# BitcoinPriceWatch

217.65K

Bitcoin has dropped below $100,000. Is this a buying opportunity? Share your BTC strategy and market outlook with the community!

ybaser

#BitcoinActivityPicksUp #BitcoinPriceWatch

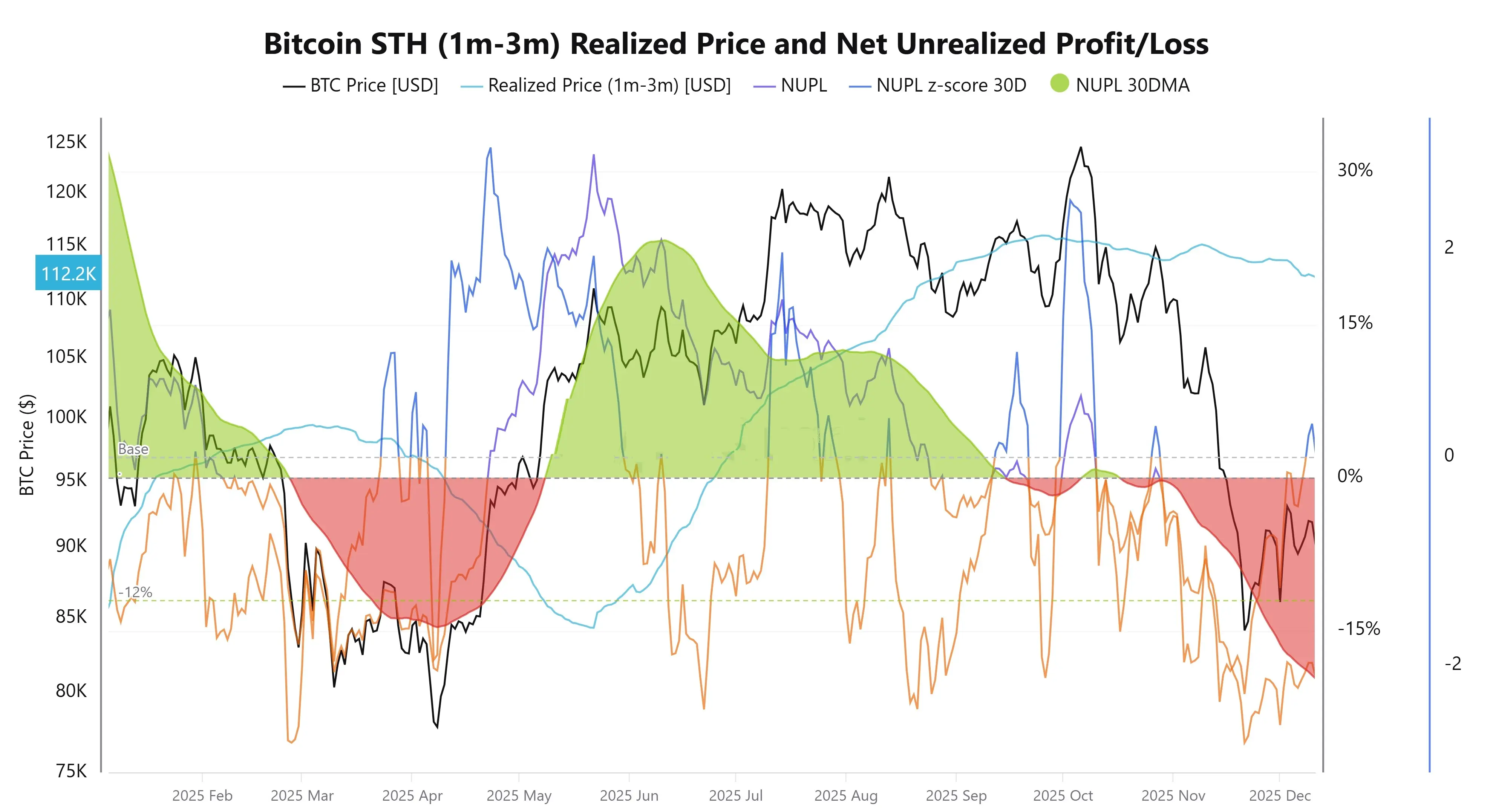

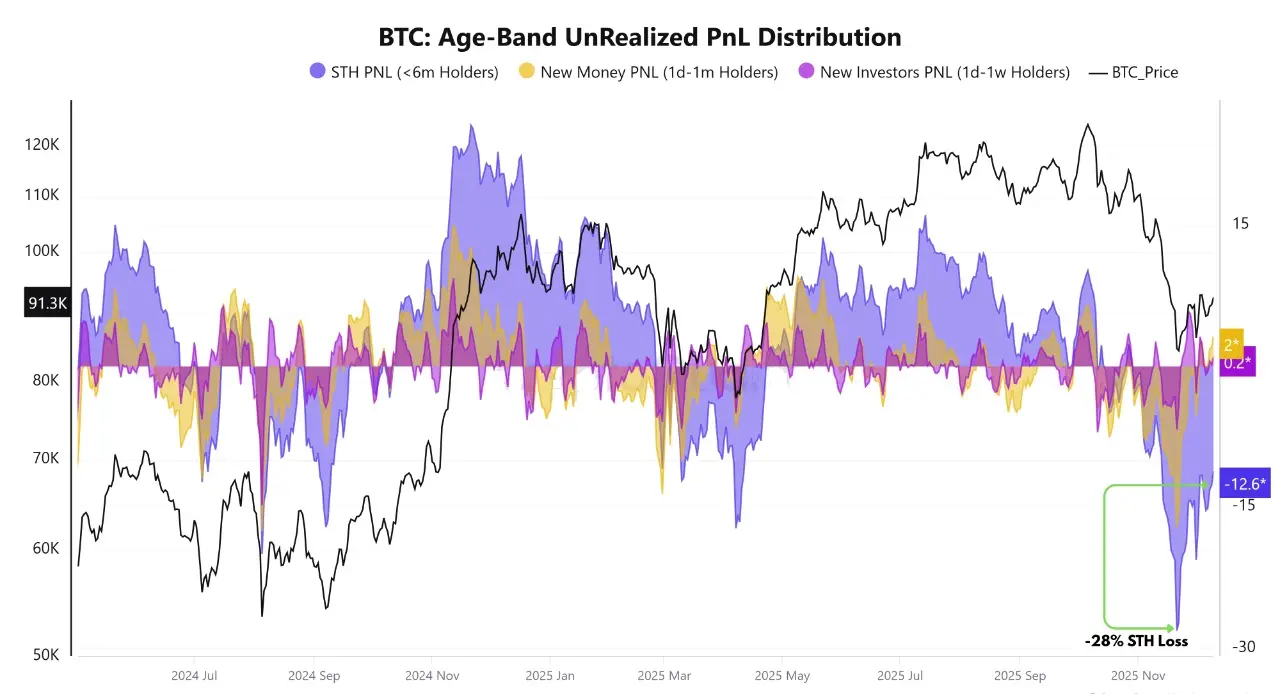

How did short-term investors remain profitable in 2025?

The data shows that while Bitcoin recorded negative returns in 2025, short-term holders profited on a large portion of the days.

Short-term Bitcoin holders (STH) remained profitable on 229 out of 345 days, despite negative year-to-date returns and BTC struggling to trade above $100,000. This result seems contradictory at first glance.

However, beneath the weak headline performance, the structure of on-chain positioning reveals a different picture.

Bitcoin short-term holders recorded profits on 6

How did short-term investors remain profitable in 2025?

The data shows that while Bitcoin recorded negative returns in 2025, short-term holders profited on a large portion of the days.

Short-term Bitcoin holders (STH) remained profitable on 229 out of 345 days, despite negative year-to-date returns and BTC struggling to trade above $100,000. This result seems contradictory at first glance.

However, beneath the weak headline performance, the structure of on-chain positioning reveals a different picture.

Bitcoin short-term holders recorded profits on 6

BTC-1,98%

- Reward

- 37

- 19

- Repost

- Share

Zamin528 :

:

time to buy bitcoin in low prizeView More

📈 Ready Steady GO⚡⚡🚀

Bitcoin is holding steady as the market pauses after recent volatility. Price is moving inside a critical range, with buyers protecting key support while sellers defend major resistance. On-chain data shows cautious accumulation, signaling that smart money is watching closely but waiting for confirmation.

ETF flows and macro news remain the main catalysts. Strong inflows could ignite a fresh rally, while weak demand may keep BTC in consolidation or trigger a short-term pullback.

📈🔥Next move:

• Breakout above resistance = bullish momentum

• Loss of support = deeper

Bitcoin is holding steady as the market pauses after recent volatility. Price is moving inside a critical range, with buyers protecting key support while sellers defend major resistance. On-chain data shows cautious accumulation, signaling that smart money is watching closely but waiting for confirmation.

ETF flows and macro news remain the main catalysts. Strong inflows could ignite a fresh rally, while weak demand may keep BTC in consolidation or trigger a short-term pullback.

📈🔥Next move:

• Breakout above resistance = bullish momentum

• Loss of support = deeper

- Reward

- 2

- 2

- Repost

- Share

Mahbubsimon :

:

Earn rewards by just repost! & Boost your Active participation (viewing, liking, posting, reposting) is the key driver for significantly increasing your account's visibility and growth rate.View More

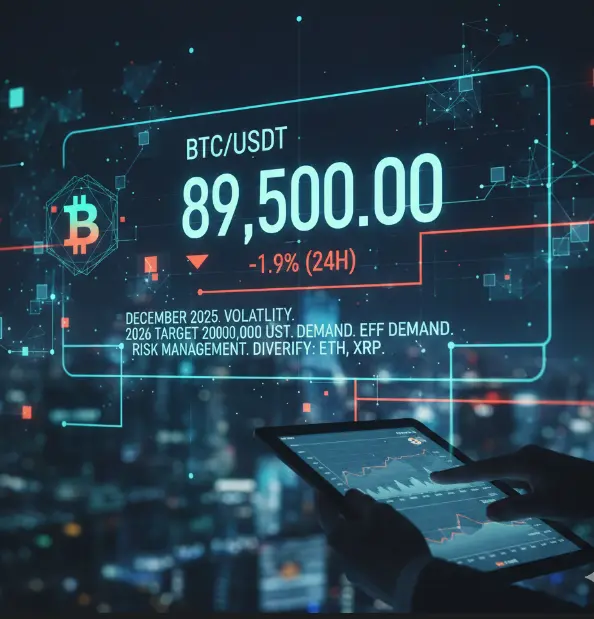

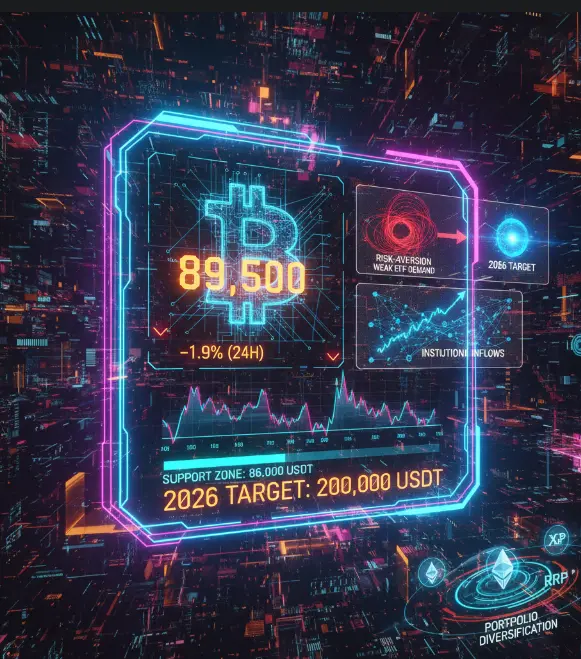

#BitcoinPriceWatch December 2025 Update

As we enter December 2025, Bitcoin remains a central focus for investors, reflecting ongoing market volatility and strategic positioning. Over the past 24 hours, BTC has fluctuated around $89,500 USDT, marking a 1.9% decrease. This short-term movement is largely influenced by risk-aversion trends in global markets and weaker-than-expected demand from ETFs.

Support and Key Levels

Current data highlights a strong support zone around $86,000 USDT, which is critical to maintain in the near term. Holding this level is essential to prevent further downside pre

As we enter December 2025, Bitcoin remains a central focus for investors, reflecting ongoing market volatility and strategic positioning. Over the past 24 hours, BTC has fluctuated around $89,500 USDT, marking a 1.9% decrease. This short-term movement is largely influenced by risk-aversion trends in global markets and weaker-than-expected demand from ETFs.

Support and Key Levels

Current data highlights a strong support zone around $86,000 USDT, which is critical to maintain in the near term. Holding this level is essential to prevent further downside pre

- Reward

- 6

- 1

- Repost

- Share

Discovery :

:

Thank you for the information and sharing.#BitcoinPriceWatch BTC Technical Outlook | Bitcoin Defends Key Demand Zone as Bearish Momentum Fades

Bitcoin remains under bearish pressure following a sharp rejection from higher price levels, yet recent price action suggests early signs of stabilization. BTC is currently holding within a critical demand zone between $86,000–$89,000, an area where buyers are actively defending. This zone aligns with previously established lower support blocks on the chart and now represents the primary short-term battleground that will likely determine the next directional move.

The recent sell-off began afte

Bitcoin remains under bearish pressure following a sharp rejection from higher price levels, yet recent price action suggests early signs of stabilization. BTC is currently holding within a critical demand zone between $86,000–$89,000, an area where buyers are actively defending. This zone aligns with previously established lower support blocks on the chart and now represents the primary short-term battleground that will likely determine the next directional move.

The recent sell-off began afte

BTC-1,98%

- Reward

- 7

- 3

- Repost

- Share

ybaser :

:

Thank you for the information and sharing.View More

#BitcoinPriceWatch

The Bitcoin market remains a focus for investors as we enter December 2025. Over the past 24 hours, the price has fluctuated around 89,500 USDT, recording a 1.9% decrease. This volatility is attributed to a risk-aversion trend in global markets and weak ETF demand.

Current data shows Bitcoin has a strong support zone around 86,000 USDT. Maintaining this level is critical in the short term. In the medium term, with increased institutional inflows, expectations for a rise to 200,000 USDT by 2026 are on the agenda.

Technical analysis suggests lower peaks and troughs indicate a

The Bitcoin market remains a focus for investors as we enter December 2025. Over the past 24 hours, the price has fluctuated around 89,500 USDT, recording a 1.9% decrease. This volatility is attributed to a risk-aversion trend in global markets and weak ETF demand.

Current data shows Bitcoin has a strong support zone around 86,000 USDT. Maintaining this level is critical in the short term. In the medium term, with increased institutional inflows, expectations for a rise to 200,000 USDT by 2026 are on the agenda.

Technical analysis suggests lower peaks and troughs indicate a

ETH-7,19%

MC:$3.67KHolders:2071

0.55%

- Reward

- 71

- 45

- Repost

- Share

MrSTAR :

:

Merry Christmas ⛄View More

#BitcoinPriceWatch

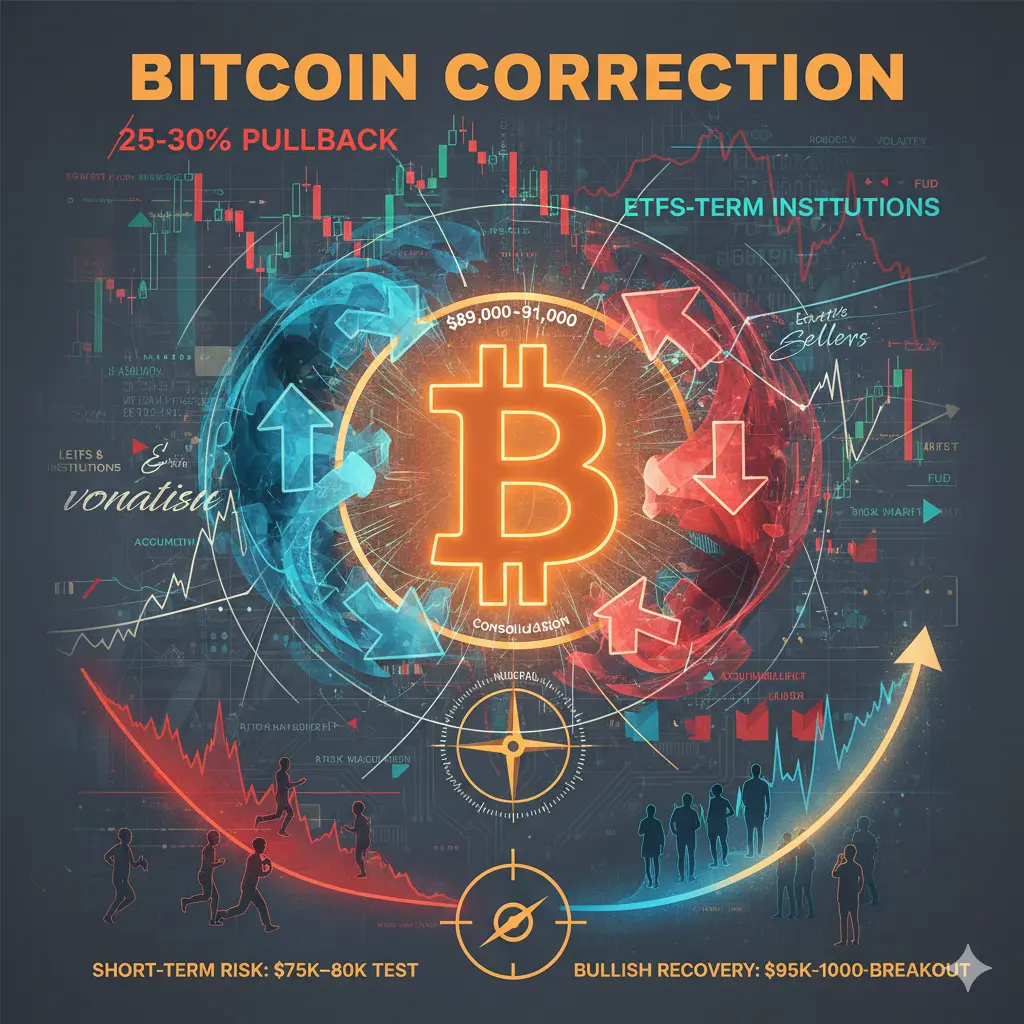

Bitcoin Below $100,000: Market Reset, Strategic Accumulation Zone, or Warning Sign for the Next Move?

Bitcoin falling below the $100,000 level has become one of the most discussed developments in the market. As a major psychological and technical milestone, this level naturally attracts strong emotional reactions. However, experienced market participants understand that price alone never tells the full story. The real question now is whether this move represents a healthy correction within an ongoing uptrend or a signal of deeper consolidation ahead.

From a technical struc

Bitcoin Below $100,000: Market Reset, Strategic Accumulation Zone, or Warning Sign for the Next Move?

Bitcoin falling below the $100,000 level has become one of the most discussed developments in the market. As a major psychological and technical milestone, this level naturally attracts strong emotional reactions. However, experienced market participants understand that price alone never tells the full story. The real question now is whether this move represents a healthy correction within an ongoing uptrend or a signal of deeper consolidation ahead.

From a technical struc

BTC-1,98%

- Reward

- 9

- 10

- Repost

- Share

BabaJi :

:

HODL Tight 💪View More

BTC Technical Outlook: Bitcoin Holds Key Demand Zone as Bears Lose Momentum

Bitcoin remains under bearish pressure after a sharp rejection from higher levels, but price is now stabilizing inside a critical demand zone between $86,000–$89,000, where buyers are actively defending. This area aligns with the lower support blocks marked on the chart and has become the short-term battleground for trend direction.

The recent sell-off was triggered after BTC failed to hold above the $109,400 (0.618 Fib) and $116,450 (0.786 Fib) levels, confirming strong distribution at the top. This rejection caused a

Bitcoin remains under bearish pressure after a sharp rejection from higher levels, but price is now stabilizing inside a critical demand zone between $86,000–$89,000, where buyers are actively defending. This area aligns with the lower support blocks marked on the chart and has become the short-term battleground for trend direction.

The recent sell-off was triggered after BTC failed to hold above the $109,400 (0.618 Fib) and $116,450 (0.786 Fib) levels, confirming strong distribution at the top. This rejection caused a

BTC-1,98%

- Reward

- 16

- 14

- Repost

- Share

BeautifulDay :

:

HODL Tight 💪View More

#BitcoinPriceWatch

Bitcoin (BTC), the largest cryptocurrency in the world, is currently going through a cool-down phase after a strong bullish run earlier. This phase is normal in every market cycle and helps reset momentum before the next major move. Below is a complete and deeply explained update covering price movement, market direction, key influences, risks, and future possibilities.

💰 Current Bitcoin Market Situation

Bitcoin is trading around the $89,000–$91,000 range, showing high volatility and sideways movement. Buyers and sellers are currently in a battle, and the market is waiting

Bitcoin (BTC), the largest cryptocurrency in the world, is currently going through a cool-down phase after a strong bullish run earlier. This phase is normal in every market cycle and helps reset momentum before the next major move. Below is a complete and deeply explained update covering price movement, market direction, key influences, risks, and future possibilities.

💰 Current Bitcoin Market Situation

Bitcoin is trading around the $89,000–$91,000 range, showing high volatility and sideways movement. Buyers and sellers are currently in a battle, and the market is waiting

BTC-1,98%

- Reward

- 21

- 13

- Repost

- Share

BlackRiderCryptoLord :

:

