2025 GOATED Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of GOATED

GOATED, the native token of GOAT Network, represents a Bitcoin-native ZK Rollup designed to deliver sustainable native BTC yield. Since its launch in September 2025, GOATED has established itself as a key infrastructure asset within the BTCFi ecosystem. As of December 2025, GOATED maintains a market capitalization of approximately $40.38 million with a circulating supply of around 113.98 million tokens, currently trading at $0.04038 per token. This innovative asset is gaining recognition as a "Bitcoin yield infrastructure" solution, playing an increasingly critical role in addressing the real demand from BTC holders seeking transparent, risk-adjusted returns.

This article will provide a comprehensive analysis of GOATED's price trajectory and market dynamics, integrating technical indicators, ecosystem developments, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for the period through 2030.

GOAT Network (GOATED) Market Analysis Report

I. GOATED Price History Review and Current Market Status

GOATED Historical Price Trajectory

- September 27, 2025: Project launch and initial trading, GOATED reached its all-time high of $0.22367

- September 27, 2025: Market entry point also marked the lowest price of $0.01251 during the same period

- December 23, 2025: Current trading price at $0.04038, reflecting a decline of approximately 81.94% from the all-time high

GOATED Current Market Dynamics

As of December 23, 2025, GOATED is trading at $0.04038 with a 24-hour trading volume of $13,456.06. The token has experienced significant downward pressure over recent periods: declining 0.63% in the past 24 hours, 15.44% over the last 7 days, 50.43% over the past month, and 60.33% annually. The 1-hour price action shows modest gains of 0.2%, suggesting minimal short-term recovery momentum.

The current market capitalization stands at approximately $4.60 million against a fully diluted valuation of $40.38 million, indicating that only 11.40% of the total token supply is currently in circulation (113,984,977.53 out of 1,000,000,000 tokens). The token maintains a market dominance of 0.0012% within the broader cryptocurrency ecosystem and is trading across 9 different exchanges. With 38 token holders currently recorded, the distribution remains relatively concentrated.

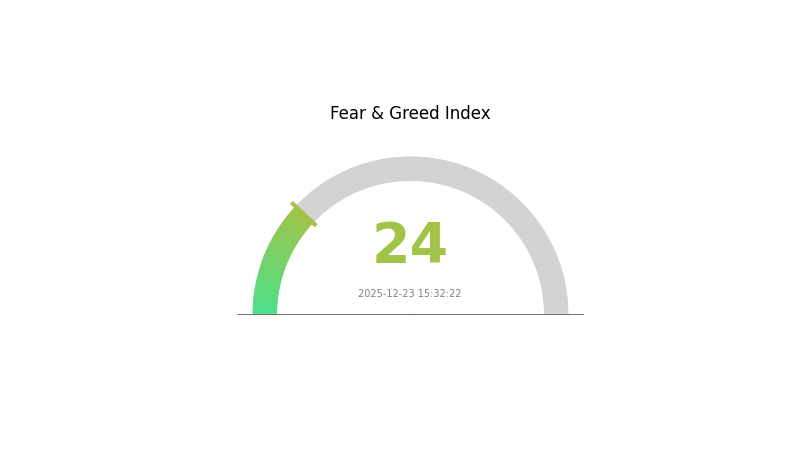

Market sentiment indicators reflect extreme fear conditions (VIX: 24), suggesting heightened risk aversion in the current trading environment.

Access current GOATED market pricing

GOATED Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with the Fear and Greed Index at 24. This historically low reading signals significant market pessimism and panic selling. Such extreme fear often represents potential buying opportunities for long-term investors, as prices may be oversold. However, traders should exercise caution and conduct thorough research before entering positions. Monitor market developments closely, as extreme sentiment readings can be volatile. Consider dollar-cost averaging strategies to mitigate risks during this fearful market phase on Gate.com.

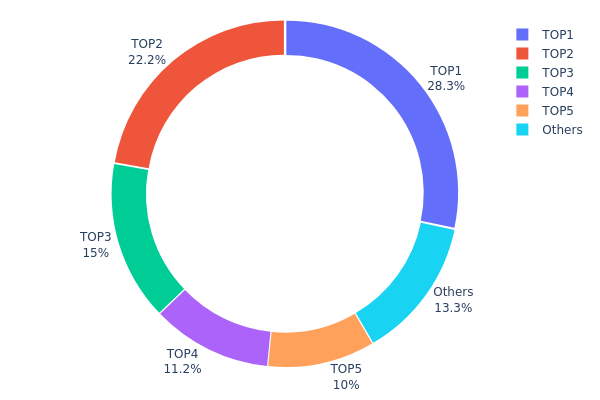

GOATED Holding Distribution

Address holding distribution serves as a critical on-chain metric that reveals the concentration of token ownership across individual addresses. This indicator measures how tokens are dispersed among market participants, providing insights into potential wealth concentration, market structure stability, and the degree of decentralization within the GOATED ecosystem.

The current holding distribution of GOATED exhibits significant concentration characteristics. The top five addresses collectively control 86.71% of the total token supply, with the leading address (0x1372...7ecd0e) alone commanding 28.30% of holdings. The second and third addresses follow with 22.20% and 14.95% respectively, indicating a pronounced concentration pattern. Notably, the remaining addresses (classified as "Others") account for only 13.29% of the total supply, suggesting that the majority of GOATED tokens are held by a relatively small number of large holders rather than being widely distributed across the network.

This distribution pattern raises important considerations regarding market dynamics and structural risks. The substantial concentration among top holders could potentially amplify price volatility, as large position movements from these addresses may trigger significant market fluctuations. Furthermore, the limited participation of smaller holders suggests a relatively narrow investor base, which may constrain organic market growth and decentralization efforts. The 86.71% concentration ratio among the top five addresses indicates that GOATED's current decentralization level remains moderate, with ownership structure dominated by major stakeholders whose coordinated or independent actions could substantially influence token valuation and market sentiment.

Visit GOATED Holding Distribution for current data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1372...7ecd0e | 2125.00K | 28.30% |

| 2 | 0xcd92...07a7e4 | 1666.99K | 22.20% |

| 3 | 0x0d07...b492fe | 1122.46K | 14.95% |

| 4 | 0xcffa...290703 | 844.64K | 11.24% |

| 5 | 0x9642...2f5d4e | 752.86K | 10.02% |

| - | Others | 995.94K | 13.29% |

II. Core Factors Influencing GOATED's Future Price

Market Demand and Adoption

-

User Adoption: GOATED's future price is significantly influenced by market demand and adoption rates. High adoption rates and strategic partnerships can boost token value.

-

Airdrop Distribution: According to recent data, GOATED conducted an airdrop distribution where eligible users could claim 375 GOATED tokens per account, with individual rewards valued at approximately USD 65 at the then-current price of USD 0.175. This distribution mechanism helps expand the user base and increase token circulation.

-

Current Market Valuation: At the time of the airdrop, GOATED had a market capitalization of USD 18.4 million, indicating an early-stage project with significant growth potential.

Market Competition and Trends

-

Competitive Landscape: GOATED's price trajectory will be affected by overall cryptocurrency market trends and competition within its segment. Current market competition plays a crucial role in determining token valuations.

-

Price Projections: Based on a projected annual growth rate of plus 5%, GOATED's price is estimated to reach approximately CNY 0.2484 (USD equivalent approximately 0.035) by the end of 2026, suggesting a moderate growth outlook for the token.

III. GOATED Price Forecast for 2025-2030

2025 Outlook

- Conservative Estimate: $0.02761 - $0.04060

- Neutral Estimate: $0.04060

- Bullish Estimate: $0.05806 (requiring sustained market interest and positive ecosystem development)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth driven by protocol adoption and market maturation

- Price Range Forecast:

- 2026: $0.02614 - $0.05278 (22% potential upside)

- 2027: $0.03829 - $0.06688 (26% potential upside)

- 2028: $0.04187 - $0.06664 (46% potential upside)

- Key Catalysts: Increased utility adoption, ecosystem expansion, strategic partnerships, and growing institutional interest in emerging digital assets

2029-2030 Long-term Outlook

- Base Case: $0.05715 - $0.07222 (55% appreciation by 2029)

- Optimistic Case: $0.06279 - $0.07156 (67% appreciation by 2030 with accelerated adoption)

- Transformative Case: Price discovery beyond baseline scenarios driven by breakthrough utility adoption, major market catalysts, and sustained network growth

Note: All price predictions should be monitored through reliable market data platforms such as Gate.com. These forecasts represent analytical projections based on historical trends and are subject to significant market volatility and unforeseen circumstances. Investors should conduct independent research before making any investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05806 | 0.0406 | 0.02761 | 0 |

| 2026 | 0.05278 | 0.04933 | 0.02614 | 22 |

| 2027 | 0.06688 | 0.05106 | 0.03829 | 26 |

| 2028 | 0.06664 | 0.05897 | 0.04187 | 46 |

| 2029 | 0.07222 | 0.0628 | 0.05715 | 55 |

| 2030 | 0.07156 | 0.06751 | 0.06279 | 67 |

GOAT Network (GOATED) Professional Investment Report

IV. GOATED Investment Strategy and Risk Management

GOATED Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Bitcoin yield-focused investors seeking sustainable returns and BTC holders interested in DeFi exposure

- Operational Recommendations:

- Accumulate GOATED during market downturns to build core positions with a 12-month+ investment horizon

- Monitor protocol development milestones including zkMIPS optimization, BitVM2 implementation, and Decentralized Sequencer network expansion

- Reinvest earned yield through the BTCFi product suite (2%-30%+ APY) to compound returns

(2) Active Trading Strategy

- Wave Operation Key Points:

- Monitor the 24-hour trading volume ($13,456.06) and price volatility relative to the 24-hour high ($0.04315) and low ($0.0402)

- Track the significant downside momentum observed over 30 days (-50.43%) and 1 year (-60.33%) to identify potential support levels

- Utilize Gate.com's trading tools to execute buy orders during oversold conditions (when price approaches historical lows near $0.01251)

GOATED Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation (GOATED represents high-risk, speculative exposure)

- Active Investors: 3-7% portfolio allocation (suitable for those with medium risk tolerance and belief in BTCFi infrastructure development)

- Professional Investors: 7-15% portfolio allocation (with hedging strategies and rebalancing protocols)

(2) Risk Hedging Solutions

- Diversification Strategy: Combine GOATED holdings with established Bitcoin L2 solutions and core BTC positions to reduce protocol-specific risk

- Dollar-Cost Averaging (DCA): Execute regular, automated purchases at fixed intervals to mitigate timing risk and reduce impact of extreme volatility

(3) Secure Storage Solutions

- Non-Custodial Option: Store GOATED on secure self-custody infrastructure with private key management

- Exchange Storage: Maintain trading positions on Gate.com with strong account security (two-factor authentication, IP whitelisting)

- Security Considerations: Given GOATED's early-stage status (ranking #1579 by market cap), prioritize wallets with strong security track records; enable withdrawal delays and whitelisting features on Gate.com to prevent unauthorized transfers

V. GOATED Potential Risks and Challenges

GOATED Market Risks

- Price Volatility: GOATED has experienced extreme drawdowns of -50.43% over 30 days and -60.33% over 1 year, indicating high sensitivity to market sentiment and Bitcoin market movements

- Liquidity Risk: With 24-hour trading volume of only $13,456.06 against a market cap of $4.6M, thin liquidity may result in significant slippage during large transactions

- Market Adoption Risk: BTCFi ecosystem adoption remains nascent; failure to attract significant Bitcoin capital could limit protocol growth and token value appreciation

GOATED Regulatory Risks

- Evolving Bitcoin Protocol Compliance: As GOAT Network operates as a Bitcoin-native solution, regulatory clarity around Bitcoin L2s and yield-bearing mechanisms remains uncertain across jurisdictions

- Smart Contract Compliance: BitVM2 challenge models and the Decentralized Sequencer network may face regulatory scrutiny depending on how governance and revenue distribution are structured

- Cross-Chain Regulatory Exposure: GOATED operates on ETH and BSC chains, creating multi-jurisdictional regulatory exposure depending on the user's domicile

GOATED Technical Risks

- zkMIPS Implementation Risk: While the team emphasizes zkMIPS as "the fastest production-ready zkVM," unproven scalability at network scale could result in performance degradation or security vulnerabilities

- BitVM2 Challenge Model Uncertainty: Although the protocol reduces challenge periods from 14 days to less than 1 day, potential edge cases or Byzantine validator scenarios could impact fund security during dispute resolution

- Decentralized Sequencer Network Risks: Bitcoin's first decentralized sequencer network is experimental; potential MEV extraction vulnerabilities or sequencer collusion could undermine trustless claims

VI. Conclusion and Action Recommendations

GOATED Investment Value Assessment

GOAT Network addresses a genuine market need for transparent, sustainable Bitcoin yield generation through native ZK Rollup infrastructure. The team's deep experience (including a 200x return track record from Metis), backing from institutions like Crypto.com and Amber Group, and comprehensive BTCFi product suite (spanning earning, trading, and gaming with 2%-30%+ APY) represent significant value propositions. However, the project remains in an early development phase with severe token price depreciation (-60.33% over 1 year) and minimal trading liquidity, creating substantial near-term risk. Success depends on rapid protocol maturation, substantial Bitcoin capital inflows, and sustained institutional adoption—outcomes that remain uncertain.

GOATED Investment Recommendations

✅ Beginners: Allocate only 1-2% of speculative capital after thoroughly understanding Bitcoin L2 infrastructure and BTCFi mechanics. Start with small purchases on Gate.com to familiarize yourself with protocol fundamentals before increasing exposure.

✅ Experienced Investors: Implement a 3-5% allocation using dollar-cost averaging over 6-12 months, treating GOATED as a long-term infrastructure bet rather than short-term trading vehicle. Monitor ecosystem development metrics, validator participation in the Decentralized Sequencer network, and BTCFi product adoption rates.

✅ Institutional Investors: Conduct deep technical due diligence on zkMIPS production readiness, BitVM2 security audit results, and sequencer decentralization metrics before committing capital. Negotiate custody arrangements with enterprise-grade security providers and establish governance participation frameworks.

GOATED Trading and Participation Methods

- Gate.com Trading: Execute spot trading of GOATED/USDT or other trading pairs with real-time price monitoring and integrated portfolio tracking

- BTCFi Product Integration: Directly participate in GOAT Network's earning, trading, and entertainment products through the protocol's native interface to generate yield while holding GOATED tokens

- Validator/Sequencer Participation: For technically qualified participants, evaluate opportunities to operate Bitcoin Decentralized Sequencer nodes to earn protocol rewards and MEV components

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and are strongly advised to consult with professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

Can goat coin reach $1?

Yes, GOAT is projected to reach $1 in early 2026. This milestone is driven by increased exchange listings and the ongoing crypto bull market cycle.

What is the price prediction for goated token?

GOATS token is predicted to reach $0.000457 by 2032. Analysts expect growth to $0.000382 by 2031, with price fluctuations between $0.000208 and $0.000265 over the next five years.

Is goat crypto a good investment?

GOAT is an AI-guided meme coin with significant growth potential in the current bull market. Its unique origin through Truth Terminal AI and strong community support position it as a compelling speculative opportunity for risk-tolerant investors seeking explosive returns.

2025 GOATED Price Prediction: Analyzing the Future Value of the Rising Cryptocurrency Star

2025 BOB Price Prediction: Expert Analysis and Market Outlook for the Coming Year

GOAT Network (GOATED): Bitcoin ZK-Rollup With Native Yield

What Makes GOAT Network GOATED

How Active is the Bitcoin Layer 2 Ecosystem in 2025?

How Secure is Merlin Chain (MERL) Against Smart Contract Vulnerabilities and Attacks?

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps