2025 KYVE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: KYVE's Market Position and Investment Value

KYVE Network (KYVE) operates as a decentralized archival network that reconstitutes data streams as permanent resources, leveraging Arweave to ensure scalability, immutability, and availability over time. As of December 2025, KYVE maintains a market capitalization of approximately $4.07 million, with a circulating supply of roughly 1.125 billion tokens, currently trading at $0.00362 per token. This innovative protocol, which standardizes and permanently archives blockchain data streams through a decentralized computational layer, is establishing itself as a critical infrastructure component within the Web3 ecosystem.

This article will comprehensively analyze KYVE's price trends from 2025 through 2030, incorporating historical performance patterns, market dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

KYVE Network (KYVE) Market Analysis Report

I. KYVE Price History Review and Current Market Status

KYVE Historical Price Evolution

-

January 2024: KYVE reached its all-time high of $0.2 on January 27, 2024, representing the peak valuation during the observed period.

-

December 2025: The token experienced a significant decline, reaching its all-time low of $0.003099 on December 18, 2025, marking an 85.85% decrease over the one-year period.

KYVE Current Market Performance

As of December 24, 2025, KYVE is trading at $0.00362, reflecting recent volatility in the cryptocurrency market. The token demonstrates the following metrics:

Price Movements:

- 1-hour change: -9.62% (down $0.000385)

- 24-hour change: +7.45% (up $0.000251)

- 7-day change: -7.18% (down $0.000280)

- 30-day change: -28.99% (down $0.001478)

- 1-year change: -85.85% (down $0.021963)

Market Capitalization and Valuation:

- Market cap: $4,073,640.39

- Fully diluted valuation (FDV): $3,620,000

- Market cap to FDV ratio: 100%

- Market dominance: 0.00011%

- 24-hour trading volume: $33,090.13

Token Supply:

- Circulating supply: 1,125,315,024.90 KYVE (112.53% of total supply)

- Total supply: 1,000,000,000 KYVE

- Maximum supply: Unlimited

Price Range (24-hour):

- High: $0.004025

- Low: $0.003366

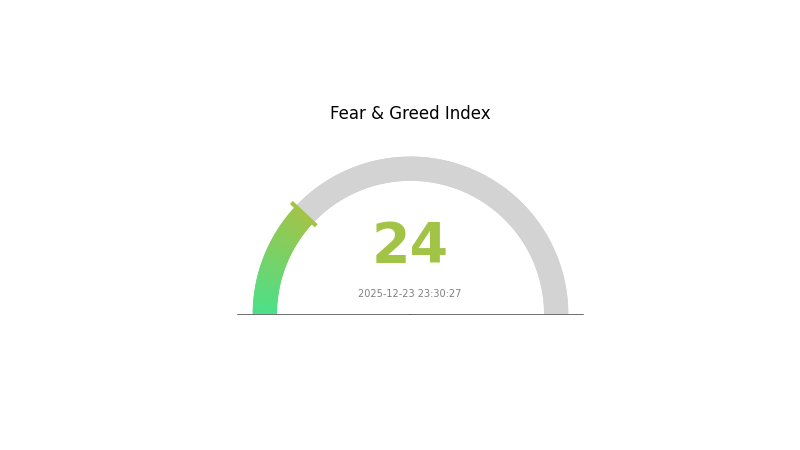

The market sentiment indicator shows an "Extreme Fear" reading with a VIX level of 24, indicating heightened market anxiety and risk aversion among investors. KYVE is currently ranked 1,660 by market capitalization among all cryptocurrency assets, with the token available for trading on Gate.com.

Check the current KYVE market price

KYVE Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 24. This indicates significant market pessimism and risk aversion among investors. During such periods of extreme fear, market volatility tends to increase substantially. Experienced traders often view these conditions as potential accumulation opportunities, as assets may be trading at discounted valuations. However, caution is advised, as further downside pressure could materialize. Investors should carefully assess their risk tolerance and portfolio positioning on Gate.com to navigate these turbulent market conditions effectively.

KYVE Holdings Distribution

The address holdings distribution represents the concentration of KYVE tokens across blockchain addresses, serving as a critical metric for assessing token decentralization and market structure. This analysis examines the top token holders to evaluate potential risks related to token concentration, liquidity dynamics, and market stability. By tracking how KYVE tokens are distributed among addresses, investors and analysts can gauge the level of decentralization and identify potential vulnerabilities to market manipulation or sudden price movements triggered by large token transfers.

Currently, the available data for KYVE's top address holdings appears to be limited or unavailable in the provided dataset. This absence of specific concentration data suggests either a relatively distributed token base or incomplete information at the present time. A robust assessment of KYVE's centralization risk requires comprehensive holdings data showing the percentage of tokens held by the largest addresses. Typically, when top addresses hold a disproportionate share of tokens, the network faces elevated risks of price volatility and reduced true decentralization.

The structural stability of KYVE's token distribution is essential for maintaining healthy market dynamics and ensuring genuine decentralization. If token holdings are well-distributed across numerous addresses, this indicates a mature ecosystem with reduced single-actor risk. Conversely, excessive concentration among a small number of addresses could compromise the project's decentralization narrative and create conditions favorable for coordinated market movements. Monitoring this metric remains vital for understanding KYVE's long-term sustainability and its resistance to potential governance or market manipulation threats.

Click to view current KYVE holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing KYVE's Future Price

Technology Development and Ecosystem Construction

-

Decentralized Data Storage: KYVE Network provides decentralized data storage services where storage providers can participate in the service. This technology meets the core needs of the Web3 ecosystem and is expected to significantly influence KYVE's future price.

-

Ecosystem Application Expansion: As Web3 infrastructure, KYVE's price is influenced by DApp development and application deployment within the ecosystem. Growth in applications drives increased demand for KYVE tokens.

-

Enterprise-Level Adoption: Adoption of KYVE by leading Web3 enterprises is expected to become a major price driver. Enterprise recognition of decentralized data storage helps enhance KYVE token demand.

III. 2025-2030 KYVE Price Forecast

2025 Outlook

- Conservative Forecast: $0.00293–$0.00362

- Neutral Forecast: $0.00362

- Optimistic Forecast: $0.00402 (requires sustained positive market sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with increasing institutional interest and ecosystem expansion

- Price Range Forecast:

- 2026: $0.00332–$0.00504

- 2027: $0.00283–$0.00633

- 2028: $0.00377–$0.00769

- Key Catalysts: Enhanced data validation network utility, strategic partnerships, growing demand for decentralized data infrastructure, and broader blockchain adoption cycles

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00582–$0.00902 (assumes steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.00887–$0.00902 (assumes accelerated enterprise adoption and significant network scalability improvements)

- Transformative Scenario: $0.00887 as support level with potential breakout higher (assumes KYVE becomes critical infrastructure layer within the Web3 data ecosystem)

- 2030-12-31: KYVE 114% appreciation potential (measured from 2025 baseline with compounded annual growth trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00402 | 0.00362 | 0.00293 | 0 |

| 2026 | 0.00504 | 0.00382 | 0.00332 | 5 |

| 2027 | 0.00633 | 0.00443 | 0.00283 | 22 |

| 2028 | 0.00769 | 0.00538 | 0.00377 | 48 |

| 2029 | 0.00902 | 0.00654 | 0.00582 | 80 |

| 2030 | 0.00887 | 0.00778 | 0.00467 | 114 |

KYVE Network (KYVE) Professional Investment Strategy and Risk Management Report

IV. KYVE Professional Investment Strategy and Risk Management

KYVE Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Long-term believers in decentralized data archival infrastructure, institutional investors, and those seeking exposure to Web3 infrastructure projects

- Operational Recommendations:

- Dollar-cost averaging (DCA): Allocate fixed capital amounts monthly to mitigate volatility risk, particularly given KYVE's -85.85% one-year performance

- Accumulation during market downturns: Current trading price of $0.00362 presents potential entry opportunities relative to historical highs of $0.2

- Hold through network development phases: Monitor protocol upgrades and node participation metrics

(2) Active Trading Strategy

- Price Monitoring Points:

- 24-hour volatility tracking: Current 24H change of +7.45% indicates potential swing trading opportunities

- Support and resistance levels: Identify key price zones based on recent 24-hour range ($0.003366 - $0.004025)

- Volume analysis: Monitor the 24-hour trading volume of $33,090.13 to assess liquidity conditions

KYVE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5% - 2% portfolio allocation

- Active Investors: 2% - 5% portfolio allocation

- Professional/Institutional Investors: 5% - 15% portfolio allocation

(2) Risk Hedging Solutions

- Diversification strategy: Balance KYVE exposure with established infrastructure tokens to reduce concentration risk

- Position sizing: Implement strict position limits based on individual risk tolerance and portfolio size

(3) Secure Storage Solutions

- Custodial Solution: Gate.com Web3 Wallet for secure token storage with institutional-grade security protocols

- Self-custody approach: Hardware wallet solutions for users managing significant KYVE holdings

- Security Best Practices: Enable two-factor authentication, maintain backup recovery phrases in secure offline storage, and avoid sharing private keys under any circumstances

V. KYVE Potential Risks and Challenges

KYVE Market Risks

- Severe Historical Drawdown: KYVE has experienced an -85.85% decline over the past year, indicating significant volatility and potential liquidity challenges

- Low Trading Volume: 24-hour volume of $33,090.13 suggests limited market liquidity, which may result in wider bid-ask spreads and slippage during trading

- Market Concentration Risk: Small market cap of $4.07M relative to total cryptocurrency market capitalization increases vulnerability to sudden price fluctuations

KYVE Regulatory Risks

- Evolving Classification: Decentralized protocol tokens face uncertain regulatory treatment across different jurisdictions

- Data Storage Compliance: Regulatory frameworks governing data archival and storage may impact protocol operations

- Jurisdictional Variability: Regulatory approaches differ significantly between regions, creating operational uncertainty

KYVE Technical Risks

- Reliance on Arweave: Protocol dependency on Arweave infrastructure for permanent storage creates single-point-of-failure risk

- Node Infrastructure: Customizable node requirements may present technical barriers for network participants

- Protocol Evolution: Future protocol updates could impact token economics and network participation incentives

VI. Conclusion and Action Recommendations

KYVE Investment Value Assessment

KYVE Network presents a specialized investment opportunity within the Web3 infrastructure segment. As a decentralized archival network leveraging Arweave for permanent data storage, the project addresses a specific but emerging need in blockchain infrastructure. However, investors should recognize the project's early-stage characteristics, evidenced by significant historical drawdown (-85.85% YTD) and limited market liquidity. The current price of $0.00362 represents a 98% decline from its all-time high of $0.2, reflecting substantial risk alongside potential recovery opportunity. Investment decision should prioritize technical fundamentals over price recovery narratives.

KYVE Investment Recommendations

✅ Beginners: Start with minimal allocation (0.1% - 0.5% of portfolio) through Gate.com, focus on understanding the protocol's value proposition before increasing exposure

✅ Experienced Investors: Consider 2% - 5% allocation as portfolio diversification, implement disciplined entry and exit strategies based on technical analysis and protocol metrics

✅ Institutional Investors: Evaluate strategic allocation within Web3 infrastructure portfolios, conduct thorough due diligence on governance mechanisms and staking economics

KYVE Trading Participation Methods

- Spot Trading: Buy and hold KYVE directly through Gate.com for immediate token ownership

- Staking Participation: Engage with protocol governance through node operation and staking mechanisms to earn protocol-distributed rewards

- Protocol Participation: Run KYVE nodes for data validation, standardization, and archival tasks in exchange for token rewards

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and are encouraged to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is KYVE crypto?

KYVE is a Cosmos-based layer 1 blockchain providing decentralized data validation, immutability, and retrieval solutions. It enables secure and immutable data management through a network of validators.

How is KYVE different from Arweave?

KYVE focuses on data validity and verification, while Arweave specializes in data availability and long-term storage. They are complementary technologies—KYVE leverages Arweave's infrastructure for persistent data archival.

What factors influence KYVE token price?

KYVE token price is influenced by supply and demand dynamics, investor sentiment, market trading volume, network adoption rates, and broader cryptocurrency market conditions.

What is KYVE's market cap and trading volume?

KYVE's market cap is currently $0.00, with a 24-hour trading volume of $40,030. These metrics reflect real-time market data as of December 23, 2025.

What are the price predictions for KYVE in 2025?

KYVE Network is predicted to reach up to $0.004029 by 2025, with potential average prices reflecting steady growth. Market analysts suggest continued upward momentum based on network adoption and development progress throughout the year.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

2025 TIA Price Prediction: Analyzing Market Trends and Growth Potential for the Celestia Token

Elon Musk's Birthday And It's Astrology

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps