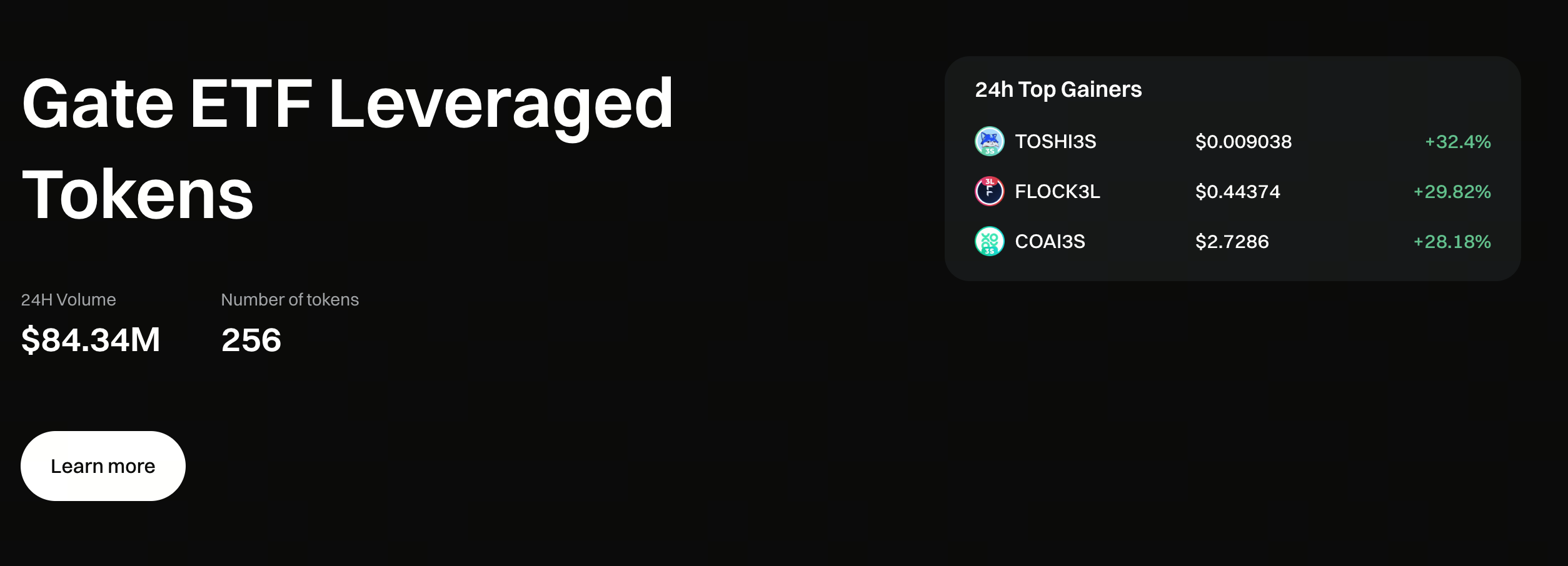

Gate ETF Leveraged Tokens Explained: Capture High-Volatility Markets Without Trading Futures

Image source: https://www.gate.com/leveraged-etf

What Are Gate ETF Leveraged Tokens?

Gate ETF Leveraged Tokens are trading products that deliver leveraged exposure through tokenized instruments. Users do not need margin or contract positions; they can buy and sell these tokens just like spot assets to achieve 2x or 3x long or short returns.

For instance, purchasing BTC3L means you’re investing in a token product backed by Bitcoin perpetual contracts, targeting 3x leverage.

This structure dramatically lowers the learning curve and operational hurdles compared to traditional leveraged trading.

Core Mechanism of Gate ETF Leveraged Tokens

Gate ETF Leveraged Tokens do not simply multiply price by a leverage factor. Instead, they operate using the following mechanisms:

- First, the system automatically configures contract positions based on the target leverage multiple (e.g., 3×).

- Second, when market volatility causes leverage to stray from the target range, the system automatically rebalances positions to maintain stable risk exposure.

- Finally, daily management fees and rebalancing mechanisms ensure the token’s long-term sustainability.

For users, this means you don’t need to worry about liquidation thresholds, margin ratios, or margin calls.

Why Don’t ETF Leveraged Tokens Have a Forced Liquidation Mechanism?

In traditional contract trading, if price volatility hits the liquidation line, positions are immediately closed. Gate ETF Leveraged Tokens use a net asset value mechanism, so there are no sudden forced liquidation events that instantly wipe out your position.

Even during sharp market reversals, the token’s net asset value may drop significantly, but the system will not liquidate your position directly. This design gives users greater flexibility in extreme market conditions.

However, keep in mind: “No forced liquidation” does not mean “no risk.”

What Market Conditions Suit ETF Leveraged Tokens Best?

Gate ETF Leveraged Tokens are best suited for the following scenarios:

When the market is trending strongly upward or downward, the automatic rebalancing mechanism amplifies returns and compounds gains. During news-driven moves, breakouts, or trend continuation phases, ETF Leveraged Tokens often magnify price swings quickly.

Conversely, in choppy, sideways markets with frequent reversals, rebalancing and management fees can erode net asset value, making these tokens unsuitable for long-term holding.

As a result, these products are better used as “trend trading tools” rather than asset allocation vehicles.

Summary

Gate ETF Leveraged Tokens are fundamentally “low-barrier leveraged tools” designed for everyday users. Without using contracts, traders can participate in volatile markets and capture amplified returns during trends.

But there is one key point: you must understand that this is “short-term trend trading,” not long-term investing.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution