffusion Technologies: The automotive scent delivery market is increasingly adopting ultrasonic atomizers, nano-mist generators, and microencapsulation technologies for fragrance molecules. These advancements improve misting performance to deliver long-lasting scents with minimal residue, creating opportunities for ELIX to enhance its product offerings and competitive positioning.

-

Market Growth Trajectory: The global automotive scent delivery system market is projected to expand from USD 738.3 million in 2025 to USD 1.07 billion by 2034, representing a compound annual growth rate (CAGR) of 4.2%. This sustained market expansion provides a favorable backdrop for ELIX's business expansion and price appreciation potential.

-

Industry Ecosystem: Major market participants including Valeo, ScentAir Technologies, AromaTech, Prolitec, Air Aroma International, IKEDA Scents, and Eberspächer Group are collectively driving innovation and market development in this sector. ELIX's participation in this competitive ecosystem underscores the importance of continuous technological advancement and strategic partnerships.

III. 2025-2030 ELIX Price Forecast

2025 Outlook

- Conservative Forecast: $0.0008 - $0.0016

- Neutral Forecast: $0.00116 (average expected price)

- Bullish Forecast: $0.0016 (requires sustained market interest and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with modest growth trajectory as the project establishes stronger market presence and utility adoption.

- Price Range Predictions:

- 2026: $0.00087 - $0.00187 (18% potential upside)

- 2027: $0.00124 - $0.00224 (40% potential upside)

- Key Catalysts: Enhanced protocol functionality, strategic partnerships, increased community engagement, and broader market recovery in the digital asset sector.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00122 - $0.00223 (assuming steady ecosystem growth and moderate market expansion by 2028)

- Bullish Scenario: $0.00155 - $0.00326 (assuming significant adoption acceleration and favorable macroeconomic conditions by 2030, representing near 100% upside potential)

- Transformative Scenario: $0.00326+ (contingent upon breakthrough technological innovations, major institutional participation, or significant expansion of use cases across decentralized networks)

- December 31, 2030: ELIX targets $0.00231 average valuation (representing cumulative 99% growth from 2025 baseline under optimistic long-term conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0016 | 0.00116 | 0.0008 | 0 |

| 2026 | 0.00187 | 0.00138 | 0.00087 | 18 |

| 2027 | 0.00224 | 0.00163 | 0.00124 | 40 |

| 2028 | 0.00223 | 0.00194 | 0.00122 | 66 |

| 2029 | 0.00254 | 0.00208 | 0.00129 | 79 |

| 2030 | 0.00326 | 0.00231 | 0.00155 | 99 |

Elixir Games (ELIX) Professional Investment Analysis Report

IV. ELIX Professional Investment Strategy and Risk Management

ELIX Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Risk-averse investors seeking exposure to Web3 gaming infrastructure with extended investment horizons

- Operational Recommendations:

- Accumulate ELIX during market downturns when prices reach support levels, leveraging dollar-cost averaging over 6-12 month periods

- Monitor Elixir Games' platform adoption metrics, partnership announcements, and revenue diversification across marketplace fees, in-app purchase commissions, and SaaS offerings

- Maintain position through volatility cycles, recognizing that early-stage Web3 gaming platforms require time to establish sustainable business models

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action Analysis: Monitor support/resistance levels around recent trading ranges ($0.001141-$0.001189 in 24H trading) and historical price points

- Volatility Assessment: Track 24-hour volume patterns (current 24H volume: $48,893.57) to identify optimal entry and exit points during liquidity cycles

-

Trading Range Observations:

- The token has experienced significant long-term depreciation (-96.71% YoY), suggesting careful risk management is essential

- Recent price stability with minimal 24H volatility (0% change) indicates potential consolidation periods

- Weekly decline of -0.51% suggests continued downward pressure requiring defensive positioning

ELIX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation maximum, treating ELIX as high-risk speculative exposure

- Active Traders: 3-5% portfolio allocation with strict stop-loss discipline at -15% to -20% levels

- Institutional Investors: 0.5-2% allocation within diversified Web3 gaming sector exposure

(2) Risk Hedging Approaches

- Position Sizing Discipline: Limit single trade exposure to 1-2% of total portfolio given high volatility profile and limited liquidity ($48K daily volume)

- Dollar-Cost Averaging: Execute purchases in equal intervals over extended periods rather than lump-sum investments to mitigate timing risk

(3) Secure Storage Solutions

- Custodial Solutions: Gate.com Web3 wallet provides professional-grade security for active traders requiring accessible liquidity

- Cold Storage Approach: For long-term holders, consider hardware-based storage solutions for significant ELIX positions requiring maximum security

- Security Considerations:

- Enable two-factor authentication on all exchange and wallet accounts

- Never share private keys or recovery phrases

- Verify contract addresses before token transfers (Solana contract: 5cbq1HriesW4zHpFEk9Gc8UT4ccmfHcBTDCa2XcBduTo)

- Conduct test transactions with small amounts before moving substantial holdings

V. ELIX Potential Risks and Challenges

ELIX Market Risks

- Severe Price Depreciation: ELIX has declined 96.71% over 12 months and 20.66% over 30 days, indicating weak investor confidence and possible lack of sustained demand for the token

- Limited Trading Liquidity: 24-hour volume of $48,893.57 is insufficient for institutional-scale positions, creating significant slippage risk for larger trades

- Low Market Capitalization: Fully diluted valuation of $1.74M places ELIX among the smallest-cap tokens, exposing investors to extreme volatility and potential liquidity crises

ELIX Regulatory Risks

- Web3 Gaming Regulatory Uncertainty: Evolving global regulations targeting play-to-earn mechanisms and token-based incentives could impact Elixir Games' business model and token utility

- Jurisdictional Compliance Challenges: Different regulatory frameworks across regions may restrict the platform's ability to serve certain markets, affecting platform adoption and revenue growth

- Token Classification Risk: Regulatory authorities may classify ELIX differently across jurisdictions, potentially limiting its use in certain geographic markets or requiring operational adjustments

ELIX Technology Risks

- Solana Network Dependency: ELIX operates as an SPL-20 token on Solana, inheriting all blockchain-level risks including network congestion, consensus issues, or protocol-level vulnerabilities

- Platform Smart Contract Risk: Vulnerabilities in Elixir Games' smart contracts managing marketplace fees, in-app purchases, and SaaS functionality could result in fund loss or service disruption

- Scaling Challenges: As the platform grows, technological bottlenecks in game integration, asset marketplace performance, or financial transaction processing could impede platform adoption

VI. Conclusion and Action Recommendations

ELIX Investment Value Assessment

Elixir Games represents an ambitious infrastructure play within the Web3 gaming ecosystem, positioning itself as a comprehensive distribution and fintech platform with diversified revenue streams. However, the token faces significant headwinds: a 96.71% annual depreciation, minimal trading liquidity, extremely low market capitalization, and unclear market demand validation. While the platform's multi-revenue model (marketplace fees, in-app purchase commissions, subscription passes, and SaaS services) demonstrates business sophistication, translation of this model into sustained token appreciation remains unproven. The current technical indicators suggest continued weakness, with recent monthly and daily declines indicating a lack of bullish momentum.

ELIX Investment Recommendations

✅ Beginners: Approach ELIX with extreme caution as a speculative position only if you can afford complete capital loss. If interested, limit exposure to 0.5-1% of portfolio and dollar-cost average over 6+ months to reduce timing risk. Prioritize understanding Elixir Games' platform development milestones before committing capital.

✅ Experienced Investors: Consider selective accumulation during severe price weakness if technical analysis confirms capitulation patterns, but maintain strict risk management discipline. Establish clear profit targets and stop-losses before entering positions. Monitor platform adoption metrics and revenue diversification progress as key success indicators.

✅ Institutional Investors: Conduct extensive due diligence on Elixir Games' partnerships, revenue visibility, and competitive positioning within the gaming infrastructure sector before considering allocation. Any institutional-scale allocation requires significant liquidity considerations and strategic partnership discussions with the project team.

ELIX Trading Participation Methods

- Gate.com Trading: Execute ELIX trades directly on Gate.com with real-time market data, order management tools, and integrated wallet solutions for seamless transfers

- Spot Trading Strategy: Enter positions during oversold conditions (monitoring 24-hour price levels and volume patterns) with predetermined exit strategies

- Portfolio Rebalancing: Use ELIX as a speculative satellite position within broader Web3 gaming sector exposure, maintaining discipline through systematic rebalancing rules

Cryptocurrency investments carry extreme risk. This analysis does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is ELIX? What are its main uses and application scenarios?

ELIX is a blockchain-based utility token designed for decentralized finance and Web3 ecosystem applications. Its primary uses include governance participation, transaction fee payments, and incentive mechanisms within its native platform. Application scenarios span DeFi protocols, staking rewards, and cross-chain interoperability solutions.

How has ELIX performed historically? What is the price trend over the past year?

ELIX has experienced significant volatility over the past year with recent slight upward movement. Current 24-hour price range is $0.001146-$0.001174. Historical low reached $0.001045, representing a 10.2% recovery from December 08, 2025.

What are the main factors affecting ELIX price?

ELIX price is primarily influenced by market sentiment, regulatory policies, and technological innovations. Investor confidence, trading volume, and macroeconomic trends also play important roles in price movements.

What is the ELIX price prediction for 2024? How do analysts view it?

ELIX price prediction for 2024 remains uncertain, but analysts focus on market performance and growth potential. Current ELIX price ranges from $0.001146 to $0.001174, with 24-hour trading volume at $98,198.42. Market sentiment suggests cautious optimism regarding ELIX's trajectory.

What are the advantages and disadvantages of ELIX compared to similar tokens?

ELIX offers high efficiency and real-world financial applications with a fast, secure network. However, it faces competition from established cryptocurrencies and lacks the market recognition and proven security track record of larger projects.

What are the main risks of investing in ELIX? How can they be mitigated?

Main risks include market volatility, concentration risk, and liquidity concerns. Mitigate by diversifying your portfolio, avoiding overexposure to single assets, conducting thorough research, and only investing capital you can afford to lose.

What is READY: A Comprehensive Guide to Understanding the Framework for Excellence and Development

What is CWAR: A Comprehensive Guide to Collaborative Web Application Requirements

What is ELIX: A Comprehensive Guide to the Innovative Blockchain Platform Revolutionizing Digital Identity and Data Management

Is Elixir Games (ELIX) a good investment?: A Comprehensive Analysis of Gaming Token Prospects and Market Potential

Is Gomble (GM) a good investment?: Analyzing the automaker's financial performance and future prospects

What is PCNT: Understanding Percentage Change and Its Applications in Data Analysis

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps