Post content & earn content mining yield

placeholder

naeemulmorsalin

High Volatility in BTC/ETH/SOL —washout or trend reversal

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

23Traders :

:

Laughing to death🤣抖音

抖音

Created By@JeffBezos

Subscription Progress

0.00%

MC:

$0

Create My Token

- Reward

- like

- Comment

- Repost

- Share

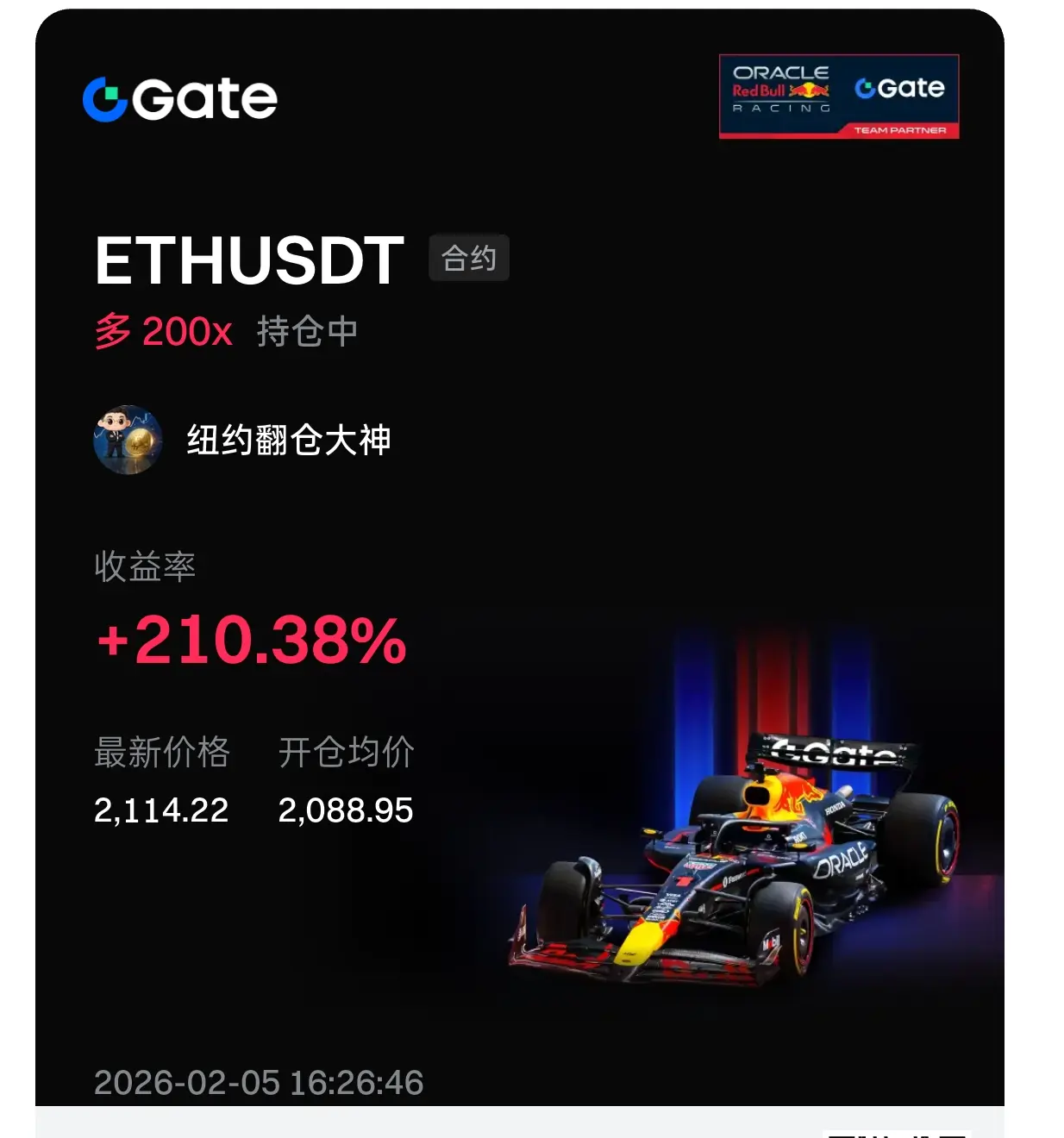

Ethereum (ETH) is showing a significant downward trend today, with market bearish sentiment strong. According to multiple data sources, ETH price has broken below a key psychological level. Here is a summary of the current market key information:

📊 Current Price and Performance

· Current / 24-hour Change: approximately $2,105 - $2,160, down 5%-8.66%

· Intraday Low: $2,070 - $2,109

· Key Level: Price is trading below all major moving averages, with a clear bearish alignment

📈 Resistance Levels

· Strong Resistance Zone: $2,150 - $2,180 (4-hour Bollinger middle band and breakout resistance)

· S

📊 Current Price and Performance

· Current / 24-hour Change: approximately $2,105 - $2,160, down 5%-8.66%

· Intraday Low: $2,070 - $2,109

· Key Level: Price is trading below all major moving averages, with a clear bearish alignment

📈 Resistance Levels

· Strong Resistance Zone: $2,150 - $2,180 (4-hour Bollinger middle band and breakout resistance)

· S

ETH-6,04%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 2

- Repost

- Share

GingerYantu :

:

1100 liquidation should be no problem, right? I just don't believe he can get liquidated.View More

- Reward

- like

- Comment

- Repost

- Share

Back in 2011, Stefan Thomas earned 7,002 BTC for making an educational video.

Today? That’s worth around $620 Million.

The problem is, the Bitcoin is locked on an IronKey USB. And He forgot the password in 2012. He already used 8 of the 10 attempts already.

He has two guesses left, if he misses both & the device wipes itself forever.

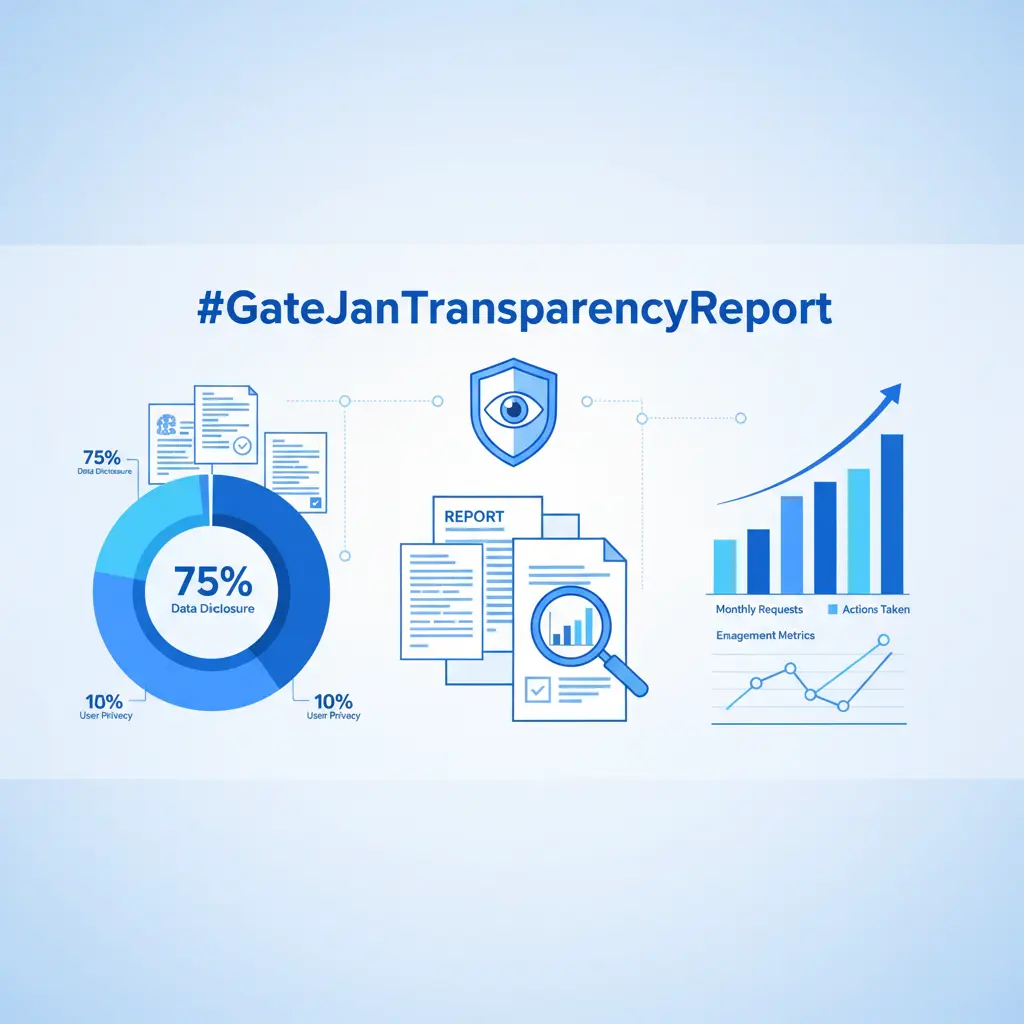

#GateJanTransparencyReport

Today? That’s worth around $620 Million.

The problem is, the Bitcoin is locked on an IronKey USB. And He forgot the password in 2012. He already used 8 of the 10 attempts already.

He has two guesses left, if he misses both & the device wipes itself forever.

#GateJanTransparencyReport

BTC-6,1%

- Reward

- like

- Comment

- Repost

- Share

XRP Technical Structure Update | From Trend Breakdown to Base-Building Test

XRP remains locked in a post-cycle corrective phase after failing to sustain price acceptance above the prior distribution region. The broader market structure continues to favor sellers, with price action showing weak rebounds and persistent lower-high formation.

🔻 Macro Rejection & Trend Shift

XRP previously faced strong rejection from the $3.20–$3.65 supply band, a zone aligned with deep Fibonacci retracement resistance from the prior cycle advance. That rejection confirmed the end of impulsive upside and transitio

XRP remains locked in a post-cycle corrective phase after failing to sustain price acceptance above the prior distribution region. The broader market structure continues to favor sellers, with price action showing weak rebounds and persistent lower-high formation.

🔻 Macro Rejection & Trend Shift

XRP previously faced strong rejection from the $3.20–$3.65 supply band, a zone aligned with deep Fibonacci retracement resistance from the prior cycle advance. That rejection confirmed the end of impulsive upside and transitio

XRP-10,5%

- Reward

- 1

- Comment

- Repost

- Share

GM guys! Don’t forget to always take profits from crypto!

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

GSAGA

gate saga

Created By@Underated

Listing Progress

0.13%

MC:

$2.59K

Create My Token

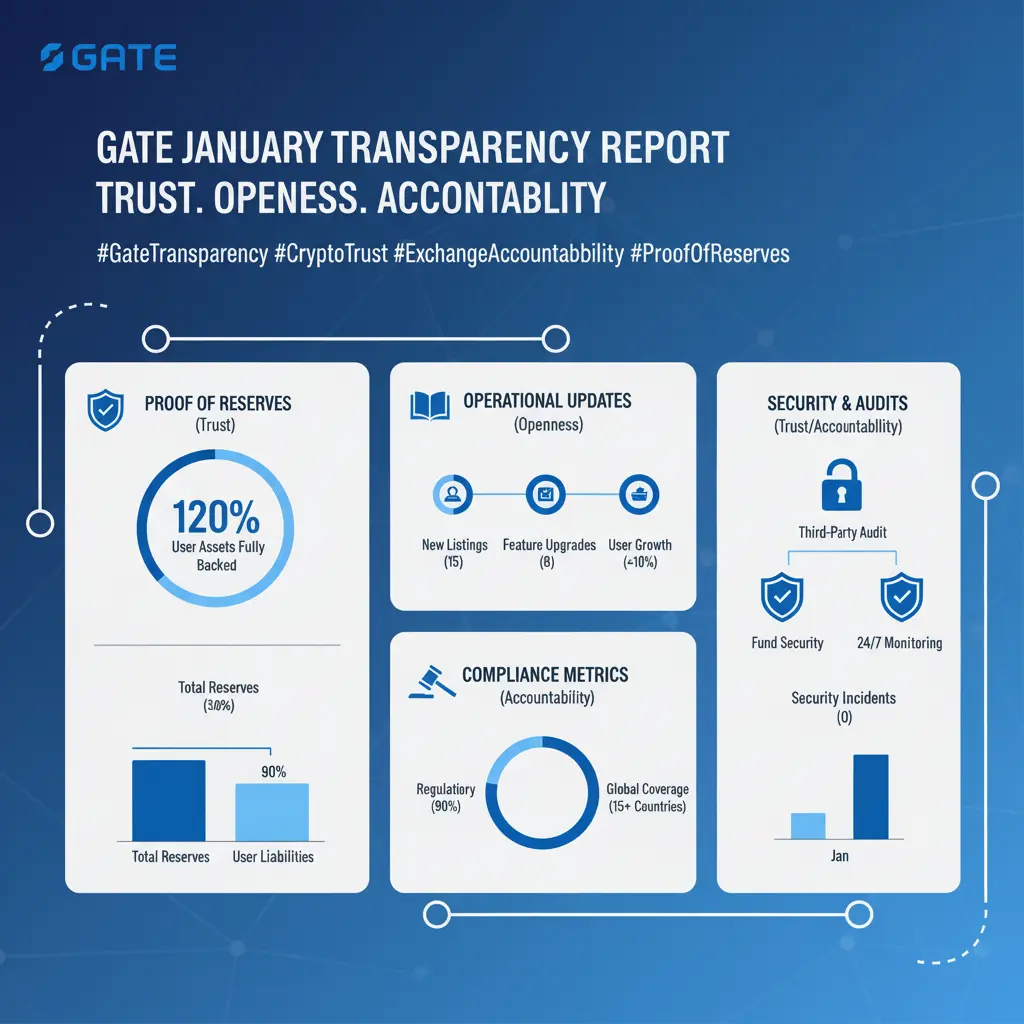

Gate January Transparency Report: Strengthening Trust Through Openness 🔍📊

Gate’s January Transparency Report highlights the platform’s continued commitment to accountability, security, and user trust. By openly sharing key metrics such as reserves data, operational updates, and compliance efforts, Gate reinforces confidence in its ecosystem during a time when transparency is critical for the crypto industry. These reports help users better understand how assets are managed and how risks are mitigated.

In an evolving regulatory and market environment, consistent transparency sets strong excha

Gate’s January Transparency Report highlights the platform’s continued commitment to accountability, security, and user trust. By openly sharing key metrics such as reserves data, operational updates, and compliance efforts, Gate reinforces confidence in its ecosystem during a time when transparency is critical for the crypto industry. These reports help users better understand how assets are managed and how risks are mitigated.

In an evolving regulatory and market environment, consistent transparency sets strong excha

- Reward

- 1

- 2

- Repost

- Share

MissCrypto :

:

Watching Closely 🔍️View More

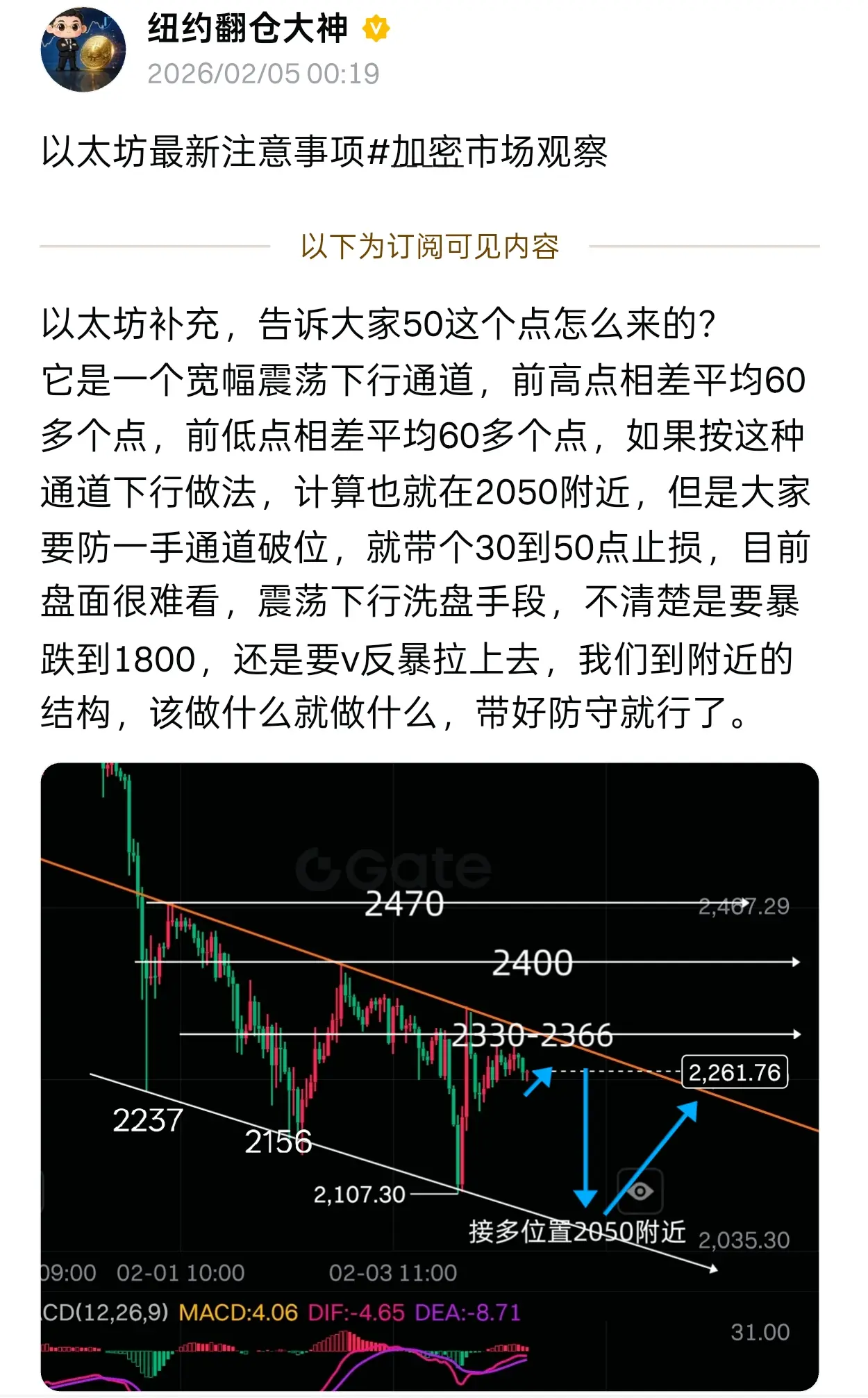

The current market shows a significant divergence: Bitcoin has experienced a sharp decline, while Ethereum demonstrates relative strength, successfully holding the key support level of 2070 in the early session.

However, it should be noted that although the price is currently above 2070, from an overall structural perspective, this more reflects a "resistance stance relying on support," and cannot yet be considered a trend reversal. The bulls are currently facing a severe test, and market dominance still remains in the hands of the bears.

In terms of strategy, if the subsequent rebound cannot

View OriginalHowever, it should be noted that although the price is currently above 2070, from an overall structural perspective, this more reflects a "resistance stance relying on support," and cannot yet be considered a trend reversal. The bulls are currently facing a severe test, and market dominance still remains in the hands of the bears.

In terms of strategy, if the subsequent rebound cannot

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#GateJanTransparencyReportGate

Gate.io has officially released its January 2026 Transparency Report, offering the community a clear view into its operational growth, platform integrity, and market expansion initiatives. This month’s report underscores Gate.io’s commitment to transparency, innovation, and user-centric development in the ever-evolving cryptocurrency landscape.

A key highlight of the January report is Gate.io’s continued expansion into TradFi (Traditional Finance) integration, which significantly broadens multi-scenario trading opportunities for users. By bridging traditional fi

Gate.io has officially released its January 2026 Transparency Report, offering the community a clear view into its operational growth, platform integrity, and market expansion initiatives. This month’s report underscores Gate.io’s commitment to transparency, innovation, and user-centric development in the ever-evolving cryptocurrency landscape.

A key highlight of the January report is Gate.io’s continued expansion into TradFi (Traditional Finance) integration, which significantly broadens multi-scenario trading opportunities for users. By bridging traditional fi

- Reward

- 3

- 10

- Repost

- Share

MissCrypto :

:

Watching Closely 🔍️View More

Live MarkeT Analysis with Trade Entry

- Reward

- like

- Comment

- Repost

- Share

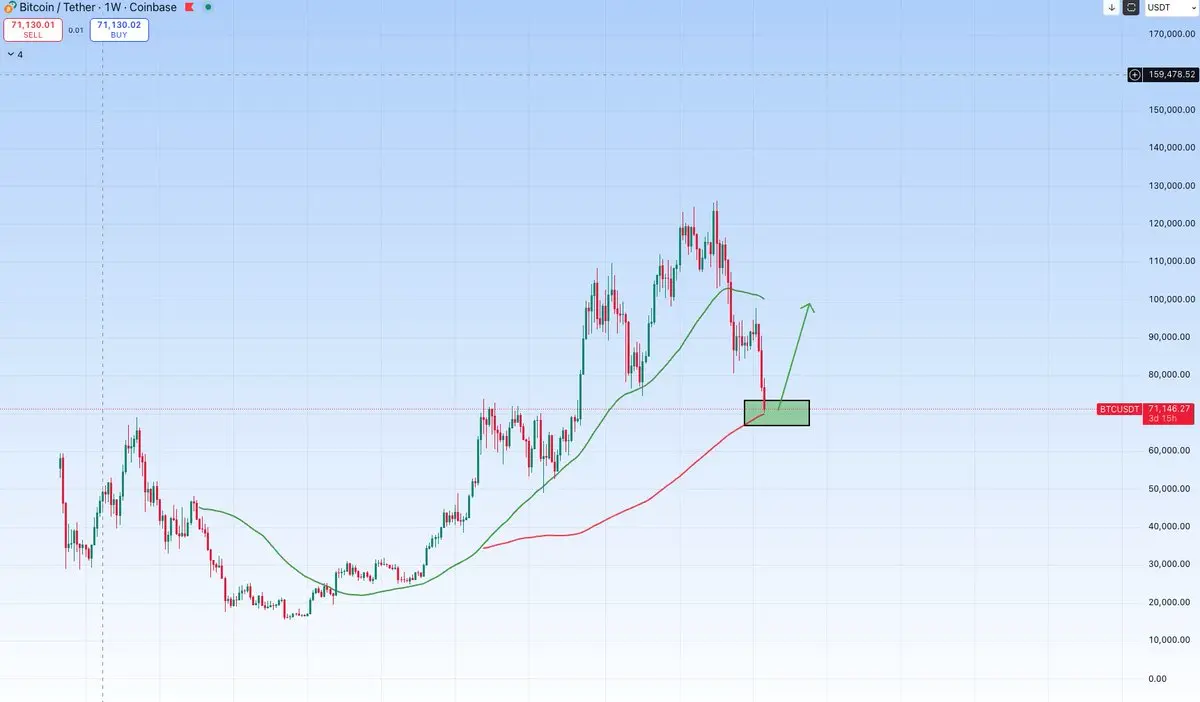

Thursday afternoon, the 2.5 BTC/ETH Silk Share

The current 4-hour chart is in a clear downtrend. The price rebounded to the middle band of the Bollinger Bands and showed an upper shadow pressure signal, then continued to weaken. This indicates that the bears still hold the advantage, and the current slight rebound is only a short-term pause in the decline, not a trend reversal. Therefore, before the trend clearly shifts, it is advisable to look for high-level entry points to short during rebounds, rather than prematurely bottom-fishing.

Operational suggestions:

Bitcoin 71,200-71,700 range for

View OriginalThe current 4-hour chart is in a clear downtrend. The price rebounded to the middle band of the Bollinger Bands and showed an upper shadow pressure signal, then continued to weaken. This indicates that the bears still hold the advantage, and the current slight rebound is only a short-term pause in the decline, not a trend reversal. Therefore, before the trend clearly shifts, it is advisable to look for high-level entry points to short during rebounds, rather than prematurely bottom-fishing.

Operational suggestions:

Bitcoin 71,200-71,700 range for

- Reward

- like

- Comment

- Repost

- Share

Gate Indices section futures has now launched US2000, TW88, AUS200, VIX and HSCHKD. Trade to earn instant rewards, meet trading targets to share additional prizes, and enjoy exclusive welcome bonuses for new users. Both new and existing users are invited to participate and share a 200,000 USDT reward pool. https://www.gate.com/campaigns/4015?ref=VLIWBLOKUW&ref_type=132

- Reward

- 3

- 5

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

- Reward

- 2

- 11

- Repost

- Share

CrabBurger,TheGeniusWithYellow :

:

Let's get the group invitation on the schedule,大神😭I'm going all in now!View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More72.1K Popularity

2.47K Popularity

1.3K Popularity

1.66K Popularity

4.75K Popularity

Hot Gate Fun

View More

News

View MoreXRP plummets nearly 50%, but the wallet surpasses 7.5 million: Are retail investors quietly entering and sending a key signal?

3 m

Elon Musk and Pavel Durov criticize "digital tyranny": Spain's social media ban for under 16 sparks global privacy controversy

4 m

Ben Cowen warns: M2 turning point may be approaching, and Bitcoin bullish macro fundamentals face reversal risk

7 m

DWF Founder: The crypto market is close to "bottoming out," with behind-the-scenes M&A activity being very active

8 m

XRP Price News: Repeating Historical Cycles? XRP May Bottom Out in March, $1.2 Becomes a Key Anchor Point

9 m

Pin