ETHEN

No content yet

ETHEN

Hlo my Gate family. Let’s step back, breathe, and read what the daily charts are quietly telling us:

I hope you’re all doing well. Today I want to talk to you calmly and honestly, not as someone trying to predict tomorrow’s candle, but as someone reading the daily charts the way long term market participants do. What we are looking at here are not five minute emotions or fifteen minute traps. These are one day charts for Bitcoin and Ethereum, and daily charts speak slowly, but when they speak, they matter. I want to answer three questions dire

I hope you’re all doing well. Today I want to talk to you calmly and honestly, not as someone trying to predict tomorrow’s candle, but as someone reading the daily charts the way long term market participants do. What we are looking at here are not five minute emotions or fifteen minute traps. These are one day charts for Bitcoin and Ethereum, and daily charts speak slowly, but when they speak, they matter. I want to answer three questions dire

- Reward

- 2

- Comment

- Repost

- Share

BTC is trading near 87,275 after a sharp intraday flush toward 86,100 that quickly got bought back. That move was not random. Price dipped into a clean liquidity pocket below recent lows, triggered long liquidations, and immediately saw strong bids step in. This kind of reaction usually tells us larger players were waiting for cheaper fills rather than chasing higher prices.

The rebound back above the short term moving averages shows momentum shifting from panic selling to stabilization. Volume spiked on the selloff and then cooled on the bounce, which fits a classic liquidation driven move in

The rebound back above the short term moving averages shows momentum shifting from panic selling to stabilization. Volume spiked on the selloff and then cooled on the bounce, which fits a classic liquidation driven move in

BTC1.41%

- Reward

- 1

- Comment

- Repost

- Share

NIGHT is trading around 0.0558 after a sharp rejection from the 0.0590 to 0.0600 liquidity zone. That spike higher was quickly sold into, which tells me it was driven more by short covering and thin liquidity than by sustained spot demand. Once price failed to hold above the 30 MA, late longs were trapped and we saw a fast unwind back toward the mid range.

The drop toward 0.0545 cleared a visible pocket of liquidity and triggered a wave of short term liquidations. After that sweep, selling pressure slowed and price started to stabilize, which is why candles are compressing again. Funding has c

The drop toward 0.0545 cleared a visible pocket of liquidity and triggered a wave of short term liquidations. After that sweep, selling pressure slowed and price started to stabilize, which is why candles are compressing again. Funding has c

NIGHT0.17%

- Reward

- 2

- Comment

- Repost

- Share

Hello my Gate family. Let’s talk honestly about where this market really stands:

I hope you’re doing well, staying calm, and most importantly staying rational in a market that loves to test emotions. I want to talk today in a very grounded way about the big question everyone is asking but very few are answering clearly. Are the major coins still pushing back. Has the market already found its bottom. And most importantly, is this actually the right time to buy the dip or is patience still the real edge. I am not here to hype anything. I

I hope you’re doing well, staying calm, and most importantly staying rational in a market that loves to test emotions. I want to talk today in a very grounded way about the big question everyone is asking but very few are answering clearly. Are the major coins still pushing back. Has the market already found its bottom. And most importantly, is this actually the right time to buy the dip or is patience still the real edge. I am not here to hype anything. I

- Reward

- 2

- 1

- Repost

- Share

SYEDA :

:

Watching Closely 🔍An SEC roundtable doesn’t mean instant bullish or bearish moves. What it really means is uncertainty, and uncertainty is where volatility lives. When regulators talk, markets listen, but they also overreact. I’ve seen this pattern enough times to know that the first move is rarely the real move.

If the tone leans constructive, price squeezes fast. If the language feels restrictive, we get a shakeout that tests conviction. Either way, this is not a moment to trade on emotion. It’s a moment to watch how price reacts after the noise settles.

When events like this hit, I focus on structure, not he

If the tone leans constructive, price squeezes fast. If the language feels restrictive, we get a shakeout that tests conviction. Either way, this is not a moment to trade on emotion. It’s a moment to watch how price reacts after the noise settles.

When events like this hit, I focus on structure, not he

BTC1.41%

- Reward

- 2

- Comment

- Repost

- Share

When I see the Fear & Greed Index sitting at 16, I don’t panic, I pause.

Because when there is extreme fear, price is usually doing its job, shaking out weak hands, forcing emotions to the surface. I’ve learned over time that markets rarely reward comfort. They reward patience when conviction is hardest to hold.

Right now, there’s fear in headlines, fear in timelines, fear in candles. And that tells me something important: most people are reacting, not thinking. When everyone feels the same thing at once, risk is often already priced in.

I’m not saying this is the exact bottom. Markets don’t a

Because when there is extreme fear, price is usually doing its job, shaking out weak hands, forcing emotions to the surface. I’ve learned over time that markets rarely reward comfort. They reward patience when conviction is hardest to hold.

Right now, there’s fear in headlines, fear in timelines, fear in candles. And that tells me something important: most people are reacting, not thinking. When everyone feels the same thing at once, risk is often already priced in.

I’m not saying this is the exact bottom. Markets don’t a

BTC1.41%

- Reward

- 2

- 2

- Repost

- Share

SYEDA :

:

Watching Closely 🔍View More

NIGHT is trading around 0.0636 after a sharp pullback from the 0.0694 high. The move down was driven by aggressive long liquidations as price lost the intraday support zone and slipped below short term moving averages. That flush cleared late longs and shifted positioning back to neutral to slightly defensive.

Liquidity behavior shows sell side pressure easing near 0.0626, where buyers stepped in and absorbed the move. Volume spiked during the selloff and then cooled, which usually signals forced selling rather than sustained distribution. Whale activity looks reactive rather than aggressive,

Liquidity behavior shows sell side pressure easing near 0.0626, where buyers stepped in and absorbed the move. Volume spiked during the selloff and then cooled, which usually signals forced selling rather than sustained distribution. Whale activity looks reactive rather than aggressive,

NIGHT0.17%

- Reward

- 2

- 1

- Repost

- Share

SYEDA :

:

HODL Tight 💪Almost $200M hitting the market in a single week isn’t noise. It’s supply showing up all at once, and when that happens, price usually reacts before people finish reading the headline.

Especially when a single name like ASTER leads with such a large share, there’s always pressure somewhere.

What matters to me is timing. When liquidity is already selective, unlocks tend to test conviction. Strong projects absorb it and move on. Weaker ones bleed quietly while everyone looks elsewhere.

So if you’re positioned, this is the week to be awake, not emotional.

Understand where supply comes from, whe

Especially when a single name like ASTER leads with such a large share, there’s always pressure somewhere.

What matters to me is timing. When liquidity is already selective, unlocks tend to test conviction. Strong projects absorb it and move on. Weaker ones bleed quietly while everyone looks elsewhere.

So if you’re positioned, this is the week to be awake, not emotional.

Understand where supply comes from, whe

- Reward

- 3

- Comment

- Repost

- Share

If you believe currencies will keep getting diluted over time, then owning Bitcoin isn’t about chasing upside. It’s about opting out of a system that slowly leaks value. That’s the part many people miss. This isn’t a trade, it’s a position.

What stands out to me is who is saying it. When the head of the world’s largest asset manager frames Bitcoin as a hedge against debasement, it tells you the conversation has shifted. What was once considered extreme is now being spoken in plain, institutional language.

So when I hold Bitcoin, I’m not reacting to today’s price. I’m responding to a longer rea

What stands out to me is who is saying it. When the head of the world’s largest asset manager frames Bitcoin as a hedge against debasement, it tells you the conversation has shifted. What was once considered extreme is now being spoken in plain, institutional language.

So when I hold Bitcoin, I’m not reacting to today’s price. I’m responding to a longer rea

BTC1.41%

- Reward

- 2

- 1

- Repost

- Share

SYEDA :

:

HODL Tight 💪What makes the NIGHT launch interesting is not the token itself, but the way Midnight is trying to fix a problem most blockchains quietly ignore.

On most networks, usage slowly destroys capital. Every transaction eats into the same asset that users and developers are expected to hold long term. Over time, this creates pressure to sell, especially for teams building real products. Midnight takes a different route by separating value from consumption.

NIGHT functions as a capital asset, while DUST acts as the operational fuel. Holding NIGHT continuou

On most networks, usage slowly destroys capital. Every transaction eats into the same asset that users and developers are expected to hold long term. Over time, this creates pressure to sell, especially for teams building real products. Midnight takes a different route by separating value from consumption.

NIGHT functions as a capital asset, while DUST acts as the operational fuel. Holding NIGHT continuou

NIGHT0.17%

- Reward

- 3

- 2

- Repost

- Share

SYEDA :

:

Watching Closely 🔍View More

When I see a monthly MACD flip bearish, I don’t panic, and I don’t dismiss it either. I respect it.

This signal has a long memory. When it shows up on the 1M chart, it usually means momentum is slowing at a structural level, not just a short-term shakeout. And yes, the 4-year cycle matters, because crowd behavior tends to rhyme when liquidity tightens.

But here’s the part people skip. Indicators don’t operate in a vacuum. Back in 2019–2020, this same setup failed because liquidity flipped fast. QT paused, T-bill buying started, and QE followed. Pr

This signal has a long memory. When it shows up on the 1M chart, it usually means momentum is slowing at a structural level, not just a short-term shakeout. And yes, the 4-year cycle matters, because crowd behavior tends to rhyme when liquidity tightens.

But here’s the part people skip. Indicators don’t operate in a vacuum. Back in 2019–2020, this same setup failed because liquidity flipped fast. QT paused, T-bill buying started, and QE followed. Pr

- Reward

- 2

- Comment

- Repost

- Share

NIGHT is trading around 0.0496 after a clean rebound from the 0.0474 liquidity sweep. That downside move flushed weak longs and triggered liquidations, which is visible in the long lower wicks and the quick reclaim above short term moving averages. Price has now pushed back above the intraday trend line, signaling a short term momentum shift.

Liquidity behavior shows bids stepping in aggressively near 0.0475, suggesting whale accumulation rather than panic selling. Volume expanded on the bounce, confirming real participation. Funding on perps remains relatively calm, which tells me this move i

Liquidity behavior shows bids stepping in aggressively near 0.0475, suggesting whale accumulation rather than panic selling. Volume expanded on the bounce, confirming real participation. Funding on perps remains relatively calm, which tells me this move i

NIGHT0.17%

- Reward

- 2

- Comment

- Repost

- Share

Five out of twelve FOMC members already leaning toward a January cut tells me something important: the pressure is shifting. When jobless claims start talking louder than inflation headlines, the Fed’s tone usually follows. Not all at once, not cleanly, but step by step.

There is still uncertainty, and there will be volatility around every data print. But when I look at history, markets rarely wait for full consensus. They move when the direction becomes obvious, not when it becomes comfortable.

For me, this is less about one 25 bps cut and more about what it signals. Liquidity conditions are

There is still uncertainty, and there will be volatility around every data print. But when I look at history, markets rarely wait for full consensus. They move when the direction becomes obvious, not when it becomes comfortable.

For me, this is less about one 25 bps cut and more about what it signals. Liquidity conditions are

BTC1.41%

- Reward

- 1

- Comment

- Repost

- Share

When BlackRock says Bitcoin can grow faster than the internet, I do not hear hype. I hear pattern recognition. I remember how the internet felt early on, when adoption looked slow, messy, and misunderstood, yet everything underneath was compounding quietly.

What makes Bitcoin different is timing. The internet grew without instant global capital rails. Bitcoin has them from day one. So when institutions, nations, and individuals all tap into the same network, growth does not move in decades, it compresses.

I am not expecting straight lines or easy price a

What makes Bitcoin different is timing. The internet grew without instant global capital rails. Bitcoin has them from day one. So when institutions, nations, and individuals all tap into the same network, growth does not move in decades, it compresses.

I am not expecting straight lines or easy price a

BTC1.41%

- Reward

- 2

- Comment

- Repost

- Share

BTC is trading near 90,500 after a sharp intraday recovery from the 89,200 liquidity sweep. The bounce was driven by short liquidations below 89.5k, where sell pressure got absorbed quickly and price reclaimed the intraday moving averages. That reclaim shifted short term momentum back to the upside and forced late shorts to cover.

Liquidity behavior shows buyers defending the 90k handle aggressively, while sell side liquidity above 90.6k to 90.8k remains the next magnet. Volume expanded on the impulse candle, signaling real participation rather than a weak bounce. Whale activity looks tactical

Liquidity behavior shows buyers defending the 90k handle aggressively, while sell side liquidity above 90.6k to 90.8k remains the next magnet. Volume expanded on the impulse candle, signaling real participation rather than a weak bounce. Whale activity looks tactical

BTC1.41%

- Reward

- 2

- Comment

- Repost

- Share

FDUSD pulled back sharply from 0.9991 after a liquidity sweep that triggered a cluster of fast sell orders. The drop into 0.9983 flushed out short term leverage and cleared resting bids, which is why the bounce that followed came with clean absorption. Price is now stabilizing around 0.9985 with a slow grind upward, but momentum remains neutral.

MA5 and MA10 have just curled upward and are flattening against MA30, showing early signs that short term pressure is easing but not yet reversing into strength. Volume on the recovery is modest, meaning whales are not aggressively repositioning. This

MA5 and MA10 have just curled upward and are flattening against MA30, showing early signs that short term pressure is easing but not yet reversing into strength. Volume on the recovery is modest, meaning whales are not aggressively repositioning. This

FDUSD0.02%

- Reward

- 2

- Comment

- Repost

- Share

LUNA continues to trade under strong downside pressure as sellers keep control of the 15m structure. The breakdown from 0.20455 accelerated once price lost MA10 and MA5, with both averages now sharply angled downward, confirming sustained trend momentum.

Liquidity was swept at 0.17760 where forced selling and small liquidation clusters appeared, which is why we saw an immediate bounce from that exact level.

Even with the bounce, buyers are not showing dominance. Volume on green candles remains weaker compared to the sell-side bursts, signaling that larger players are not aggressively absorbin

Liquidity was swept at 0.17760 where forced selling and small liquidation clusters appeared, which is why we saw an immediate bounce from that exact level.

Even with the bounce, buyers are not showing dominance. Volume on green candles remains weaker compared to the sell-side bursts, signaling that larger players are not aggressively absorbin

LUNA-3.58%

- Reward

- 3

- Comment

- Repost

- Share

NIGHT is attempting a recovery after the liquidity sweep at 0.04617, and the latest 15m candle shows the first sign of buyers stepping back in. The bounce aligns with a clear short covering reaction because liquidations were triggered right into the low. That created a pocket of thin liquidity, allowing price to snap back toward the previous micro resistance.

Even with the bounce, structure remains in a downtrend. Price is still trading below MA5, MA10 and MA30, and all three averages continue pointing downward. This shows sellers still control the trend and buyers are only reacting, not leadi

Even with the bounce, structure remains in a downtrend. Price is still trading below MA5, MA10 and MA30, and all three averages continue pointing downward. This shows sellers still control the trend and buyers are only reacting, not leadi

NIGHT0.17%

- Reward

- 2

- Comment

- Repost

- Share

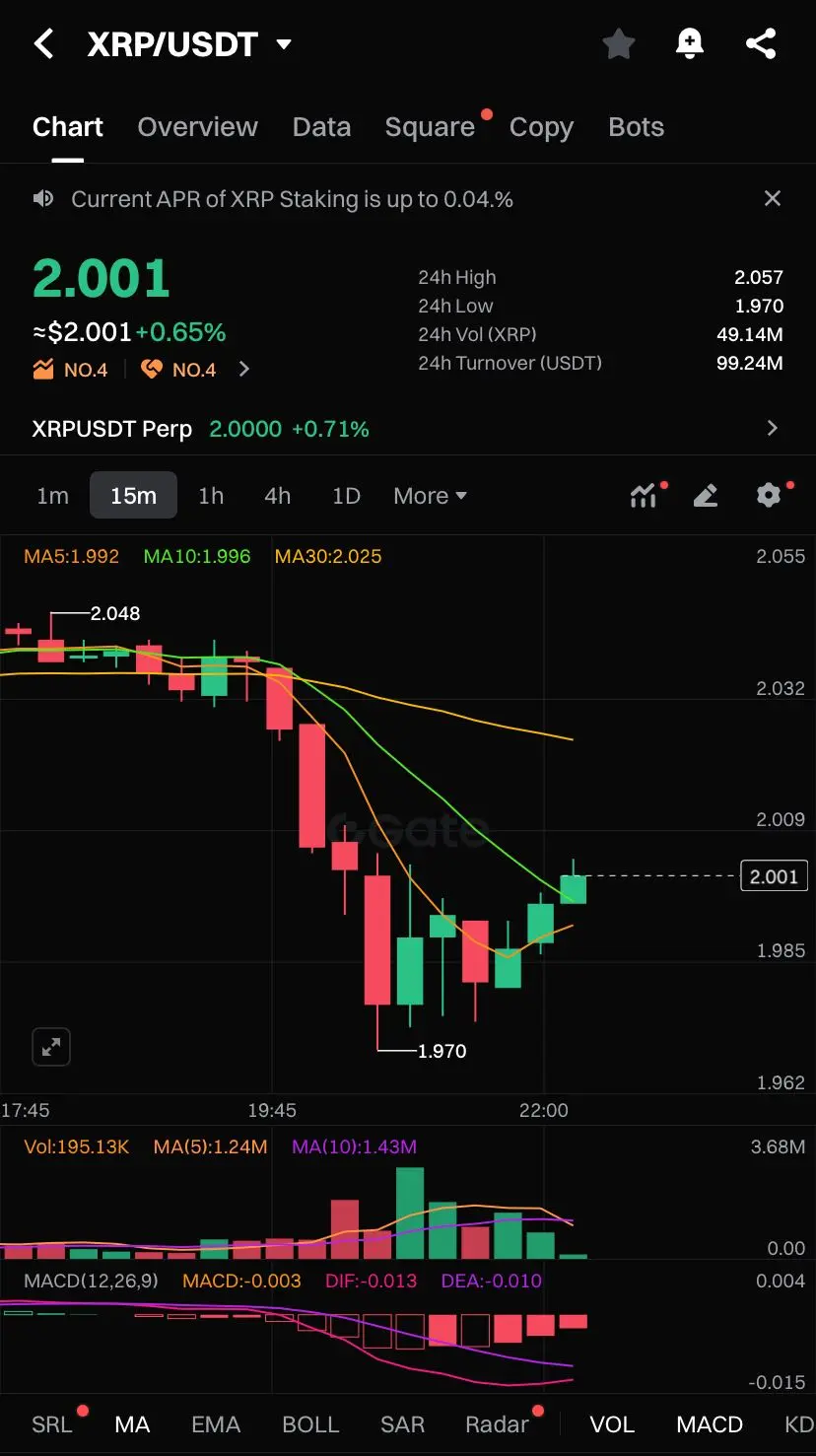

XRP is pushing a mild recovery after tagging 1.970, which acted as the intraday liquidity sweep. The bounce shows buyers defending the level, but the broader structure is still bearish because price remains below MA5, MA10 and MA30, all angled downward. This alignment signals that any upside here is corrective unless XRP reclaims 2.020 with strong participation.

Liquidity behavior shows sell side pressure easing as volume spikes appeared near the lows. That pattern often signals short covering rather than aggressive whale accumulation. No large absorption candles yet, which suggests big player

Liquidity behavior shows sell side pressure easing as volume spikes appeared near the lows. That pattern often signals short covering rather than aggressive whale accumulation. No large absorption candles yet, which suggests big player

XRP1.69%

- Reward

- 3

- Comment

- Repost

- Share

GT is trying to stabilize around 10.29 after a steady intraday selloff that pushed price down into the 10.25 liquidity pocket. The reaction from that level is visible but still weak, suggesting buyers are not yet stepping in with conviction. Most of the bounce candles remain small and low volume, showing that the move is more about shorts covering than real accumulation.

Price is still trading below all short term moving averages MA5, MA10, and MA30. All three are angled downward and spreading apart, confirming a bearish micro trend. Until GT reclaims at least the MA10 with a strong green cand

Price is still trading below all short term moving averages MA5, MA10, and MA30. All three are angled downward and spreading apart, confirming a bearish micro trend. Until GT reclaims at least the MA10 with a strong green cand

GT1.76%

- Reward

- 2

- Comment

- Repost

- Share