2025 HAEDALPrice Prediction: Analyzing Growth Potential and Market Factors Influencing Cryptocurrency Value

Introduction: HAEDAL's Market Position and Investment Value

Haedal Protocol (HAEDAL), as a leading liquid staking protocol natively built on Sui, has been providing robust liquid staking infrastructure since its inception. As of 2025, HAEDAL's market capitalization has reached $26,102,700, with a circulating supply of approximately 195,000,000 tokens, and a price hovering around $0.13386. This asset, known as the "Sui Liquid Staking Pioneer," is playing an increasingly crucial role in decentralized finance (DeFi) and blockchain security.

This article will comprehensively analyze HAEDAL's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment, to provide investors with professional price predictions and practical investment strategies.

I. HAEDAL Price History Review and Current Market Status

HAEDAL Historical Price Evolution

- 2025: Project launch, price reached an all-time high of $0.3059 on July 17

- 2025: Market fluctuation, price dropped to an all-time low of $0.07 on April 29

- 2025: Price recovery, currently trading at $0.13386 as of October 4

HAEDAL Current Market Situation

HAEDAL is currently trading at $0.13386, with a 24-hour trading volume of $856,815.47. The token has shown a slight increase of 0.08% in the past 24 hours. However, it has experienced a 1.18% decrease in the last hour. The 7-day and 30-day price changes are positive, with increases of 2.21% and 1.94% respectively. The market capitalization stands at $26,102,700, ranking HAEDAL at 985th position in the cryptocurrency market. The circulating supply is 195,000,000 HAEDAL tokens, which represents 19.5% of the total supply of 1,000,000,000 tokens. The fully diluted market cap is $133,860,000.

Click to view the current HAEDAL market price

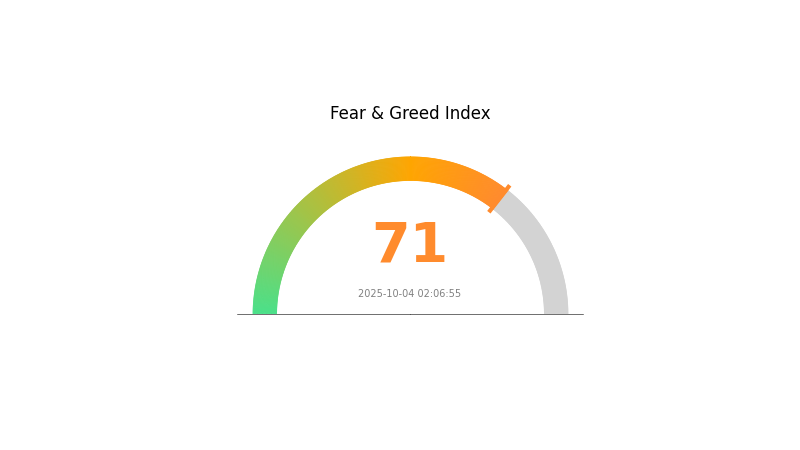

HAEDAL Market Sentiment Indicator

2025-10-04 Fear and Greed Index: 71 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a strong wave of optimism, as indicated by the Fear and Greed Index reaching 71. This suggests that investors are feeling confident and bullish about the market's prospects. However, it's important to remember that extreme greed can sometimes lead to overvaluation and increased volatility. Traders should remain cautious and consider diversifying their portfolios to mitigate potential risks in this exuberant market environment.

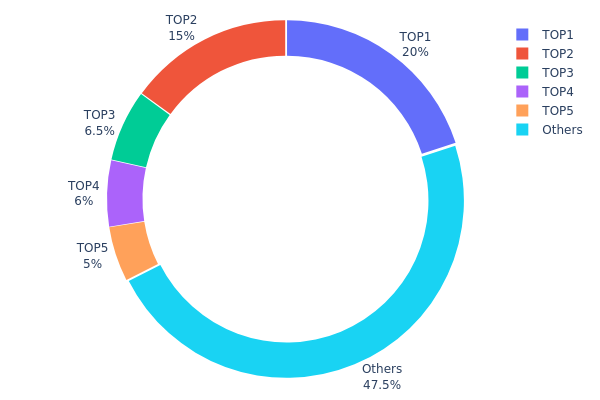

HAEDAL Holdings Distribution

The address holdings distribution data for HAEDAL reveals a significant concentration of tokens among the top holders. The top address controls 20% of the total supply, while the top 5 addresses collectively hold 52.5% of all HAEDAL tokens. This high concentration suggests a relatively centralized ownership structure, which could potentially impact market dynamics.

Such a concentrated distribution raises concerns about market manipulation and price volatility. With over half of the supply controlled by just five addresses, there's an increased risk of large-scale sell-offs or coordinated actions that could significantly influence token prices. However, it's worth noting that 47.5% of tokens are distributed among other addresses, indicating some level of broader market participation.

This distribution pattern reflects a moderate level of decentralization for HAEDAL, though it falls short of ideal standards for a widely distributed token ecosystem. The current structure may pose challenges to market stability and could potentially deter some investors concerned about excessive influence from large holders.

Click to view the current HAEDAL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3c0c...2d83eb | 200000.00K | 20.00% |

| 2 | 0xdd1f...5da329 | 150000.00K | 15.00% |

| 3 | 0xfd72...918da6 | 65000.00K | 6.50% |

| 4 | 0xd147...dac4c6 | 60000.00K | 6.00% |

| 5 | 0x69a7...356642 | 50000.00K | 5.00% |

| - | Others | 475000.00K | 47.5% |

II. Key Factors Influencing HAEDAL's Future Price

Supply Mechanism

- Dynamic Validator Selection: HAEDAL's unique feature of dynamic validator selection sets it apart in the liquid staking sector.

- Current Impact: This innovative mechanism is expected to positively influence HAEDAL's market positioning and potential price growth.

Institutional and Whale Dynamics

- Corporate Adoption: HAEDAL's distinctive products, such as the HaeVault liquidity management tool, are attracting attention in the liquid staking domain.

Macroeconomic Environment

- Inflation Hedging Properties: As market liquidity recovers, HAEDAL may benefit from increased investor interest in crypto assets as inflation hedges.

Technological Development and Ecosystem Building

- Liquidity Management: The HaeVault liquidity management tool represents a significant technological advancement for HAEDAL.

- Ecosystem Applications: HAEDAL is positioning itself as a key player in the liquid staking ecosystem, potentially driving future growth and adoption.

III. HAEDAL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.126 - $0.13404

- Neutral prediction: $0.13404 - $0.15549

- Optimistic prediction: $0.15549 - $0.17693 (requires favorable market conditions)

2026-2028 Outlook

- Market stage expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.0964 - $0.20835

- 2027: $0.17646 - $0.25651

- 2028: $0.12276 - $0.25209

- Key catalysts: Increased adoption, technological advancements, and overall crypto market growth

2029-2030 Long-term Outlook

- Base scenario: $0.23565 - $0.29103 (assuming steady market growth)

- Optimistic scenario: $0.29103 - $0.34641 (assuming strong market performance)

- Transformative scenario: $0.34641 - $0.3667 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: HAEDAL $0.3667 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.17693 | 0.13404 | 0.126 | 0 |

| 2026 | 0.20835 | 0.15549 | 0.0964 | 16 |

| 2027 | 0.25651 | 0.18192 | 0.17646 | 36 |

| 2028 | 0.25209 | 0.21921 | 0.12276 | 63 |

| 2029 | 0.34641 | 0.23565 | 0.18381 | 76 |

| 2030 | 0.3667 | 0.29103 | 0.25611 | 117 |

IV. HAEDAL Professional Investment Strategy and Risk Management

HAEDAL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Sui ecosystem

- Operation suggestions:

- Accumulate HAEDAL tokens during market dips

- Stake HAEDAL tokens to earn additional rewards

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

HAEDAL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for HAEDAL

HAEDAL Market Risks

- Volatility: Crypto market can experience extreme price fluctuations

- Competition: Other liquid staking protocols may emerge on Sui

- Adoption: Slow growth of Sui ecosystem could impact HAEDAL's value

HAEDAL Regulatory Risks

- Unclear regulations: Cryptocurrency regulations are still evolving globally

- Compliance issues: Potential challenges in adhering to new regulations

- Taxation uncertainties: Unclear tax treatment of staking rewards

HAEDAL Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Sui network may face scaling issues

- Validator risks: Potential slashing or downtime of validator nodes

VI. Conclusion and Action Recommendations

HAEDAL Investment Value Assessment

HAEDAL shows promise as a leading liquid staking protocol on Sui, offering potential long-term value. However, investors should be aware of short-term volatility and the nascent stage of the Sui ecosystem.

HAEDAL Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about liquid staking

✅ Experienced investors: Consider allocating a portion of Sui holdings to HAEDAL for staking

✅ Institutional investors: Evaluate HAEDAL as part of a diversified crypto portfolio

HAEDAL Trading Participation Methods

- Spot trading: Buy and sell HAEDAL tokens on Gate.com

- Staking: Participate in liquid staking through the Haedal protocol

- Yield farming: Explore additional DeFi opportunities with HAEDAL tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Haedal a meme coin?

Yes, Haedal is a meme coin. It's a community-driven token built on the Solana blockchain, inspired by marine themes.

Would hamster kombat coin reach $1?

While Hamster Kombat's potential is notable, reaching $1 remains uncertain. Market trends and investor interest will play crucial roles in its future price movement.

How much will Hbar cost in 2030?

Based on current market predictions, Hbar is expected to cost between $0.25 and $0.83 in 2030, though exact prices remain uncertain.

What is the all time high for the Haedal coin?

The all-time high for the Haedal coin is $0.2394, which was reached in the past.

MILK vs XLM: Comparing Two Powerful Multilingual Language Models for Cross-Lingual Transfer Learning

PSTAKE vs NEAR: Comparative Analysis of Two Leading Blockchain Protocols for Decentralized Applications

Is Milkyway (MILK) a Good Investment?: Analyzing the Potential Returns and Risks in the Crypto Dairy Space

What is the Haedal Protocol (HAEDAL) Price Prediction for 2025?

2025 MILKPrice Prediction: Global Dairy Market Trends and Economic Factors Shaping Future Values

2025 LAIR Price Prediction: Analyzing Market Trends and Potential Growth Factors

Cryptocurrency Earning Platform Overview

Two-Factor Authentication (2FA): A Comprehensive Guide

Can Solana Reach $10,000 Dollars?

What is Cryptocurrency Market Cap and How Does It Work?

What is Hopium in Crypto?