2025 TEVA Price Prediction: Expert Analysis and Market Forecast for Teva Pharmaceutical Industries

Introduction: TEVA's Market Position and Investment Value

Tevaera (TEVA), a UX-first gaming ecosystem powered by ZK Stack and AI technology, has emerged as a distinctive player in the Web3 gaming sector. With over a million Soulbound Gamers, TEVA is redefining the gaming landscape through multi-genre Web3 games, innovative gaming agents powered by Teva Chain, and a robust gaming technology stack. As of December 27, 2025, TEVA maintains a market capitalization of approximately $1.15 million USD, with a circulating supply of 747.97 million tokens trading at $0.001539. The asset has demonstrated notable price dynamics, reaching an all-time high of $0.075043 on January 3, 2025, while recently testing support levels near $0.001434.

This report will provide a comprehensive analysis of TEVA's price trajectory and market outlook, examining historical price patterns, ecosystem development, supply-demand dynamics, and macroeconomic factors that shape the token's valuation. By synthesizing technical indicators, on-chain metrics, and market sentiment analysis, this guide aims to equip investors with actionable insights and evidence-based price forecasts for informed decision-making in the evolving digital asset landscape.

I. TEVA Price History Review and Market Current Status

TEVA Historical Price Evolution Trajectory

- January 3, 2025: TEVA reached its all-time high of $0.075043, marking the peak of the current market cycle.

- December 19, 2025: TEVA hit its all-time low of $0.001434, representing a significant correction of approximately 98.09% from the historical peak.

- December 27, 2025: TEVA is currently trading at $0.001539, showing minor recovery momentum from recent lows.

TEVA Current Market Status

As of December 27, 2025, TEVA is ranked 2,518 by market capitalization, with a current price of $0.001539. The token has experienced significant volatility over the past year, declining 88.97% from its year-ago levels.

In shorter timeframes, TEVA shows modest positive momentum: up 0.33% in the past hour and 0.32% in the past 24 hours. However, the 7-day performance shows a 4.47% increase, while the 30-day period reflects a notable 18.05% decline. The 24-hour trading volume stands at $13,963.85, with the token trading between a low of $0.001488 and a high of $0.001568.

The token's market capitalization is approximately $1.15 million with a fully diluted valuation of $6.16 million. With 4 billion total tokens and a circulating supply of approximately 747.97 million TEVA (representing 18.70% of total supply), the token maintains a market dominance of 0.00019%. The holder count stands at 71,220 addresses, indicating a distributed token ownership base.

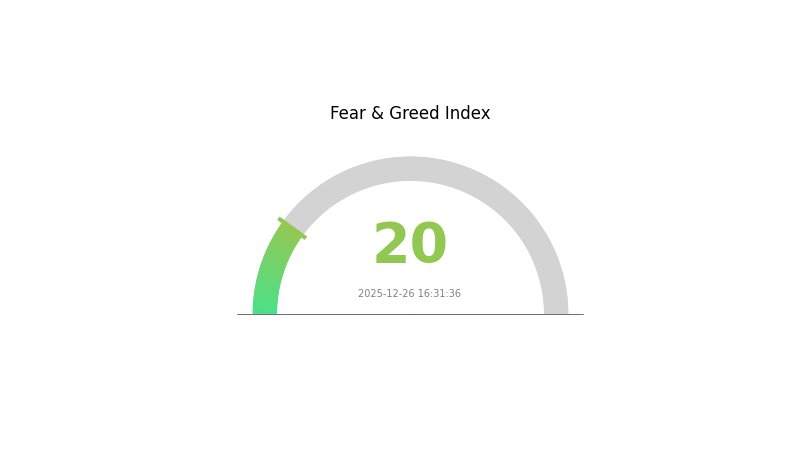

Market sentiment as of December 26, 2025 reflects extreme fear conditions (VIX score: 20), suggesting heightened market anxiety and potential volatility in the broader cryptocurrency market.

View current TEVA market price

TEVA Market Sentiment Index

2025-12-26 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index plummeting to 20. This reading suggests heightened market anxiety and risk aversion among investors. During such periods, volatility typically increases as traders rush to secure positions. However, extreme fear can also present contrarian opportunities for long-term investors seeking advantageous entry points. Market participants should exercise caution while monitoring support levels and macroeconomic factors. Stay informed through Gate.com's comprehensive market data tools to navigate this turbulent landscape effectively.

TEVA Holdings Distribution

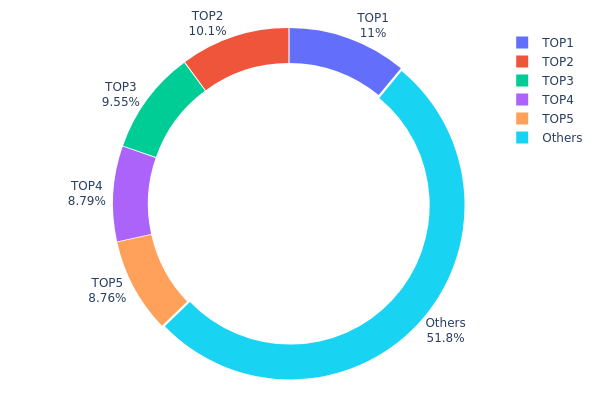

The address holdings distribution represents the concentration of TEVA tokens across the blockchain, illustrating how token ownership is segmented among different wallet addresses. This metric serves as a critical indicator of decentralization and market structure, revealing whether token supply is widely dispersed or concentrated among a limited number of holders.

Current analysis of TEVA's top five addresses reveals a moderately concentrated distribution pattern. The leading address holds 11.02% of total supply, followed by addresses controlling 10.10%, 9.55%, 8.78%, and 8.75% respectively. Collectively, these five addresses command approximately 48.2% of all TEVA tokens in circulation. While the remaining 51.8% is distributed among other addresses, the substantial concentration in the top five holders suggests a degree of centralization risk that warrants attention from market participants.

This distribution structure presents meaningful implications for market dynamics and price stability. The concentration of nearly half the token supply among five addresses creates potential vulnerability to significant price movements should these major holders execute coordinated liquidations or accumulation strategies. However, the fact that the majority stake (51.8%) remains distributed among numerous smaller holders provides a degree of market resilience and reduces the likelihood of unilateral price manipulation. The current configuration indicates a market in transition between early-stage concentration and broader decentralization, reflecting typical patterns as projects mature and their token bases become increasingly distributed through trading activity and community acquisition.

Click to view current TEVA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 82350.32K | 11.02% |

| 2 | 0x18b0...281e9f | 75496.52K | 10.10% |

| 3 | 0x69be...6ee5e0 | 71359.12K | 9.55% |

| 4 | 0xb733...086a18 | 65622.77K | 8.78% |

| 5 | 0xd3e0...20cd97 | 65410.76K | 8.75% |

| - | Others | 386592.72K | 51.8% |

II. Core Factors Affecting TEVA's Future Price Trends

Competitive Market Dynamics

-

Generic Drug Competition: Teva's generic drug business faces intense competition from global pharmaceutical counterparts. The consolidation of customer bases and commercial alliances among customers continuously impacts generic drug sales. Additionally, competitors increasingly pursue market exclusivity for important generic drug versions in the United States, which may adversely affect Teva's revenue and profitability.

-

Regulatory Policy Changes: Changes in regulatory policies and the competitive landscape of other pharmaceutical companies can lead to declining revenues and profits in the generic drug segment. New non-proprietary product launches have experienced delays and may continue to be delayed.

-

Specialty Drug Competition: Teva's specialty pharmaceutical portfolio faces intense competition from companies with greater resources and capabilities.

Debt and Financial Risk

-

Substantial Debt Burden: As of December 31, 2020, Teva carries a substantial debt of USD 25.919 billion, which increases expenditures and limits the company's ability to assume additional debt or engage in other transactions. The company may need to raise additional capital in the future.

-

Credit Rating Risk: If major rating agencies further downgrade the company's credit rating, Teva may be unable to borrow at favorable amounts or terms.

-

Debt Reduction Progress: By Q1 2021, Teva reduced its net debt to USD 23.2 billion, indicating ongoing efforts to deleverage and improve financial health.

Asset Base and Operational Challenges

-

Asset Erosion: Total assets continued to shrink, declining to USD 50.64 billion by 2020, despite total liabilities decreasing from USD 26.908 billion to USD 25.919 billion.

-

Revenue Decline: Annual total revenue declined from USD 16.887 billion in 2019 to USD 16.659 billion in 2020, representing a year-over-year decline of 1.35% and marking the third consecutive decline since 2018.

-

Operational Risks: Public health crises, supply chain disruptions, manufacturing or quality control issues, data security breaches, and intellectual property challenges across different jurisdictions all pose risks to business operations.

Technology Development and Ecosystem Building

-

Biosimilar Pipeline: Teva has 11 biosimilar drugs in development, representing the largest portion of its pipeline. Key biosimilar projects include:

- HUMIRA (adalimumab) biosimilar: Co-developed with Icelandic biotech firm Alvotech, currently under regulatory review. This addresses the high cost burden of the original drug, which costs USD 2,984 per injector in the United States and approximately CNY 7,000 per injection in China.

- Prolia (denosumab) biosimilar: Entered Phase III clinical trials for osteoporosis treatment.

-

Innovative Drug Development: To address intense generic drug competition, Teva is developing innovative therapeutics:

- AJOVY (fremanezumab): A humanized monoclonal antibody for migraine prevention, expanding into Phase II trials for fibromyalgia treatment.

- AUSTEDO (deutetrabenazine): An innovative treatment for Huntington's disease-related chorea and tardive dyskinesia, with Phase III trials ongoing for movement disorder cerebral palsy.

- Fasinumab (co-developed with Regeneron): A humanized NGF monoclonal antibody for osteoarthritis pain, currently in Phase III trials.

-

Novel Drug Formats: The pipeline includes 10 novel biologics and 2 inhalation drugs, with 28 total research projects covering indications including migraine, schizophrenia, gastrointestinal disorders, movement disorders, inflammatory pain, respiratory diseases, and oncology.

-

Core Product Performance:

- Truxima (rituximab biosimilar): Market share increased to 26%.

- COPAXONE (glatiramer acetate): Remains a leading multiple sclerosis treatment in North America and Europe despite revenue pressure.

- Generic and specialty drug portfolio: North American generic product revenues continue to support overall performance.

III. TEVA Price Forecast 2025-2030

2025 Outlook

- Conservative Forecast: $0.00114 - $0.00154

- Neutral Forecast: $0.00154

- Bullish Forecast: $0.00184 (requires positive market sentiment and increased adoption)

Mid-term Forecast (2026-2028)

- Market Phase Expectation: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Predictions:

- 2026: $0.001 - $0.00218

- 2027: $0.00139 - $0.00209

- 2028: $0.00137 - $0.00229

- Key Catalysts: Ecosystem development expansion, institutional interest growth, and improved market liquidity

Long-term Outlook (2029-2030)

- Base Case: $0.00179 - $0.00310 (assuming steady market adoption and stable macroeconomic conditions)

- Bullish Case: $0.00310 (assuming accelerated ecosystem maturation and increased institutional participation)

- Transformative Case: $0.00310+ (extreme favorable conditions including breakthrough technological developments and mainstream adoption)

- Performance Trajectory: TEVA demonstrates cumulative gains of approximately 70% by 2030 from 2025 baseline, reflecting moderate long-term value appreciation

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00184 | 0.00154 | 0.00114 | 0 |

| 2026 | 0.00218 | 0.00169 | 0.001 | 9 |

| 2027 | 0.00209 | 0.00193 | 0.00139 | 25 |

| 2028 | 0.00229 | 0.00201 | 0.00137 | 30 |

| 2029 | 0.0031 | 0.00215 | 0.00179 | 39 |

| 2030 | 0.0031 | 0.00263 | 0.0016 | 70 |

TEVA Token Investment Analysis Report

IV. TEVA Professional Investment Strategy and Risk Management

TEVA Investment Methodology

(1) Long-Term Holding Strategy

- Target Audience: Community-oriented gamers and Web3 enthusiasts interested in gaming ecosystems

- Operational Recommendations:

- Dollar-cost averaging (DCA) approach to accumulate TEVA tokens over time, reducing timing risk given the token's -88.97% one-year decline

- Monitor Tevaera's development milestones, including new Web3 game releases and Teva Chain updates

- Maintain a minimum 12-24 month holding horizon to benefit from ecosystem maturation

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current price at $0.001539 with 24H range of $0.001488-$0.001568; historical resistance at ATH of $0.075043 (January 3, 2025)

- Moving Averages: Apply 7-day and 30-day MA to identify trend direction, given recent 4.47% 7-day gain amid longer-term decline

- Swing Trading Key Points:

- Enter positions near historical lows ($0.001434, December 19, 2025) with defined stop losses

- Take partial profits upon 15-25% gains in volatile market conditions

TEVA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Active Investors: 3-7% of crypto portfolio allocation

- Professional Investors: 5-10% of crypto portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine TEVA holdings with established gaming tokens and mainstream cryptocurrencies to reduce single-asset risk

- Stablecoin Reserves: Maintain 20-30% of gaming portfolio allocation in stablecoins for opportunistic entry points during market downturns

(3) Secure Storage Solutions

- Hot Wallet Options: Gate.com Web3 Wallet for frequent trading and earning opportunities within the Tevaera ecosystem

