BitMine Increases ETH Holdings by 48,049 Again: Institutional Entry Sparks Market Attention

BitMine Latest Accumulation Update

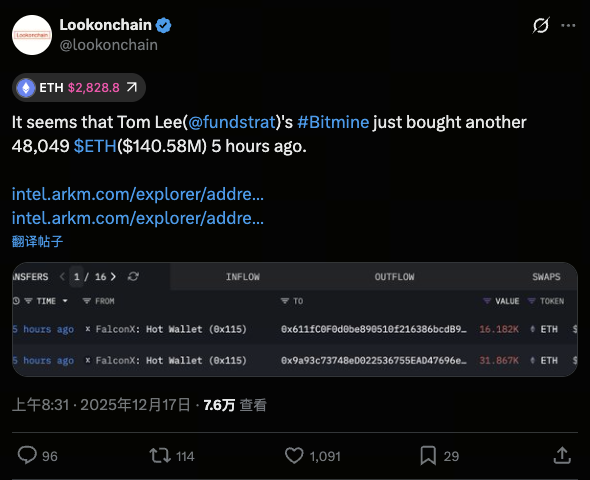

Source: https://x.com/lookonchain/status/2001087945223348417

Recently, the crypto market has seen a noteworthy institutional move: BitMine Immersion Technologies (BitMine) has increased its Ethereum (ETH) holdings by 48,049 ETH in its latest purchase round. Market reports indicate that BitMine acquired these assets primarily through the institutional platform FalconX, with a total investment of approximately $140 million.

This accumulation aligns with BitMine’s ongoing strategy to build its Ethereum reserves. The company aims to position ETH as a strategic reserve asset and to drive long-term value growth through continuous accumulation.

Purchase Scale and Market Value

This addition of 48,049 ETH is substantial. At current market prices, the holding is valued at about $140 million, underscoring persistent institutional interest in Ethereum as a core crypto asset.

Market data shows that, compared to BitMine’s large-scale purchases in November and early December, this round focused more on OTC (over-the-counter) accumulation during a period of price stability.

Currently, BitMine’s total ETH holdings have surpassed 3.8 million, representing over 3% of Ethereum’s circulating supply.

BitMine’s Strategic Intent

This series of purchases by BitMine reflects not only an expectation of future ETH price appreciation but also a long-term strategic approach. In public statements, the company noted its objective to accumulate more ETH during market corrections and, in the future, to launch staking or yield products—such as the MAVAN validator node network—to enhance capital returns.

As institutional investors increasingly treat digital assets as strategic allocations, BitMine’s approach represents a move to seek long-term value growth beyond the traditional corporate balance sheet.

Potential Impact on Ethereum Price and Market

Source: https://www.gate.com/trade/ETH_USDT

BitMine’s large-scale accumulation could impact the market’s supply side. As major institutions lock up more ETH, the available circulating supply decreases, which may increase upward price pressure in bullish conditions.

However, in the short term, ETH price movements remain influenced by overall market sentiment, macroeconomic conditions, and the ongoing development of the Ethereum ecosystem. As a result, institutional accumulation may not immediately show up in price charts, but over the medium to long term, it reinforces Ethereum’s status as a core value asset.

How Investors Should Interpret This Move

For individual investors, BitMine’s latest accumulation sends two key signals:

- Institutions are confident in Ethereum’s technology and ecosystem potential. This move is not just a price bet; it reflects belief in future proof-of-stake yields and the growth of DeFi and Layer 2 solutions.

- Supply-side scarcity may intensify. Institutional funds locking up ETH could reduce tradable supply, heightening supply-demand tension.

Nonetheless, market volatility remains a risk. Investors should tailor their strategies to their own risk tolerance and investment timelines.

Summary and Outlook

In its latest Ethereum purchase round, BitMine increased its holdings by 48,049 ETH, demonstrating a strong commitment to its ETH strategy. As an institutional investor, BitMine’s actions highlight confidence in Ethereum’s long-term value and signal a growing trend of institutional asset allocation toward digital assets.

Looking ahead, as the Ethereum ecosystem matures, staking mechanisms improve, and institutional participation expands, large-scale treasury accumulation could become a major force driving market maturity.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution