Pi Price Prediction: Can It Reach 1.65 to 3 Amid Legal Challenges in 2026?

Lawsuit Draws Attention

SocialChain Inc., the parent company of Pi Network, is currently facing a lawsuit filed by Arizona resident Harro Moen in the U.S. District Court for the Northern District of California. Moen alleges that the company and Pi Network founders Nicolas Kokkalis and Chengdiao Fan unlawfully transferred his 5,137 Pi tokens, resulting in an estimated $2 million in financial losses.

$307 Price Dispute

The lawsuit references a $307 value per Pi token, a figure that industry experts have widely questioned. Analysts highlight that since Pi began trading on centralized exchanges, its price has never surpassed $3. The cited $307 value comes from unregulated IOU markets and does not represent actual market value.

Token Theft Allegation

Moen asserts that his 5,137 Pi tokens were transferred without his authorization. However, experts maintain that unless there is direct evidence of wallet access by the Pi Core Team, the chances of substantiating this claim are slim. Most wallet-related issues stem from phishing attacks or inadequate user security.

Token Migration Delays

Moen also complains that some tokens have not yet migrated from the legacy mining app to the mainnet, which restricts liquidity. Analysts note that this is a widespread issue affecting users globally and does not constitute sufficient grounds for fraud allegations.

Lawsuit Unlikely to Succeed, but Pressures for Transparency Grow

Experts consider the probability of this lawsuit succeeding to be low. However, it may drive the Pi Core Team to improve transparency, especially regarding migration schedules, user support, and mainnet development updates.

Pi Token Price Outlook

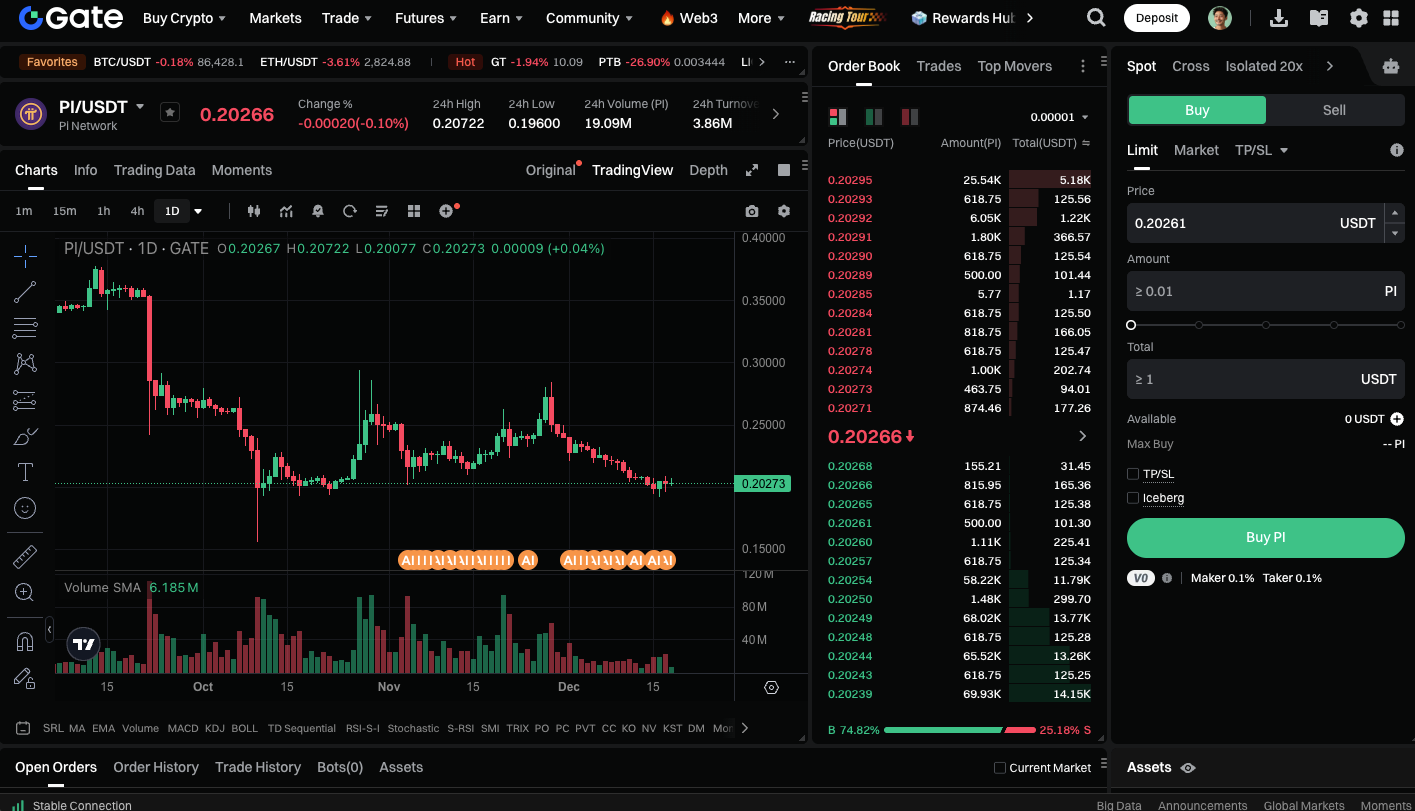

If Pi can deliver real utility within its ecosystem and boost on-chain demand, its price could climb quickly. Technical analysis suggests that breaking through key resistance levels could trigger a trend reversal, setting a short-term target at $0.81 and potentially challenging the $1.00–$1.65 range. Should the ecosystem experience robust growth, Pi could reach $2.00–$3.00 as early as late 2026.

Start trading PI spot now: https://www.gate.com/trade/PI_USDT

Summary

While the lawsuit and historical price disputes create uncertainty for Pi Network, the market remains focused on the project’s ecosystem development and on-chain demand. If Pi continues to expand real-world use cases and attract more users, its token could see substantial growth in 2026, potentially ushering in a bullish market phase.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution