Is Kintsugi (KINT) a good investment?: A Comprehensive Analysis of Price Potential, Risk Factors, and Market Outlook

Introduction: Kintsugi (KINT) Investment Position and Market Prospects

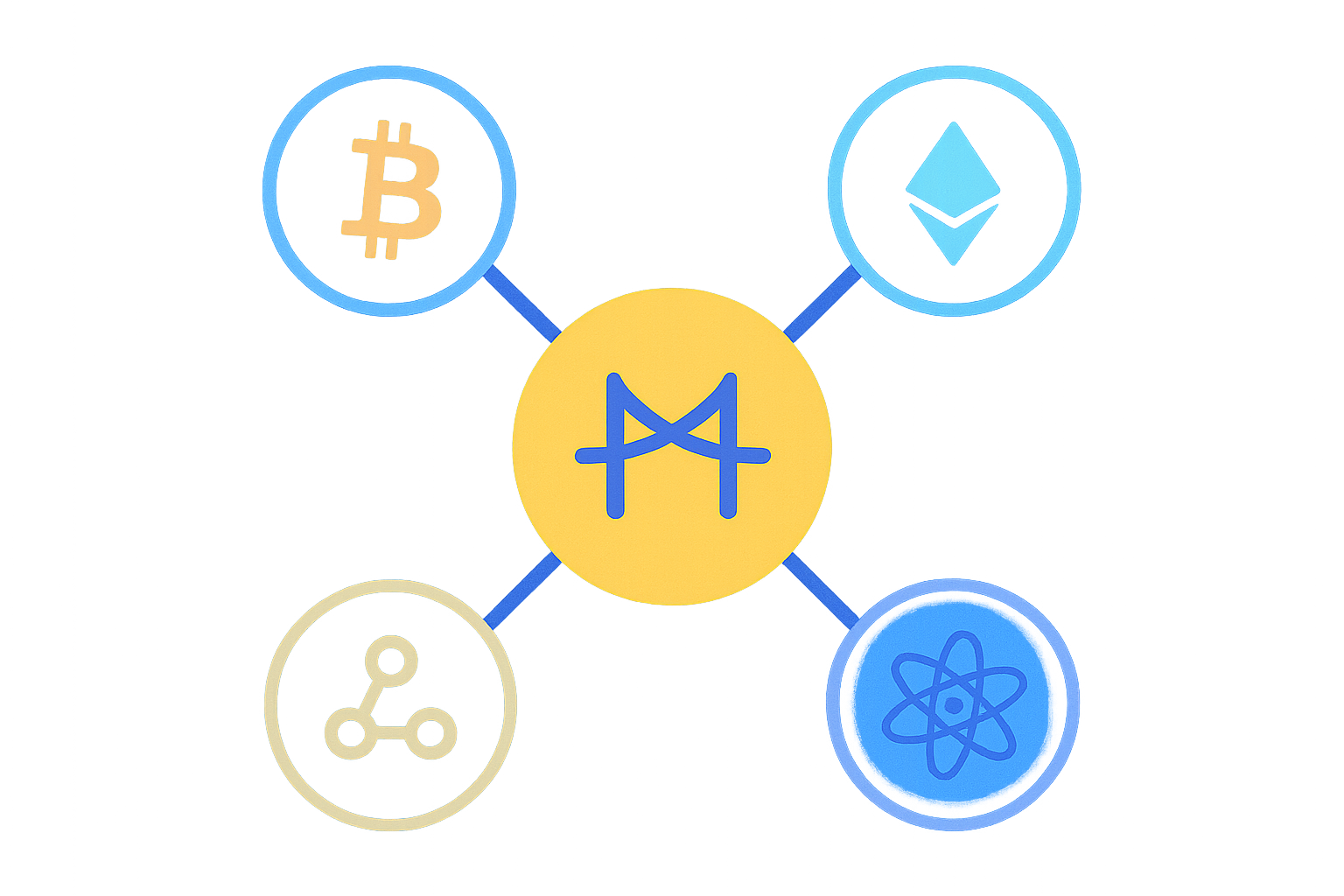

Kintsugi (KINT) is a decentralized network asset dedicated to connecting cryptocurrencies such as Bitcoin with DeFi platforms like Kusama. As of January 4, 2026, KINT maintains a market capitalization of approximately $82,388.54, with a circulating supply of 3,696,210.99 KINT tokens and a current price hovering around $0.02229. The token serves dual functions as both a governance instrument and utility token within the Kintsugi ecosystem, which operates as a Kusama parachain and is designed to bridge connections with Polkadot, Cosmos, Ethereum, and other major DeFi networks.

Despite its modest current market position (ranked 5,115 by market cap), KINT presents an interesting case study for cryptocurrency investors. The token has experienced significant volatility since its inception, reaching an all-time high of $65.42 on January 7, 2022, before declining to recent lows near $0.01539 by January 2, 2026, representing a one-year loss of approximately 95.98%. However, recent price action shows modest recovery momentum, with a 24-hour gain of 18.75% as of the latest update.

This article provides a comprehensive analysis of KINT's investment value proposition, historical price dynamics, forward-looking price forecasts, and associated investment risks. The analysis aims to equip investors with evidence-based insights to inform their assessment of whether Kintsugi represents a viable investment opportunity within the broader cryptocurrency market landscape.

Kintsugi (KINT) Crypto Asset Research Report

I. Kintsugi (KINT) Price History Review and Current Investment Value

Historical Price Performance and Investment Returns

Based on available data, KINT reached its all-time high (ATH) of $65.42 on January 7, 2022, followed by a significant decline over the subsequent period. The token has experienced substantial long-term depreciation, with a 1-year return of -95.98%, reflecting a dramatic contraction in value from its peak.

The all-time low (ATL) of $0.01539001 was recorded on January 2, 2026, indicating extreme price compression within a narrow trading range during recent market conditions.

Current Market Status (January 4, 2026)

Price Metrics:

- Current Price: $0.02229

- 24-Hour Change: +18.75%

- 7-Day Change: +7.16%

- 30-Day Change: +10.29%

- 1-Year Change: -95.98%

Market Capitalization Data:

- Circulating Market Cap: $82,388.54

- Fully Diluted Valuation (FDV): $222,900.00

- Circulating Supply: 3,696,210.996 KINT

- Total Supply: 10,000,000 KINT

- Max Supply: Unlimited

- Market Dominance: 0.0000068%

Trading Activity:

- 24-Hour Trading Volume: $10,445.08

- Price Range (24H): $0.01855 (low) to $0.025 (high)

- Market Emotion Indicator: Neutral (1)

Liquidity Metrics:

- Circulating Supply Ratio: 36.96% of total supply

- Market Cap to FDV Ratio: 36.96%

Current real-time KINT price data available at Gate

II. Project Overview and Fundamental Architecture

Network Description

Kintsugi is a decentralized network designed to establish interoperability between Bitcoin and other cryptocurrencies with DeFi platforms. The network operates as a Kusama parachain and is planned for integration with Polkadot, Cosmos, Ethereum, and other major DeFi ecosystems.

KINT Token Utility and Functions

I. Governance Functions: KINT token holders participate in protocol governance by voting on governance proposals and electing council members responsible for operational decisions.

II. Medium-Term Utility Applications: Kintsugi is designed to support transaction fee payments and support for additional digital assets beyond KSM (Kusama token) within its ecosystem.

III. Market Position and Ranking

- Global Market Ranking: #5115

- Listed Exchanges: 1

- Network: KINTSUGI mainnet

IV. Technical Resources and Community Channels

Official Platforms:

- Website: https://kintsugi.interlay.io/

- Block Explorer: https://kintsugi.subscan.io/account/0x000c

- GitHub Repository: https://github.com/interlay/interbtc

- Twitter: https://twitter.com/kintsugi_btc

Smart Contract:

- Chain: KINTSUGI

- Contract Address: 0x000c

Disclaimer

This report presents factual market data and project information based on available sources as of January 4, 2026. This analysis does not constitute investment advice, financial guidance, or recommendations for asset purchases or sales. Cryptocurrency markets are highly volatile and subject to significant price fluctuations. Investors should conduct independent research and consult qualified financial advisors before making investment decisions.

Kintsugi (KINT) Investment Analysis Report

Report Date: January 4, 2026

I. Executive Summary

Kintsugi (KINT) is a decentralized network designed to connect cryptocurrencies such as Bitcoin with DeFi platforms including Kusama. Operating as a Kusama parachain with planned connections to Polkadot, Cosmos, Ethereum, and other major DeFi networks, KINT serves governance and utility functions within the ecosystem.

Current Market Position (as of January 4, 2026):

- Current Price: $0.02229

- Market Capitalization: $82,388.54

- Circulating Supply: 3,696,210.996 KINT (36.96% of total supply)

- Total Supply: 10,000,000 KINT

- 24-hour Volume: $10,445.08

- Market Ranking: #5115

II. Core Factors Influencing KINT Investment Prospects

Supply Mechanism and Scarcity

The KINT token operates with a total supply cap of 10,000,000 tokens, with approximately 3.7 million currently in circulation. This represents a circulating supply ratio of 36.96%, indicating substantial room for supply expansion as the network matures.

Historical Context:

- All-Time High (ATH): $65.42 (January 7, 2022)

- All-Time Low (ATL): $0.01539001 (January 2, 2026)

- Current price represents a -95.98% decline from ATH over the past year

The significant distance between current price and historical lows suggests the token has recently approached extreme valuation levels, which may impact future scarcity dynamics.

Technology and Ecosystem Development

Core Functionality:

- Governance: KINT holders vote on governance proposals and elect council members responsible for operational decisions

- Utility: Kintsugi plans to support transaction fee payments and other digital assets beyond KSM in the medium term

Network Architecture: Kintsugi operates as a Kusama parachain with planned integration across multiple blockchain networks:

- Polkadot

- Cosmos

- Ethereum

- Other major DeFi networks

This multi-chain strategy positions the protocol to bridge fragmented DeFi ecosystems, potentially expanding its utility and user base.

III. Price Performance and Market Dynamics

Recent Price Trends

| Time Period | Change Percentage | Price Movement |

|---|---|---|

| 1 Hour | +3.96% | +$0.000849 |

| 24 Hours | +18.75% | +$0.003519 |

| 7 Days | +7.16% | +$0.001489 |

| 30 Days | +10.29% | +$0.002080 |

| 1 Year | -95.98% | -$0.532188 |

Analysis: Short-term price action shows positive momentum across 1-hour to 30-day timeframes, with the strongest gains appearing in the 24-hour period (+18.75%). However, this must be contextualized against severe long-term depreciation over the past twelve months.

Trading Activity

24-hour trading volume stands at $10,445.08, reflecting relatively modest liquidity. The market dominance of KINT remains negligible at 0.0000068%, indicating minimal systemic importance within broader cryptocurrency markets.

IV. Investment Outlook Summary

Short-term Sentiment: Mixed signals with recent positive price momentum (+18.75% in 24 hours) contrasting against extremely depressed valuation levels

Long-term Context: Significant structural challenges evident from -95.98% annual decline and current price proximity to historical lows

Market Condition: Ranked #5115 by market capitalization, indicating limited mainstream adoption and market liquidity

V. Key Resources

- Official Website: https://kintsugi.interlay.io/

- Block Explorer: https://kintsugi.subscan.io/account/0x000c

- Social Media: https://twitter.com/kintsugi_btc

- Repository: https://github.com/interlay/interbtc

Disclaimer: This report presents factual market data and technical information. Investment decisions should be based on individual risk assessment and thorough due diligence.

III. KINT Future Investment Predictions and Price Outlook (Is Kintsugi(KINT) worth investing in 2026-2031)

Short-term Investment Prediction (2026, short-term KINT investment outlook)

- Conservative forecast: $0.01761 - $0.02229

- Neutral forecast: $0.02229 - $0.02563

- Optimistic forecast: $0.02563 and above

Mid-term Investment Outlook (2027-2029, mid-term Kintsugi(KINT) investment forecast)

-

Market phase expectation: KINT is positioned in the early recovery phase with gradual network expansion and cross-chain bridge development. The project aims to enhance interoperability between major DeFi platforms including Polkadot, Cosmos, and Ethereum.

-

Investment return predictions:

- 2027: $0.01222 - $0.02756 (anticipated 7% increase)

- 2028: $0.02344 - $0.03091 (anticipated 15% increase)

- 2029: $0.02352 - $0.03740 (anticipated 27% increase)

-

Key catalysts: Successful deployment of multi-chain bridge infrastructure, increased adoption of KINT for transaction fee payments, governance token utility expansion, and enhanced integration with major DeFi ecosystems.

Long-term Investment Outlook (Is Kintsugi a good long-term investment?)

-

Base case scenario: $0.02695 - $0.03813 USD (assuming steady network development and moderate market adoption of cross-chain solutions)

-

Optimistic scenario: $0.03550 - $0.04813 USD (assuming significant growth in interoperability solutions and expanded DeFi integration across multiple blockchain networks)

-

Risk scenario: $0.01222 - $0.02352 USD (under conditions of stalled ecosystem development, reduced market interest in cross-chain protocols, or competitive pressures from alternative solutions)

Click to view KINT long-term investment and price predictions: Price Prediction

2026-2031 Long-term Outlook

-

Base case scenario: $0.02352 - $0.03813 USD (corresponding to steady network development and gradual mainstream adoption of cross-chain solutions)

-

Optimistic scenario: $0.03550 - $0.04813 USD (corresponding to large-scale adoption of interoperability solutions and favorable market conditions)

-

Transformative scenario: $0.04813 USD and above (such as breakthrough progress in ecosystem development and mainstream proliferation of cross-chain protocols)

-

2031-12-31 predicted high point: $0.03727 USD (based on optimistic development assumptions)

Disclaimer: This analysis is based on available market data and historical trends. It does not constitute investment advice. Cryptocurrency markets are highly volatile and unpredictable. All forecasts carry inherent uncertainty and should not be relied upon as the sole basis for investment decisions. Past performance does not guarantee future results.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.0256335 | 0.02229 | 0.0176091 | 0 |

| 2027 | 0.0275560125 | 0.02396175 | 0.0122204925 | 7 |

| 2028 | 0.0309106575 | 0.02575888125 | 0.0234405819375 | 15 |

| 2029 | 0.037401895575 | 0.028334769375 | 0.02351785858125 | 27 |

| 2030 | 0.038127265671 | 0.032868332475 | 0.0269520326295 | 47 |

| 2031 | 0.03727268902665 | 0.035497799073 | 0.02378352537891 | 59 |

Kintsugi (KINT) Research Report

I. Project Overview

Basic Information

Kintsugi is a decentralized network dedicated to connecting cryptocurrencies such as Bitcoin with DeFi platforms such as Kusama. The Kintsugi network is hosted in the form of a Kusama parachain and will be connected to Polkadot, Cosmos, Ethereum, and other major DeFi networks.

Token Details:

- Token Name: KINT

- Current Price: $0.02229

- Market Capitalization: $82,388.54

- Circulating Supply: 3,696,210.99 KINT

- Total Supply: 10,000,000 KINT

- Maximum Supply: Unlimited

- Market Ranking: #5115

- Market Share: 0.0000068%

Core Functionality

The KINT token serves two primary purposes:

- Governance: KINT holders vote on governance proposals and elect council members to make operational decisions.

- Utility: In the medium term, Kintsugi will support transaction fee payments and other digital assets beyond KSM.

II. Market Performance Analysis

Current Price Metrics

| Metric | Value |

|---|---|

| Current Price | $0.02229 |

| 24H High | $0.025 |

| 24H Low | $0.01855 |

| All-Time High | $65.42 (January 7, 2022) |

| All-Time Low | $0.01539001 (January 2, 2026) |

| 24H Volume | $10,445.08 |

Price Performance

Recent Performance:

- 1-Hour Change: +3.96%

- 24-Hour Change: +18.75%

- 7-Day Change: +7.16%

- 30-Day Change: +10.29%

- 1-Year Change: -95.98%

Key Observations: The token shows significant short-term volatility with positive performance in the past 24 hours and 30-day periods. However, the one-year decline of 95.98% indicates substantial long-term depreciation from its all-time high of $65.42, reflecting the challenging market conditions experienced by the broader cryptocurrency sector and this project specifically.

