Historisch: Die brasilianische B3-Börse wird im nächsten Jahr eine Stablecoin ausgeben

Die neue Stablecoin soll die Liquidität in verschiedenen Marktsegmenten verbessern, einschließlich tokenisierter und traditioneller Finanzangebote. Die B3-Behörden deuteten an, dass das tokenisierte Produkt potenziell als Alternative zu drex, Brasiliens CBDC, dienen könnte, die kürzlich in ihrer ersten Implementierung zurückgefahren wurde.

Brasiliens Börse bereit, eigene Stablecoin zu starten

Die Fakten

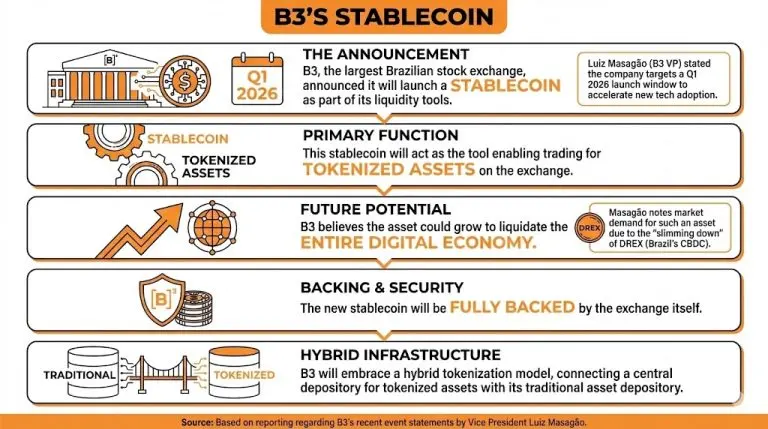

Die größte brasilianische Börse, B3, hat angekündigt, ab dem nächsten Jahr eine Stablecoin als Teil ihrer Liquiditätsinstrumente einzuführen.

Bei einer kürzlichen Veranstaltung erklärte B3s Vizepräsident für Produkte und Kunden, Luiz Masagão, dass das Unternehmen Q1 2026 als Startzeitraum anvisiert, im Rahmen einer Beschleunigung der Einführung neuer Technologien.

Masagão sagte, dass diese Stablecoin das Werkzeug werden wird, das den Handel mit tokenisierten Vermögenswerten ermöglicht. Dennoch glaubt er auch, dass sie zu etwas Bedeutenderem heranwachsen kann. Zu diesem Thema sagte er:

Es kann viel mehr sein als das. Mit der Verkleinerung von DREX besteht eine Nachfrage nach einem Vermögenswert, um die gesamte digitale Wirtschaft zu liquidieren.

Neben dieser neuen Stablecoin, die vollständig von der Börse gedeckt sein wird, erwartet das Unternehmen auch, das Tokenisierungsmodell für einige Vermögenswerte vollständig zu übernehmen und ein hybrides Angebot zu entwickeln. Dafür wird es ein zentrales Depot für tokenisierte Vermögenswerte haben, das mit seinem zentralen Depot für traditionelle Vermögenswerte verbunden ist.

„Ich glaube, dass die Erweiterung des Produktumfangs einer der großen Schlüssel für die Beschleunigung ist, die wir erreicht haben“, betonte Masagão, da das Unternehmen plant, im nächsten Jahr 22 Produkte auf den Markt zu bringen, darunter wöchentliche Bitcoin-Dollar-Optionen.

Weiterlesen: Brasiliens B3-Börse startet Ether- und Solana-Futures

Warum es relevant ist

Die Ausgabe einer Stablecoin würde B3 als eine der Pionierbörsen positionieren, die diese Technologie weltweit nutzen und einführen.

Es ist auch ein Beweis für das Vertrauen, das diese digitalen Vermögenswerte in den brasilianischen und lateinamerikanischen Märkten genießen, die täglich Tausende von Transaktionen mit Stablecoins wie USDT und USDC abwickeln.

Ausblick

Während B3 hofft, seine kommenden Stablecoins als wichtigen Treiber für tokenisierte Märkte zu positionieren, bleibt abzuwarten, ob Händler diese neue Technologie annehmen werden. Dennoch deuten Masagãos Aussagen auf eine starke Performance hin, zumal die brasilianische Zentralbank ihre Bestrebungen für die digitale Zentralbankwährung ( CBDC) reduziert hat.

FAQ

- Welche Stablecoin-Initiative plant die brasilianische Börse B3?

B3 plant, ab Q1 2026 eine Stablecoin als Teil ihrer Liquiditätsinstrumente einzuführen, um die Einführung neuer Technologien im Handel zu fördern. - Was wird die Stablecoin neben dem Handel ermöglichen?

Die Stablecoin soll den Handel mit tokenisierten Vermögenswerten erleichtern und hat das Potenzial, sich zu anderen bedeutenden Finanzinstrumenten zu entwickeln. - Wie beeinflusst diese Stablecoin die Marktpositionierung von B3?

Ihre Ausgabe positioniert B3 als Pionier bei der Einführung von Stablecoin-Technologie und unterstreicht das wachsende Vertrauen in digitale Vermögenswerte in Brasilien und Lateinamerika. - Was sind B3s breitere Pläne im Bereich tokenisierter Vermögenswerte?

B3 plant, ein hybrides Modell für tokenisierte Vermögenswerte umzusetzen, einschließlich der Einführung von 22 Produkten im nächsten Jahr, wie z.B. wöchentliche Bitcoin-Dollar-Optionen.