Gate ETF Leveraged Tokens Explained: Smart Leverage for Trending Crypto Markets

1. What Are Gate ETF Leveraged Tokens?

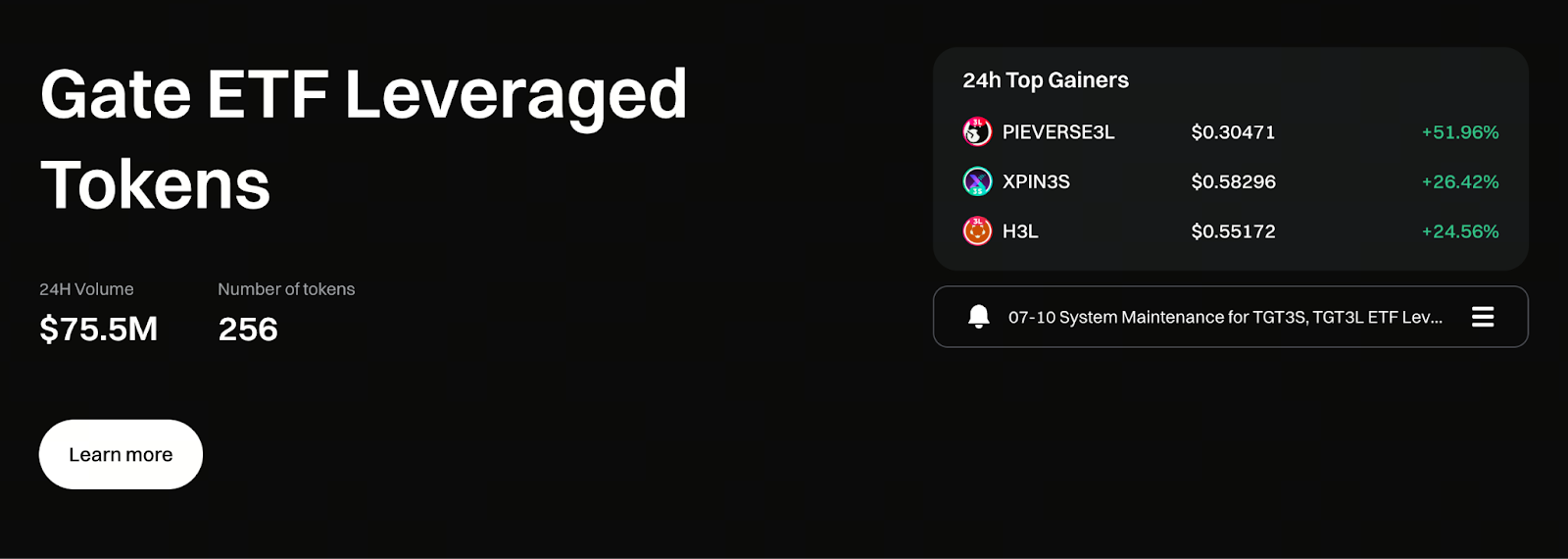

Image: https://www.gate.com/leveraged-etf

Gate ETF Leveraged Tokens are cryptocurrency products that transform leveraged trading into tokenized assets. There’s no need to open a contract account or provide additional margin. Simply buy and sell these tokens like regular cryptocurrencies to capture returns based on fixed leverage multipliers.

Common examples include:

- BTC3L: 3x Long Bitcoin

- BTC3S: 3x Short Bitcoin

- ETH3L / ETH3S: Directional leveraged tokens for Ethereum

Unlike simple spot assets, these tokens are dynamically managed by the platform through perpetual contract positions to maintain the target leverage ratio.

2. How Gate ETF Leveraged Tokens Work

1. Automated Rebalancing for Consistent Leverage

Gate ETF Leveraged Tokens use automated system adjustments to keep the leverage close to the preset multiple (for example, 3×). During periods of significant market volatility or when certain thresholds are reached, the system rebalances to prevent excessive deviation from the target leverage.

This design eliminates the need for frequent manual intervention and protects users from forced liquidation risks commonly found in traditional leveraged contracts.

2. No Forced Liquidation, Reduced Operational Stress

Unlike contract trading, Gate ETF Leveraged Tokens do not have a liquidation threshold. Even if the market moves against your position in the short term, the token’s net asset value simply fluctuates with the market—never subject to forced liquidation.

This structure is especially user-friendly for those unfamiliar with margin requirements or risk calculations, and it’s ideal for traders looking to simplify their operations.

3. Management Fees Instead of Funding Rates

ETF Leveraged Tokens apply a fixed management fee rather than the funding rate typical of contract trading. The management fee is deducted daily from the net asset value to support the position structure.

Note: In prolonged sideways or volatile markets, management fees and automatic rebalancing may gradually reduce the net asset value. These tokens are therefore better suited for short-term or medium-term trend trading.

3. Optimal Market Conditions for Gate ETF Leveraged Tokens

1. Clear Uptrends or Downtrends

When the market direction is evident, ETF Leveraged Tokens act as “trend amplifiers.” For example, holding BTC3L during an uptrend can significantly boost your returns.

2. Sudden Market Events or Sentiment-Driven Moves

During major macro announcements or periods of heightened market sentiment, price swings can be rapid. ETF Leveraged Tokens allow you to capture these opportunities quickly without the need for contracts.

3. Short-Term Traders Who Prefer Not to Monitor Markets Constantly

With no margin calls or forced liquidation risk, ETF Leveraged Tokens are ideal for traders seeking to minimize psychological stress. The buy, hold, and sell process is straightforward, with lower execution costs.

4. Why ETF Leveraged Tokens Are Unsuitable for Long-Term Holding

While Gate ETF Leveraged Tokens can amplify gains, they are not designed for long-term investment.

Key reasons include:

- Automatic rebalancing can cause “friction” in volatile markets

- Management fees continually erode net asset value

- The leveraged structure increases short-term volatility and magnifies the impact of incorrect market calls

ETF Leveraged Tokens should be viewed as tactical trading tools, not as vehicles for value investing.

5. How to Use Gate ETF Leveraged Tokens More Effectively

To trade more rationally, consider the following best practices:

- Use only in clear trending markets

- Set explicit take-profit and stop-loss targets

- Avoid holding during prolonged sideways or choppy conditions

- Don’t allocate your entire portfolio to these tokens

Treat ETF Leveraged Tokens as “tactical instruments” rather than “core long-term holdings” to better manage risk.

6. The Market Role of Gate ETF Leveraged Tokens

As the crypto market matures, the demand for efficient, accessible leveraged tools continues to grow.

Gate ETF Leveraged Tokens have emerged as a vital bridge between contract and spot trading.

They combine:

- Leverage amplification

- Simplified trading

- Transparent risk structure

For traders seeking capital efficiency in trending markets, these products offer enduring value.

Conclusion

Gate ETF Leveraged Tokens are not “guaranteed profit tools.” However, when used in suitable market conditions with the right approach, they can be powerful for amplifying returns.

Understanding how these tokens work, their best use cases, and potential risks is essential. Success comes from aligning with market trends and leveraging these products effectively.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution