Gate Stock Token Zone Explained: Understanding Stock Price Movements on a Crypto Platform

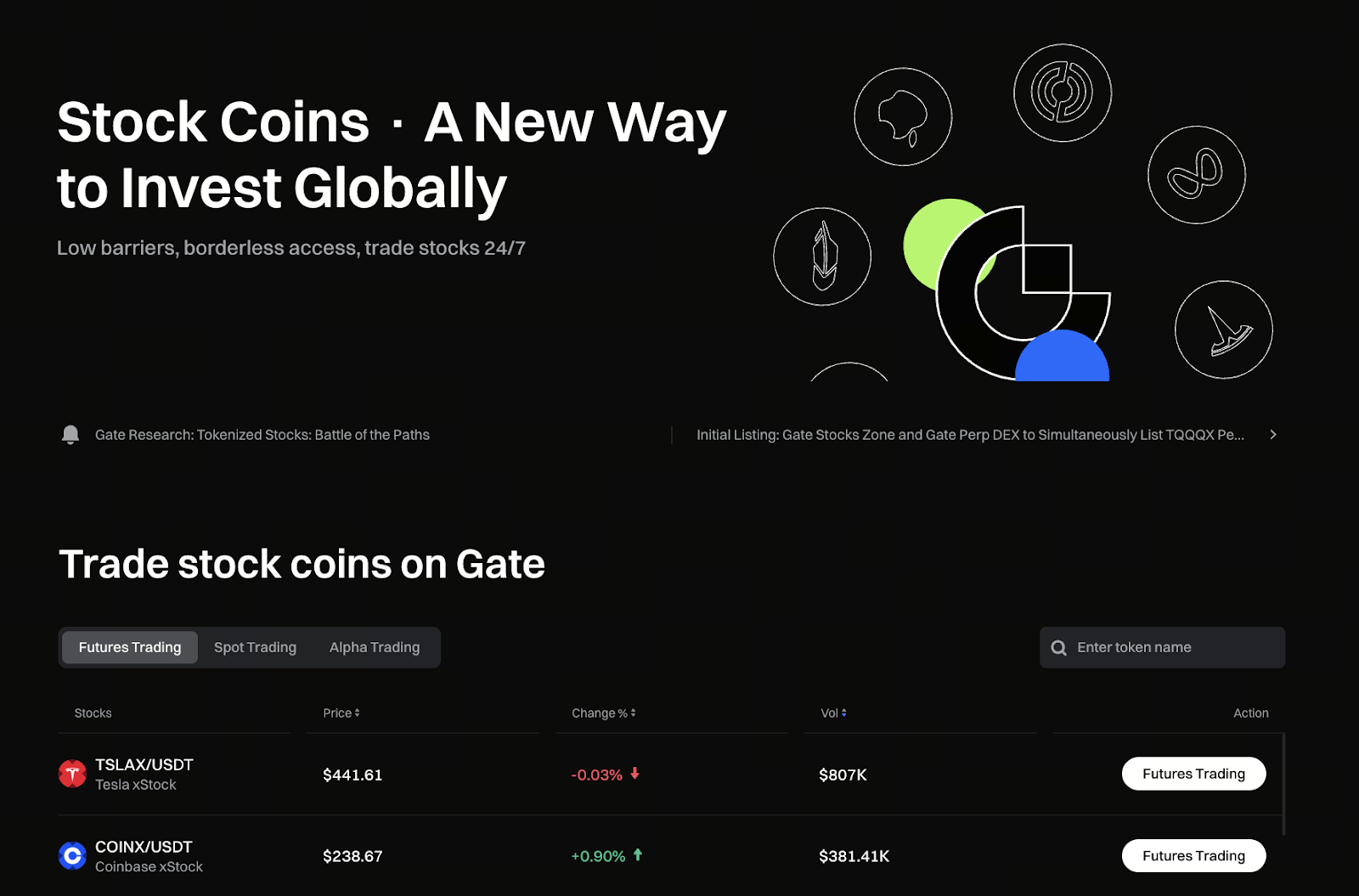

I. Background of the Gate Tokenized Stocks Section Launch

Image: https://www.gate.com/tokenized-stocks

As interest in diversified assets continues to rise among crypto market participants, Gate has introduced the Tokenized Stocks section to meet the growing demand for tokenized stock price display and trading. The primary objective is to integrate stock price elements from traditional markets into the platform, allowing users to monitor and engage with various asset price movements—all without changing their established crypto trading habits.

The Gate Tokenized Stocks section is not an extension of traditional securities services. Instead, it is a product that leverages price mapping. Users interact with the market performance of stock prices, not the underlying stocks themselves. This positioning makes the product more suitable for price speculation and market analysis, rather than for equity investment purposes.

II. Understanding Tokenized Stocks and Their Trading Logic

Tokenized stocks are digital assets pegged to the prices of specific equities, with their value tracking the performance of the corresponding stocks in traditional financial markets. When the price of a stock fluctuates, the price of its tokenized counterpart adjusts accordingly, mirroring stock market dynamics within a crypto trading environment.

Trading in the Gate Tokenized Stocks section follows the standard operational logic of digital assets. Users can buy and sell tokenized stocks to participate in price changes, without the need to open brokerage accounts or handle settlement cycles, as required in traditional stock trading. This structure lowers the participation threshold, but users must clearly understand the product’s features to avoid mistaking tokenized stocks for direct stock ownership.

III. Appropriate Use Scenarios for Tokenized Stocks

Practically speaking, tokenized stocks serve best as tools for price participation. They enable users to observe how different equities react to macroeconomic events, industry news, or market sentiment shifts, thereby deepening their understanding of stock market behavior.

Furthermore, the Gate Tokenized Stocks section offers a convenient way for users to track multiple asset classes on a single platform. This centralized display of market data helps users develop a cross-market pricing perspective. However, the section is not designed for long-term holding or value investing.

IV. Risk Awareness Before Participating in the Gate Tokenized Stocks Section

While tokenized stocks offer simplified trading operations, they still carry significant price volatility risks. Their prices are influenced not only by the underlying equities’ movements but also by changes in digital asset market liquidity and short-term sentiment, which can sometimes result in pronounced price swings.

Before trading in the Gate Tokenized Stocks section, users should fully recognize that tokenized stocks do not grant ownership rights, dividends, or governance privileges associated with actual stocks. Managing trade size prudently and conducting thorough risk assessments are essential for engaging with these price-based products. Gate also urges users to exercise sound judgment and caution in all transactions involving market volatility.

Related Articles

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About

What Are Crypto Options?