KOII vs NEAR: Comparing Two Layer-1 Blockchain Platforms for Performance, Features, and Ecosystem Growth

Introduction: KOII vs NEAR Investment Comparison

In the cryptocurrency market, the comparison between KOII and NEAR has become an increasingly relevant topic for investors. The two assets differ significantly in market capitalization ranking, application scenarios, and price performance, representing distinct positioning within the crypto ecosystem. KOII (KOII): Launched with a focus on building a decentralized supercomputer powered by people, KOII leverages distributed computing networks to enable affordable and scalable compute power for AI, storage, and decentralized applications through community-owned DePIN infrastructure. NEAR (NEAR): Established as a highly scalable base protocol, NEAR is designed to support fast decentralized application operations on mobile devices, utilizing state sharding to enable linear scaling with network growth and targeting substantial transaction throughput. This article will comprehensively analyze the investment value comparison between KOII and NEAR across historical price trends, supply mechanisms, market positioning, and technical ecosystems, addressing the critical question investors face:

"Which is the better buy right now?"

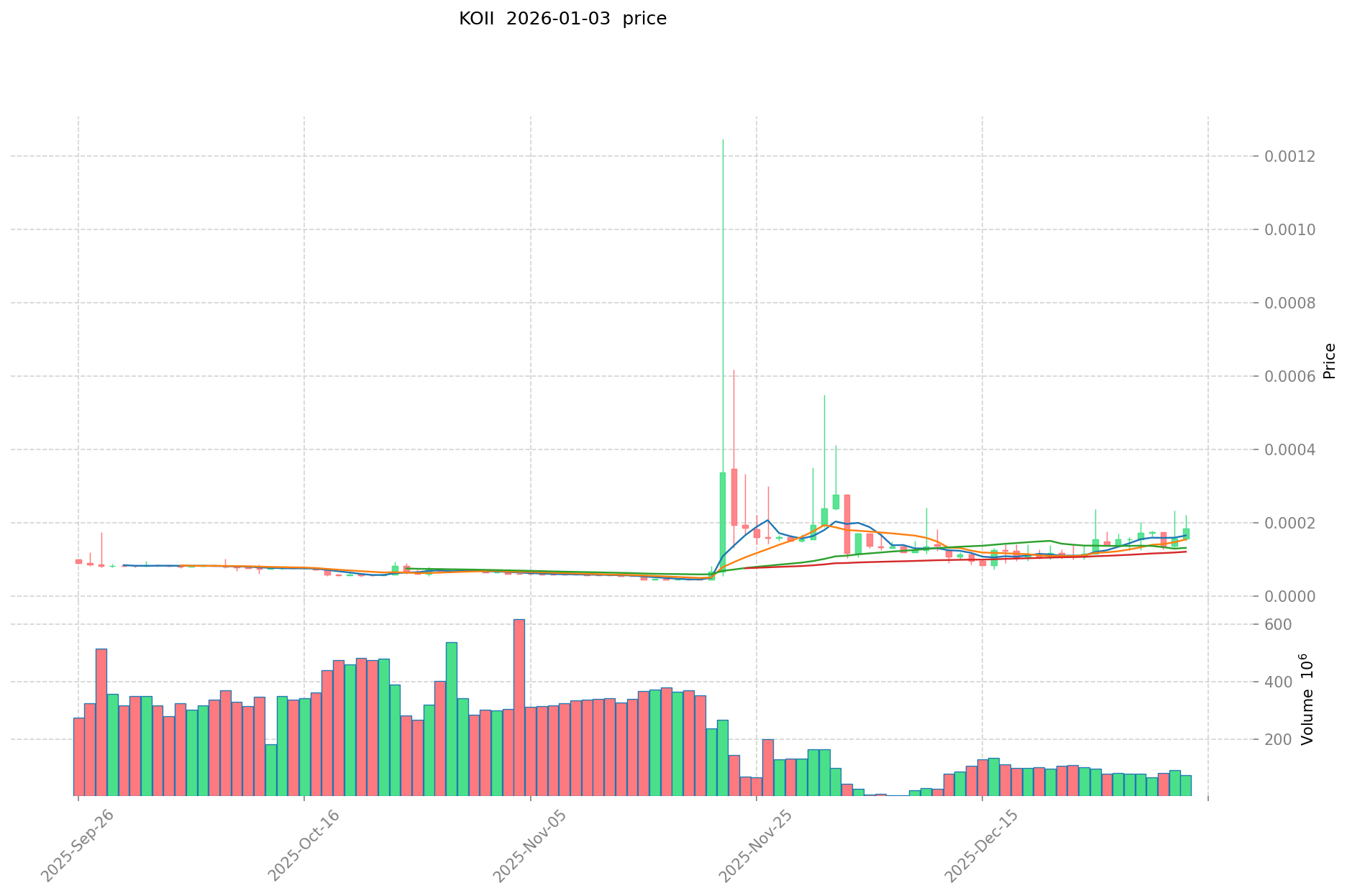

I. Price History Comparison and Current Market Status

Koii (KOII) and NEAR Protocol (NEAR) Historical Price Trends

- January 2022: NEAR reached its all-time high of $20.44, driven by the growing interest in Layer 1 blockchain solutions and the expanding NEAR ecosystem.

- January 2025: Koii reached its all-time high of $0.012968, reflecting early market enthusiasm for distributed computing networks.

- Comparative Analysis: Over the past year, Koii has experienced a significant decline of -97.88% from its peak, while NEAR has declined -69.26% from its historical highs, demonstrating greater price volatility in the smaller-cap asset.

Current Market Status (03 January 2026)

- Koii (KOII) current price: $0.00016634

- NEAR Protocol (NEAR) current price: $1.674

- 24-hour trading volume: KOII $12,734.60 vs NEAR $1,753,214.90

- Market Emotion Index (Fear & Greed Index): 29 (Fear)

View real-time prices:

- View KOII current price Market Price

- View NEAR current price Market Price

二、影响 KOII vs NEAR 投资价值的核心因素

供应机制对比(Tokenomics)

Based on the available reference materials, specific tokenomics details for KOII and NEAR are not provided in the source data. This section would require additional information about their supply mechanisms, inflation schedules, and token distribution models.

📌 Historical Pattern: Token supply mechanisms typically influence price cycles through inflation rates, vesting schedules, and emission halving events that affect market supply dynamics.

机构采用与市场应用

机构持仓

Reference materials indicate that NEAR operates within the blockchain ecosystem and attracts institutional participation, though specific comparative holding data between KOII and NEAR is not available in the provided sources.

企业采用

The materials reference NEAR as part of blockchain ecosystem development with applications in the broader Web3 landscape, including DeFi and smart contract functionality. Specific enterprise adoption comparisons between KOII and NEAR are not detailed in the available data.

国家政策

Reference materials do not provide specific regulatory information comparing different countries' approaches to KOII versus NEAR tokens.

技术发展与生态建设

生态发展对比

Reference materials mention that the blockchain ecosystem encompasses DeFi applications and protocol development, with technology advancement being a key factor in investment value. However, specific technical comparisons between KOII and NEAR ecosystems are not detailed in the provided sources.

The core investment considerations identified include:

- Technology innovation and progress tracking

- Market acceptance and adoption rates

- Ecosystem development maturity

- AI productivity enhancement integration

宏观经济与市场周期

投资回报期望

Reference materials indicate that investors require multiples-level valuation growth, with AI productivity improvements serving as a threshold that must be crossed to justify high financing costs in the current market environment.

宏观因素影响

The broader cryptocurrency market demonstrates sensitivity to macroeconomic conditions, institutional participation trends, and technological developments that collectively influence asset valuations across blockchain ecosystems.

III. 2026-2031 Price Forecast: KOII vs NEAR

Short-term Forecast (2026)

- KOII: Conservative $0.0001483482 - $0.00016302 | Optimistic $0.0001679106

- NEAR: Conservative $1.22129 - $1.673 | Optimistic $2.1749

Mid-term Forecast (2027-2029)

- KOII may enter accumulation phase, projected price range $0.000134026893 - $0.000261652264473

- NEAR may enter growth phase, projected price range $1.1736095 - $2.5589612412

- Key drivers: Institutional capital inflow, ecosystem development, network expansion

Long-term Forecast (2030-2031)

- KOII: Base scenario $0.000216721664683 - $0.233034048046 | Optimistic scenario $0.0003429096017

- NEAR: Base scenario $1.233987976312 - $2.479841221627 | Optimistic scenario $2.586628642654

KOII:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.0001679106 | 0.00016302 | 0.0001483482 | -1 |

| 2027 | 0.000186975789 | 0.0001654653 | 0.000134026893 | 0 |

| 2028 | 0.00023261111874 | 0.0001762205445 | 0.00013745202471 | 5 |

| 2029 | 0.000261652264473 | 0.00020441583162 | 0.000132870290553 | 22 |

| 2030 | 0.000274980176695 | 0.000233034048046 | 0.000216721664683 | 40 |

| 2031 | 0.0003429096017 | 0.000254007112371 | 0.000246386898999 | 52 |

NEAR:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 2.1749 | 1.673 | 1.22129 | 0 |

| 2027 | 1.9816685 | 1.92395 | 1.1736095 | 14 |

| 2028 | 2.42148347 | 1.95280925 | 1.757528325 | 16 |

| 2029 | 2.5589612412 | 2.18714636 | 1.6184883064 | 30 |

| 2030 | 2.586628642654 | 2.3730538006 | 1.233987976312 | 41 |

| 2031 | 2.55423645827581 | 2.479841221627 | 2.40544598497819 | 48 |

四、投资策略对比:KOII vs NEAR

长期 vs 短期投资策略

- KOII:适合关注分布式计算网络发展、早期DePIN生态潜力的长期投资者,但需承受高波动性风险

- NEAR:适合寻求相对稳定Layer 1协议、生态成熟度较高的投资者,适合中长期配置

风险管理与资产配置

- 保守型投资者:KOII 10% vs NEAR 40% 配合稳定币 50%

- 激进型投资者:KOII 35% vs NEAR 50% 配合衍生品对冲 15%

- 对冲工具:稳定币配置、期权套利、跨币种组合(NEAR配合主流币种如BTC、ETH)

五、潜在风险对比

市场风险

- KOII:流动性严重不足(24小时交易量仅$12,734.60),价格易受大额交易影响;历史跌幅-97.88%反映市场风险极高

- NEAR:市场深度相对较好(24小时交易量$1,753,214.90),但仍面临整体加密市场周期波动,历史跌幅-69.26%

技术风险

- KOII:分布式计算网络安全性、节点激励机制稳定性、技术采用率不确定性

- NEAR:状态分片扩展性验证、网络稳定性维护、智能合约生态风险

监管风险

- 全球监管政策对两者均存在不确定性,DePIN模式(KOII)可能面临更严格的监管审查,而Layer 1协议(NEAR)相对政策风险更为明确

六、结论:Which Is the Better Buy?

📌 投资价值总结:

- KOII优势:前沿DePIN基础设施概念、分布式计算应用场景、早期参与机会

- NEAR优势:Layer 1地位明确、生态应用相对完善、市场流动性充足、机构认可度更高

✅ 投资建议:

- 新手投资者:优先选择NEAR,市场成熟度更高、风险可控,配置比例不超过投资组合的10%

- 有经验投资者:可配置KOII进行风险敞口管理,同时保持NEAR作为核心Layer 1配置

- 机构投资者:NEAR作为Layer 1配置基础,KOII作为创新赛道小额探索性投资

⚠️ 风险提示:加密货币市场波动性极高,本文不构成投资建议。

FAQ

KOII和NEAR分别是什么?各自的核心功能和定位是什么?

KOII是去中心化创作者生态系统,帮助创作者拥有内容并获得价值。NEAR是高效区块链平台,专注低成本、高速交易处理。两者分别定位于内容创作与区块链基础设施领域。

KOII和NEAR在技术架构上有什么主要区别?

KOII专注于注意力经济和分布式计算,基于模块化架构。NEAR是通用区块链平台,采用分片技术提升扩展性。KOII与NEAR、Spheron等合作,NEAR拥有独立完整的生态系统。

KOII和NEAR的性能表现如何对比?吞吐量、交易速度、成本分别是多少?

NEAR每秒吞吐量可达数千笔交易,成本低于1美分。KOII主要聚焦任务分配,吞吐量和速度表现优异。NEAR整体性能更为成熟稳定,成本优势明显。

KOII和NEAR的应用场景分别是什么?适用于哪些项目?

KOII专注于去中心化AI计算和内容验证,适合需要分布式计算的AI项目。NEAR提供高扩展性和低交易成本,适用于DApp、DeFi和NFT等需要高性能的项目。

KOII和NEAR各自的生态发展现状如何?有哪些主要项目在使用?

NEAR生态专注于可扩展的智能合约平台,支持低成本dApp开发,拥有众多DeFi、NFT和社交类项目。KOII则专注于去中心化计算和数据存储服务。两个生态都在持续扩展,吸引更多开发者和项目入驻。

从投资角度看,KOII和NEAR哪个更有前景?风险和机会分别是什么?

KOII专注去中心化基础设施,波动性较高但潜力大;NEAR生态成熟应用丰富,稳定性更强。KOII机会在于基础设施需求增长,风险在于市场认可度;NEAR优势是生态完善,劣势是竞争激烈。

KOII和NEAR的代币经济模型有什么区别?流通量、总供应量、释放机制分别如何?

KOII总供应量固定,流通量受限,采用固定发行机制。NEAR总供应量可调整,流通量灵活,采用渐进释放机制。两者在代币经济模型设计上存在明显差异。

Is U2U Network (U2U) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Performance, and Future Growth Potential

Is U2U Network (U2U) a good investment?: A Comprehensive Analysis of Price, Technology, and Market Potential

What are AliExpress Coin

2025 SUI价格预测:区块链新贵的未来发展与投资价值分析

2025 APT Price Prediction: Key Factors That Could Drive Aptos Token to New Heights

2025 INJ Price Prediction: A Comprehensive Analysis of Market Trends and Growth Potential for Injective Protocol

Linea Airdrop: Everything You Need to Know About It

Xenea Daily Quiz Answer 8 january 2026

Is XRP a Scam or Legit? What Investors Need to Know

Does XRP Burn Coins? Everything You Need to Know About XRP Burn Rate

BONK Fails to Break Through Resistance, Volume Surges as Uptrend Stalls