2025 EQX Price Prediction: Expert Analysis and Market Forecast for Equinix Stock

Introduction: Market Position and Investment Value of EQX

EQX (EQIFi), positioned as a decentralized finance bridge token supported by a licensed and regulated global digital bank, has been operational since 2021. As of January 2026, EQX maintains a market capitalization of approximately $96,000 USD, with a circulating supply of 500 million tokens at a current price of $0.000192. This token, which serves as the reward mechanism for users on the EQIFi platform, is increasingly playing a critical role in bridging traditional finance and decentralized finance ecosystems.

This article will comprehensively analyze EQX's price trajectories from 2026 through 2031, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

EQX Price History and Market Analysis Report

I. EQX Price History Review and Current Market Status

EQX Historical Price Movement Trajectory

-

September 2021: EQX reached its all-time high (ATH) of $0.74023, marking the peak of the project's market value during its early trading period.

-

September 2021 to January 2026: A prolonged bearish period characterized by continuous decline, with the token experiencing significant depreciation over approximately 4+ years.

-

January 2026: EQX touched its all-time low (ATL) of $0.00018301, representing a decline of approximately 93.97% from its historical peak, indicating sustained downward pressure in the market.

EQX Current Market Status

As of January 3, 2026, EQX is trading at $0.000192, with a 24-hour trading volume of 1,217.71 units. The token demonstrates slight upward momentum in the short term, with a 1-hour price change of +0.025% and a 24-hour change of +0.78%. However, this minor recovery is overshadowed by significant longer-term declines: the 7-day change stands at -24.70%, the 30-day change at -44.43%, and the 1-year change at -93.97%.

The fully diluted market capitalization totals $96,000, with a circulating supply of 500,000,000 EQX tokens representing 100% of the maximum supply. The token maintains a market dominance of 0.0000029%, reflecting its minimal presence in the overall cryptocurrency market. Currently, EQX is listed on 1 exchange and has 11,668 token holders.

Click to view the current EQX market price

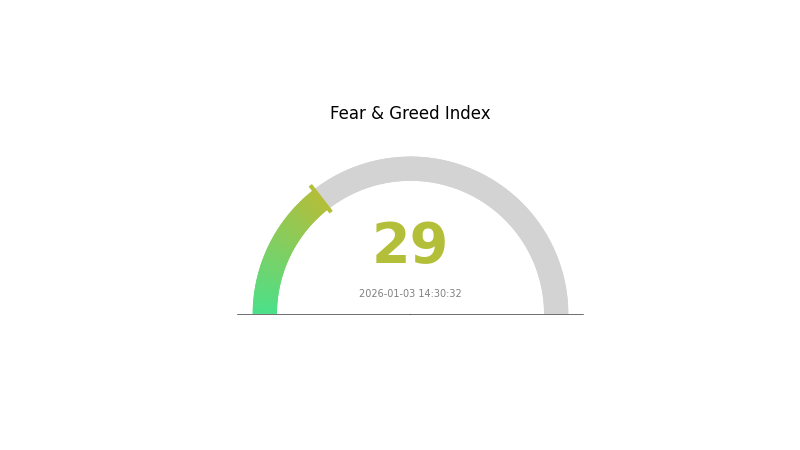

EQX Market Sentiment Index

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing significant fear sentiment, with the Fear and Greed Index standing at 29. This reading indicates heightened market anxiety and risk aversion among investors. During such periods, market volatility typically increases as participants adopt more cautious trading strategies. Conservative investors may prefer to observe from the sidelines, while experienced traders might identify potential opportunities in oversold assets. On Gate.com, you can monitor real-time market sentiment indicators to make more informed investment decisions.

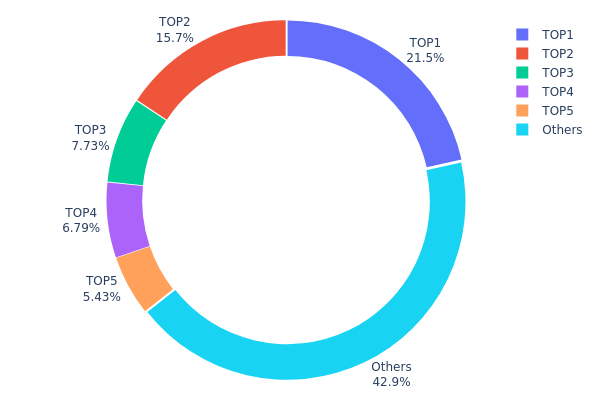

EQX Holdings Distribution

The address holdings distribution map represents the concentration of EQX tokens across the top wallet addresses on the blockchain. This metric provides critical insights into token ownership structure, potential risks of market manipulation, and the overall decentralization characteristics of the project. By analyzing how tokens are distributed among different addresses, investors and analysts can assess the level of concentration risk and the stability of the market microstructure.

EQX currently exhibits moderate concentration characteristics. The top five addresses collectively hold approximately 57.09% of the total token supply, with the leading address commanding 21.47% of all holdings. This concentration level suggests that while significant portions of EQX are held by a limited number of addresses, a meaningful proportion—42.91%—remains distributed among other holders. The top address (0x1040...aeec50) demonstrates substantially larger holdings compared to the second-ranked address (0xbd40...27f49a), which controls 15.68%, indicating some degree of hierarchical distribution rather than uniform concentration among major holders.

From a market structure perspective, this distribution pattern presents moderate centralization risks. The concentration among the top five addresses creates potential vulnerability to coordinated selling pressure or price manipulation, though the presence of a substantial "Others" category provides a degree of diversification that mitigates extreme concentration scenarios. The distribution suggests an early to mid-stage project structure where institutional holders or project stakeholders maintain significant influence, yet sufficient decentralization exists to prevent absolute market control by any single entity.

Click to view current EQX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1040...aeec50 | 107398.98K | 21.47% |

| 2 | 0xbd40...27f49a | 78408.70K | 15.68% |

| 3 | 0x0906...d4d03e | 38627.68K | 7.72% |

| 4 | 0x4bb5...68766e | 33970.78K | 6.79% |

| 5 | 0x58ed...a36a51 | 27150.59K | 5.43% |

| - | Others | 214443.27K | 42.91% |

II. Core Factors Influencing EQX's Future Price

Supply Mechanism

-

Gold Production Capacity: EQX operates multiple in-production gold mines with combined annual production of 24.73 million ounces in 2024, with production guidance of 25-27 million ounces for 2025. The company's resource reserves total 5.013 million ounces with an average grade of 1.88 g/ton, while proven reserves reach 3.873 million ounces at 1.45 g/ton average grade.

-

Asset Divestiture Impact: EQX is undergoing strategic portfolio optimization by divesting its Brazilian gold mining assets (Aurizona, RDM, and Bahia complex), which accounted for significant production volumes. This divestiture will redirect company focus toward North American gold operations, potentially affecting near-term production but improving operational efficiency and geographic concentration.

Macroeconomic Environment

-

Monetary Policy Impact: International gold prices have surged throughout 2025 supported by Federal Reserve rate cut expectations and monetary policy easing. Spot gold reached $4,345 per ounce as of December 15, 2025, with cumulative gains exceeding 160% since the bull market began in 2022. The continuation of accommodative monetary policy provides structural support for gold valuations.

-

Inflation Hedge Characteristics: Gold serves as a critical inflation hedge amid elevated U.S. inflation and economic stagnation concerns. The U.S. economy remains in a quasi-stagflation phase with high inflation and slowing growth, while fiscal deficits continue to expand, reinforcing gold's safe-haven appeal.

-

Geopolitical Risk Factors: Geopolitical tensions and international security uncertainties have driven sustained central bank gold purchases at elevated levels throughout 2025. Brazil's relative geopolitical stability compared to other emerging markets has made EQX's South American operations particularly strategic for the mining sector.

III. 2026-2031 EQX Price Forecast

2026 Outlook

- Conservative Forecast: $0.00015 - $0.0002

- Neutral Forecast: $0.00019

- Bullish Forecast: $0.0002 (requires sustained market stability)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with modest growth trajectory, characterized by incremental price appreciation and increasing market participation.

- Price Range Forecast:

- 2027: $0.00011 - $0.00024

- 2028: $0.00019 - $0.00026

- 2029: $0.00022 - $0.00028

- Key Catalysts: Ecosystem development initiatives, enhanced utility adoption, market sentiment improvement, and increased institutional interest in micro-cap digital assets.

2030-2031 Long-term Outlook

- Base Case: $0.00015 - $0.00032 (assumes moderate adoption and steady market conditions)

- Bullish Case: $0.00026 - $0.00033 (assumes accelerated ecosystem growth and positive macroeconomic environment)

- Transformative Case: $0.00029 - $0.00033 (assumes breakthrough developments in protocol functionality and mainstream adoption)

- 2031-12-31: EQX at $0.00033 (potential cycle peak with 49% cumulative appreciation from 2026 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.0002 | 0.00019 | 0.00015 | 0 |

| 2027 | 0.00024 | 0.0002 | 0.00011 | 2 |

| 2028 | 0.00026 | 0.00022 | 0.00019 | 12 |

| 2029 | 0.00028 | 0.00024 | 0.00022 | 23 |

| 2030 | 0.00032 | 0.00026 | 0.00015 | 33 |

| 2031 | 0.00033 | 0.00029 | 0.00018 | 49 |

EQX Professional Investment Strategy and Risk Management Report

IV. EQX Professional Investment Strategy and Risk Management

EQX Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Conservative investors seeking exposure to DeFi bridge solutions with extended holding periods

- Operation Recommendations:

- Establish a position during market downturns when EQX trades significantly below historical highs, considering the token's 93.97% decline over the past year

- Set a predetermined exit price target based on personal risk tolerance and time horizon, allowing for recovery potential in the DeFi sector

- Reinvest platform rewards to compound returns over time

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor the 24-hour trading range ($0.0001826 - $0.0002114) and key support/resistance levels established by historical volatility

- Volume Analysis: Track the 24-hour trading volume of $1,217.71 to identify potential breakout opportunities and market interest shifts

- Swing Trading Key Points:

- Execute trades during periods of increased volatility when daily price movements exceed normal ranges

- Monitor short-term price trends (1-hour and 7-day changes) to identify optimal entry and exit points for swing positions

EQX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 2-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Solutions

- Position Sizing Strategy: Limit individual EQX holdings to prevent catastrophic losses given the token's extreme price volatility and 93.97% year-over-year decline

- Diversification Approach: Balance EQX exposure with established DeFi protocols and stablecoins to reduce concentration risk

(3) Secure Storage Solution

- Cold Storage Method: Transfer EQX tokens to secure self-custody solutions for long-term holdings

- Exchange Storage: Maintain actively traded positions on Gate.com with two-factor authentication enabled

- Security Considerations: Never share private keys or seed phrases, enable withdrawal whitelisting for large positions, and verify smart contract addresses before transactions

V. EQX Potential Risks and Challenges

EQX Market Risk

- Extreme Price Volatility: EQX has experienced a 93.97% decline over one year, indicating high price instability and potential for further losses

- Low Trading Liquidity: With only $1,217.71 in 24-hour volume and 11,668 token holders, the market has limited depth and susceptibility to price manipulation

- Declining Market Interest: The 24.70% 7-day and 44.43% 30-day declines suggest diminishing investor confidence and potential trend continuation

EQX Regulatory Risk

- Regulatory Uncertainty: As a DeFi bridge solution, EQX faces evolving global cryptocurrency regulations that could impact platform operations and token utility

- Licensed Entity Dependency: The project's reliance on a licensed digital bank introduces counterparty risk if regulatory pressure affects the supporting institution

- Compliance Changes: Future regulatory requirements could necessitate platform modifications that reduce token utility or functionality

EQX Technology Risk

- Smart Contract Vulnerability: Bridge protocols require complex cross-chain functionality; any security vulnerabilities could result in asset loss or platform compromise

- Protocol Sustainability: Limited update frequency and development activity may indicate insufficient resources for maintaining bridge infrastructure and responding to emerging threats

- Adoption Barriers: Competing DeFi solutions and established alternatives reduce EQX's competitive positioning in the bridge market

VI. Conclusion and Action Recommendations

EQX Investment Value Assessment

EQX presents a highly speculative investment opportunity characterized by significant downside risk and uncertain recovery potential. The token's 93.97% annual decline, minimal trading volume, and small holder base indicate limited market traction for the DeFi bridge solution. While the project concept of providing seamless access to decentralized finance has merit, current execution and market adoption remain questionable. Investors should view EQX as an extremely high-risk, small-cap asset suitable only for portfolios with substantial risk capital and extended time horizons for potential recovery.

EQX Investment Recommendations

✅ Beginners: Avoid direct EQX investment; instead, gain DeFi exposure through established protocols with larger market capitalizations and proven track records

✅ Experienced Investors: Consider minimal allocation (1-2% of speculative portfolio) only if conducting thorough due diligence on the project's bridge technology and development roadmap; prioritize understanding the supporting digital bank's regulatory status

✅ Institutional Investors: Conduct comprehensive legal and technical review before considering any allocation; focus on the project's tokenomics sustainability and the licensed bank partner's regulatory compliance record

EQX Trading Participation Methods

- Gate.com Spot Trading: Purchase EQX directly on Gate.com using supported trading pairs with appropriate risk management and position sizing

- Limit Order Strategy: Set limit buy orders at lower price levels to accumulate during continued market weakness without timing concerns

- Dollar-Cost Averaging: Implement regular, small purchases over extended periods to reduce timing risk and average entry prices

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and are strongly advised to consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is the current price of EQX (Equinix) stock? How has it performed over the past year?

EQX stock has declined 21.68% over the past year, trading within a 52-week range of 701.41 to 972.02. Current price reflects recent market adjustments in the data center sector.

What are the main factors affecting EQX stock price?

EQX stock price is primarily influenced by gold prices, the company's mineral resource safety, and future return rates. With gold prices continuing upward trajectory in 2026 after two consecutive years of gains, and increasing market attractiveness of equity assets, these factors drive continued capital inflows into equities.

As a data center operator, what are EQX's future growth potential and market prospects?

EQX demonstrates strong growth potential driven by surging AI and cloud computing demand. With expanding global data center infrastructure needs, EQX is positioned for substantial long-term expansion and market leadership in the evolving digital economy landscape.

What are analysts' price predictions for EQX stock for 2024-2025?

Analysts predict EQX revenue of 575 million USD in Q4 2024, and 423.7 million USD in Q1 2025, based on S&P data. These projections reflect expected market performance during this period.

How does EQX compare to other data center companies(such as DLR and CCI)in terms of investment value?

EQX offers competitive valuation against DLR and CCI with strong growth potential. Its innovative solutions, expanding client base, and robust financial performance provide attractive investment appeal. Analysts favor EQX for superior future growth prospects in the data center sector.

What is the dividend yield of EQX? Is it suitable for long-term holding?

EQX currently has a dividend yield of 0.00% with no announced next dividend payment. Long-term suitability depends on future profitability and dividend policy developments.

What are the main risks and opportunities in investing in EQX stock?

Main risks include mining industry market volatility and geological uncertainties. Key opportunities lie in EQX's multi-mine operations, strong financial support, and growth strategy targeting over one million ounces of annual gold production with abundant mineral resources.

2025 EULPrice Prediction: Market Analysis and Future Trends for Euler Finance Token in the DeFi Ecosystem

2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

2025 BENQI Price Prediction: Analyzing Market Trends and Future Valuation for the DeFi Protocol

2025 ASTER Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 OMG Price Prediction: Analyzing Market Trends and Future Potential of the Token in a Maturing Crypto Ecosystem

2025 MORPHO Price Prediction: Analyzing Market Trends and Growth Potential for the DeFi Token

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps