# TrumpWithdrawsEUTariffThreats

80.12K

Amid ongoing trade tensions, Trump cancels tariffs on several European countries originally set for Feb 1. Do you think this easing signal will meaningfully impact market trends?

MrFlower_XingChen

#TrumpWithdrawsEUTariffThreats 📊

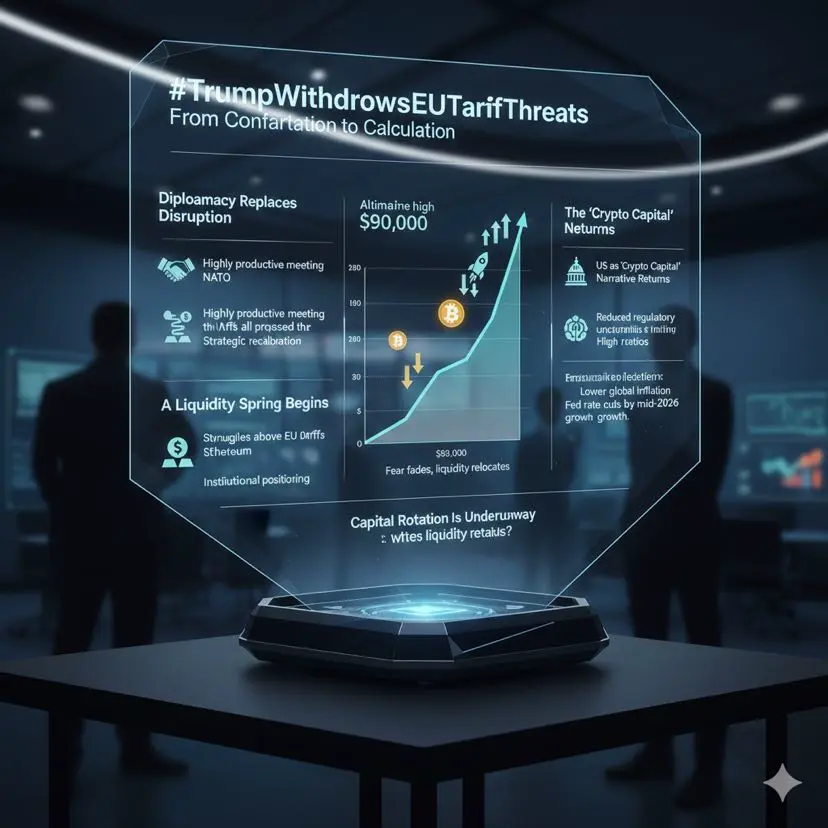

From Confrontation to Calculation: A Strategic Reset in 2026

The opening weeks of 2026 offered global markets a powerful reminder: political signals still move capital faster than data. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately began pricing in the return of a transatlantic trade war. The announcement was tied to growing tensions surrounding Washington’s Arctic strategy and the controversial Greenland acqui

From Confrontation to Calculation: A Strategic Reset in 2026

The opening weeks of 2026 offered global markets a powerful reminder: political signals still move capital faster than data. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately began pricing in the return of a transatlantic trade war. The announcement was tied to growing tensions surrounding Washington’s Arctic strategy and the controversial Greenland acqui

- Reward

- 18

- 151

- Repost

- Share

Yunna :

:

buy to earnView More

#TrumpWithdrawsEUTariffThreats From Confrontation to Calculation: A Strategic Reset in 2026

The opening phase of 2026 delivered a familiar reminder to global markets: political signaling still moves capital faster than economic data. When the United States administration floated the possibility of new customs tariffs on several European nations, market sentiment shifted instantly. The scale of the proposal mattered less than the uncertainty it introduced.

Within hours, investors began repricing geopolitical risk. Equities weakened, crypto markets corrected sharply, and capital rotated toward t

The opening phase of 2026 delivered a familiar reminder to global markets: political signaling still moves capital faster than economic data. When the United States administration floated the possibility of new customs tariffs on several European nations, market sentiment shifted instantly. The scale of the proposal mattered less than the uncertainty it introduced.

Within hours, investors began repricing geopolitical risk. Equities weakened, crypto markets corrected sharply, and capital rotated toward t

- Reward

- 14

- 108

- Repost

- Share

GateUser-3ae550c6 :

:

Honesty is the best policyView More

#TrumpWithdrawsEUTariffThreats

Trump Withdraws EU Tariff Threats — Will This Easing Signal Meaningfully Move Markets?

Context & What Happened

• On January 21–22, 2026, U.S. President Donald Trump cancelled planned tariffs on eight major European allies that had been scheduled to take effect on Feb 1 — originally set at 10% and rising to 25% unless negotiations over Greenland progressed.

• The reversal followed a “framework” agreement reached at the World Economic Forum in Davos with NATO leadership on future Arctic cooperation and de‑escalation of the Greenland dispute.

Immediate Market React

Trump Withdraws EU Tariff Threats — Will This Easing Signal Meaningfully Move Markets?

Context & What Happened

• On January 21–22, 2026, U.S. President Donald Trump cancelled planned tariffs on eight major European allies that had been scheduled to take effect on Feb 1 — originally set at 10% and rising to 25% unless negotiations over Greenland progressed.

• The reversal followed a “framework” agreement reached at the World Economic Forum in Davos with NATO leadership on future Arctic cooperation and de‑escalation of the Greenland dispute.

Immediate Market React

- Reward

- 8

- 124

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats the withdrawal of EU tariff threats may be remembered as a defining inflection point in 2026, where global markets transitioned from reactive fear to strategic confidence. By removing a major geopolitical overhang, policymakers effectively restored visibility, allowing capital to move with intention rather than hesitation. This shift favors assets that thrive on liquidity expansion and policy clarity, setting the stage for a more stable yet opportunity-rich environment across global markets.

As diplomacy replaces disruption, investors are likely to continue reall

As diplomacy replaces disruption, investors are likely to continue reall

BTC0,44%

- Reward

- 1

- 17

- Repost

- Share

Peacefulheart :

:

Ape In 🚀View More

#TrumpWithdrawsEUTariffThreats

Ceasefire in Trade Wars: Global Markets Breathe a Sigh of Relief

An announcement from the White House this morning reported that the additional tariffs expected to be imposed on the European Union's automotive, technology, and agricultural products have been "suspended for now." This decision has brought significant relief, particularly to German automakers and French agricultural sectors. Following the news, markets surged as concerns over a global recession eased slightly.

Initial Market Reaction: Green Lights Everywhere

European Stock Markets: The DAX index i

Ceasefire in Trade Wars: Global Markets Breathe a Sigh of Relief

An announcement from the White House this morning reported that the additional tariffs expected to be imposed on the European Union's automotive, technology, and agricultural products have been "suspended for now." This decision has brought significant relief, particularly to German automakers and French agricultural sectors. Following the news, markets surged as concerns over a global recession eased slightly.

Initial Market Reaction: Green Lights Everywhere

European Stock Markets: The DAX index i

- Reward

- 46

- 42

- Repost

- Share

sun_zero :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats 🌍

Former U.S. President Donald Trump’s decision to withdraw tariff threats against the European Union marks a notable shift in transatlantic trade dynamics. The move eases immediate concerns over escalating trade tensions and offers temporary relief to global markets that have remained sensitive to policy-driven uncertainty.

By stepping back from punitive tariffs, the development signals a more measured approach toward EU–U.S. trade relations, supporting stability for industries spanning manufacturing, agriculture, and technology. Market participants are viewing

Former U.S. President Donald Trump’s decision to withdraw tariff threats against the European Union marks a notable shift in transatlantic trade dynamics. The move eases immediate concerns over escalating trade tensions and offers temporary relief to global markets that have remained sensitive to policy-driven uncertainty.

By stepping back from punitive tariffs, the development signals a more measured approach toward EU–U.S. trade relations, supporting stability for industries spanning manufacturing, agriculture, and technology. Market participants are viewing

- Reward

- 8

- 12

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#TrumpWithdrawsEUTariffThreats

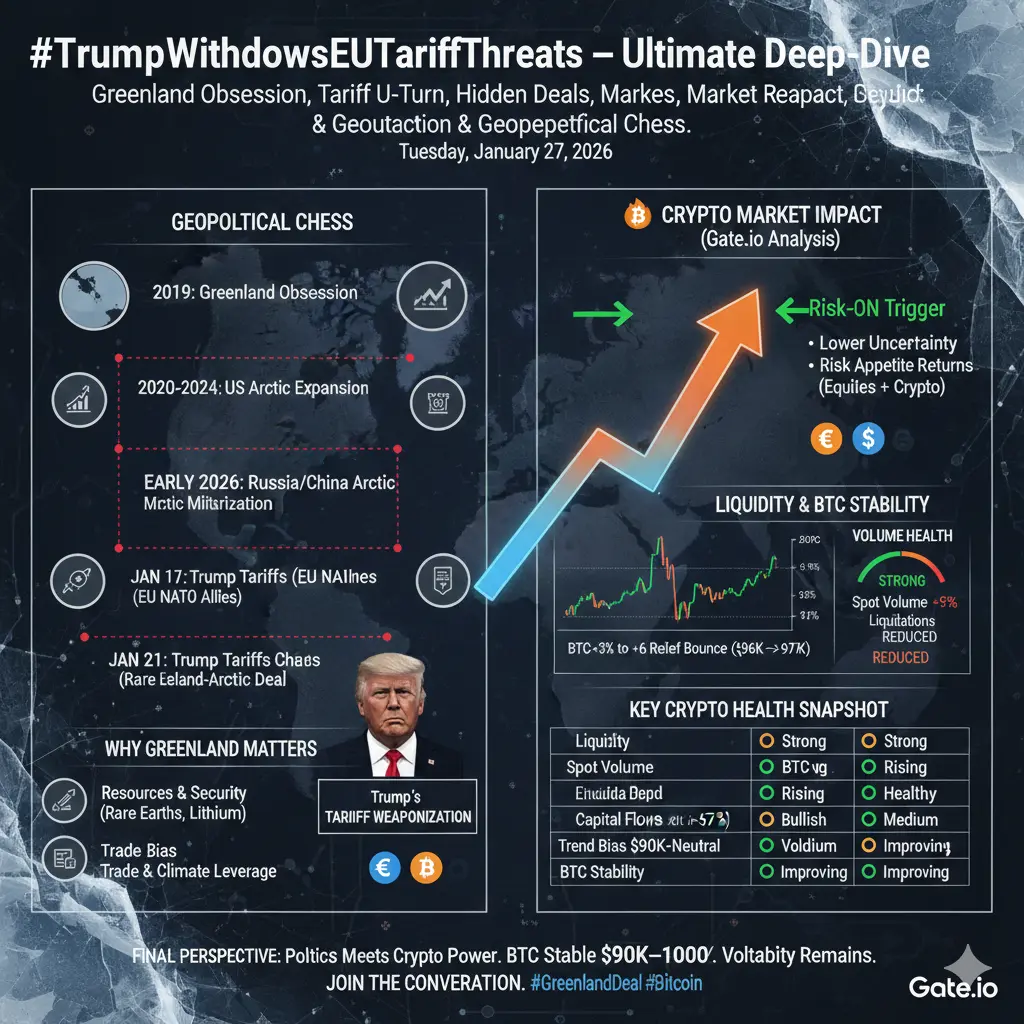

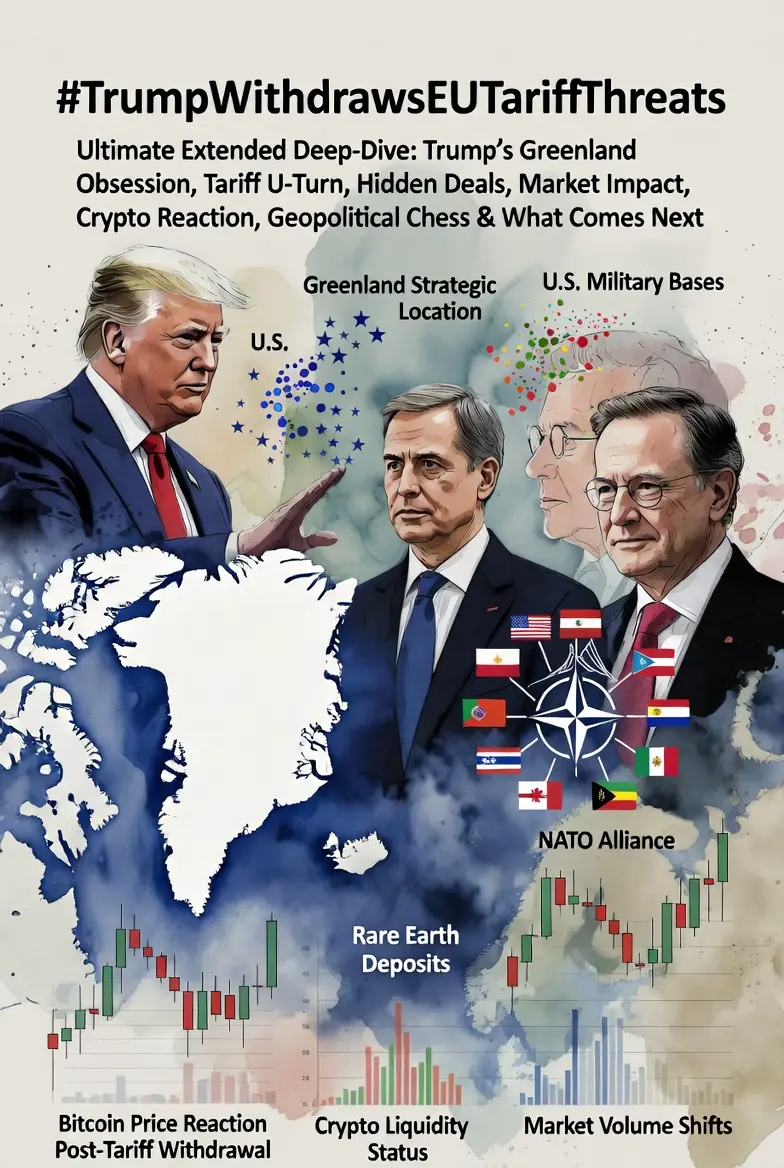

In one of the most dramatic and high-stakes geopolitical episodes of 2026, U.S. President Donald Trump threatened sweeping tariffs on eight European NATO allies — only to abruptly withdraw them days later. The unexpected trigger? Greenland.

This was not just a trade dispute. It was a power play blending tariffs, territorial ambition, Arctic strategy, alliance politics, financial markets, and crypto liquidity dynamics — showcasing how economic weapons are becoming geopolitical tools.

1️⃣ The Full Timeline — From 2019 Greenland Obsession to the 2026 Tariff Crisis

In one of the most dramatic and high-stakes geopolitical episodes of 2026, U.S. President Donald Trump threatened sweeping tariffs on eight European NATO allies — only to abruptly withdraw them days later. The unexpected trigger? Greenland.

This was not just a trade dispute. It was a power play blending tariffs, territorial ambition, Arctic strategy, alliance politics, financial markets, and crypto liquidity dynamics — showcasing how economic weapons are becoming geopolitical tools.

1️⃣ The Full Timeline — From 2019 Greenland Obsession to the 2026 Tariff Crisis

- Reward

- 18

- 20

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#TrumpWithdrawsEUTariffThreats From Confrontation to Calculation: A Strategic Reset in 2026

The opening weeks of 2026 offered global markets a powerful reminder: political signals still move capital faster than data. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately began pricing in the return of a transatlantic trade war. The announcement was tied to tensions surrounding Washington’s Arctic strategy and the controversial Greenland acquisition disc

The opening weeks of 2026 offered global markets a powerful reminder: political signals still move capital faster than data. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately began pricing in the return of a transatlantic trade war. The announcement was tied to tensions surrounding Washington’s Arctic strategy and the controversial Greenland acquisition disc

- Reward

- 10

- 10

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#TrumpWithdrawsEUTariffThreats

Tariffs paused. Risk sentiment breathes again.

Markets were pricing escalation — now they must reprice relief.

Gold cools, yields stabilize, and crypto may catch a short-term bid if this de-escalation holds.

I’m watching BTC and ETH reaction closely before adding positions.

This feels like a sentiment shift, not a trend change… yet.

Do you see this as real easing or just political noise?

Tariffs paused. Risk sentiment breathes again.

Markets were pricing escalation — now they must reprice relief.

Gold cools, yields stabilize, and crypto may catch a short-term bid if this de-escalation holds.

I’m watching BTC and ETH reaction closely before adding positions.

This feels like a sentiment shift, not a trend change… yet.

Do you see this as real easing or just political noise?

- Reward

- 12

- 13

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats From Confrontation to Calculation: A Strategic Reset in 2026

The opening phase of 2026 delivered a familiar reminder to global markets: political signaling still moves capital faster than economic data. When the United States administration floated the possibility of new customs tariffs on several European nations, market sentiment shifted instantly. The scale of the proposal mattered less than the uncertainty it introduced.

Within hours, investors began repricing geopolitical risk. Equities weakened, crypto markets corrected sharply, and capital rotated toward t

The opening phase of 2026 delivered a familiar reminder to global markets: political signaling still moves capital faster than economic data. When the United States administration floated the possibility of new customs tariffs on several European nations, market sentiment shifted instantly. The scale of the proposal mattered less than the uncertainty it introduced.

Within hours, investors began repricing geopolitical risk. Equities weakened, crypto markets corrected sharply, and capital rotated toward t

- Reward

- 5

- 7

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

61.39K Popularity

21.89K Popularity

17.39K Popularity

7.58K Popularity

6.33K Popularity

6.69K Popularity

5.58K Popularity

5.57K Popularity

70.99K Popularity

113.67K Popularity

80.12K Popularity

22.88K Popularity

47.59K Popularity

41.84K Popularity

194.83K Popularity

News

View MoreTether's gold reserves exceed 140 tons, USAT launches to expand in the US dollar market

1 m

SOMI (Somnia) increased by 19.45% in the last 24 hours

1 m

PENGUIN(Nietzschean Penguin)24小时上涨23.52%

20 m

High inflation supports the Federal Reserve's cautious stance, market focuses on Powell's signals

22 m

Revolut opens its first licensed bank outside Europe in Mexico with an investment of over $100 million

37 m

Pin