Daytime strategy: Investing is like hunting—only those who wait can get the reward. Being in cash requires discipline, holding positions requires conviction. In trading, the first to lose everything are those who can't stay idle.

View Original繁星说交易

No content yet

繁星说交易

BTC Short-term

After breaking below the upward channel, it moved sideways without structure. The overall trend maintains a high-low point operation, with a bias towards long positions in the short term!

Watch the 90000-91000 range above; once reached, consider a short position with a target of 89000-88000.

Below, focus on the 85500-85000 range for long entries, with a stop loss at 84000, and targets of 88000-90000-93000!

After breaking below the upward channel, it moved sideways without structure. The overall trend maintains a high-low point operation, with a bias towards long positions in the short term!

Watch the 90000-91000 range above; once reached, consider a short position with a target of 89000-88000.

Below, focus on the 85500-85000 range for long entries, with a stop loss at 84000, and targets of 88000-90000-93000!

BTC-0,5%

- Reward

- 3

- Comment

- Repost

- Share

I personally believe this downward cycle has already ended. Next comes the Christmas and New Year cycle.

From mid-December to the New Year, there are basically no major news events to digest in advance. The landing, rate hikes, and rate cuts—whether positive or negative—have already been completed.

Plus, with the secondary test at 84,400, the structure is also about to be in place. If we can regain the 90,000 level and stay above it, then it's safe to fully go long!

View OriginalFrom mid-December to the New Year, there are basically no major news events to digest in advance. The landing, rate hikes, and rate cuts—whether positive or negative—have already been completed.

Plus, with the secondary test at 84,400, the structure is also about to be in place. If we can regain the 90,000 level and stay above it, then it's safe to fully go long!

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 4

- Comment

- Repost

- Share

Bitcoin has fallen below the $90,000 mark, and a new 4-hour level decline has officially begun. Any small rebound within the day could be an opportunity to look for shorting opportunities. Ethereum's trend is generally following, and a rebound is expected for technical correction. The key point to watch is whether the price can effectively recover above $3,250 to temporarily halt the decline. The market's short-term structure has weakened, so the trading strategy should shift to a rebound and short approach.

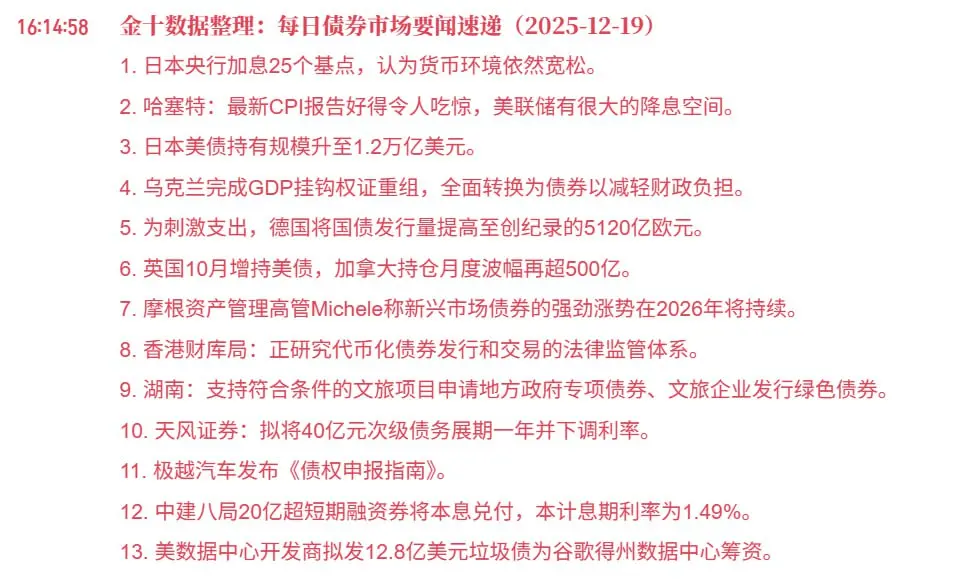

The Federal Reserve cut interest rates by 25 basis points as expected, but Powell'

View OriginalThe Federal Reserve cut interest rates by 25 basis points as expected, but Powell'

- Reward

- 5

- Comment

- Repost

- Share