III. Investment Strategy and Risk Management

Investment Methodology

- Long-term Holding (HODL KINT): Suitable for investors with conviction in the Polkadot/Kusama ecosystem and interoperability solutions. This approach requires patience given the significant decline from ATH.

- Active Trading: Dependent on technical analysis and swing trading strategies. The 24-hour volume of $10,445.08 suggests limited liquidity, which may constrain frequent trading opportunities.

Risk Management

Asset Allocation Considerations:

- Conservative Investors: Minimal allocation due to high volatility and market risk

- Aggressive Investors: Limited liquidity and ranking at #5115 suggest cautious position sizing

- Professional Investors: Diversification across multiple DeFi infrastructure plays recommended

Risk Mitigation Strategies:

- Multi-asset Portfolio: Combine with established Layer 1 or infrastructure tokens to reduce concentration risk

- Hedging: Consider positions in more liquid Polkadot ecosystem tokens as a hedge

- Safe Storage: Utilize cold wallets or hardware wallets (Ledger, Trezor) for long-term holdings; hot wallets only for active trading

IV. Investment Risks and Challenges

Market Risk

- High Volatility: 95.98% decline from ATH demonstrates extreme price fluctuations

- Low Liquidity: 24-hour volume of only $10,445.08 relative to market cap indicates potential slippage on larger trades

- Price Manipulation Risk: Limited trading volume on single exchange creates vulnerability to price movements

Regulatory Risk

- Uncertainty surrounding DeFi platform regulations across multiple jurisdictions (Polkadot ecosystem, Cosmos, Ethereum)

- Potential regulatory changes affecting cross-chain bridge protocols and asset wrapping mechanisms

Technology Risk

- Security vulnerabilities in cross-chain bridge infrastructure

- Dependency on Kusama parachain security and governance

- Integration risks with multiple blockchain networks

V. Conclusion: Is Kintsugi a Good Investment?

Investment Value Summary

Kintsugi operates in the cross-chain interoperability space, which addresses a significant need in the fragmented DeFi ecosystem. However, the token's 95.98% depreciation from its all-time high and current ranking at #5115 indicate limited market adoption and investor confidence. The project's utility depends on the successful adoption of interoperability solutions and the growth of connected DeFi platforms.

Investor Guidance

✅ Beginner Investors: If considering KINT exposure, employ dollar-cost averaging with minimal allocation; prioritize secure self-custody storage solutions.

✅ Experienced Traders: Swing trading opportunities may exist given short-term price volatility; maintain strict position sizing due to liquidity constraints.

✅ Institutional Investors: Strategic long-term allocation possible only if confident in Kusama/Polkadot ecosystem adoption; conduct comprehensive due diligence on technical development and partnerships.

⚠️ Disclaimer: Cryptocurrency investment carries substantial risk of total loss. This report is provided for informational purposes only and does not constitute investment advice. Conduct thorough independent research and consult qualified financial advisors before making investment decisions.

Report Date: January 4, 2026

Data Source: Gate Data

Language: English

Kintsugi (KINT) Frequently Asked Questions

VII. FAQ

Q1: What is Kintsugi (KINT) and what problem does it solve?

Answer: Kintsugi is a decentralized network designed to establish interoperability between Bitcoin, Kusama, and other major DeFi platforms including Polkadot, Cosmos, and Ethereum. The project addresses the fragmentation problem in cryptocurrency markets by creating cross-chain bridges that enable seamless asset transfer and interaction between isolated blockchain ecosystems. The KINT token serves dual functions as both a governance instrument and utility token for transaction fee payments within the network.

Q2: What is the current price of KINT and how has it performed historically?

Answer: As of January 4, 2026, KINT is trading at $0.02229 with a market capitalization of $82,388.54. The token has experienced significant volatility, reaching an all-time high of $65.42 on January 7, 2022, before declining to an all-time low of $0.01539001 on January 2, 2026, representing a one-year loss of approximately 95.98%. Recent price action shows modest recovery momentum, with a 24-hour gain of 18.75%.

Q3: What are the token supply mechanics and distribution?

Answer: KINT operates with a total supply cap of 10,000,000 tokens, with approximately 3,696,210.99 tokens currently in circulation (36.96% of total supply). This indicates substantial room for supply expansion as the network matures. The remaining 63.04% of tokens are not yet circulated, which could have future implications for token value as these tokens enter circulation during network development phases.

Q4: What are the primary functions of KINT tokens?

Answer: KINT tokens serve two primary functions within the ecosystem. First, they provide governance rights, allowing token holders to vote on governance proposals and participate in council member elections responsible for operational decisions. Second, they serve utility functions, with planned support for transaction fee payments and interaction with additional digital assets beyond KSM (Kusama token) in the medium term.

Q5: What is the investment outlook for KINT through 2026-2031?

Answer: Price forecasts vary by scenario. Short-term predictions for 2026 range from $0.01761 to $0.02563. Mid-term forecasts (2027-2029) anticipate gradual recovery with projected prices reaching $0.02756 by 2027, $0.03091 by 2028, and $0.03740 by 2029. Long-term base case scenarios (2030-2031) project prices between $0.02352 and $0.03813, while optimistic scenarios estimate potential prices reaching $0.04813 USD. Key catalysts include successful multi-chain infrastructure deployment and increased DeFi ecosystem adoption.

Q6: What are the primary risks associated with investing in KINT?

Answer: KINT carries multiple risk categories. Market risks include extreme price volatility (95.98% decline from ATH), limited trading liquidity ($10,445.08 daily volume), and potential price manipulation due to concentrated trading on limited exchanges. Regulatory risks involve uncertainty surrounding DeFi platform regulations across multiple jurisdictions. Technology risks include potential security vulnerabilities in cross-chain bridge infrastructure, dependency on Kusama parachain security, and integration risks with multiple blockchain networks. The project's current ranking at #5115 reflects limited mainstream adoption.

Q7: Is KINT suitable for beginner investors?

Answer: KINT is generally not recommended for conservative or beginner investors due to its high volatility, limited liquidity, and significant historical depreciation. For investors considering exposure to KINT, a dollar-cost averaging strategy with minimal allocation is advisable. Secure self-custody storage solutions (cold wallets or hardware wallets such as Ledger or Trezor) are essential for long-term holdings. Beginner investors should prioritize understanding the Kusama/Polkadot ecosystem and interoperability concepts before committing capital. Professional financial consultation is strongly recommended before making investment decisions.

Q8: What distinguishes Kintsugi from competing cross-chain solutions?

Answer: Kintsugi differentiates itself through its specific focus on connecting Bitcoin and other cryptocurrencies with DeFi platforms via Kusama parachain infrastructure with planned expansion to Polkadot, Cosmos, Ethereum, and other major networks. This multi-chain strategy positions the protocol to bridge fragmented DeFi ecosystems more comprehensively than single-chain alternatives. However, the project faces competition from established interoperability solutions and other cross-chain bridge protocols. Success depends on achieving widespread adoption of its bridges and demonstrated technical security across connected networks.

Report Date: January 4, 2026

Disclaimer: This FAQ presents factual market data and technical information based on available sources. This analysis does not constitute investment advice, financial guidance, or recommendations for asset purchases or sales. Cryptocurrency markets carry substantial risk of total loss. Investors should conduct independent research and consult qualified financial advisors before making investment decisions.

Is Akash Network (AKT) a good investment?: Analyzing the potential of this decentralized cloud computing platform

BEL vs ATOM: Comparing Two Leading Frameworks for Biological Knowledge Representation

Is Cosmos (ATOM) a good investment?: Analyzing the potential and risks of the interoperable blockchain network

Is Sei (SEI) a good investment?: Analyzing the potential of this layer-1 blockchain in the evolving crypto landscape

HAI vs KAVA: Comparing Two Promising Blockchain Platforms for DeFi Innovation

PLUME vs ATOM: A Comparative Analysis of Two Cutting-Edge Text Editors for Modern Developers

Samsung Q4 Profit Jumps 160 Percent, How the AI Chip Boom Is Reshaping Markets

How to Find My BNB Smart Chain Address

What Is Official Platform Verification Tool?

Copper Hits Record Above $13,000, What the US Import Rush Means for Traders

Understanding Profit and Loss (PnL) – Evaluating Your Financial Health