2025 PUSH Price Prediction: Expert Analysis and Market Forecast for the Push Protocol Token

Introduction: Market Position and Investment Value of PUSH

PUSH (PUSH) serves as the native governance token of the EPNS (Ethereum Push Notification Service) protocol, a decentralized notification infrastructure. Since its launch in 2021, PUSH has established itself as a key utility token within the Web3 notification ecosystem. As of December 2025, PUSH maintains a market capitalization of approximately $1,502,437, with a circulating supply of around 90.24 million tokens, currently trading at $0.01665 per token. This innovative protocol token is increasingly becoming essential infrastructure for decentralized applications and DeFi services.

This article will comprehensively analyze PUSH's price trajectory through 2030, integrating historical patterns, market supply dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and practical investment strategies for informed decision-making.

PUSH Token Market Analysis Report

I. PUSH Price History Review and Current Market Status

PUSH Historical Price Evolution

- April 2021: Token launch with initial price of $3.97, reaching all-time high of $8.73 on April 14, 2021, representing a 119.6% gain from launch price.

- 2021-2024 Period: Significant price decline phase, with the token experiencing sustained downward pressure over the three-year period.

- December 2025: New all-time low of $0.0116806 reached on December 15, 2025, marking a 99.87% decrease from the historical peak of $8.73.

PUSH Current Market Status

As of December 26, 2025, PUSH is trading at $0.01665, reflecting a 24-hour decline of 3.08% and a 1-hour decline of 0.36%. However, the token demonstrates stronger performance over longer timeframes, with a 7-day gain of 15.8% and a 30-day gain of 24.83%, indicating recent recovery momentum from the recent low. The 1-year performance shows a steep decline of 85.50%.

The current market capitalization stands at $1,502,437.43, with a fully diluted valuation of $1,665,000. The token maintains a circulating supply of 90,236,482 PUSH out of a total supply of 100,000,000, representing 90.24% circulation. Daily trading volume reached $158,964.46, with 5,557 token holders participating in the network.

PUSH maintains a market dominance of 0.000052%, ranking 2,329 across all cryptocurrencies. The token is actively listed on Gate.com with price data continuously updated.

Click to view current PUSH market price

PUSH Market Sentiment Index

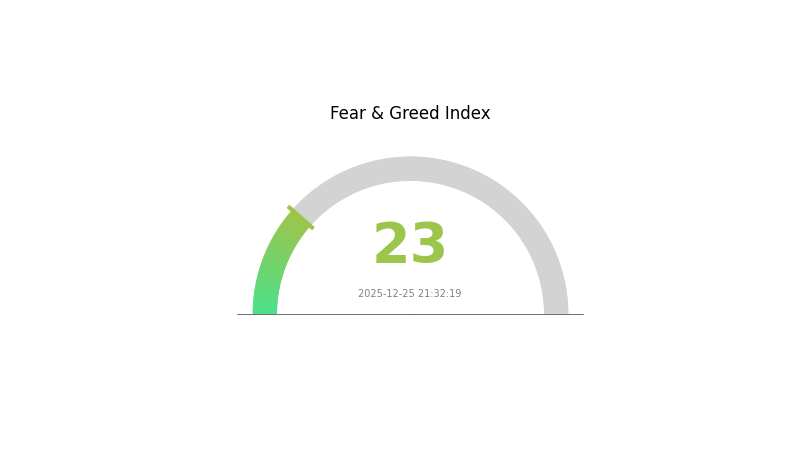

2025-12-25 Fear and Greed Index: 23 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear as the index hits 23. This level typically indicates severe panic selling and significant market pessimism. When fear reaches such extremes, contrarian investors often view it as a potential buying opportunity, as excessive pessimism can lead to oversold conditions. However, traders should exercise caution and conduct thorough analysis before making any investment decisions. Monitor key support levels and consider dollar-cost averaging strategies during periods of extreme fear to mitigate risk.

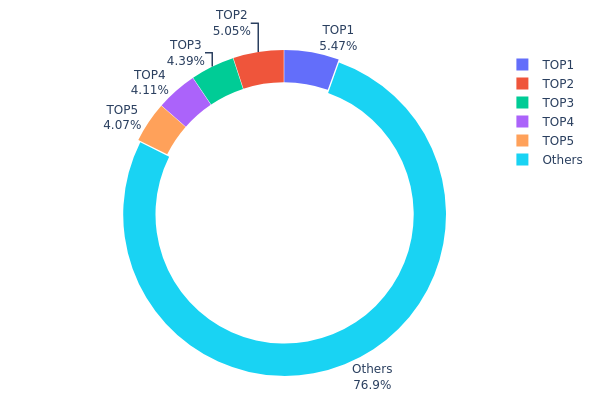

PUSH Holdings Distribution

The address holdings distribution map provides a snapshot of how PUSH tokens are allocated across the blockchain ecosystem, revealing the concentration levels among major holders and the degree of decentralization within the network. This metric is crucial for assessing potential risks related to market manipulation, liquidity dynamics, and the overall health of the token's distribution structure.

Analysis of the current PUSH holdings data demonstrates a relatively moderate concentration profile. The top five addresses collectively hold approximately 23.06% of total tokens, with the largest holder commanding 5.47% and the second-largest controlling 5.05%. This distribution pattern indicates that no single entity maintains overwhelming dominance, yet the concentration among the top tier remains noteworthy. The significant portion allocated to "Others" at 76.94% suggests a reasonably dispersed holder base, though this aggregate category masks the granular distribution beneath the top five positions. Such a structure reflects a market environment where influence is distributed across multiple stakeholders rather than concentrated in a few dominant hands.

The current address distribution landscape presents a balanced risk profile for PUSH. While the top five holders' combined 23.06% stake does not constitute excessive concentration that would typically trigger systemic concerns, monitoring these addresses remains important for evaluating potential coordinated actions that could impact price stability or liquidity provision. The substantial "Others" category indicates healthy participation from retail and institutional investors at various scales. This distribution architecture supports market resilience and reduces the likelihood of acute flash liquidations or coordinated sell-offs, while the presence of notable individual holders ensures sufficient capital concentration to maintain trading depth and market functionality.

Visit PUSH Holdings Distribution for the latest data.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6632...eeeeee | 5470.91K | 5.47% |

| 2 | 0x8eda...ebacf0 | 5050.36K | 5.05% |

| 3 | 0x58ed...a36a51 | 4387.14K | 4.38% |

| 4 | 0x510e...c67ecf | 4109.91K | 4.10% |

| 5 | 0x6368...14d6c5 | 4069.74K | 4.06% |

| - | Others | 76911.94K | 76.94% |

II. Core Factors Influencing PUSH's Future Price

Market Demand and Adoption

- Decentralized Communication Utility: PUSH functions as a decentralized communication token within its ecosystem, with demand driven by user adoption and platform growth.

- Market Trends: Analysts predict moderate growth with price fluctuations, with institutional investments and market trends playing key roles in price direction.

- Current Market Position: PUSH is anticipated to enter a growth period, with predicted price range of $0.03548747285 - $0.04266471455 based on current market analysis.

Institutional Investments and Market Dynamics

- Institutional Capital Flow: Institutional investments and ETF progress are cited as core driving factors for the token's price movement.

- Market Sentiment: The token's future trajectory will be significantly influenced by broader cryptocurrency market sentiment and capital allocation patterns toward decentralized communication solutions.

Price Prediction Analysis

- Conservative Forecast: $0.00671 - $0.01315 USD

- Neutral Forecast: $0.01315 - $0.01414 USD

- 2027 Projection: $0.01652 - $0.02156 USD

- 2028 Projection: $0.01207 - $0.02025 USD

Disclaimer: This analysis is for informational purposes only and should not be considered as investment advice. Cryptocurrency markets carry inherent risks, and price predictions are subject to significant volatility and unforeseen market changes. Investors are encouraged to conduct their own research and exercise caution when making investment decisions.

For trading and investment opportunities in PUSH, visit Gate.com, your trusted cryptocurrency trading platform.

III. PUSH Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00895 - $0.01271

- Base Case Forecast: $0.01658

- Optimistic Forecast: $0.01824 (requires sustained market recovery and increased adoption)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery momentum, characterized by stabilizing price floors and expanding trading volumes on platforms like Gate.com

- Price Range Predictions:

- 2026: $0.01271 - $0.02211

- 2027: $0.01027 - $0.02193

- Key Catalysts: Ecosystem development initiatives, increased institutional participation, integration with major DeFi protocols, and overall market sentiment recovery

2028-2030 Long-term Outlook

- Base Scenario: $0.01355 - $0.02272 in 2028, progressing to $0.01609 - $0.03263 by 2030 (assumes steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.02418 - $0.03263 range by 2029-2030 (assumes accelerated platform adoption and strengthened tokenomics)

- Transformational Scenario: Price reaching upper $0.03+ levels (extreme favorable conditions including breakthrough technological developments, major enterprise partnerships, and significant market capitalization expansion)

- 2030-12-31: PUSH targets $0.02298 average price (consolidation phase with 38% cumulative growth from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01824 | 0.01658 | 0.00895 | 0 |

| 2026 | 0.02211 | 0.01741 | 0.01271 | 4 |

| 2027 | 0.02193 | 0.01976 | 0.01027 | 18 |

| 2028 | 0.02272 | 0.02085 | 0.01355 | 25 |

| 2029 | 0.02418 | 0.02178 | 0.01808 | 30 |

| 2030 | 0.03263 | 0.02298 | 0.01609 | 38 |

PUSH Token Investment Analysis Report

IV. PUSH Professional Investment Strategy and Risk Management

PUSH Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for investors: Protocol enthusiasts and Web3 infrastructure believers with extended time horizons

- Operational recommendations:

- Accumulate PUSH tokens during market corrections, taking advantage of the -85.50% annual decline to establish positions at lower valuations

- Hold through governance participation cycles to benefit from protocol development and fee-sharing rewards (70% allocation to PUSH holders)

- Dollar-cost averaging approach to reduce timing risk given current market volatility

(2) Active Trading Strategy

- Technical analysis tools:

- Support and resistance levels: Monitor the 24-hour range of $0.01657 (low) to $0.01725 (high) for breakout opportunities

- Volume analysis: Track the $158,964.46 daily volume to identify liquidity patterns and entry/exit points

- Wave operation key points:

- Capitalize on the 7-day uptrend of +15.8% to identify momentum reversal zones

- Set stop-loss orders below the recent all-time low of $0.0116806 to manage downside risk

- Use the 30-day gain of +24.83% as a reference for understanding intermediate-term trend strength

PUSH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of total portfolio

- Active investors: 2-5% of total portfolio

- Professional investors: 5-10% of total portfolio

(2) Risk Hedging Solutions

- Position sizing: Limit individual PUSH holdings to a percentage that allows recovery even with total loss

- Diversification across DeFi protocols: Balance PUSH exposure with other decentralized infrastructure tokens to reduce concentration risk

(3) Secure Storage Solutions

- Custodial wallet option: Gate.com Web3 Wallet for convenient access and PUSH token management

- Non-custodial approach: Direct wallet control through smart contract interaction on Ethereum mainnet

- Security considerations: Always verify contract address (0xf418588522d5dd018b425e472991e52ebbeeeeee) before transfers; enable two-factor authentication; use hardware-backed security solutions for significant holdings

V. PUSH Potential Risks and Challenges

PUSH Market Risk

- Extreme price volatility: -85.50% decline over the past year indicates substantial downside exposure and continued market uncertainty

- Liquidity constraints: Market cap of only $1,502,437.43 with 5,557 token holders creates concentration risk and potential slippage during large trades

- Low market capitalization ranking: Current position at #2329 reflects limited market adoption and reduced institutional interest

PUSH Regulatory Risk

- Protocol compliance uncertainty: As a decentralized notification service, regulatory treatment of notification mechanisms and token governance remains ambiguous across jurisdictions

- Token classification ambiguity: Uncertainty regarding whether PUSH will be classified as a security or utility token in major regulatory markets

- Operational jurisdiction challenges: Changes in DeFi regulation could impact protocol viability and token utility value

PUSH Technical Risk

- Smart contract vulnerabilities: Notification protocol complexity increases potential attack surface for exploits

- Ethereum network dependencies: PUSH operations depend on Ethereum mainnet stability and gas fee economics

- Adoption barriers: Limited mainstream integration with dApps may restrict the protocol's growth trajectory and token utility expansion

VI. Conclusion and Action Recommendations

PUSH Investment Value Assessment

PUSH represents a specialized infrastructure play within the decentralized notification ecosystem. While the protocol addresses a legitimate need for Web3 communication infrastructure, the token exhibits significant challenges: severe price deterioration (-85.50% annually), modest market capitalization ($1.67M fully diluted valuation), and limited market penetration (5,557 holders). The recent recovery trends (7-day +15.8%, 30-day +24.83%) suggest potential bottoming, but the fundamental question of protocol adoption and sustainable value generation remains unresolved. The governance utility and 70% fee-sharing mechanism provide intrinsic value, but current market conditions suggest investors should approach with measured expectations and strict risk controls.

PUSH Investment Recommendations

✅ Beginners: Avoid direct PUSH allocation; consider learning about decentralized notification protocols through research before participating

✅ Experienced investors: Consider small speculative positions (1-3% of portfolio) with strict stop-loss discipline; prioritize entry during confirmed oversold conditions with volume confirmation

✅ Institutional investors: Conduct thorough protocol technology assessment and team capability analysis before considering PUSH as part of Web3 infrastructure exposure

PUSH Trading Participation Methods

- Direct spot trading: Execute PUSH purchases on Gate.com with verified liquidity during peak trading hours

- Limit order strategy: Place buy orders at key support levels ($0.0116806 area or higher technical support zones) to improve entry execution

- Protocol engagement: Participate in governance through PUSH holdings and monitor fee pool activation (approximately one year after mainnet launch) to assess reward potential

Cryptocurrency investment carries extreme risk and potential for total capital loss. This analysis does not constitute investment advice. Investors must make decisions based on personal risk tolerance and conduct thorough due diligence. It is strongly recommended to consult with professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is the price prediction for PUSH token in 2025?

Based on market analysis, PUSH token is predicted to reach approximately $1.16 by 2025, representing steady price stability. This forecast reflects current market trends and technical analysis.

Will PUSH coin reach $1?

Yes, PUSH could reach $1 by 2029 as the Web3 ecosystem matures and Push Protocol adoption grows. Continued protocol advancements and positive market sentiment will be key drivers for price appreciation towards this target.

What are the key factors that could drive PUSH token price up or down?

PUSH price rises with technical breakouts, increased network activity, and positive market sentiment. It declines during broader market downturns, reduced adoption, or negative news. Trading volume and developer ecosystem expansion also significantly influence price movements.

How does PUSH token compare to other notification/communication blockchain projects?

PUSH token powers the Ethereum Push Notification Service (EPNS), focusing on decentralized, real-time notifications. It enables governance and incentivizes secure on-chain communication, differentiating itself through infrastructure-level reliability and user ownership compared to traditional messaging platforms.

What is PUSH token used for and what is its utility?

PUSH token secures the Push Protocol network, enables network utility for notification services, facilitates Push DAO governance, and grants voting rights to token holders for protocol decisions.

Is PUSH token a good investment - what are the risks?

PUSH token offers growth potential in Web3 notifications infrastructure. Main risks include market volatility, regulatory uncertainty, and competition. Consider your risk tolerance before investing.

2025 BAKED Price Prediction: Will This DeFi Token Rise to New Heights or Crumble?

2025 DAOLITY Price Prediction: Expert Analysis and Future Market Outlook for Cryptocurrency Investors

2025 DCK Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 BAKED Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

2025 ICP Price Prediction: Analyzing Growth Factors and Market Potential in the Post-Halving Cycle

Marina Protocol Daily Quiz Answer for 8 january 2026

Spur Protocol Daily Quiz Answer Today 8 january 2026

Dropee Question of the Day for 8 january 2026

Gold's 2025 Rally Pauses, Bitcoin Seen as Potential Alternative

TRON ECO Launches WINkLink Price Prediction Contest in Holiday Odyssey Campaign