Post content & earn content mining yield

placeholder

十一

【$SKR Signal】Short + Volume Breakout

$SKR After experiencing a significant decline, a volume breakout occurred, indicating strong selling pressure dominates the market.

🎯 Direction: Short

🎯 Entry: 0.0348 - 0.0352

🛑 Stop Loss: 0.0365 ( Rigid Stop Loss )

🚀 Target 1: 0.0320

🚀 Target 2: 0.0290

The price dropped nearly 20% in one day accompanied by massive volume, a typical weak signal. Market logic suggests that position size should be considered; the current pattern leans more towards continued weakness after the release of bearish momentum rather than a simple short squeeze rebound. The k

$SKR After experiencing a significant decline, a volume breakout occurred, indicating strong selling pressure dominates the market.

🎯 Direction: Short

🎯 Entry: 0.0348 - 0.0352

🛑 Stop Loss: 0.0365 ( Rigid Stop Loss )

🚀 Target 1: 0.0320

🚀 Target 2: 0.0290

The price dropped nearly 20% in one day accompanied by massive volume, a typical weak signal. Market logic suggests that position size should be considered; the current pattern leans more towards continued weakness after the release of bearish momentum rather than a simple short squeeze rebound. The k

SKR-27,52%

- Reward

- 2

- Comment

- Repost

- Share

Gass continue holding Btc. On the way to the moon. Don't miss out, maximize the opportunity. Towards infinity, Gasss keep goingsss

BTC-0,23%

- Reward

- like

- Comment

- Repost

- Share

$Sand Will Explode from here Buy as much as You can This Altcoin will hit $10 surely because Metaverse season will be back

SAND5,46%

- Reward

- like

- Comment

- Repost

- Share

AHT

AH Token

Created By@Cryto_Inside

Listing Progress

0.00%

MC:

$3.38K

Create My Token

After evening Bitcoin dips and stabilizes, short-term rebound momentum becomes evident. The support at 88,000-88,500 is effective. The bearish momentum is weakening and the decline has not yet stopped. The rebound can be used to position accordingly; the "Auntie" token moves in sync, with the key support zone at 2860-2890. Follow the Bitcoin rebound for correction, mainly adopting a oscillation and rebound strategy.

Real trading strategy

Bitcoin

Direction: Long

Entry points: 88,500-88,000

Target: Around 90,000

Auntie

Direction: Long

Entry points: 2890-2860

Target: Around 3100

View OriginalReal trading strategy

Bitcoin

Direction: Long

Entry points: 88,500-88,000

Target: Around 90,000

Auntie

Direction: Long

Entry points: 2890-2860

Target: Around 3100

- Reward

- like

- 1

- Repost

- Share

TheMagnificentEighteenFaces :

:

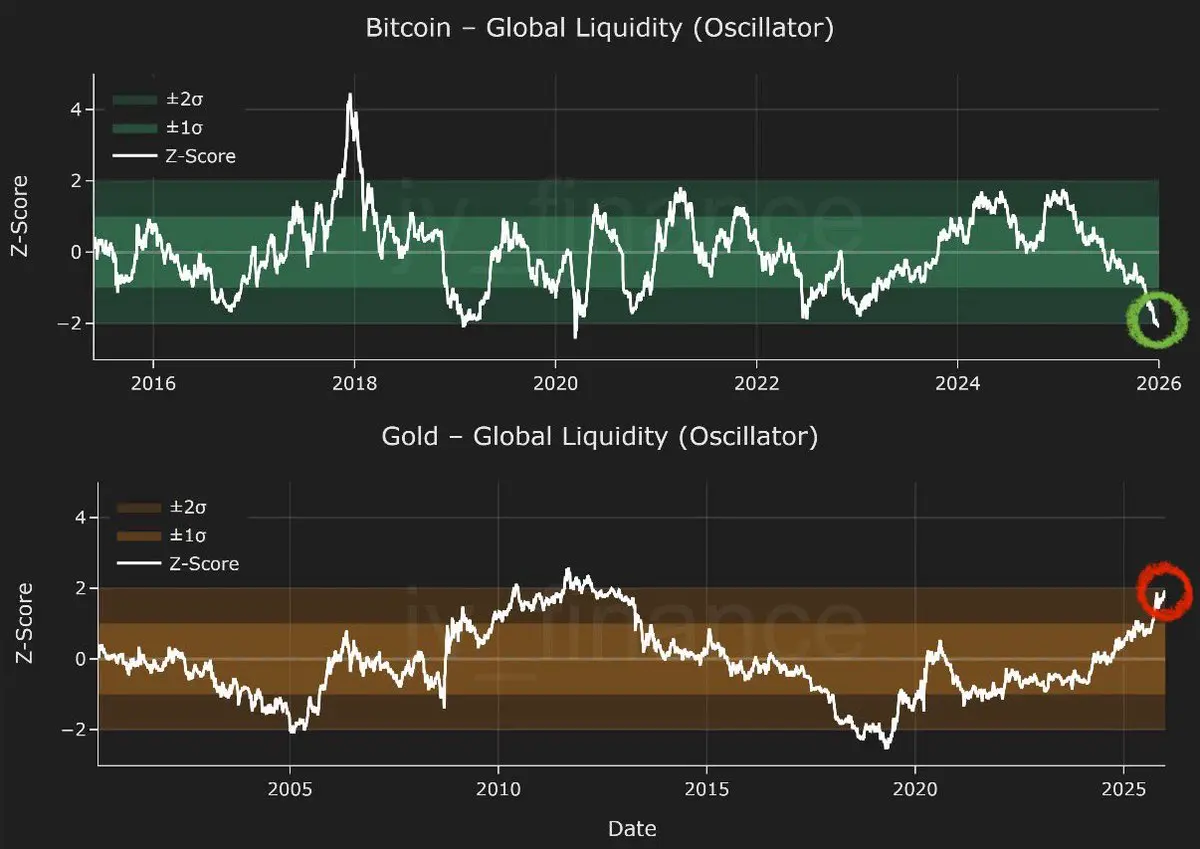

2026 Go Go Go 👊Either bounce back and die immediately, or drop straight down and die here. From a long-term perspective, this position is very dangerous. Be cautious if you're still long. #BTC

BTC-0,23%

- Reward

- like

- Comment

- Repost

- Share

[Market Predicition]🔹 A mysterious whale keeps accumulating, pushing Ethereum holdings past 80,000 ETH — confidence still intact?

- Reward

- 3

- Comment

- Repost

- Share

Hi this is my first post ever on Gate io. Hope it gets some hype as isbdvsbakkasbbsvsvsvsjakababavavacacacbssbnssbdbshs

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

#晒出我的合约收益 Quantify now, experience the charm of the quantitative robot with me, no risk of liquidation, assets steadily increasing

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 2

- Repost

- Share

YangDou888 :

:

How to do itView More

$ENSO is cooking up pressure around 0.7821, and that level is laying down a clean setup for a continuation move if the push hits.

Entry Zone: 0.7816-0.7822

TP 1: 0.7825

TP 2: 0.7828

TP 3: 0.7832

Solid momentum vibes here...just watch the reaction 'round the entry.

#ENSO #Rmj-Trades

Entry Zone: 0.7816-0.7822

TP 1: 0.7825

TP 2: 0.7828

TP 3: 0.7832

Solid momentum vibes here...just watch the reaction 'round the entry.

#ENSO #Rmj-Trades

ENSO22,47%

- Reward

- like

- Comment

- Repost

- Share

Contract Position Notification:

AXS is currently at a major resistance level. The current price is 2.853. Aggressive traders can open a short position. Recommended orders: short at 3.18, add to the short at 3.58, stop loss at 3.8. First take-profit target is 2.2, second take-profit target is 1.8.

Better to stay out of the market than to be liquidated!

AXS is currently at a major resistance level. The current price is 2.853. Aggressive traders can open a short position. Recommended orders: short at 3.18, add to the short at 3.58, stop loss at 3.8. First take-profit target is 2.2, second take-profit target is 1.8.

Better to stay out of the market than to be liquidated!

AXS16,76%

- Reward

- 9

- 2

- Repost

- Share

Qingshan :

:

Hold on tight, we're about to take off 🛫View More

Core Market (As of 2026-01-23 22:30, UTC+8)

• Current Price: approximately $2930, intraday decline of about 1.8%, 24-hour volatility of about 3.2%, trading within the range of $2906-$3028.

• Key Data: approximately $22 billion in 24-hour trading volume, shrinking liquidity; market capitalization around $354 billion, market sentiment is cautious.

📉 Trends and Technical Analysis

• Daily K: Bearish arrangement, Bollinger Bands downward, RSI≈39.55 (neutral leaning bearish), MACD death cross, green bars expanding, short-term weakness persists.

• 4-hour: Within a descending channel, support at $290

• Current Price: approximately $2930, intraday decline of about 1.8%, 24-hour volatility of about 3.2%, trading within the range of $2906-$3028.

• Key Data: approximately $22 billion in 24-hour trading volume, shrinking liquidity; market capitalization around $354 billion, market sentiment is cautious.

📉 Trends and Technical Analysis

• Daily K: Bearish arrangement, Bollinger Bands downward, RSI≈39.55 (neutral leaning bearish), MACD death cross, green bars expanding, short-term weakness persists.

• 4-hour: Within a descending channel, support at $290

BTC-0,23%

- Reward

- 1

- Comment

- Repost

- Share

X型-魅力女性

X型-魅力女性

Created By@GateUser-e3e793f2

Listing Progress

0.00%

MC:

$3.37K

Create My Token

- Reward

- like

- Comment

- Repost

- Share

The Central Bank of Iran uses USDT to bypass global sanctions - - #cryptocurrency #bitcoin #altcoins

BTC-0,23%

- Reward

- like

- Comment

- Repost

- Share

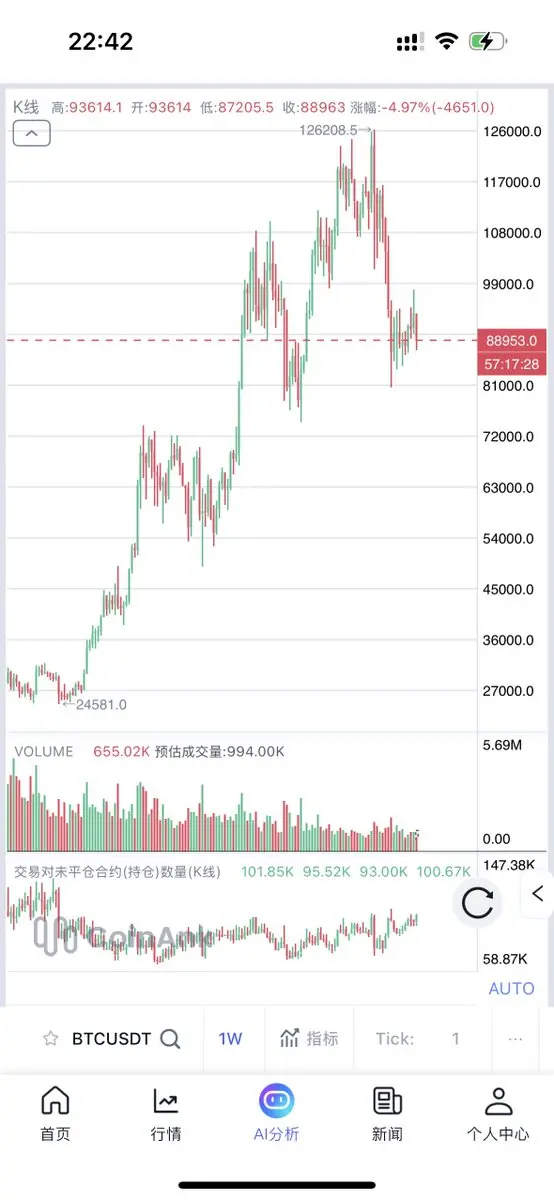

Trend (2026.1.22, UTC): Intraday initially dipped to around **$87,200** low, then V-shaped rebound, trading within a wide range of $87,200–$90,500 throughout the day, closing at about $90,000, up slightly by approximately 0.3%, showing a oscillating recovery pattern with a long lower shadow.

Core Reasons

1. Technical and Fund Flow: Reached the 0.618 Fibonacci retracement level / key support at 87,000, with bears taking profits and bottom-fishing funds entering, forming a V-shaped rebound; however, the resistance zone of **$90,000–$90,500** faces heavy selling pressure, making the rebound weak

View OriginalCore Reasons

1. Technical and Fund Flow: Reached the 0.618 Fibonacci retracement level / key support at 87,000, with bears taking profits and bottom-fishing funds entering, forming a V-shaped rebound; however, the resistance zone of **$90,000–$90,500** faces heavy selling pressure, making the rebound weak

- Reward

- 2

- 1

- Repost

- Share

GateUser-165a7bda :

:

😁#AIBT With AIBT in hand, there’s no need to worry. There’s no fear of missing out—everything is under control. ☺️

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More27.2K Popularity

10.46K Popularity

6.62K Popularity

2.36K Popularity

4.19K Popularity

Hot Gate Fun

View More- MC:$3.44KHolders:20.10%

- MC:$0.1Holders:10.00%

- MC:$3.48KHolders:20.35%

- MC:$3.37KHolders:10.00%

- MC:$3.42KHolders:20.05%

News

View MoreAnalysis: Trump's renewed attack on the Federal Reserve prompted the market to seek safe-haven assets, pushing silver prices above $100 per ounce.

6 m

In the past 24 hours, the total contract liquidation across the entire network reached $151 million, with both longs and shorts being liquidated.

7 m

Data: 30 WBTC transferred out from Wincent, valued at approximately $2,655,800.

12 m

Gambler Deploys $1.82M in Maximum Leverage Trades Across BTC, ETH, and HYPE

17 m

U.S. leading economic indicator release delayed due to a temporary network outage at the World Federation of Large Enterprises

24 m

Pin