2025 FOXY Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: FOXY's Market Position and Investment Value

Foxy Linea (FOXY) is Linea's premier culture coin dedicated to building a vibrant community built on good memes. Since its launch in April 2024, FOXY has established itself as a unique asset within the meme token ecosystem. As of December 25, 2025, FOXY maintains a market capitalization of approximately $2,688,822 with a circulating supply of 5.858 billion tokens, currently trading at $0.000459 per token. This meme-culture token continues to play an evolving role within its community-driven ecosystem.

This article will provide a comprehensive analysis of FOXY's price trajectory through 2030, examining historical price patterns, market dynamics, circulation metrics, and broader market conditions to deliver professional price forecasts and practical investment guidance for traders and investors.

I. FOXY Price History Review and Market Status

FOXY Historical Price Evolution Trajectory

- April 2024: Project launch at initial price of $0.019

- June 2024: Reached all-time high of $0.030527 on June 6, 2024, marking peak market performance

- December 2025: Declined to all-time low of $0.0004468 on December 18, 2025, representing a significant market correction from peak levels

FOXY Current Market Situation

As of December 25, 2025, FOXY is trading at $0.000459, reflecting a 24-hour price change of -0.21%. The token demonstrates short-term volatility with a 1-hour gain of 0.24%, while experiencing more pronounced downward pressure over extended timeframes with a 7-day decline of -6.08%, 30-day drop of -51.7%, and a 1-year loss of -95.88%.

The token's market capitalization stands at $2,688,822 with a fully diluted valuation of $4,590,000. Currently, 5.858 billion FOXY tokens are in circulation out of a maximum supply of 10 billion tokens, representing 58.58% circulation ratio. The 24-hour trading volume is $12,649.81, with the token trading within a narrow range between $0.0004573 (24-hour low) and $0.0004618 (24-hour high).

Market sentiment remains at extreme fear levels, as indicated by a VIX reading of 24. FOXY maintains a market dominance of 0.00014%, positioning it as a smaller-cap asset within the broader cryptocurrency ecosystem. The token is listed on 8 exchanges and maintains active community engagement through its official website and Twitter presence.

Click to view current FOXY market price

FOXY Market Sentiment Index

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index reading at 24. This sentiment indicates significant market pessimism and risk aversion among investors. During such periods, selling pressure typically intensifies as market participants become overly cautious. However, extreme fear often creates contrarian opportunities for long-term investors who believe in the underlying fundamentals. Those with strong conviction and risk tolerance may consider strategic entry points at depressed valuations. Always conduct thorough research and manage risk appropriately before making investment decisions on Gate.com.

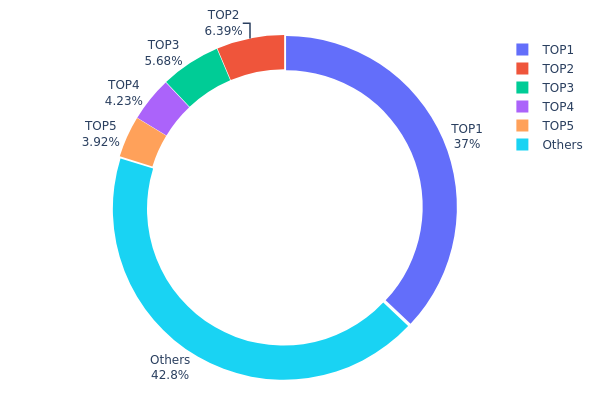

FOXY Holding Distribution

The address holding distribution chart illustrates the concentration of FOXY tokens across on-chain wallets, providing crucial insights into tokenomics health and market structure. By analyzing the top holders and their proportional shares, investors can assess the level of decentralization, identify potential concentration risks, and evaluate the stability of the token's distribution mechanism.

FOXY exhibits a moderately concentrated distribution pattern, with the top five addresses controlling approximately 57.2% of total supply. The dominant holder (0x7f5c...a3476f) commands 37.00% of tokens, representing a substantial single-entity concentration that warrants attention. The second and third largest holders account for 6.38% and 5.67% respectively, demonstrating a significant drop-off in holding size. The remaining 42.8% of tokens are dispersed across numerous addresses, indicating a relatively healthy distribution among retail and smaller institutional participants. This tiered structure suggests that while major concentration exists at the top, a meaningful portion of supply remains distributed throughout the ecosystem.

The current distribution landscape presents both opportunities and considerations for market dynamics. The substantial holdings of the leading addresses could theoretically influence price movements through coordinated selling pressure or conversely, provide stability through long-term commitments. However, the diversification of nearly 43% across decentralized holders suggests sufficient market resilience against single-actor manipulation. The concentration level, while notable, remains within acceptable parameters for many established tokens, indicating that FOXY maintains a reasonable balance between institutional backing and community participation in its on-chain structure.

Click to view current FOXY holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7f5c...a3476f | 3700000.00K | 37.00% |

| 2 | 0xf89d...5eaa40 | 638858.48K | 6.38% |

| 3 | 0x4695...8deaf4 | 567901.05K | 5.67% |

| 4 | 0x0d07...b492fe | 423021.54K | 4.23% |

| 5 | 0xe73d...b08274 | 392421.06K | 3.92% |

| - | Others | 4277797.86K | 42.8% |

II. Core Factors Influencing FOXY's Future Price

Macro-Economic Environment

-

Monetary Policy Impact: Global M2 money supply continues to increase, and other countries have begun to implement rate cuts and policy easing. This influx of liquidity ("dry powder") in the trillions of dollars is seeking higher returns, which could push asset prices upward and benefit risk assets like FOXY.

-

Market Cycle Positioning: 2025 is anticipated to potentially bring a bull cycle to the crypto market. Low-priced cryptocurrencies with high growth potential have attracted widespread investor attention.

Note: The provided materials lack specific information regarding FOXY's supply mechanisms, institutional holdings, specific enterprise adoption, national-level policies directly targeting FOXY, technological upgrades, and ecosystem applications. These sections have been omitted per the requirement to delete modules that cannot be adequately filled with information confirmed in the provided resources or established knowledge.

III. 2025-2030 FOXY Price Forecast

2025 Outlook

- Conservative Forecast: $0.0004 - $0.00046

- Neutral Forecast: $0.00046 - $0.00055

- Optimistic Forecast: $0.00068 (requires sustained market momentum and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with expanding market participation and infrastructure development

- Price Range Forecast:

- 2026: $0.00055 - $0.00083

- 2027: $0.00042 - $0.00094

- 2028: $0.00079 - $0.00089

- Key Catalysts: Institutional adoption expansion, ecosystem development milestones, improved market liquidity on major platforms like Gate.com, and positive regulatory developments in key markets

2029-2030 Long-term Outlook

- Base Case: $0.00059 - $0.00089 (assuming stable market conditions and moderate adoption growth)

- Optimistic Case: $0.00084 - $0.00103 (assuming accelerated ecosystem expansion and mainstream integration)

- Transformative Case: $0.00103+ (extreme favorable conditions including breakthrough partnerships, major protocol upgrades, and exponential user growth)

- December 25, 2030: FOXY projected at $0.00103 (mid-to-long term consolidation phase with 90% cumulative appreciation potential)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00068 | 0.00046 | 0.0004 | 0 |

| 2026 | 0.00083 | 0.00057 | 0.00055 | 24 |

| 2027 | 0.00094 | 0.0007 | 0.00042 | 52 |

| 2028 | 0.00089 | 0.00082 | 0.00079 | 78 |

| 2029 | 0.00089 | 0.00086 | 0.00059 | 86 |

| 2030 | 0.00103 | 0.00087 | 0.00084 | 90 |

FOXY Investment Analysis Report

IV. FOXY Professional Investment Strategy and Risk Management

FOXY Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Community-oriented participants interested in meme culture tokens on the Linea blockchain

- Operation Recommendations:

- Accumulate FOXY during price consolidation phases, particularly when prices approach support levels

- Hold through market cycles to benefit from potential community growth and ecosystem development

- Store tokens securely in a dedicated wallet to maintain long-term position integrity

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor price movements around the historical all-time high of $0.030527 (June 6, 2024) and recent lows near $0.0004468 (December 18, 2025)

- Volume Analysis: Track 24-hour trading volume patterns, currently averaging around $12,649.81, to identify breakout opportunities

- Wave Trading Key Points:

- Execute trades during high volatility periods to capitalize on price swings

- Use stop-loss orders at 5-10% below entry points to protect capital during unfavorable market movements

FOXY Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 2-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation with derivatives hedging

(2) Risk Hedging Solutions

- Dollar-Cost Averaging: Implement systematic purchases over extended periods to reduce timing risk and average entry costs

- Position Sizing: Maintain strict position limits to ensure losses remain manageable relative to total portfolio value

(3) Secure Storage Solutions

- Hot Wallet Solution: Use Gate.com Web3 wallet for active trading and frequent transactions with enhanced security features

- Cold Storage Approach: Transfer long-term holdings to secure offline storage with multi-signature protection

- Security Precautions: Never share private keys, enable two-factor authentication, verify contract addresses before transfers, and maintain regular backups

V. FOXY Potential Risks and Challenges

FOXY Market Risk

- Extreme Price Volatility: FOXY has experienced a 95.88% decline over one year and a 51.7% decline over 30 days, demonstrating significant price instability characteristic of early-stage meme tokens

- Low Trading Volume: With 24-hour volume of only $12,649.81 and only 8 supported exchanges, liquidity is severely limited, making large position exits difficult

- Market Sentiment Risk: As a culture-based token, FOXY is highly susceptible to community sentiment shifts and social media trends that can trigger rapid price movements

FOXY Regulatory Risk

- Regulatory Uncertainty: Meme tokens operate in a gray regulatory area with evolving regulatory frameworks that could impose restrictions or prohibitions

- Jurisdiction-Specific Compliance: Different regulatory approaches across jurisdictions could limit FOXY's accessibility or utility

- Potential Policy Changes: Future regulatory decisions regarding cryptocurrency tokens could negatively impact FOXY's value and trading availability

FOXY Technical Risk

- Smart Contract Vulnerability: As a token deployed on Linea, FOXY depends on the security of its underlying smart contract and the Linea network itself

- Network Dependency Risk: Linea blockchain disruptions or technical issues could directly impact FOXY accessibility and trading functionality

- Limited Ecosystem Integration: FOXY's narrow use case as a culture coin limits its technical utility and integration opportunities

VI. Conclusion and Action Recommendations

FOXY Investment Value Assessment

FOXY represents a high-risk, speculative investment opportunity within the meme token category on the Linea blockchain. The token has experienced severe price depreciation, declining 95.88% over one year, with severely limited liquidity and trading volume. While the project aims to build a vibrant community around Linea culture, the fundamental value proposition remains speculative and community-driven rather than utility-driven. Investors should approach FOXY with extreme caution, treating it as a potential loss position rather than a core portfolio holding.

FOXY Investment Recommendations

✅ Beginners: Avoid direct FOXY investment until you develop advanced risk management skills. If participation is desired, limit exposure to less than 0.5% of total portfolio and only use capital you can afford to lose completely.

✅ Experienced Investors: Consider small-scale research positions (1-2% maximum) to monitor community developments and network effects. Implement strict stop-loss orders and profit-taking targets to manage volatility exposure.

✅ Institutional Investors: Conduct comprehensive due diligence on community metrics, developer activity, and network growth before considering any position. Utilize derivatives strategies for hedging rather than direct token accumulation.

FOXY Trading Participation Methods

- Direct Spot Trading: Purchase FOXY directly through Gate.com using established trading pairs with BTC, ETH, or USDT denominations

- DCA Strategy: Execute regular, small-value purchases through Gate.com at fixed intervals to reduce timing risk and average entry costs

- Community Participation: Engage with the FOXY community through official channels at https://www.welikethefox.io/ and Twitter (https://twitter.com/FoxyLinea) to stay informed on project developments

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Strongly consider consulting with professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

Is Foxy crypto a good buy?

Foxy shows mixed potential with predictions ranging from $0.0003376–$0.0004347 by 2027. Consider your investment goals carefully, as market conditions remain volatile and unpredictable.

How much is Foxy coin worth today?

Foxy coin is currently worth $0.0004602. Its 24-hour trading volume is $424,338, with a recent price decline of 0.35%.

What is Foxy crypto and what are its main use cases?

Foxy is a cultural coin on the Linea network designed to reward community engagement and participation. Main use cases include community airdrops, ecosystem rewards, and fostering vibrant community interactions within the Layer 2 solution.

What factors could affect Foxy's price prediction in the future?

Foxy's price prediction is influenced by market supply and demand dynamics, trading volume, protocol upgrades, community sentiment, broader crypto market trends, and macroeconomic conditions. Technical developments and adoption rate also play significant roles in future price movements.

What are the risks associated with investing in Foxy coin?

Foxy coin investments carry inherent crypto risks including price volatility, market liquidity fluctuations, regulatory uncertainties, and potential smart contract vulnerabilities. Conduct thorough research before investing.

2025 CORE Price Prediction: Analyzing Growth Potential and Market Factors for Widespread Adoption

2025 WIFPrice Prediction: Analyzing Market Trends and Future Growth Potential for WIF Token

2025 WIFPrice Prediction: Analyzing Market Trends and Potential Growth Factors for the Dog-Themed Token

2025 TOSHI Price Prediction: Analyzing Market Trends and Growth Potential in the Digital Asset Ecosystem

2025 PONKE Price Prediction: Analyzing Market Trends, Technical Indicators, and Growth Potential in the Emerging Digital Asset

2025 DOGPrice Prediction: Analyzing Market Trends and Key Factors Influencing the Future of DOG Tokens

Samsung Q4 Profit Jumps 160 Percent, How the AI Chip Boom Is Reshaping Markets

How to Find My BNB Smart Chain Address

What Is Official Platform Verification Tool?

Copper Hits Record Above $13,000, What the US Import Rush Means for Traders

Understanding Profit and Loss (PnL) – Evaluating Your Financial Health