A Token With Nearly $10 Billion in Daily Trading Volume—And It Comes From Cardano?

Recently, the token NIGHT, which launched spot and derivatives trading on Bitget, Binance, OKX, and Bybit earlier this month, recorded a 24-hour global trading volume exceeding $9 billion, nearing $10 billion. Bybit even outperformed Binance in 24-hour spot trading volume, driven by NIGHT’s activity.

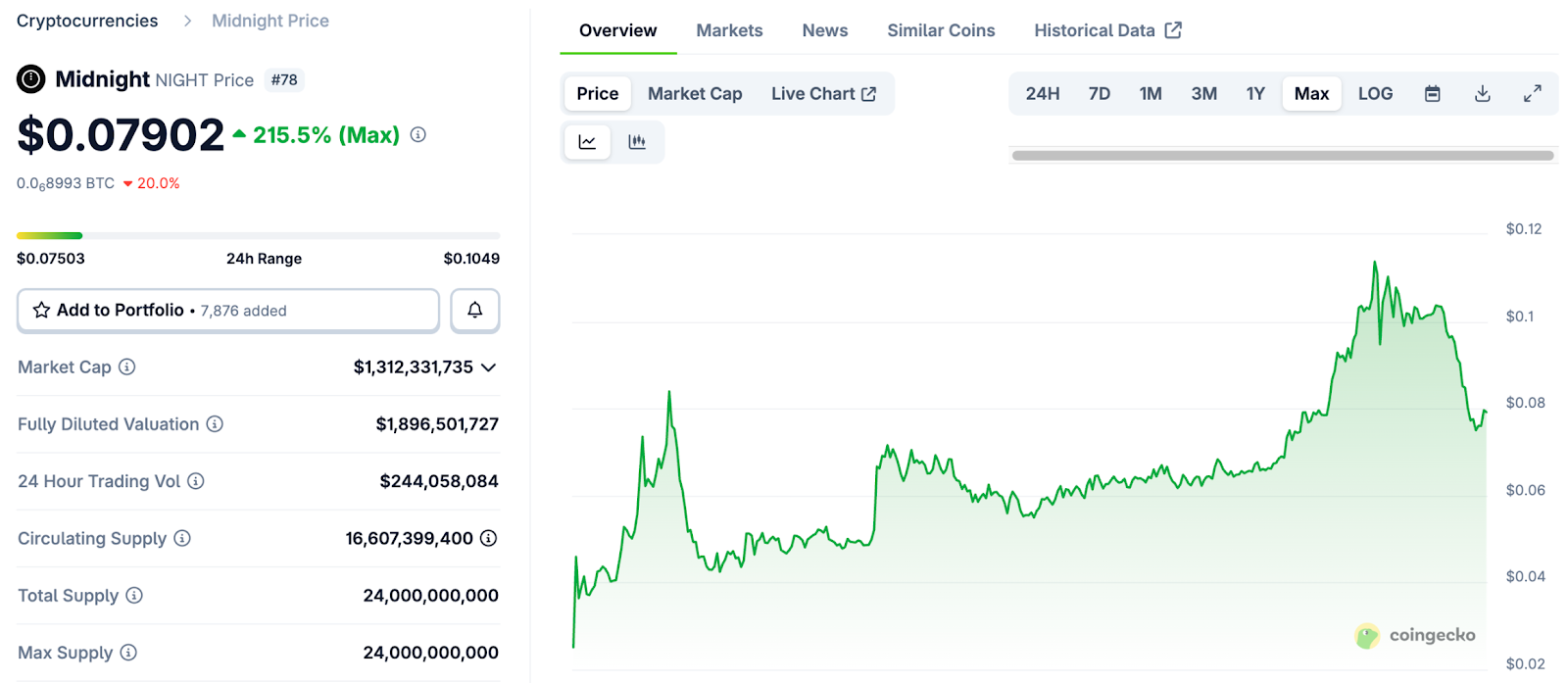

NIGHT officially launched on December 9. According to CoinGecko, the token’s price surged from around $0.025 at inception to nearly $0.114 in less than two weeks—a more than threefold increase. Its fully diluted valuation (FDV) briefly surpassed $2.5 billion, placing it in the top 50 by market capitalization. At the time of writing, NIGHT’s price has retraced to approximately $0.08.

It’s expected for a token listed on multiple leading exchanges to perform well, but what’s striking is that NIGHT is the native token of Midnight, Cardano’s privacy sidechain. The remarkable growth of a project labeled both “Cardano” and “privacy” has genuinely surprised most market participants.

What Gives Midnight Its “Value”?

Midnight is a sidechain developed by Input Output Global (IOG, Cardano’s parent company), centered on “programmable data protection.” It integrates zero-knowledge proofs (ZKP) into a plug-and-play TypeScript API, enabling Web2 developers to implement “selective disclosure” on-chain without needing cryptography expertise. The network uses Cardano as its consensus foundation and Halo2 as its ZK backend, operates on a dual-token model (NIGHT+DUST), and aims first to deliver “usable but invisible data” for enterprises, then expand into DeFi, RWA, on-chain compliance identity, and other use cases.

Fundamentally, the approach isn’t groundbreaking—privacy is enabled via ZKP, but rather than native privacy protection, privacy features are offered as optional tools to address real-world requirements.

IOG first announced Midnight’s development publicly in November 2022, but the testnet only launched nearly two years later in October 2024. This slow rollout is typical for IOG; almost five years passed between Cardano’s smart contract announcement and its actual implementation, which arrived in September 2021 after the bull market had faded.

In May, Midnight established its foundation, led by Fahmi Syed, former CFO of Parity (Polkadot’s development team), signaling the start of its Token Generation Event (TGE). Just two days after the foundation’s announcement, Cardano founder Charles Hoskinson revealed plans to airdrop tokens to 37 million addresses across eight major blockchains, clarifying that the airdrop would target retail users only, with no VC participation.

What truly ignited market sentiment was Midnight’s “massive token distribution.” Beyond the airdrop, Midnight partnered with Binance, OKX, and Bybit to distribute nearly 3 billion NIGHT tokens. This bold strategy stands in stark contrast to recent ICO trends and has generated strong market enthusiasm.

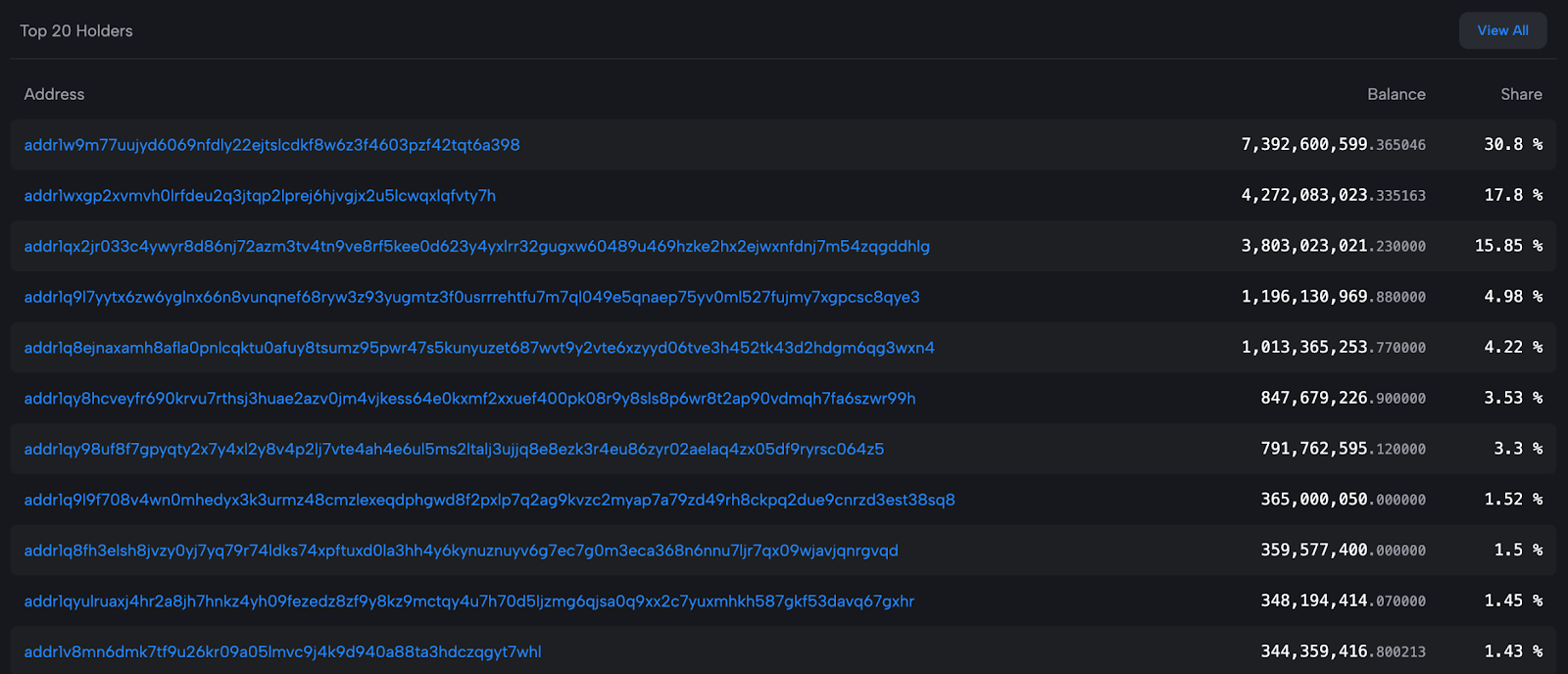

Blockchain explorer data indicates that, apart from the top three addresses—likely belonging to IOG or the Midnight Foundation—NIGHT’s major holders are relatively decentralized. Based on official data, the author estimates that tokens distributed via airdrops and exchange partnerships account for nearly one-third of the total supply (24 billion NIGHT), marking a significant allocation.

Midnight’s token system features more than just NIGHT; it uses a dual-token model (“NIGHT+DUST”). This uncommon design is not a mere innovation—it ensures regulatory compliance. NIGHT is used for governance, incentives, and generating the secondary token DUST. NIGHT itself does not provide privacy and is fully auditable on-chain.

DUST, generated by holding NIGHT, is used to pay transaction fees, functioning similarly to Gas. DUST also covers privacy fees; users wishing to add privacy to on-chain transactions must pay DUST. DUST is automatically distributed to NIGHT holders with each new block and gradually “decays” over time to prevent hoarding and network abuse.

In this model, NIGHT serves as an “equity” token for governance and for generating DUST, but doesn’t pay transaction fees directly. DUST, as a “renewable resource” created from NIGHT and diminishing over time, is classified as a resource rather than an asset under regulatory frameworks, meeting global compliance requirements.

Cardano to Invest Heavily in On-Chain Ecosystem Next Year

Cardano’s roadmap highlights next year as a pivotal period for boosting on-chain activity.

Cardano will begin by upgrading its network, increasing throughput to 1,000–10,000 TPS using parallel block processing and a layered architecture for vertical scaling, all while maintaining security and decentralization. Midnight’s mainnet launch is expected to drive DeFi activity and TVL through its optional privacy features. Cardano’s treasury will also allocate funds for the native issuance of major stablecoins like USDT and USDC on Cardano.

Perhaps most importantly, Cardano aims to prioritize interoperability—not just basic cross-chain bridges, but allowing users from other blockchains to interact directly with Cardano DApps by spending Gas tokens from their original chains.

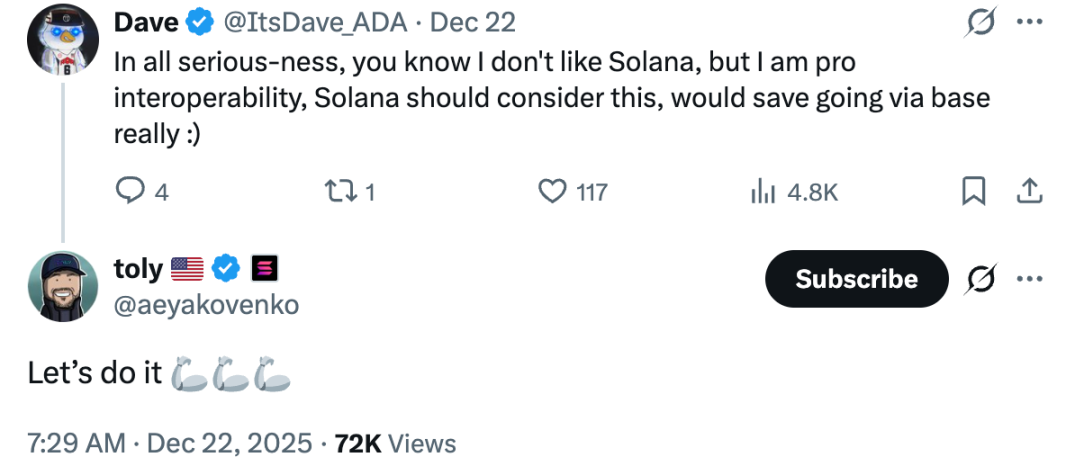

Last week, Cardano enabled atomic swaps between BTC and ADA via Fluid—not through cross-chain bridges, wrapped tokens, or centralized custody, but through direct script-to-script transactions at the protocol level. This is possible in part because Cardano uses a UTXO ledger model. Two days ago, Cardano stake pool operators engaged with Solana co-founders on X, further confirming this direction.

These strategic and product plans are backed by significant financial investment. The Cardano Foundation will increase its marketing budget by 12%, participate in events like TOKEN2049 and Consensus, and invest 2 million ADA via its Venture Hub to support startups and ecosystem projects. Additionally, the Foundation plans to inject tens of millions of ADA into Cardano’s DeFi ecosystem to boost liquidity and attract institutional players.

In essence, NIGHT’s price rally may be just the start of Cardano’s broader initiative. By 2026, this project—which launched its mainnet in 2017 and has been largely overlooked by the mainstream Web3 market—may be worth renewed attention.

Statement:

- This article is reprinted from [Foresight News] and is copyrighted by the original author [Eric]. If you have concerns regarding republication, please contact the Gate Learn team for prompt resolution through the appropriate channels.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is credited, reproduction, distribution, or plagiarism of translated content is strictly prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?