2025 GAMESTARTER Price Prediction: Will This Gaming Token Reach New Heights in the Coming Year?

Introduction: Market Position and Investment Value of GAMESTARTER

GAMESTARTER (GAME) operates as a blockchain-based crowdfunding platform that helps independent game developers raise funds by pre-selling game assets in NFT form. Since its launch in August 2021, the project has established itself in the gaming and NFT ecosystem. As of January 2026, GAMESTARTER maintains a market capitalization of approximately $210,300 with a circulating supply of around 70.99 million tokens, currently trading at $0.002103 per token. This innovative asset is playing an increasingly important role in the gaming asset tokenization and community incentive mechanisms.

This article will comprehensively analyze GAMESTARTER's price movements and market trends for the 2026-2031 period, combining historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. GAMESTARTER Price History Review and Market Status

GAMESTARTER Historical Price Evolution

- 2021: Project launch and initial exchange listing, price reached all-time high of $3.58 on November 16, 2021

- 2021-2026: Extended market downturn, price declined significantly from peak levels

GAMESTARTER Current Market Situation

As of January 2, 2026, GAMESTARTER (GAME) is trading at $0.002103, reflecting substantial depreciation from its historical peak. The token has experienced a dramatic 95.67% decline over the past year, with a current market capitalization of $149,287.33 and a fully diluted valuation of $210,300. The circulating supply stands at approximately 70,987,793.04 tokens out of a maximum supply of 100,000,000 tokens, representing a circulation ratio of 70.99%.

Short-term price movements show mixed signals: the token declined 3.63% over the past 24 hours and 0.13% in the last hour, with a daily trading range between $0.002084 and $0.002224. However, medium-term trends indicate recovery potential, with a 5.37% gain over the past 7 days and a 20.99% increase over the past 30 days. The 24-hour trading volume is $11,564.01, indicating relatively limited liquidity. The token is currently held by 1,971 unique addresses, demonstrating limited holder concentration. Market sentiment remains cautious with a fear index reading of 28.

Click to view current GAMESTARTER market price

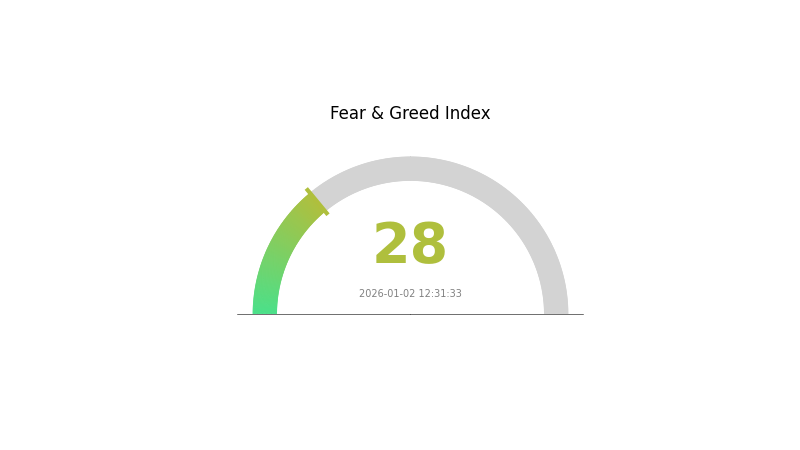

GAMESTARTER Market Sentiment Indicator

2026-01-02 Fear and Greed Index: 28 (Fear)

Click to view current Fear & Greed Index

The crypto market is currently in a fear state with an index reading of 28. This indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, risk appetite diminishes as traders become cautious about positioning. Market volatility typically increases under fear conditions, presenting both challenges and opportunities. Investors should exercise prudent risk management and consider their portfolio allocation carefully. Monitor market developments closely, as sentiment can shift rapidly based on macroeconomic factors and industry news. Track the Fear and Greed Index on Gate.com to stay informed about real-time market psychology and sentiment trends.

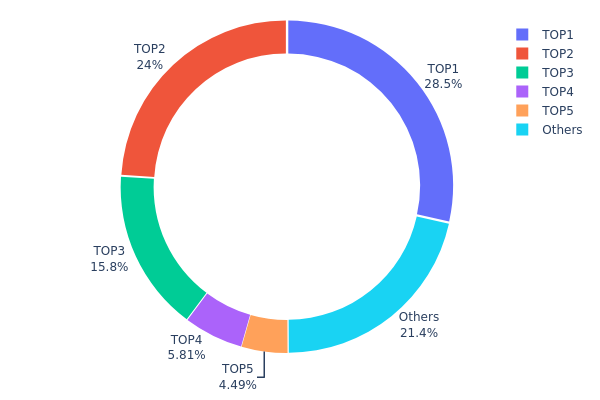

GAMESTARTER Holdings Distribution

The address holding distribution chart illustrates the concentration of GAMESTARTER tokens across blockchain addresses, revealing the degree of wealth centralization within the token ecosystem. By analyzing the top token holders and their respective portfolio percentages, this metric provides critical insights into the token's decentralization status and potential vulnerability to market manipulation.

The current distribution of GAMESTARTER demonstrates significant concentration risk, with the top three addresses commanding 68.27% of total token supply. The largest holder alone controls 28.50% of circulating tokens, while the second and third holders maintain 23.99% and 15.78% respectively. This elevated concentration level indicates moderate to high centralization, where a relatively small number of addresses maintain decisive influence over token liquidity and price discovery mechanisms. The remaining top five addresses account for an additional 10.29%, collectively representing 78.56% of token holdings, while decentralized holders comprise only 21.44% of the total supply.

Such distribution patterns carry meaningful implications for market dynamics and structural stability. High concentration among a limited number of addresses elevates the potential for coordinated selling pressure or price volatility triggered by the actions of major holders. Additionally, the current structure may facilitate price discovery inefficiencies and reduce overall market resilience during periods of elevated volatility. The concentration ratio suggests that GAMESTARTER's decentralization profile remains nascent, with token distribution skewed toward early stakeholders rather than achieving broad-based community participation.

Click to view current GAMESTARTER Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa320...c10679 | 28500.00K | 28.50% |

| 2 | 0xca9a...499a46 | 23992.07K | 23.99% |

| 3 | 0x7b8f...16ea19 | 15781.10K | 15.78% |

| 4 | 0x0cfb...808bf4 | 5809.28K | 5.80% |

| 5 | 0x8730...81be87 | 4493.22K | 4.49% |

| - | Others | 21424.33K | 21.44% |

II. Core Factors Influencing GAMESTARTER's Future Price

Market Demand and Adoption

-

Project Development: GAMESTARTER's future price is primarily influenced by ongoing project development and the execution of its roadmap. Continuous improvements and feature releases directly impact investor confidence and token utility.

-

Adoption Rate and Partnerships: The token's price trajectory is significantly affected by its adoption rate within the gaming ecosystem and strategic partnerships with established gaming platforms. Increased integration with major gaming projects enhances utility and demand.

-

Trading Activity: GAMESTARTER maintains liquidity on Gate.com, which provides accessibility for market participants and contributes to price discovery mechanisms.

Overall Cryptocurrency Market Trends

-

Market Sentiment: GAMESTARTER's price movements are influenced by broader cryptocurrency market trends and overall market sentiment. During bullish cryptocurrency cycles, gaming tokens typically experience increased demand, while bearish conditions may suppress valuations.

-

Historical Price Performance: The token has demonstrated significant price volatility, with historical highs reaching 13.51 SAR, indicating substantial market interest during peak periods. This historical context reflects the speculative nature of gaming tokens and their sensitivity to market cycles.

Regulatory Environment

- Regulatory Changes Impact: Regulatory developments at the government level can significantly impact GAMESTARTER's price trajectory. Changes in how gaming cryptocurrencies and blockchain gaming projects are regulated globally may affect adoption rates, investor participation, and overall market dynamics for gaming-related tokens.

III. 2026-2031 GAMESTARTER Price Forecast

2026 Outlook

- Conservative Forecast: $0.00144 - $0.00180

- Neutral Forecast: $0.00180 - $0.00212

- Optimistic Forecast: $0.00212 - $0.00224 (requires sustained ecosystem development and increased adoption)

2027-2029 Mid-Term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with incremental growth as the project matures and market sentiment stabilizes

- Price Range Forecasts:

- 2027: $0.00129 - $0.00301

- 2028: $0.00239 - $0.00316

- 2029: $0.00204 - $0.00322

- Key Catalysts: Enhanced platform functionality, expanded gaming partnerships, growing user base on Gate.com and other platforms, positive regulatory developments in the gaming and blockchain sectors

2030-2031 Long-Term Outlook

- Base Case Scenario: $0.00281 - $0.00424 (assumes steady market adoption and moderate ecosystem expansion)

- Optimistic Scenario: $0.00424 - $0.00518 (assumes accelerated mainstream gaming integration and significant user growth)

- Transformation Scenario: $0.00518+ (assumes revolutionary adoption in the gaming industry and major institutional investment participation)

- 2031-12-31: GAMESTARTER targets potential appreciation of approximately 73% from current levels (accumulated growth trajectory assumption)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00224 | 0.00212 | 0.00144 | 0 |

| 2027 | 0.00301 | 0.00218 | 0.00129 | 3 |

| 2028 | 0.00316 | 0.00259 | 0.00239 | 23 |

| 2029 | 0.00322 | 0.00288 | 0.00204 | 36 |

| 2030 | 0.00424 | 0.00305 | 0.00281 | 45 |

| 2031 | 0.00518 | 0.00365 | 0.00292 | 73 |

GAMESTARTER Professional Investment Strategy and Risk Management Report

I. GAMESTARTER Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Community members committed to gaming NFT ecosystems and blockchain gaming development

-

Operational Recommendations:

- Accumulate GAMESTARTER tokens during market downturns when sentiment is bearish, as the token has declined 95.67% over the past year, potentially offering entry opportunities for patient investors

- Participate in community incentive programs and recommendation plans to generate additional token rewards beyond price appreciation

- Monitor game launches and NFT marketplace activity, as successful game releases could drive ecosystem adoption and token utility increase

-

Storage Solutions:

- For long-term holdings, consider using Gate.com's Web3 wallet for secure asset custody while maintaining accessibility to ecosystem participation

- Implement cold storage solutions for amounts exceeding your active trading capital

(2) Active Trading Strategy

-

Technical Analysis Indicators:

- Volume Analysis: Current 24-hour volume stands at 11,564 units. Monitor volume spikes during announcements of new game launches or NFT marketplace updates, as these may signal trend reversals

- Price Action Patterns: Track the token's range between the 24-hour low (0.002084) and high (0.002224) to identify support and resistance levels for swing trading opportunities

-

Wave Trading Key Points:

- Utilize NFT marketplace transaction announcements as catalysts for short-term price movements

- Monitor community engagement metrics and recommendation program participation rates as leading indicators of potential price appreciation

II. GAMESTARTER Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation - suitable given the token's extreme historical volatility (down 95.67% YoY) and speculative nature

- Active Investors: 3-5% portfolio allocation - appropriate for investors with higher risk tolerance who understand gaming sector dynamics

- Professional Investors: Up to 10% allocation - only for institutional players conducting deep fundamental analysis of game development partnerships

(2) Risk Hedging Solutions

- Diversification Strategy: Combine GAMESTARTER holdings with established cryptocurrencies and traditional assets to mitigate concentration risk, given the project's speculative gaming focus

- Position Sizing: Implement strict position limits and scale into positions gradually rather than deploying capital in a single transaction

(3) Secure Storage Solutions

- Self-Custody Approach: Utilize Gate.com's Web3 wallet for managing GAMESTARTER tokens with full control over private keys

- Exchange-Based Solution: Maintain a portion of holdings on Gate.com for active trading purposes, ensuring you use strong authentication protocols

- Security Precautions: Never share private keys or seed phrases, enable two-factor authentication on all accounts, verify contract addresses before token transfers (Official contract: 0xd567b5f02b9073ad3a982a099a23bf019ff11d1c on Ethereum), and regularly audit wallet activity for suspicious transactions

III. GAMESTARTER Potential Risks and Challenges

Market Risks

- Extreme Price Volatility: The token has experienced a 95.67% decline over the past year and a 99.96% decline from its all-time high of 3.58 (set on November 16, 2021), indicating severe market sentiment deterioration and ongoing selling pressure

- Liquidity Risk: With 1,971 total token holders and only 1 exchange listing, liquidity is highly concentrated, making it difficult to execute large positions without significant price slippage

- Limited Trading Volume: 24-hour trading volume of only 11,564 units suggests thin order books and potential challenges in executing trades at desired price levels

Regulatory Risks

- Gaming Sector Uncertainty: Regulations surrounding NFT-based gaming assets and in-game collectibles remain unclear and are evolving across jurisdictions, potentially affecting platform operations and token utility

- Securities Classification: Depending on jurisdiction, gaming tokens bundled with rewards programs and VIP access could face regulatory scrutiny regarding their classification as securities

Technology Risks

- Smart Contract Security: As an ERC-20 token on Ethereum, GAMESTARTER faces inherent smart contract risks including potential vulnerabilities, exploits, or protocol-level issues

- Platform Dependency: The token's value is entirely dependent on Gamestarter platform adoption and game developer participation; failure to attract quality gaming projects would undermine fundamental value

- Game Launch Execution Risk: The platform's success depends on the ability to successfully launch quality games and maintain active NFT marketplace trading; delays or failed launches could severely impact token demand

IV. Conclusion and Action Recommendations

GAMESTARTER Investment Value Assessment

GAMESTARTER represents a highly speculative investment in the blockchain gaming ecosystem. The token has experienced catastrophic value deterioration, declining 95.67% annually and 99.96% from its peak, reflecting either fundamental challenges within the gaming platform or broader market rejection of the project's value proposition. The extremely thin liquidity, limited exchange presence, and small holder base present significant execution risks. However, for investors with deep conviction in the potential for NFT-based gaming platforms to eventually gain mainstream adoption, current price levels may represent a recovery opportunity. Success would depend entirely on the platform's ability to attract quality game developers and build sustained marketplace trading volume.

GAMESTARTER Investment Recommendations

✅ Newcomers: Approach with extreme caution and allocate only capital you can afford to lose completely. If interested, start with micro-positions (0.5-1% of portfolio) and gradually increase only after observing concrete evidence of game launches and marketplace activity growth. Ensure you understand the gaming NFT ecosystem before committing capital.

✅ Experienced Investors: Consider this token only as a high-risk/high-reward speculation within a diversified portfolio. Conduct thorough due diligence on the game development pipeline and marketplace metrics. Use strict position sizing and implement tight stop-losses. Monitor quarterly updates on platform adoption metrics.

✅ Institutional Investors: Perform comprehensive analysis of development team credentials, game publisher partnerships, and competitive positioning before consideration. This token lacks the market maturity and institutional infrastructure suitable for significant allocations.

GAMESTARTER Trading Participation Methods

- Method 1 - Direct Trading on Gate.com: Access GAMESTARTER/USDT or GAMESTARTER/ETH trading pairs directly on Gate.com's spot trading platform, executing market or limit orders based on your price targets and technical analysis

- Method 2 - Community Participation: Engage in Gamestarter's recommendation and community incentive plans to earn token rewards, supplementing your holdings through active ecosystem participation rather than direct purchase

- Method 3 - NFT Marketplace Integration: Once game assets are listed on the Gamestarter NFT marketplace, GAMESTARTER token holders can access VIP content and fee discounts, creating long-term utility incentives for token retention

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest capital you cannot afford to lose entirely. The gaming and NFT sectors remain highly experimental and speculative.

FAQ

GAMESTARTER是什么项目?它的主要功能和用途是什么?

Gamestarter is a blockchain-based crowdfunding platform specializing in gaming projects. It enables independent game developers to raise funds through NFT asset pre-sales and provides a marketplace for trading digital assets from funded games. The platform operates on the GAME token ecosystem, supporting game creators and players globally.

What is the current price of GAMESTARTER token? How has its historical price performed?

GAMESTARTER (GAME) is currently trading around $0.00167. The token reached an all-time high of BTC0.00006811 and a low of BTC0.071552. Recent 24-hour trading volume stands at $11,518.80, with the token showing 4.40% growth over the past 7 days.

What are the price predictions for GAMESTARTER in 2024 and 2025?

Based on cryptocurrency price indices, GAMESTARTER's predicted average price for 2025 is $0.0115, with a low of $0.0107 and high of $0.0118. These projections reflect market analysis and historical data trends.

What are the risks of investing in GAMESTARTER? What should I pay attention to?

GAMESTARTER investment carries market volatility and technology risks. Monitor price fluctuations closely, evaluate project fundamentals, and only invest capital you can afford to lose. Stay informed on market developments and adjust strategies accordingly.

What advantages does GAMESTARTER have compared to other gaming tokens such as Axie Infinity and The Sandbox?

GAMESTARTER offers unique gameplay mechanics and higher reward systems where players earn tokens through active participation. With a more engaged community, it prioritizes player rewards and accessibility compared to Axie Infinity and The Sandbox.

What is GAMESTARTER's team background and development roadmap? What are the future prospects?

GAMESTARTER's team focuses on high-quality game development with streamlined operations for improved efficiency. The project maintains strong competitive positioning with promising market prospects and continued commitment to delivering quality gaming experiences in the Web3 ecosystem.

2025 ENJ Price Prediction: Analyzing Market Trends and Potential Growth Factors for Enjin Coin

2025 CWS Price Prediction: Analyzing Market Trends and Potential Growth Factors for Crowns

2025 GCOIN Price Prediction: Analyzing Potential Growth and Market Trends for the Digital Asset

KARRAT vs ENJ: A Comprehensive Comparison of Two Leading Gaming Token Projects

2025 AGLD Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 OSHI Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Samsung Q4 Profit Jumps 160 Percent, How the AI Chip Boom Is Reshaping Markets

How to Find My BNB Smart Chain Address

What Is Official Platform Verification Tool?

Copper Hits Record Above $13,000, What the US Import Rush Means for Traders

Understanding Profit and Loss (PnL) – Evaluating Your Financial Health