2025 XZK Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of XZK

Expand (XZK) operates as a universal ZK SDK that enhances the scalability, interoperability, and security of all L1 and L2 blockchains. Since its launch in 2024, the project has established itself as a foundational infrastructure layer for Web3. As of January 2026, XZK has a fully diluted market valuation of $495,100, with a circulating supply of approximately 252.2 million tokens and a current price hovering around $0.0004951. This asset, recognized as a "Web3 base layer infrastructure provider," plays an increasingly critical role in enabling developers to build blockchain applications with reduced costs, seamless scaling capabilities, secure cross-chain interactions, and protection of users' on-chain identity.

This article will provide a comprehensive analysis of XZK's price trajectory, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors throughout 2026 and beyond.

I. XZK Price History Review and Market Status

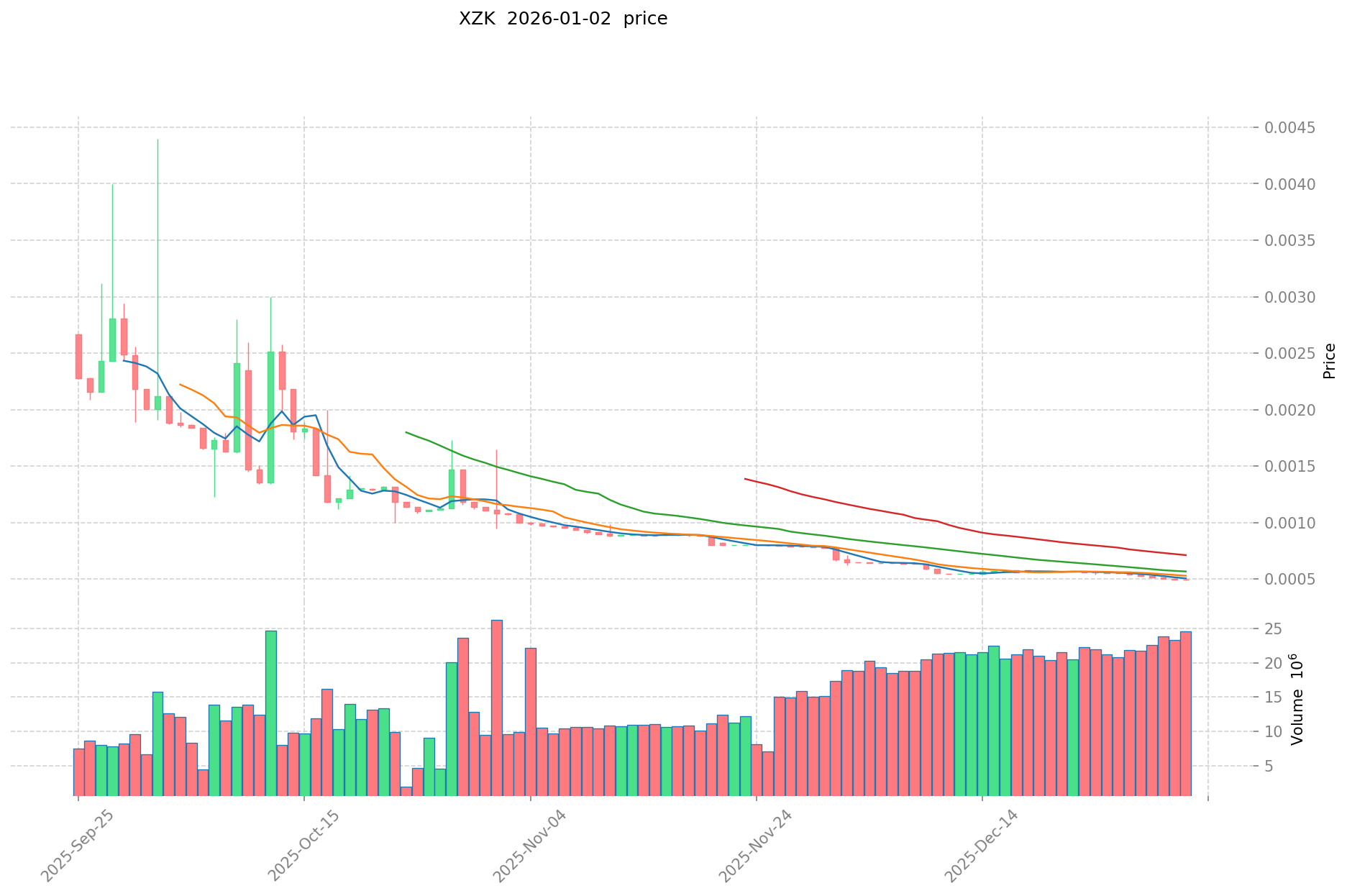

XZK Historical Price Evolution Trajectory

- June 2024: Project launch, initial price of $0.15 with peak price reaching $0.42399 on June 18, 2024

- 2024-2026: Significant market correction, price declined from historical high of $0.42399 to current levels, representing a decline of approximately 98.36% over the one-year period

- January 2026: Price reached historical low of $0.0004938 on January 1, 2026, approaching current trading levels

XZK Current Market Status

As of January 3, 2026, XZK is trading at $0.0004951, with a 24-hour trading volume of approximately $12,000.93. The token demonstrates minimal price movement in the short term, with a 1-hour change of +0.24% and a 24-hour change of +0.24%. However, the broader trend remains significantly negative, with a 7-day decline of -9.95% and a 30-day decline of -23.43%.

The token's market capitalization stands at $124,862.28, with a fully diluted valuation of $495,100. The circulating supply comprises 252,196,073 tokens out of a total supply of 1,000,000,000 tokens, representing 25.22% circulation. XZK maintains a market dominance of 0.000015%, ranking 4,660 among all cryptocurrency assets. The token currently has 13,254 holders and is listed on a limited number of exchanges.

Market sentiment indicators suggest a cautious environment, reflecting broader market conditions. The token's performance over the past year underscores the challenging conditions faced by many blockchain projects in the crypto market.

Click to view current XZK market price

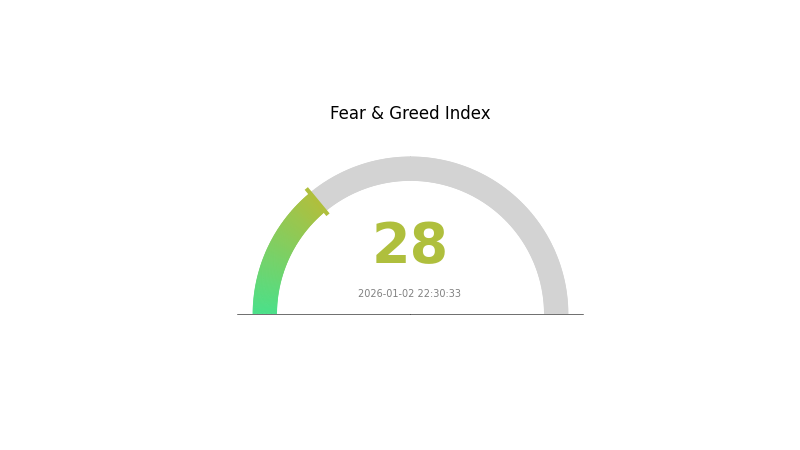

XZK Market Sentiment Indicator

2026-01-02 Fear and Greed Index: 28 (Fear)

Click to view current Fear & Greed Index

The crypto market is currently showing significant fear sentiment with an index reading of 28. This indicates heightened anxiety among investors, reflecting market uncertainty and potential sell-off pressures. During fear phases, risk-averse traders typically reduce positions while contrarian investors may view extreme fear as a buying opportunity. Market participants should exercise caution and conduct thorough analysis before making trading decisions. Monitor macroeconomic factors and technical levels closely as sentiment shifts can rapidly impact price movements. The current fear environment suggests conservative position sizing may be prudent.

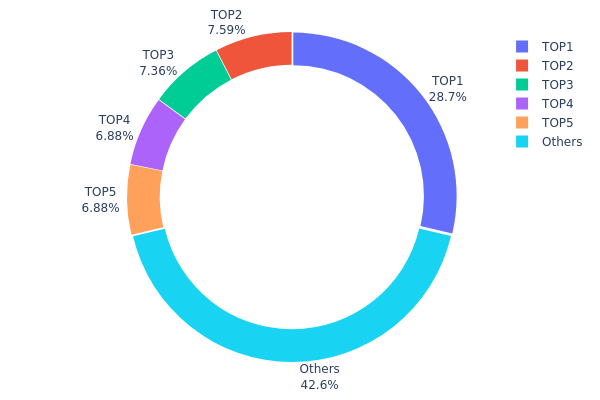

XZK Holdings Distribution

The address holdings distribution chart illustrates the concentration of XZK tokens across blockchain addresses, revealing the ownership structure and potential market dynamics. This metric tracks the top holders and their respective token quantities, providing critical insights into token concentration levels and the degree of decentralization within the network.

XZK currently exhibits pronounced concentration characteristics, with the top five addresses controlling approximately 57.36% of the total token supply. The leading address (0x7c01...b21056) alone commands 28.68% of all tokens, representing a significant concentration point that warrants attention. The second and third-largest holders maintain positions of 7.58% and 7.36% respectively, while addresses ranked four and five each hold 6.87%. This distribution pattern indicates a relatively high degree of token concentration among major stakeholders, with the remaining 42.64% dispersed among other addresses.

Such concentration levels present notable implications for market structure and price dynamics. The dominance of a single address holding nearly one-third of circulating tokens creates potential vulnerability to significant price volatility, as coordinated movements or liquidations from major holders could substantially impact market pricing. The moderate decentralization beyond the top five addresses suggests that while some distribution exists, the token's supply architecture remains influenced by a limited number of stakeholders. This structural characteristic indicates that XZK's on-chain stability depends considerably on the actions and intentions of principal token holders, potentially affecting price discovery mechanisms and market resilience during periods of heightened volatility.

Visit XZK Holdings Distribution for current data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7c01...b21056 | 286838.12K | 28.68% |

| 2 | 0x0eb2...b79b79 | 75875.00K | 7.58% |

| 3 | 0xbcac...bc25d6 | 73614.66K | 7.36% |

| 4 | 0x91af...c83fa6 | 68750.00K | 6.87% |

| 5 | 0x4b6e...5e1d26 | 68750.00K | 6.87% |

| - | Others | 426172.22K | 42.64% |

II. Core Factors Influencing XZK's Future Price

Technology Development and Ecosystem Building

-

Universal ZK SDK Architecture: Mystiko Network operates as a universal zero-knowledge (ZK) SDK, significantly enhancing blockchain scalability, interoperability, and security. This core technology enables developers to build blockchain applications with reduced costs, easier scalability, and secure cross-chain interactions while maintaining user data privacy.

-

Zero-Knowledge Proof Technology: The platform leverages advanced cryptographic protocols and decentralized mechanisms to ensure transaction privacy and security. Zero-Knowledge Proofs allow transaction verification without exposing sensitive information, keeping underlying data hidden from public view while maintaining accuracy.

-

Ecosystem Applications: XZK serves as the native functional and governance token for Mystiko Network. Token holders can stake XZK to become ZK-Rollup miners or relayers, facilitating transaction batching and gas fee payments on target chains. This staking mechanism incentivizes active network participation, ensuring network security and efficiency.

-

Development Incentive Program: Mystiko Network launched an incentive program valued at $5 million USD in XZK tokens to support innovative blockchain application development on its platform. This initiative aims to accelerate ZK technology innovation and ecosystem expansion, providing financial and technical support to qualified projects.

Disclaimer: This article is provided for informational purposes only and does not constitute investment advice. Cryptocurrency investments carry high risks. Please consult with professional financial advisors before making investment decisions. Check the latest market data on Gate.com.

III. 2026-2031 XZK Price Forecast

2026 Outlook

- Conservative Forecast: $0.00043-$0.00049

- Neutral Forecast: $0.00049-$0.00067

- Optimistic Forecast: $0.00067 (requires sustained market stability and positive ecosystem developments)

2027-2029 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation phase with moderate growth trajectory, supported by increasing adoption and market maturation

- Price Range Predictions:

- 2027: $0.00056-$0.00074 (17% upside potential)

- 2028: $0.00050-$0.00094 (33% upside potential)

- 2029: $0.00078-$0.00118 (61% upside potential)

- Key Catalysts: Protocol upgrades, ecosystem expansion, institutional adoption, and positive regulatory developments

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00073-$0.00147 (99% upside potential by 2030, assuming continued market development and steady adoption)

- Optimistic Scenario: $0.00110-$0.00147 (significant network growth and mainstream integration achieved)

- Transformative Scenario: $0.00137-$0.00147 (148% cumulative gains by 2031, contingent on breakthrough technological innovations and mass market adoption)

- 2031-12-31: XZK trading at $0.00123 average price (sustained bull market phase with consolidation patterns)

Disclaimer: These forecasts are based on historical trend analysis and market modeling. Actual price movements may vary significantly based on macroeconomic conditions, regulatory changes, and unexpected market events. Investors are advised to conduct independent research and risk assessment before making investment decisions through platforms like Gate.com.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00067 | 0.00049 | 0.00043 | 0 |

| 2027 | 0.00074 | 0.00058 | 0.00056 | 17 |

| 2028 | 0.00094 | 0.00066 | 0.0005 | 33 |

| 2029 | 0.00118 | 0.0008 | 0.00078 | 61 |

| 2030 | 0.00147 | 0.00099 | 0.00073 | 99 |

| 2031 | 0.00137 | 0.00123 | 0.0011 | 148 |

XZK Investment Strategy and Risk Management Report

IV. XZK Professional Investment Strategy and Risk Management

XZK Investment Methodology

(1) Long-term Holding Strategy

- Suitable investors: Developers and blockchain infrastructure enthusiasts who believe in zero-knowledge proof technology adoption across L1 and L2 blockchains

- Operational recommendations:

- Accumulate XZK tokens during market downturns when sentiment is negative, focusing on the project's utility as a universal ZK SDK

- Set a long-term holding period of 2-3 years to allow the underlying technology to mature and gain market adoption

- Rebalance your portfolio quarterly to maintain desired allocation levels

(2) Active Trading Strategy

- Technical analysis tools:

- Support and Resistance Levels: Identify key price levels at $0.0004938 (all-time low) and $0.42399 (all-time high) to determine entry and exit points

- Moving Averages: Use 50-day and 200-day moving averages to identify trend direction and potential reversal points

- Wave trading key points:

- Monitor 24-hour and 7-day price volatility; the 7-day decline of -9.95% suggests potential accumulation opportunities

- Execute trades during periods of increased volume (current 24-hour volume: $12,000.93) to ensure adequate liquidity

XZK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of total crypto portfolio

- Active investors: 3-5% of total crypto portfolio

- Professional investors: 5-10% of total crypto portfolio allocation, with hedging strategies

(2) Risk Hedging Solutions

- Dollar-cost averaging (DCA): Invest fixed amounts at regular intervals to reduce the impact of price volatility and timing risk

- Position sizing: Limit individual XZK holdings to a percentage that won't significantly impact overall portfolio performance during extreme market movements

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 wallet is recommended for active traders who need frequent access to XZK tokens for trading on Gate.com

- Cold storage approach: Transfer XZK to secure offline storage for long-term holdings beyond 6 months

- Security precautions: Enable two-factor authentication on all exchange accounts, use hardware-backed key storage when possible, and never share private keys or seed phrases

V. XZK Potential Risks and Challenges

XZK Market Risks

- Extreme price volatility: XZK has experienced a -98.36% decline over one year and trades at $0.0004951, far below its all-time high of $0.42399, indicating significant liquidity and valuation risks

- Low trading volume: Daily volume of $12,000.93 suggests limited market depth and potential difficulties when executing large trades

- Market sentiment dependency: With only 13,254 token holders and a market cap of $124,862.28, XZK is highly vulnerable to sentiment shifts and whale movements

XZK Regulatory Risks

- Classification uncertainty: The regulatory status of zero-knowledge proof tokens remains ambiguous in many jurisdictions, potentially exposing investors to regulatory changes

- Compliance challenges: As privacy-enabling technology, regulatory scrutiny on ZK-focused projects may increase, potentially impacting token utility and value

- Jurisdictional restrictions: Certain countries may restrict or ban access to privacy-focused blockchain infrastructure, limiting XZK's addressable market

XZK Technical Risks

- Smart contract vulnerability: The ERC-20 implementation may contain undetected security flaws that could result in token loss or theft

- Protocol adoption risk: Successful implementation depends on mainstream adoption by L1 and L2 blockchains, which remains uncertain

- Competition from established solutions: Other ZK infrastructure projects may outpace Mystiko's development, reducing competitive advantage and market share

VI. Conclusions and Action Recommendations

XZK Investment Value Assessment

XZK represents a high-risk, high-reward opportunity in the zero-knowledge proof infrastructure space. While the underlying technology addresses critical blockchain challenges around scalability, interoperability, and security, the token has experienced devastating losses over the past year, declining 98.36% from its peak. Current extremely low trading volume and limited token holders suggest a nascent market with substantial execution risk. The project's success depends heavily on mainstream blockchain adoption of its ZK SDK, which remains unproven. This token is suitable only for speculative investors with high risk tolerance and a multi-year investment horizon.

XZK Investment Recommendations

✅ Beginners: Avoid direct XZK investment; instead, gain exposure to ZK technology through larger, more established blockchain infrastructure projects with proven adoption metrics ✅ Experienced investors: Consider small speculative positions (1-3% of crypto holdings) using dollar-cost averaging, with clear exit rules if the project fails to achieve SDK adoption milestones ✅ Institutional investors: Conduct extensive technical due diligence on the Mystiko protocol before any allocation; consider only if the project demonstrates concrete enterprise or protocol partnerships

XZK Trading Participation Methods

- Via Gate.com spot trading: Purchase and sell XZK directly against stablecoins with real-time price discovery and transparent order books

- Through Gate.com Web3 Wallet: Hold XZK for long-term positions while maintaining full custody and security control over private keys

- Gradual accumulation strategy: Use limit orders on Gate.com to systematically build positions at predetermined price levels without moving the market

Cryptocurrency investment carries extreme risk and volatility. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Consult qualified financial professionals before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

What is the current price of XZK token, and what are its all-time high and all-time low prices?

XZK current price is $0.000493. All-time high is BTC0.052864, all-time low is BTC0.085494. Price is down 99.70% from peak levels.

What are the main factors affecting XZK price?

XZK price is influenced by supply and demand dynamics, market sentiment, technological developments, and overall crypto market trends. Regulatory changes and investor confidence also significantly impact its price movements.

How to conduct XZK price prediction, what analysis methods and tools are available?

XZK price prediction utilizes technical analysis, market trends, and historical data examination. Key tools include TradingView and CoinMarketCap for comprehensive analysis. 2026-2027 price predictions range from $0.00057 to $0.0011 based on market dynamics and trading volume indicators.

What will be XZK's future price trend development?

XZK is projected to range from $0.00055237 to $0.001033721 in 2025. Medium-term forecasts suggest $0.00064664574975 to $0.001420661116875 by 2027-2028. Long-term, optimistic scenarios predict XZK could reach $0.00188843544244 by 2030, driven by increased adoption of its universal ZK SDK technology.

What are the risks to pay attention to when investing in XZK tokens?

XZK token investments carry market volatility risk, regulatory uncertainty, and technology risk. Token value may fluctuate significantly. Investors should conduct thorough research before participating.

What are the advantages or disadvantages of XZK compared to similar tokens?

XZK stands out with strong community engagement and sustainable branding approach. However, it faces challenges in adoption compared to established tokens. Its niche positioning may limit broader market penetration, though it maintains consistent performance during market volatility.

What is the difference between competitive analysis and product experience analysis?

What is ZKJ: A Comprehensive Guide to Zero-Knowledge Proof Technology and Its Applications

What is KOS: Understanding the Keep Out Symbol in Safety Signage

What is VFY: A Comprehensive Guide to Virtual Financial Yield and Its Applications in Modern Investment Strategies

Is Kontos (KOS) a good investment?: A Comprehensive Analysis of Market Performance, Tokenomics, and Future Potential

What is Lagrange (LA) token: whitepaper logic, use cases, and technical innovation analysis?

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps