Gate Research: Plasma Token Down 90% From Early Peak | Bitcoin Faces $13.6B in Monthly Options Expiry

Summary

- BTC and ETH have reclaimed the crucial $90,000 and $3,000 psychological levels, with market sentiment recovering and capital rotating into platform tokens, major Layer-1s, and memecoins.

- S&P has downgraded USDT’s stability rating to “Weak”; the Cosmos community has begun research into a new tokenomics model for ATOM; Vitalik donates to privacy-oriented messaging applications.

- The Plasma token has dropped 90% from its early peak, with the project far from achieving its ambitious goals—becoming one of the most representative examples of a failed new token listing this year.

- Boosted by strong investor enthusiasm in AI-related equities, the broader crypto market—driven by elevated leverage—has seen Bitcoin fall more than 20% over the past month.

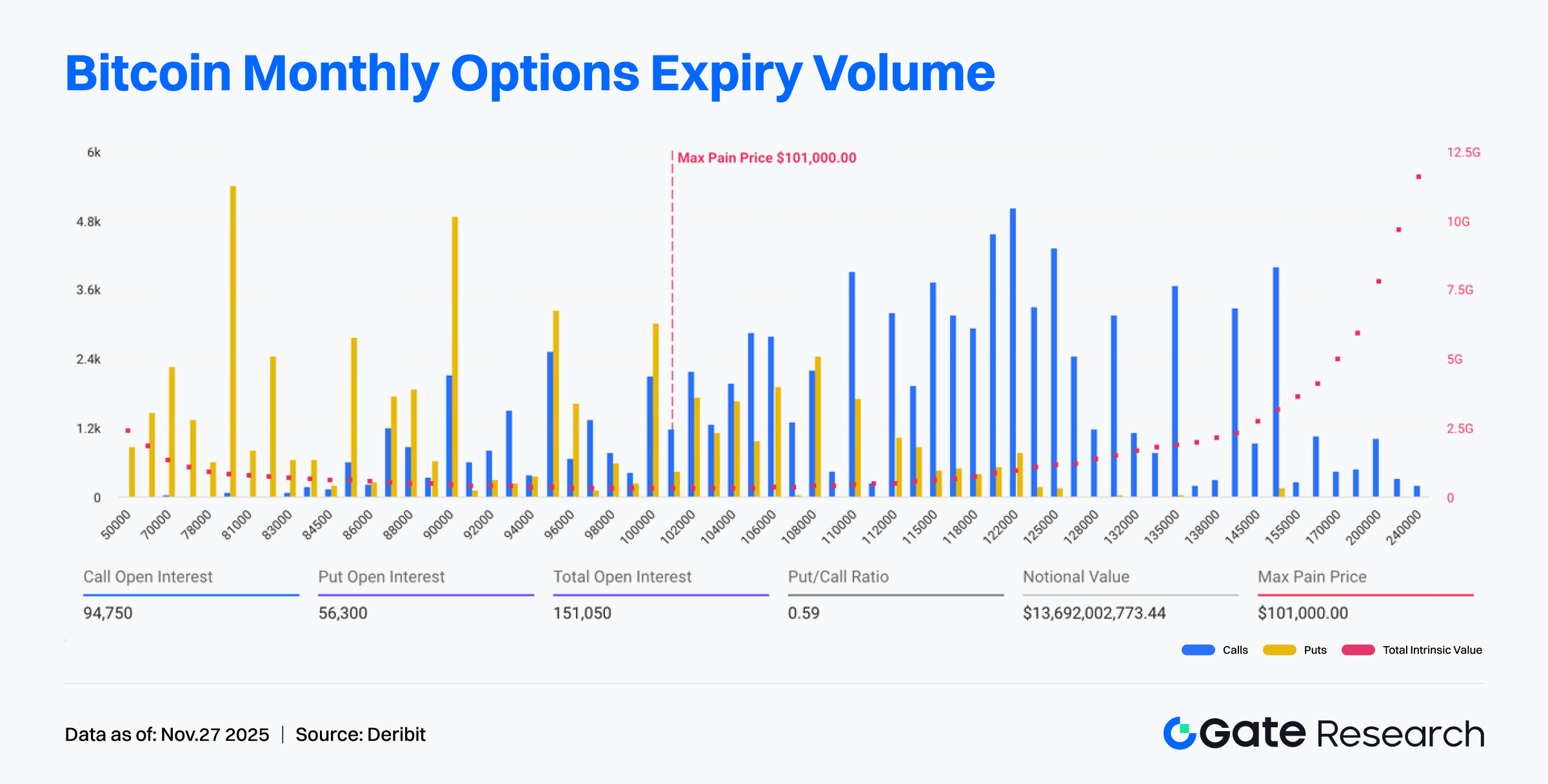

- Bitcoin faces a $13.6 billion monthly options expiration this Friday, with 77% of open interest out-of-the-money, potentially increasing short-term market volatility through hedging activities.

- HYPE, SUI, and EIGEN are set for token unlocks in the next 7 days, valued at approximately $359 million, $68.51 million, and $22.62 million, respectively.

Market Overview

Market Commentary

- BTC Market Update—On the morning of the 27th, BTC staged a strong volume-driven breakout from the $87,000–$88,000 consolidation range, quickly rallying above $90,000 with intraday gains exceeding 3%. Technically, the MA5 has turned upward and crossed above both the MA10 and MA30, followed by the MA10’s upward slope—forming a classic short-cycle bullish alignment. The MA30 has also begun rising gradually, further confirming a strengthening trend. Currently, the three moving averages display a bullish divergence structure, with the $88,000 level near the MA30 serving as key short- to medium-term support—a breach below which could signal the end of the short-term uptrend. Overall, with sentiment improving, BTC appears poised to challenge the $92,000+ range.

- ETH Market Update—On the morning of the 27th, ETH surged in tandem with BTC, breaking through the $3,000 psychological level and peaking at $3,050, with intraday gains exceeding 3%. Technically, the MA5, MA10, and MA30 are aligned in a bullish configuration, with the MA30 (around $2,960) providing critical medium-term support to fuel steady upward momentum. ETH’s performance continues to move closely with BTC; if BTC holds above $90,000, ETH may target the $3,100–$3,150 zone. Conversely, if BTC pulls back, ETH could retest $3,000 support, with a break below $2,960 potentially turning the short-term trend toward consolidation with a bearish bias.

- Altcoins—Market sentiment has improved significantly, with capital reactivating under the leadership of BTC and ETH. The rally has extended into exchange tokens, Layer-1s, and meme coin sectors, reflecting a renewed appetite for risk.

- Stablecoins—Total stablecoin market capitalization stands at $305.35 billion, marking a weekly increase of $2.131 billion and nearly fully recovering last week’s decline.

- Gas Fees—Over the past week, Ethereum gas fees have generally remained below 1 Gwei, with the highest hourly peak at 6.96 Gwei. As of November 27, the daily average gas fee stands at 0.065 Gwei.

Trending Tokens

Over the past 24 hours, the cryptocurrency market has shown sustained strength. BTC and ETH have reclaimed the $90,000 and $3,000 psychological thresholds, lifting overall sentiment and driving platform tokens such as GT higher. Hotspot sectors have seen standout performances, including Merlin (MERL), which surged over 150% amid its mainnet upgrade and short-squeeze dynamics; XION (+98.6%) boosted by activity around its KRW trading pair; and BANANAS31 (+66.6%) with trading volume soaring to $470 million—signaling a resurgence in meme coin enthusiasm. The following sections break down the key drivers behind each token’s recent rally.

MERL Merlin(+157.97%,Market Cap: $550m)

According to Gate’s market data, the MERL token is currently quoted at $0.0552, with an increase of over 150% in the past 24 hours. Merlin Chain is a Bitcoin-native Layer 2 scaling solution developed by Bitmap Technology and launched in January 2024. According to data from DeFiLlama, Merlin’s TVL has surpassed $44 million, reflecting a 7.8% increase over the past 24 hours.

The recent surge in MERL is driven by both narrative momentum and favorable funding conditions. Merlin Chain recently completed a 12-hour mainnet upgrade aimed at improving scalability and optimizing ZooKeeper performance for coordinating distributed systems—further reducing latency and supporting the deployment of more dApps. This upgrade has been widely regarded by the community as a short-term price catalyst. In addition, annualized negative funding rates for MERL USDT-margined perpetual contracts on major exchanges have exceeded 2,000%, creating sustained upward pressure in the short term due to intense short squeezing.

XION XION (+98.6%, Market Cap: $30.25m)

According to Gate’s market data, the XION token is currently trading at $0.067, with a 24-hour increase of 100%. XION is a Layer 1 blockchain developed by the Burnt team, built using the Cosmos SDK and powered by the Tendermint Proof-of-Stake (PoS) consensus mechanism. Its core focus is “chain abstraction” and consumer-grade Web3 experiences, aiming to make blockchain interactions “invisible”—removing the need for wallets, seed phrases, or gas fees, while supporting login methods such as Face ID or credit cards and using USDC as the gas token.

The surge in XION is closely tied to strong momentum from Korean investors. Following its recent listing on a major Korean exchange with a KRW trading pair, Korean whales have actively entered the market, with the XION/KRW pair accounting for over 30% of its spot trading volume. However, it is worth noting that strategic backer and team token allocations are scheduled to begin phased unlocks starting in December, potentially introducing tens of millions of dollars in selling pressure into circulation over the coming months.

BANANAS31 Banana For Scale (+66.62%, Market Cap: $58.7m)

According to Gate’s market data, the BANANAS31 token is currently quoted at $0.0058, with an increase exceeding 60% in the past 24 hours. BANANAS31 is a memecoin built on the Binance Smart Chain (BSC), named and branded after the popular internet meme “Banana for Scale” (where people use a banana as a humorous reference object for scale in photographs). The project aims to integrate “internet culture’s sense of humor with blockchain, AI, dApps, and token economics.”

This wave of gains in BANANAS31 is not a “silent pump” but is accompanied by active trading volume alongside surges in community engagement and capital inflows. Gate’s market data indicates that BANANAS31’s 24-hour trading volume has reached as high as $475 million. Additionally, with meme activity on BSC picking up again, memecoins with prior deep accumulation and strong meme culture tend to attract renewed speculative interest.

Key Market Data Highlights

S&P Global Ratings Downgrades Tether USDT Rating to “Weak”

In a report published in November 2025, S&P Global Ratings downgraded Tether’s USDT stablecoin rating from “4 (constrained)” to “5 (weak),” the lowest score in its framework. The downgrade was primarily driven by an increasing share of “high-risk assets” in USDT’s reserve portfolio—including BTC, precious metals, corporate bonds, and secured loans. S&P also pointed to deficiencies in Tether’s disclosures, asset segregation, hedging mechanisms, and counterparty risk management. As of the latest review, high-risk assets constituted around 24% of USDT’s reserves, up sharply from about 17% a year earlier, while allocations to the most secure assets—such as U.S. Treasuries—have declined.

This downgrade is not an arbitrary move against USDT, nor does it necessarily indicate the stablecoin is unsafe; rather, it is consistent with S&P’s broader trend of reassessing risk, transparency, asset composition, and redemption stability within the stablecoin industry. Amid heightened volatility in the crypto asset markets and growing scrutiny from traditional financial institutions toward stablecoin participants, the asset structure stability and transparency of stablecoins—as alternatives to or bridges for digital dollars—have become pivotal determinants of their credibility. USDT’s increasing allocation of reserves to BTC is viewed by traditional industry standards as exposure to a high-risk, high-volatility asset, which contravenes the conventional notion of a dollar substitute or monetary equivalent. In response, Tether’s CEO issued a high-profile rebuttal, proudly declaring it an honor “to be loathed by the old system.”

ATOM’s Long-Term Underperformance Prompts Cosmos Community to Propose Tokenomics Overhaul

Cosmos is an ecosystem centered around blockchain interoperability, modular chains, custom chain development, and cross-chain communication. It enables seamless interaction between different blockchains via the Cosmos SDK and the Inter-Blockchain Communication (IBC) protocol. However, adoption within the Cosmos ecosystem and the market performance of ATOM have both lagged expectations in recent years. In response, the Cosmos community is researching and gathering feedback for a comprehensive redesign of ATOM’s economic model.

The new tokenomics model aims to base value accrual on real fee revenue rather than relying primarily on inflation and staking rewards. This would align ATOM’s value more directly with economic activity and revenue generated across the Cosmos ecosystem—including on-chain usage, dApp fees, IBC transactions, and infrastructure operations. The redesign seeks to solve long-standing issues in ATOM’s existing model:

- Mitigating inflation and sell pressure: The previous issuance and inflation mechanisms, tied to staking and reward structures, could result in excessive token releases combined with holder sell-offs, thereby eroding long-term value.

- Improving value capture: As Cosmos generates more fees, ATOM holders—as the network’s foundational token—should benefit from value accrual.

Supporters hope that a transparent, research-driven, and community-led redesign process will help restore confidence in Cosmos.

Vitalik Donates to Privacy Messaging Apps Session and SimpleX Chat

Ethereum co-founder Vitalik Buterin announced donations of 128 ETH each to Session and SimpleX Chat to support their work in privacy-focused messaging, decentralization, metadata protection, and permissionless account creation. Vitalik emphasized that both projects prioritize end-to-end encryption, privacy, decentralization, metadata protection (including sender/recipient information, timing, and frequency), multi-device support, and resistance to Sybil/DoS attacks—areas he considers essential for the future of user privacy and secure communication.

Session is a decentralized chat application developed by the Australian team at the Loki Foundation (now rebranded as Session Network), operating on a blockchain-based network. Users can register without a phone number, and their messages are routed through anonymous nodes, making metadata virtually untraceable. SimpleX Chat, by contrast, takes a different approach: it does not rely on fixed servers or user IDs, instead utilizing end-to-end ephemeral (temporary) connections to achieve truly serverless and decentralized communication. Both projects tackle the long-standing problem of metadata leakage in traditional encrypted messaging—specifically, the ability to infer who is communicating with whom, when, and how frequently.

That said, decentralized communication still lags behind mainstream social applications in user experience, performance, and scalability. Striking the right balance between privacy and convenience remains the foremost technical challenge. Regardless of how things unfold, Vitalik’s donation sends a clear signal: amid the market noise, there are still voices in the crypto world committed to the original ideals—a free, censorship-resistant internet that protects user privacy.

Focus of the Week

Plasma Token Down 90% from Early Peak, Project Far from Delivering on Its Grand Vision

Plasma once garnered immense attention for its bold claim to revolutionize stablecoin infrastructure. The project launched its native token XPL, which quickly attracted over $500 million in funding shortly after going live, with the token price surging to a high of $1.67 and market capitalization exceeding $2 billion. It promised “next-generation blockchain” features such as high throughput, instant payments, and seamless scalability, appearing to possess all the potential to disrupt the stablecoin sector.

However, in terms of actual on-chain usage and market performance post-launch, the project has fallen far short of realizing its ambitious vision. As hype has dissipated and usage volumes have severely underperformed expectations, XPL’s price has plummeted rapidly, now trading in the $0.18–$0.20 range—a retracement of approximately 88–90% from its peak. Although the project team released an engineering progress update in November, it failed to deliver meaningful catalysts or restore community confidence. This has emerged as one of the most emblematic cases of a failed new token launch in the recent crypto market landscape, underscoring the common risks inherent in so-called “stablecoin infrastructure + high-growth narratives” when lacking substantive on-chain data and transparent communication. For investors, this serves as a clear reminder: even for infrastructure-type projects, it is essential to monitor real usage and liquidity before assessing long-term value and risk.

Bitcoin Down Over 20% in the Past Month: Why It’s Underperforming the Stock Market

Despite a series of bullish catalysts, Bitcoin’s recent performance has significantly trailed the stock market. BTC has fallen more than 30% from its highs, breaking below the 50-week moving average, while many altcoins have dropped over 50%. Over the past month alone, Bitcoin has declined 22%, sharply contrasting with traditional equity markets: During the same period, the S&P 500 dipped just 2.5%, and the Nasdaq—historically aligned with Bitcoin’s movements—shed only 4%.

This divergence stems from the fact that equity markets, exemplified by the S&P 500 and Nasdaq-100, have continued to thrive on investor enthusiasm for AI, driving sustained gains amid robust corporate earnings and delayed expectations for Federal Reserve rate cuts. In contrast, the crypto market has been hampered by excessive leverage, with prior liquidation cascades and persistent selling pressure on risk assets fostering a cautious overall sentiment. Compounding this is institutional profit-taking and macroeconomic uncertainties, including trade tensions and inflationary pressures, which have weighed heavily on Bitcoin and major crypto assets, exerting pressure on both technical indicators and funding flows. Many long-term holders have capitalized on highs to realize gains, further softening market liquidity and sentiment.

Looking ahead, most analysts expect that regulatory clarity and eventual rate cuts will act as major catalysts for a Bitcoin rebound in 2026.

Bitcoin Faces $13.6B Monthly Options Expiration: Hedging Likely to Amplify Volatility

Following a sharp retracement, Bitcoin is heading into Friday’s monthly options expiration. During this week’s volatility, the price plunged more than 30% to $81,000 before rebounding toward $90,000; however, sentiment remains cautious and positioning defensive. The market is closely watching the scale of this expiration cycle. Deribit data indicates that the total expiring contracts amount to 151,050 BTC, comprising 94,750 BTC in call options and 56,300 BTC in put options, with a total notional value of approximately $13.6 billion. The put/call ratio stands at 0.59, signaling that bullish positions still dominate but with a notable uptick in demand for downside protection.

The maximum pain point is $101,000—roughly 12% above current spot—indicating that the market is trading far from the optimal zone for option sellers. Around $3.3 billion (22%) of contracts are in-the-money, while the remaining ~$11.7 billion (77%) are out-of-the-money, implying that traders have positioned heavily for a breakout beyond the current consolidation range. Put options are most concentrated near the $81,000 strike, while call options cluster above $120,000—though most high-strike calls are far from being exercised, given the current spot price. Overall, market sentiment remains fragile, with a heavy weighting toward out-of-the-money positions shaping the funding structure. Near key strike prices, market makers’ hedging activities are likely to further magnify short-term volatility, keeping Bitcoin’s price swings elevated ahead of Friday’s expiration.

Funding Weekly Recap

According to RootData, between November 21 and November 27, 2025, a total of 12 crypto and related projects announced financing rounds or mergers/acquisitions, spanning fintech, DApps, MPC wallets, RWA, DEXs, and more. Below are this week’s top projects by funding scale:

Dunamu

On November 26, Naver Financial announced the acquisition of Dunamu via a stock-swap transaction, valuing the company at approximately $10.3 billion.

Dunamu is a leading South Korean fintech company specializing in blockchain and financial technology, operating the country’s largest cryptocurrency exchange, Upbit. Korean internet giant Kakao currently holds a 10.88% stake in Dunamu, down from approximately 20% previously held through its affiliated funds.

Monad

On November 22, Monad announced the completion of a $188 million funding round through a public sale conducted on the Coinbase platform.

Monad is developing a high-performance Layer 1 blockchain designed for next-generation decentralized applications. Its mission is to accelerate the disruptive potential of decentralization by building a blockchain that is 100 to 1,000 times faster than its closest competitors. This performance leap aims to eliminate severe bottlenecks in existing blockchains and enable more complex applications with broader real-world adoption.

Baanx

On November 24, Baanx announced the successful closing of a $175 million funding round led by Exodus.

Baanx is a fully B2B2C-focused service provider offering API-driven digital and crypto-friendly financial services, including physical and virtual debit cards, digital wallets, IBAN accounts, crypto remittances, FX/remittance solutions, and payment gateways. Through its partnership with CL Technology, Baanx also provides white-label, fully hosted applications, enabling global brands to seamlessly integrate blockchain technology, digital assets, and cryptocurrency services at scale.

Next Week to Watch

Token Unlocks

According to data from Tokenomist, the market is set to experience significant token unlocks over the next 7 days (November 28–December 4, 2025). The top three unlocks are as follows:

- HYPE is scheduled to unlock tokens valued at approximately $359 million in the coming 7 days, representing 3.7% of its circulating supply.

- SUI will unlock tokens worth about $68.51 million over the next 7 days, accounting for 1.2% of its circulating supply.

- EIGEN is poised to unlock tokens valued at roughly $22.62 million in the next 7 days, equivalent to 8.3% of its circulating supply. References:

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/crypto-market-data

- Coingecoko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

- CoinDesk, https://www.coindesk.com/markets/2025/11/20/why-bitcoin-is-underperforming-equities-despite-bullish-catalysts

- CoinDesk, https://www.coindesk.com/markets/2025/11/26/a-new-crypto-project-vowed-to-transform-stablecoins-then-its-token-crashed-90

- CoinDesk, https://www.coindesk.com/markets/2025/11/25/bitcoin-faces-usd13-3b-monthly-options-expiry-as-btc-trades-well-below-max-pain

- DeFiLlama, https://defillama.com/chain/merlin

- Reuters, https://www.reuters.com/business/finance/tethers-stablecoin-downgraded-weak-sp-assessment-2025-11-26/?utm_source=chatgpt.com

- Cosmos Hub Forum, https://forum.cosmos.network/t/atom-tokenomics-research-kickoff/16462?u=mag

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025