HODL Tight 💪View More

#BitcoinPriceWatch

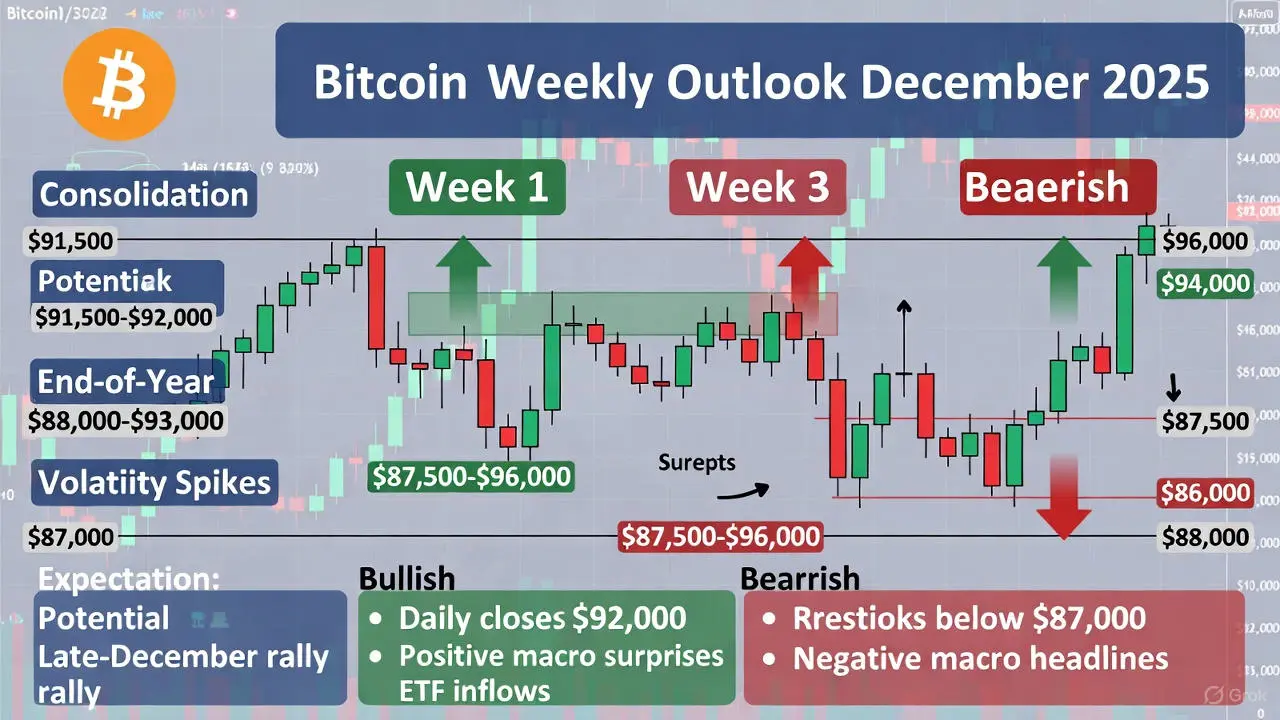

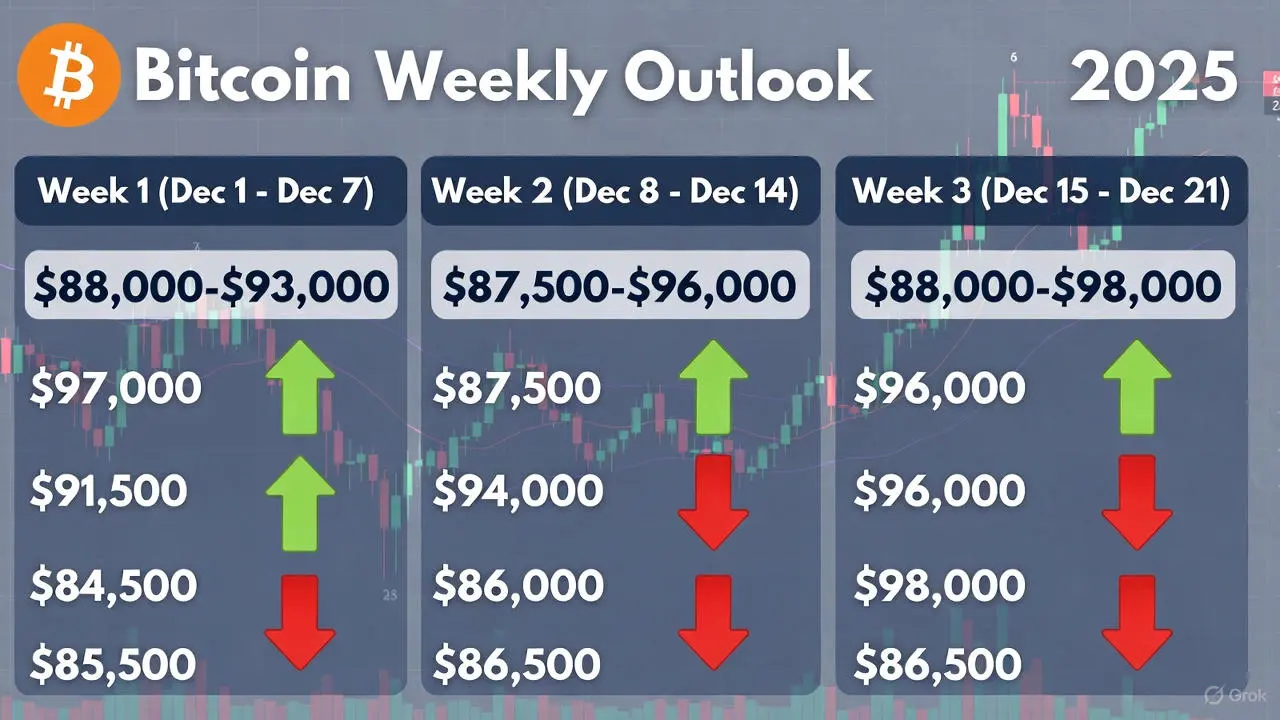

Bitcoin Weekly Outlook — December 2025

Week 1 (Dec 14–20)

Current Range: ~$88,000–$93,000

Support Levels: $87,000 / $85,500

Resistance Levels: $91,500 / $94,000

Expectations: Consolidation likely; volatility may spike around macro data releases. Watch for a decisive close above $91,500 to signal short-term bullish momentum.

Week 2 (Dec 21–27)

Projected Range: ~$87,500–$96,000

Support Levels: $87,500 / $86,000

Resistance Levels: $94,000 / $96,000

Expectations: Potential for a late-December rally if support holds and institutional inflows continue. Thin holiday liquidity may

Bitcoin Weekly Outlook — December 2025

Week 1 (Dec 14–20)

Current Range: ~$88,000–$93,000

Support Levels: $87,000 / $85,500

Resistance Levels: $91,500 / $94,000

Expectations: Consolidation likely; volatility may spike around macro data releases. Watch for a decisive close above $91,500 to signal short-term bullish momentum.

Week 2 (Dec 21–27)

Projected Range: ~$87,500–$96,000

Support Levels: $87,500 / $86,000

Resistance Levels: $94,000 / $96,000

Expectations: Potential for a late-December rally if support holds and institutional inflows continue. Thin holiday liquidity may

BTC-1,98%

- Reward

- 13

- 7

- Repost

- Share

ybaser :

:

Bull Run 🐂View More

#BitcoinPriceWatch

Bitcoin Today: Price Stability, Key Levels & Technical Outlook

Bitcoin (BTC) continues to command the spotlight as it trades within a critical consolidation range, reflecting a market that is cooling, absorbing liquidity, and preparing for its next major move. Rather than showing signs of weakness, today’s price behavior highlights strength through structure, controlled volatility, and disciplined participation from both traders and long-term holders.

At present, Bitcoin is trading around the mid-$90,000 zone, fluctuating within a tight range as buyers and sellers remain ev

Bitcoin Today: Price Stability, Key Levels & Technical Outlook

Bitcoin (BTC) continues to command the spotlight as it trades within a critical consolidation range, reflecting a market that is cooling, absorbing liquidity, and preparing for its next major move. Rather than showing signs of weakness, today’s price behavior highlights strength through structure, controlled volatility, and disciplined participation from both traders and long-term holders.

At present, Bitcoin is trading around the mid-$90,000 zone, fluctuating within a tight range as buyers and sellers remain ev

BTC-1,98%

- Reward

- 10

- 9

- Repost

- Share

Myrons :

:

Hold tight 💪View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

6.85K Popularity

50.15K Popularity

362.16K Popularity

38.02K Popularity

60.88K Popularity

12.16K Popularity

23.72K Popularity

16K Popularity

89.49K Popularity

34.62K Popularity

28.99K Popularity

28.15K Popularity

14.36K Popularity

20.63K Popularity

210.43K Popularity

News

View MoreData: 5849 ETH transferred into OSL, valued at approximately $14.74 million.

1 m

Ethereum drops out of the top 50 in global asset market capitalization, currently ranked 56th

2 m

Machi Faces Continuous Liquidations with Losses Exceeding $26M, Opens New ETH Long Position

7 m

"After the 1011 flash crash, the giant whale opened a short position" reduced its holdings by 24,639.69 ETH in the past 20 minutes, worth approximately $62.88 million.

17 m

BTC 跌破 81000 USDT

23 m

Pin