- Cold Storage Approach: For long-term TEVA holders, consider secure storage methods with offline backup of private keys

- Security Best Practices: Enable multi-factor authentication, use unique passwords, never share private keys, and verify contract addresses on Base blockchain (0x00309d634d11541b857f927be91ad2f0bd78894c)

V. TEVA Potential Risks and Challenges

TEVA Market Risk

- Extreme Price Volatility: TEVA has experienced -88.97% decline over the past year, indicating significant downside risk despite recent recovery signs

- Liquidity Constraints: 24-hour trading volume of only $13,963.85 with 3 exchange listings suggests limited liquidity for large position exits

- Low Market Capitalization: At $1.15M circulating market cap against $6.16M fully diluted valuation, TEVA remains a micro-cap asset with high execution risk

TEVA Regulatory Risk

- Gaming Industry Scrutiny: Web3 gaming tokens face increasing regulatory examination regarding game mechanics and player protections across multiple jurisdictions

- Cryptocurrency Market Regulation: Broader crypto regulations in major markets could impact TEVA's accessibility and trading conditions

TEVA Technology Risk

- ZK Stack Integration: Dependency on ZK Stack and AI technologies requires continuous development and security audits to maintain platform functionality

- Teva Chain Execution: The success of multi-genre Web3 games and gaming agents relies on Teva Chain's scalability and reliability

- Smart Contract Risk: TEVA operates on Base blockchain; vulnerabilities in smart contracts could expose investors to security breaches

VI. Conclusion and Action Recommendations

TEVA Investment Value Assessment

Tevaera presents a speculative opportunity in the gaming-focused Web3 space with strong community foundations (over one million Soulbound players) and innovative technology integration. However, the token's -88.97% one-year performance and micro-cap status indicate substantial volatility and risk. The recent 4.47% weekly gain suggests potential sentiment shifts, but investors should view TEVA as a high-risk, high-reward asset suitable only for risk-tolerant portfolios with allocated research capacity.

TEVA Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of crypto allocation) through dollar-cost averaging via Gate.com, focusing on understanding the Tevaera ecosystem before increasing exposure

✅ Experienced Investors: Consider tactical accumulation near support levels ($0.001434-$0.001500) while monitoring ecosystem development milestones; implement strict stop-loss discipline at -20% from entry

✅ Institutional Investors: Conduct comprehensive due diligence on Tevaera's game development pipeline and Teva Chain technical specifications before considering allocation; evaluate market-making opportunities given low liquidity conditions

TEVA Trading Participation Methods

- Gate.com Spot Trading: Direct TEVA purchase and sale with real-time price discovery

- Limit Orders: Set buy orders near resistance levels and sell orders at predetermined profit targets to optimize entry and exit

- Ecosystem Participation: Engage with Tevaera's Web3 games and Soulbound player communities to evaluate intrinsic value before capital deployment

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Teva stock a good buy now?

Yes, Teva stock shows strong potential with analyst consensus rating of "Strong Buy" and a 12-month price target of $32.11, indicating positive growth opportunities ahead.

What is the price prediction for TEVA in 2025?

Based on current market analysis, TEVA is predicted to reach approximately $31.24 by the end of 2025, indicating a modest upward movement and positive growth trajectory for the year.

Is TEVA a good long-term investment?

TEVA demonstrates moderate long-term potential with improving operational efficiency. While facing debt challenges, its generic drug portfolio provides stable cash flows. Strategic cost management and market positioning suggest cautious optimism for patient long-term investors seeking healthcare sector exposure.

Will Teva stock ever recover?

Yes, Teva stock has potential to recover. Despite recent 14% decline following weak forecasts, the company's strong 80% gain in 2024 shows market confidence. Recovery depends on improved financial performance, cost management, and market conditions. Long-term prospects remain viable for patient investors.

What are the main factors affecting TEVA stock price?

TEVA stock price is primarily influenced by free cash flow trends, pharmaceutical product demand, investor sentiment, pipeline development progress, and overall market conditions in the healthcare sector.

What are the risks and challenges facing Teva Pharmaceutical?

Teva Pharmaceutical faces legal disputes, pricing pressures from generic competition, regulatory challenges, and market competition. These factors impact profitability and market share growth.

2025 PIXEL Price Prediction: Expert Analysis and Market Forecast for Google's Revolutionary AI Chip Token

2025 PORTAL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 FOREST Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 ELIX Price Prediction: Expert Analysis and Market Forecast for the Next Year

2025 TICO Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

2025 LOE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps