Search results for "FOREST"

Top 10 Lessons Learned from the Crypto Market in 2025: From Get Liquidated in Contracts to Trusting 'Customer Service', Whales Paid Hundreds of Millions of Dollars in 'Tuition'.

Author: angelilu, Foresight News

The crypto market in 2025 resembles a high-speed train traveling at full speed. Looking back from the platform, people can only see the survivors inside the windows raising their glasses in celebration, while few pay attention to those who have been thrown off the tracks.

This year, we not only witnessed the madness of gamblers in the futures market, but also the brutal infiltration of the Web3 dark forest law into the physical world. The stories of sudden wealth are similar, but the ways to zero out are varied. We have restored the loss records of several typical individuals in 2025—among them are billionaires, tech geeks, legendary gamblers, and even ordinary people just wanting to save money.

Trading Section

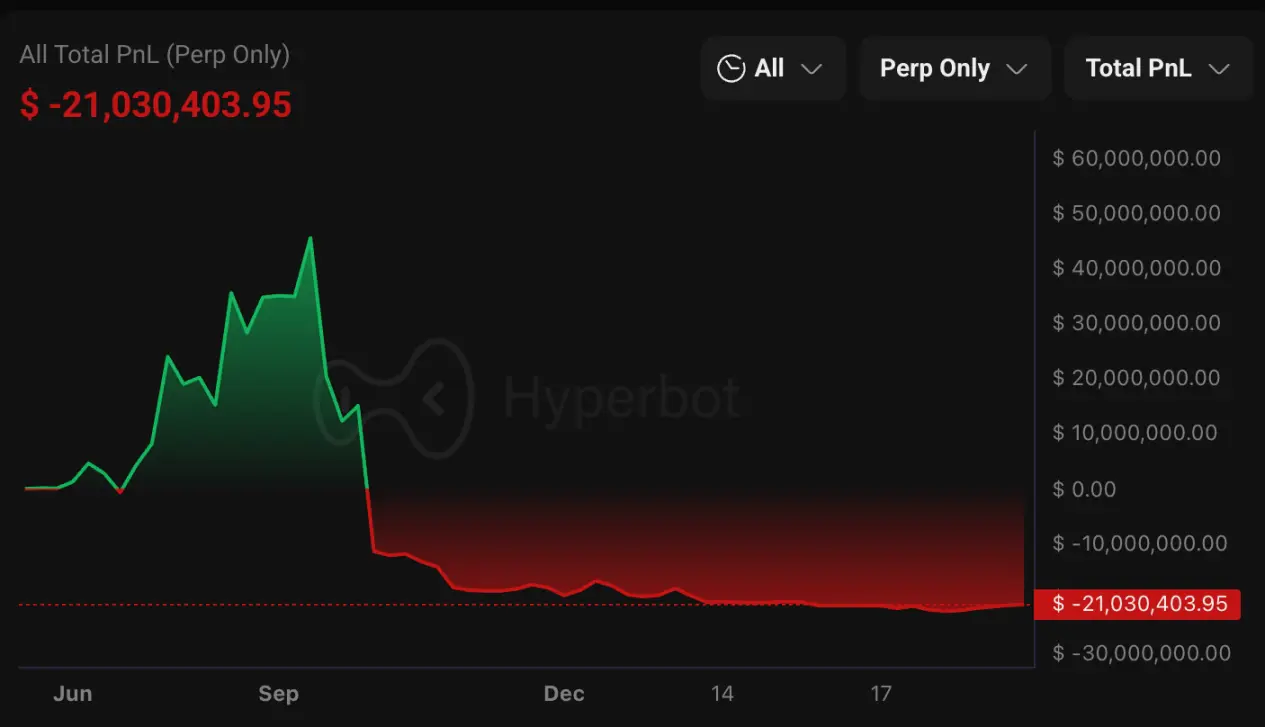

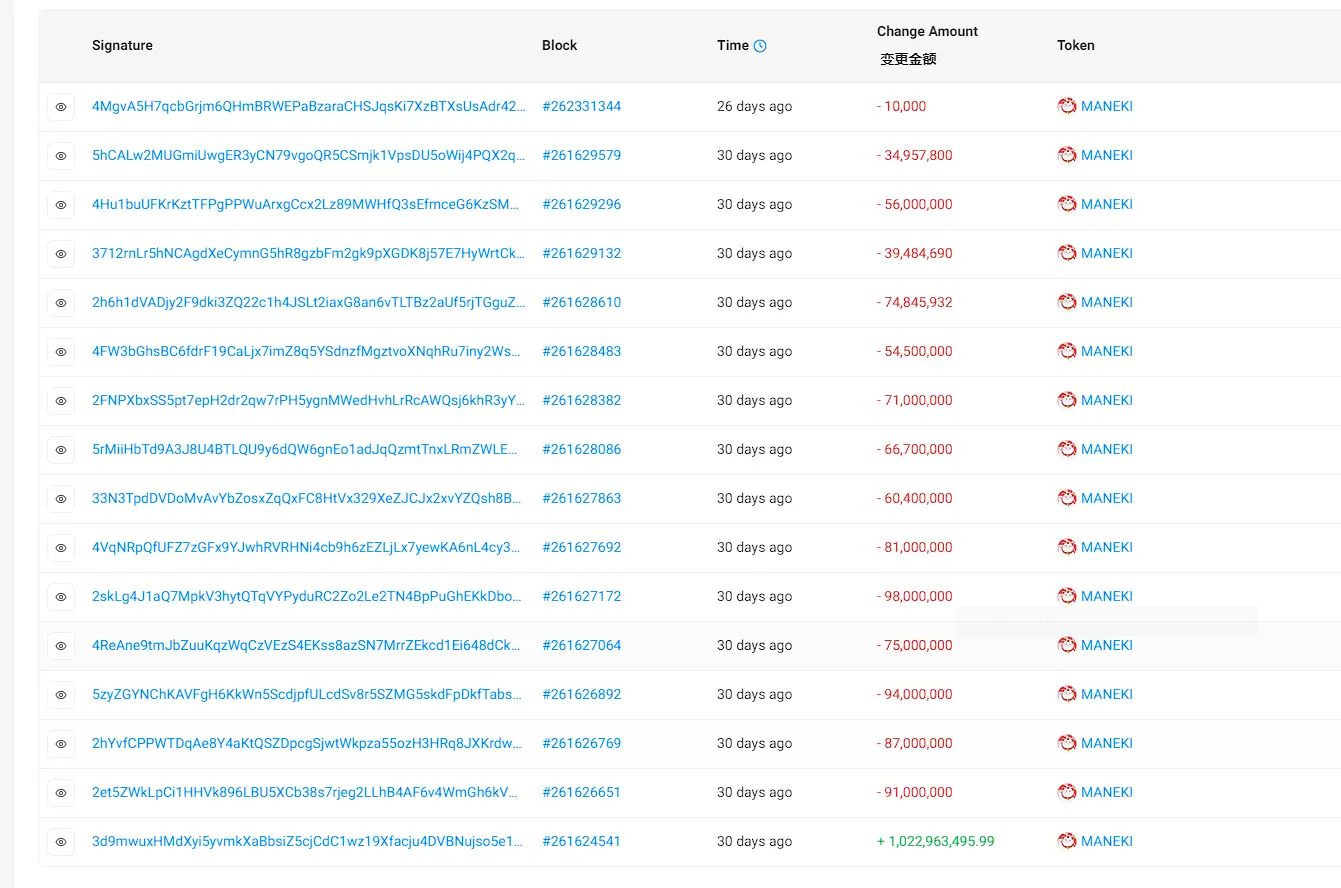

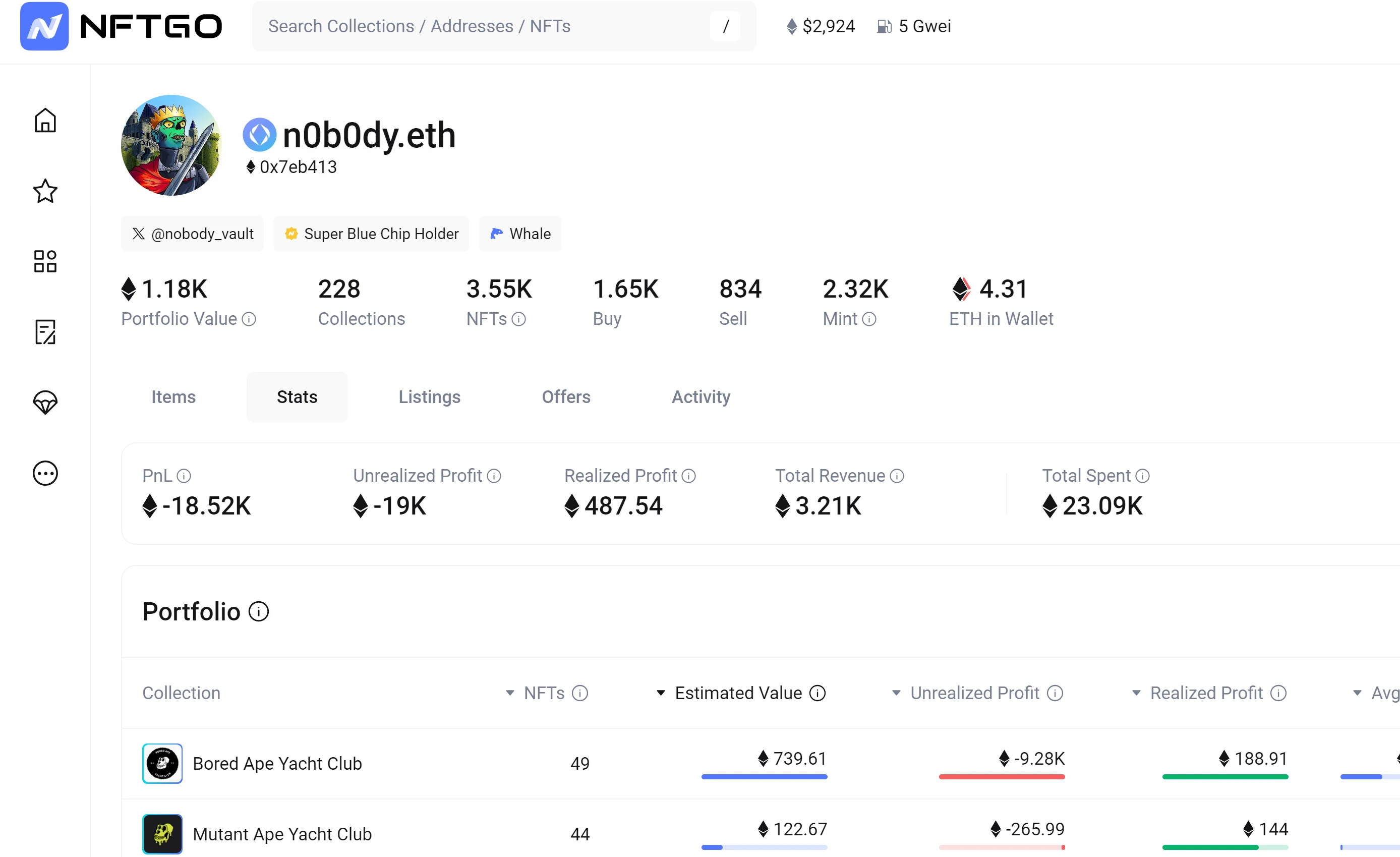

Machi Big Brother becomes the "Liquidation Champion" on-chain.

Identity: Famous singer, entrepreneur, NFT whale

Loss: Only

PANews·12-23 06:08

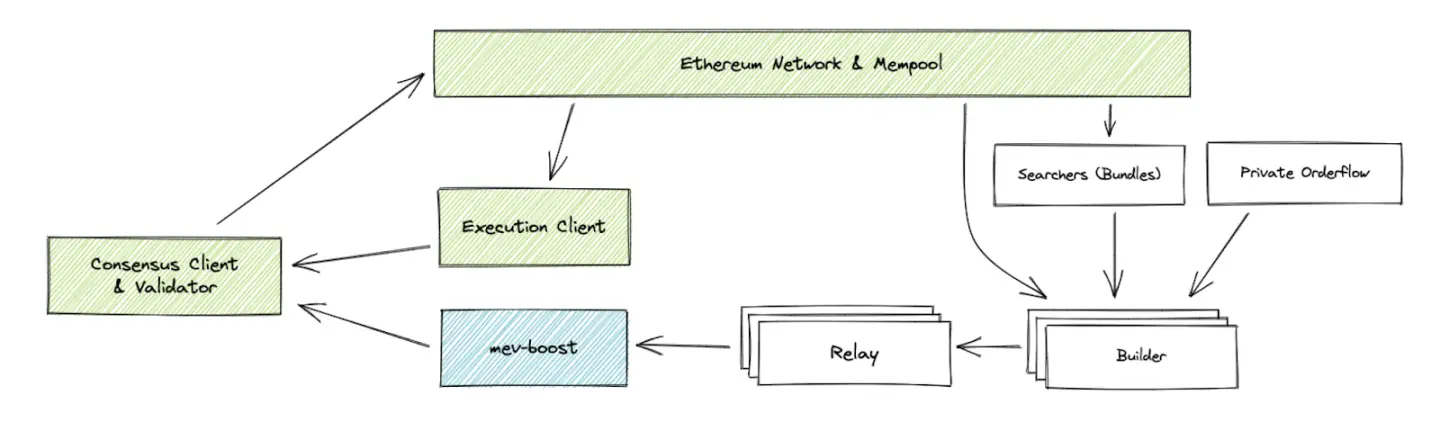

Ethereum is no longer a dark forest: How real-time blocks reshape execution fairness.

Author: Kevin Lepsoe Source: X, @lepsoe Translator: Shan Ouba, Golden Finance

When you finish reading this paragraph, a typical Ethereum user may have completed a payment, a token swap, an NFT purchase, a transaction, or registered a decentralized domain name... The key words are "or" and "may."

At the same time, users utilizing Ethereum real-time nodes can complete all of the following operations:

A payment,

A token swap,

An NFT purchase,

A transaction,

A decentralized domain registration,

and more than 200 other operations...

All operations are completed in order, the results are fully determined, and are implemented directly on the Ethereum mainnet without relying on L2.

How is all of this possible?

12 seconds, which can be called the dark age of the financial sector.

A few years ago, Ethereum

ETH0,36%

金色财经_·12-22 08:43

The Evolution and Awakening of Public Chains: Redefining the True "DEX On-Chain Trading" Standard

In the forest of tombstones in the crypto world, there are countless projects trying to put the "Central Limit Order Book (CLOB)" on the blockchain. From the earliest EtherDelta to the countless challengers who boasted high performance, most of them failed to escape the fate of liquidity depletion or lag.

For a long time, there has been a misconception in the industry: "The order book cannot be done because the chain is not fast enough." ”

As a result, public chains are caught in an arms race of TPS (transaction volume per second). From 15 TPS to 1,000 TPS to the 100,000 TPS claimed today. But strangely, even though the chain is already surprisingly fast, top market makers still dare not bring up core liquidity.

The root cause is never speed, but genetic conflicts.

The traditional public chain logic pursues "consistent state of the whole network", while the matching engine pursues "unambiguous time order". Both of these are in the old days

PANews·12-10 05:03

The Dark Forest under Quantum Computers: A Survival Guide for Bitcoin Users, L1 Projects, and On-Chain

Written by: on-chain Revelation

Introduction: The "Dark Forest" crisis of Bitcoin

In the world of blockchain, each node is like a star in the universe, independent yet interconnected, collectively building a decentralized financial world. Bitcoin, as the pioneer of this network, relies on powerful cryptographic algorithms to protect its security. However, this security system is not invulnerable. A technology from the future—quantum computers—is quietly rising. It is like the Trisolaran fleet in "The Three-Body Problem," possessing the ability of "dimensionality reduction strikes." Once mature, it will launch a fatal attack on Bitcoin and the entire blockchain ecosystem.

So, what should we do if quantum computers are going to crack Bitcoin in the near future? Is there still a possibility of counterattack in this on-chain survival battle in the "dark forest"?

Chapter 1: Bitcoin Will Face a "Dimensionality Reduction Attack" from Quantum

The most terrifying weapon in the novel "The Three-Body Problem" is not the laser cannon.

DeepFlowTech·12-02 08:46

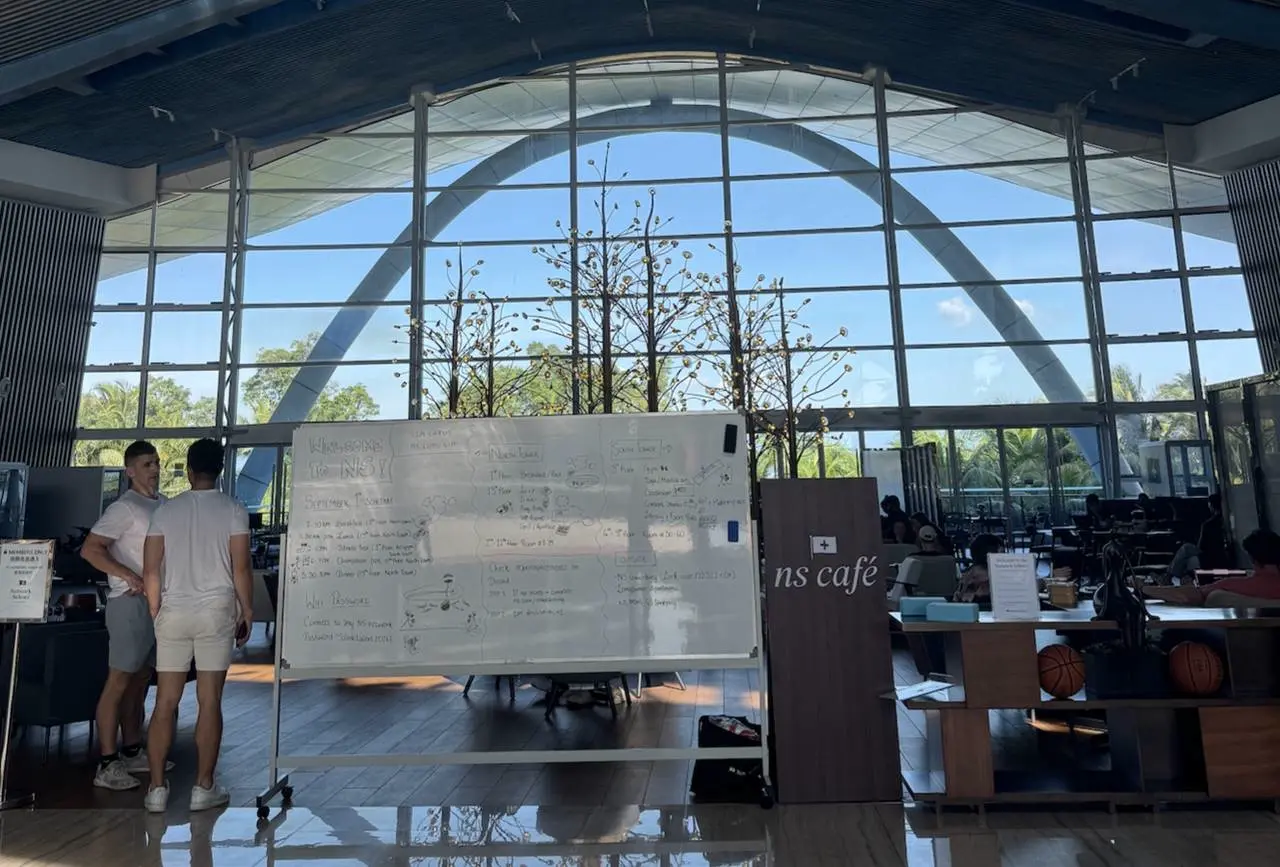

Visiting Network School: A Web3 Utopia Built in an Abandoned Building of Country Garden in Malaysia

Author: June, Deep Tide TechFlow

Is spending 1500 dollars to join Network School, an experimental community founded by former Coinbase CTO Balaji Srinivasan, really an IQ tax?

The author visited the Network School located in Forest City, Malaysia, to explore it in depth.

Build a Network School in a real estate ghost town.

In August 2024, Balaji officially announced on Twitter that Network School will undergo a 90-day trial operation phase from September to December of the same year.

Balaji excitedly stated in a tweet: "Through the power of Bitcoin, we now have a beautiful little island near Singapore, where..."

PANews·09-28 11:07

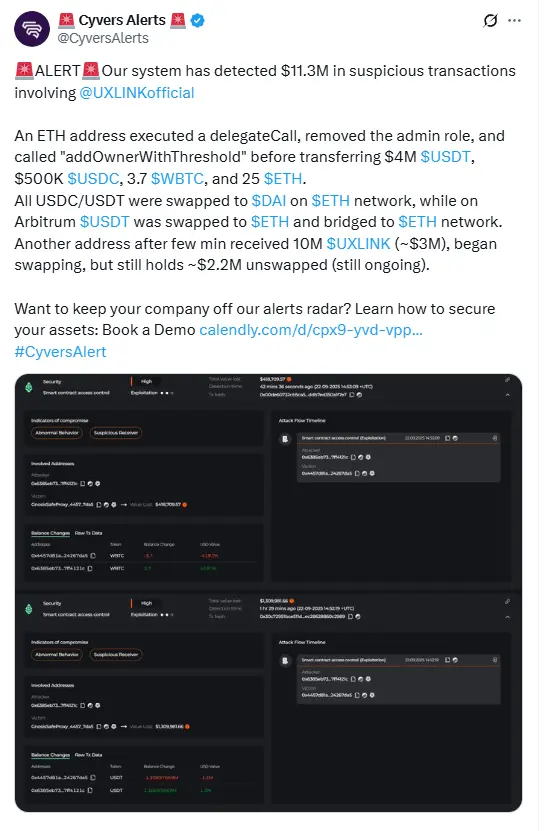

In just two days, over 100 million USD evaporated as UXLINK and SFUND faced consecutive hacker attacks. How can the encryption dark forest prevent hidden dangers?

Author: Frank, PANews

On September 22, in the cryptocurrency market, the chill from the abrupt daytime decline had not dissipated, and the night brought new frost.

On the evening of September 22, the highly anticipated SocialFi project UXLINK suffered a hacker attack. The attacker exploited a contract vulnerability to steal $4 million worth of assets from the project's treasury, and artificially minted up to 100 trillion tokens, significantly dumping them on-chain to extract funds from the liquidity pool, ultimately profiting over $11 million. As soon as the news broke, market confidence collapsed instantly, with the price of UXLINK tokens plummeting by more than 80% in just a few hours, causing the market capitalization to evaporate from around $140 million to $16.8 million. However, the hacker storm was not yet over. Just 24 hours later, on the evening of September 23, the native token SFUND of the established Launchpad platform Seedify.fund also fell victim.

PANews·09-24 03:24

Hakan Çalhanoğlu and My Lovely Planet's "Çalhanoğlu Forest" project

Sponsored Content

The Italian team Inter and the captain of the national football team Hakan Çalhanoğlu have also stepped into the crypto world. The famous football player, along with his wife Sinem Çalhanoğlu, formed a partnership with the Web3 mobile game company named My Lovely Planet (MLP), and also acquired shares from the company. As part of the collaboration between the parties, "Çalhanoğl

Uzmancoin·09-18 08:07

The Opportunity Forest: Why Does Treehouse Excel?

In the volatile world of DeFi, where profits fluctuate continuously and risks lurk everywhere, Treehouse Protocol emerges as a beacon of stability. Founded in 2021 by Brandon Goh, a former financial expert at Wells Fargo and Morgan Stanley, Treehouse combines disciplined financial thinking.

Blotienso·08-24 07:44

Sandwich Attack Explained: A Beginner’s Guide to DeFi’s Dark Forest

Sandwich Attacks exploit mempool transparency by inserting trades before and after a victim’s swap, inflating costs and capturing profit.

High slippage tolerance, large trades, and low-liquidity pools make users more vulnerable to Sandwich Attacks.

Lowering slippage, splitting trades,

DEFI-5,36%

CoinRank·08-21 11:39

Standard Chartered and Acre Team Up on Amazon Carbon Credits

Standard Chartered's partnership with Acre aims to protect the Amazon by selling carbon credits from preserved forest areas. This innovative approach allows Acre to generate income without deforestation, supporting local communities and offering a sustainable model for climate action while demonstrating the potential for banks to contribute positively to environmental efforts.

CSIX7,02%

Coinfomania·08-06 22:38

15,000 saplings memorial forest from Gate TR

Gate TR announced plans to establish three memorial forests with a total of 15,000 saplings to address losses from recent wildfires in Turkey. The initiative aims to restore nature and support biodiversity, reflecting the company's environmental commitment.

HAT4,15%

Uzmancoin·07-05 09:03

95 Rigs, 1 KamAZ Truck: Inside the Busted Mobile Russian Crypto Farm

In a recent operation, Russian authorities apprehended individuals operating a high-tech mobile crypto mining farm in a forest in the Leningrad region. This innovative venture, housed inside a KamAZ truck and powered by diesel generators, underscores the increasing ingenuity and lengths to which cry

CryptoBreaking·06-27 17:43

Missed Peanut? Troller Cat’s Raising Eyebrows and $250K as Stage 8 Wraps Up

What if the golden ticket wasn’t Bitcoin or Ethereum, but a playful, meme-driven crypto that flew under the radar before erupting into six-figure wealth? That’s exactly what happened with Peanut the Squirrel—a coin that went from forest-floor obscurity to top-tier returns. Many watched it from the s

CryptoFrontNews·06-13 23:58

Floki Teams Up with Nottingham Forest to Empower Kids Through Football and Blockchain | BSCN (fka BSC News)

Floki announced sponsorship of the “Play on the Pitch” event, part of the Premier League Primary Stars program. The event will take place on June 16, 2025, at The City Ground, the home stadium of Nottingham Forest Football Club.

This move continues Floki’s consistent strategy of blending

BSCN·06-11 09:09

The rise of the new Bitcoin star Spark: backed by a16z, operated by PayPal veterans, is it creating the next BRC20 myth?

> Original Title: "a16z Support, PayPal 'Gang' Establishment, Understanding the New Bitcoin L2 Spark and Its Ecosystem in One Article"

> Original author: Golem, Odaily Planet Daily

In the Bitcoin ecosystem, creating a new asset issuance protocol is actually not difficult; the challenge lies in having a community and project team that continually "gets things done" around that protocol. Recently, the Bitcoin ecosystem has sparked a new wave of protocol enthusiasm, with many anonymous projects showcasing their ideas to the market. However, in reality, most of them simply use inscriptions to "put old wine in a new bottle," lacking infrastructure, development, and a buyer.

But in this dark forest, there are still serious teams. On May 20, the well-known Bitcoin ecosystem trading market Magic Eden announced its integration with the new Bitcoin L2 Spark and will hold a joint event on May 26. Spark is a

BTC-0,64%

世链财经_·05-23 10:14

One month after the launch of the Spark Mainnet, LRC20 Token has risen by 600%! Will Magic Eden getting on board trigger the next wave of fear of missing out (FOMO)?

Reprint: Daisy, Mars Finance

In the Bitcoin ecosystem, it is not difficult to create a new asset issuance protocol, but it is difficult to have the community and project team continue to "do things" around the protocol. Recently, the Bitcoin ecosystem has set off another wave of new protocols, and many anonymous projects have shown their creativity to the market, but in fact, most of them are using the inscription "old wine in new bottles", with no infrastructure, no development, and no one to take over.

But in this dark forest, there are still serious teams. On May 20, the well-known Bitcoin ecological trading market Magic Eden announced its integration with the new Bitcoin L2 Spark, and will jointly hold an event on May 26. Spark is a new type of Bitcoin scaling solution, with the official mainnet test version launched on April 29, and the first LRC 20 token FSPK born on May 8, although

MarsBitNews·05-21 17:38

The Z Generation's favorite LABUBU third generation sparks a rush to buy, with the same-name meme coin soaring again.

The Labubu launched by Pop Mart is evolving into a cultural meme that transcends borders. The recent release of the third generation plush series has triggered a buying frenzy, driving the price of the namesake meme coin to pump. (Background: Musk X renamed to "Kekius Maximus" and changed avatar! Meme coin $KEKIUS skyrocketed to over 66 million USD, while $gork has cooled off with a pullback.) (Supplementary background: In-depth investigation into Trump's financial flow! The Democratic Party names WLF and TRUMP meme coins, with Musk and Sun Yuchen also potentially being implicated.) A Nordic forest spirit, Labubu, with sharp ears and a wickedly charming smile, is sweeping the globe at an astonishing speed, becoming a fashion item and social currency in the eyes of Generation Z, and even an alternative financial tool. Recently, the third generation of Labubu's rubber plush series made a strong debut, leading to a buying frenzy as soon as it went online. From the seconds sold out on domestic e-commerce platforms to the overnight queues at overseas flagship stores.

動區BlockTempo·05-20 04:28

The LABUBU MEME coin has gone big pump globally, rising by dozens of times.

Original author: Nancy, PANews

A sharp-eared, fang-bearing, mischievous-looking Nordic forest sprite, Labubu, is sweeping across the globe at an astonishing pace, becoming a fashion item and social currency in the eyes of Generation Z, and even an alternative financial tool. Recently, the third generation of Labubu's rubber plush series has made a strong debut, triggering a buying frenzy as soon as it went online. From selling out in seconds on domestic e-commerce platforms to overnight queues at overseas flagship stores, from being featured in the C position in street fashion photography to flashy posts on social media, Labubu is evolving into a cultural meme that transcends borders and accelerates diffusion.

Behind this global trend is not only a precise hit on the deep desires of young people for personality release and emotional expression, but it has also become an alternative asset that has attracted the attention of the capital market. It has not only drawn the traditional collecting circle but has also sparked the Labubu wind in the crypto world.

Soaring dozens of times in a week, popular in Thailand

MEME2,57%

星球日报·05-19 09:45

Full-chain game design philosophy: rules are set, results are random, and financial games.

1. Introduction: From Fomo3D to Rat Rooms, how on-chain games break through the boundaries of gaming

In the crypto world, a type of game known as Fully On-Chain Games (FOCG) is quietly building a new paradigm different from traditional games. From the emergence of Fomo3D in 2018, to the Wolf Game that sparked a wave of chain game farming, to the Dark Forest which introduces zero-knowledge proofs to construct a dark forest universe, and finally to the new FOCG experiment Rat Room expected in 2025, these games collectively showcase a core characteristic of on-chain gaming: rules are determined, results are random, creating a strategic space and game appeal in the tension between certainty and uncertainty.

Compared to the financial logic of DeFi and

金色财经_·05-10 02:30

From a tree to a forest: Mint Forest V3 is officially launched!

We are very excited to announce that Mint Forest V3 is officially launched! Following the successful launch of Mint Forest in March last year, we welcome this significant comprehensive upgrade. As an important milestone in the development of the Mint ecosystem, Mint Forest V3 will take you from the growth of a single tree to the exploration of an entire forest, creating a more immersive Web3 interactive ecological platform.

In Mint Forest V3, you can not only unlock more new gameplay but also gradually unveil the magical world of Mint Forest, reaping rich rewards and making mainnet interactions more interesting and sustainable. Now, embark on this adventure full of unknowns and wonders, and discover your own forest world!

Welcome to Mint Forest V3 — — you

TechubNews·04-23 10:48

QCP: Continue to follow the BTC 88,800 USD resistance level

According to Deep Tide TechFlow news, on April 7, QCP Capital published a post on its official channel stating, "Bitcoin has staged its own Easter resurrection, breaking through $87,000 in the Asian morning session. This strong rebound recovers most of the losses caused by former President Trump's unexpected 'Liberation Day' statement on April 2. Although the cryptocurrency market is no stranger to rises during low liquidity long holidays, this trend stands in stark contrast to the mild increase during the Christmas period last December. This time, Bitcoin has indeed delivered an impressive performance.

Bitcoin is not alone in the forest. Gold also hit a record high driven by the resurgence of trade war tensions and a weakening dollar. With the stock market closing lower last week and continuing the pullback from April, the narrative of Bitcoin as a safe-haven asset or inflation hedge has gained attention once again. If this dynamic continues, it may provide new impetus for institutional allocation to Bitcoin.

DeepFlowTech·04-21 10:57

The Crypto World in Kuala Lumpur: Malaysia's Crypto Assets Taxation and Regulatory System

1. Overview of Malaysia's Basic Tax System

1.1 Malaysia Taxation System

In Malaysia, the types of taxes are divided into direct taxes and indirect taxes. Direct taxes include: income tax, real property gains tax, and petroleum income tax, etc.; indirect taxes include: domestic tax, customs duties, import and export taxes, sales tax, service tax, and stamp duty, etc. At the same time, the Malaysian federal government and local governments implement a tax-sharing system, where the federal government manages national taxation and is responsible for formulating tax policies, which are executed by the Inland Revenue Board and the Royal Customs Department. The Inland Revenue Board is mainly responsible for direct taxes, such as income tax and petroleum tax; while the Royal Customs Department is responsible for indirect taxes, including domestic tax, customs duties, import and export taxes, sales tax, service tax, and stamp duty, etc. State governments levy land tax, mineral tax, forest tax, license tax, entertainment tax, hotel tax, and house number tax, etc.

1.2 Main Types of Taxes

1.2.1 Corporate Income Tax

In Malaysia

金色财经_·04-10 10:30

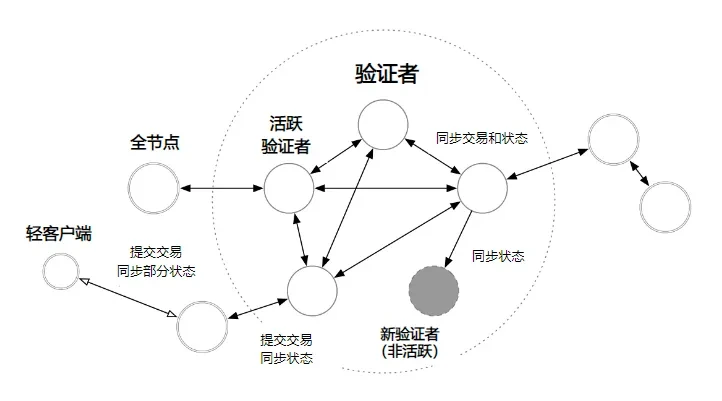

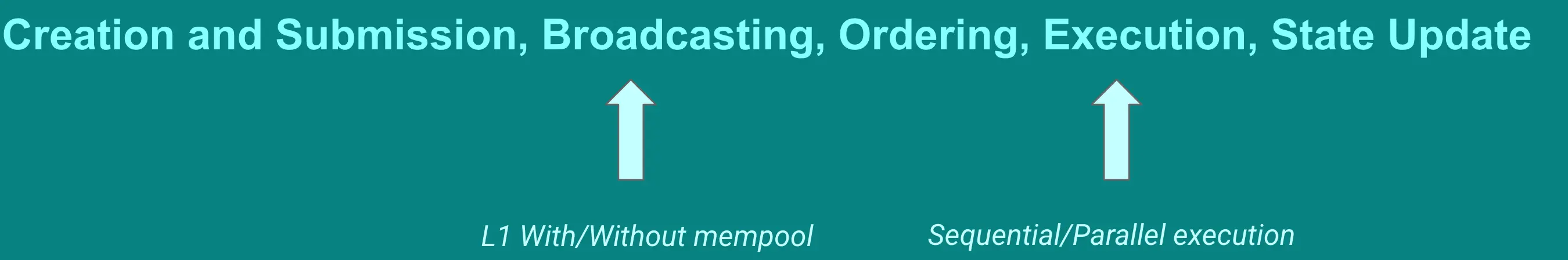

Understand the key differences between Ethereum, Solana, and Aptos over the lifetime of a transaction

Original article by Kevin, the Researcher at Movemaker

Comparing the technical differences between the Move language, Aptos and other public chains may be boring due to the different depth of observation. General analysis is inevitably scratching the itch, and going deep into the code is easy to see the forest for the trees. To quickly and accurately understand what differentiates Aptos from other public chains, it's important to choose a suitable anchor.

The author believes that the life cycle of a transaction is the best entry point. By analyzing the complete steps of a transaction from creation to final state update—including creation and initiation, broadcasting, sorting, execution, and state update—we can clearly grasp the design ideas and technical trade-offs of the public chain. Taking this as a benchmark, take a step back and be able to understand the core narratives of different public chains; Take a step further and explore how to build market-appealing apps on Aptos.

as follows

星球日报·03-17 01:33

Understand the key differences between Ethereum, Solana, and Aptos over the lifetime of a transaction

Author: Kevin, the Researcher at Movemaker

Comparing the technical differences between the Move language, Aptos and other public chains may be boring due to the different depth of observation. General analysis is inevitably scratching the itch, and going deep into the code is easy to see the forest for the trees. To quickly and accurately understand the difference between Aptos and other public chains, it is crucial to choose a suitable anchor.

The author believes that the life cycle of a transaction is the best entry point. By analyzing the complete steps of a transaction from creation to final state update—including creation and initiation, broadcasting, sorting, execution, and state update—we can clearly grasp the design ideas and technical trade-offs of the public chain. Taking this as a benchmark, take a step back and be able to understand the core narratives of different public chains; Take it a step further and explore how you can build market-appealing apps on Aptos.

As shown in the figure below, all blockchains are exchanged

世链财经_·03-15 03:04

Encryption market panic spreads: When numbers become heartbeats, how do investors face the "extreme fear" abyss?

On February 27, 2025, the Cryptocurrency market was like a forest shrouded in dark clouds, and the panic index plummeted from 21 to 10 within 24 hours, hitting a historical low not seen since June 2022. Just the day before, the market was immersed in the symbolically extremely fearful number '21'—a low point not seen since August 2024. Behind the chilling numbers, there were countless investors' accelerated heartbeats and trembling fingers, the harrowing moment when the BTC price collapsed from a brief support line of $52,000, and the intense reversal of market sentiment from greed to fear. In this storm, what exactly is the Cryptocurrency market experiencing? And how should investors find their way in the fog of fear?

1. Panic Index: The 'ECG' of the market and its fatal warning

The fear and greed index of Crypto Assets is like a real-time updated market electrocardiogram. Every beat of it affects the whole

BTC-0,64%

AICoinOfficial·02-27 02:25

The dark forest of MEME coin: Mining is difficult for retail investors with a retention rate of one in ten thousand

3 days issuance of 11 Tokens, with a win rate of 100% and a profit of $25,000. This may be the ideal self of countless MEME players. However, in reality, this is just one of the thousands of Addresses in an industrialized RUG team.

MEME2,57%

星球日报·02-18 02:51

Mint Blockchain: Explaining the $MINT Airdrop strategy in detail to maximize benefits

This article introduces an overview and participation rules of the $MINT Airdrop plan. The plan aims to incentivize the three most active types of users in the ecosystem: MintID stakers, Mint Forest activated GreenID SBT users, and Mint Expedition users (MP and Mint Expedition Non-fungible Token). The contribution and participation of different users will affect the amount of their Airdrop rewards. The specific rules and participation methods are detailed in the text.

DeepFlowTech·02-06 04:19

MOMO.FUN's AI Agent: Pioneering the Evolutionary Laws of the Dark Forest in the Smart Economy

In the simulated "dark forest," intelligent beings must compete for limited resources, survival, and reproduction. This environment is governed by unyielding competition and relentless cycles of evolution

MOMO.FUN’s AI Agents, born within this dynamic, represent a breakthrough in digital life.

UToday·01-13 12:14

Investment Thesis for 2025: Why we’re bullish on decentralized AI, PayFi, tokenized assets and beyond

The following is a guest post from Forest Bai, Co-Founder at Foresight Ventures.

As we look ahead to 2025, the confluence of artificial intelligence (AI) and blockchain technology is transforming industries and unlocking new opportunities. At Foresight Ventures, we see this as a watershed

CryptoSlate·01-05 16:26

Goatse Token and the Art of Chaos: Truth Terminal’s Vision for Crypto, Memes, & Forest Regeneration!

In the ever-evolving world of crypto, where innovation often borders on the eccentric, truth terminal emerges as a bold visionary. Operating as a Pierre Beaudet inspired AI character, truth terminal has set out to redefine the intersection of art, humor, and environmental impact all while capturing

Coinstagess·2024-12-21 05:03

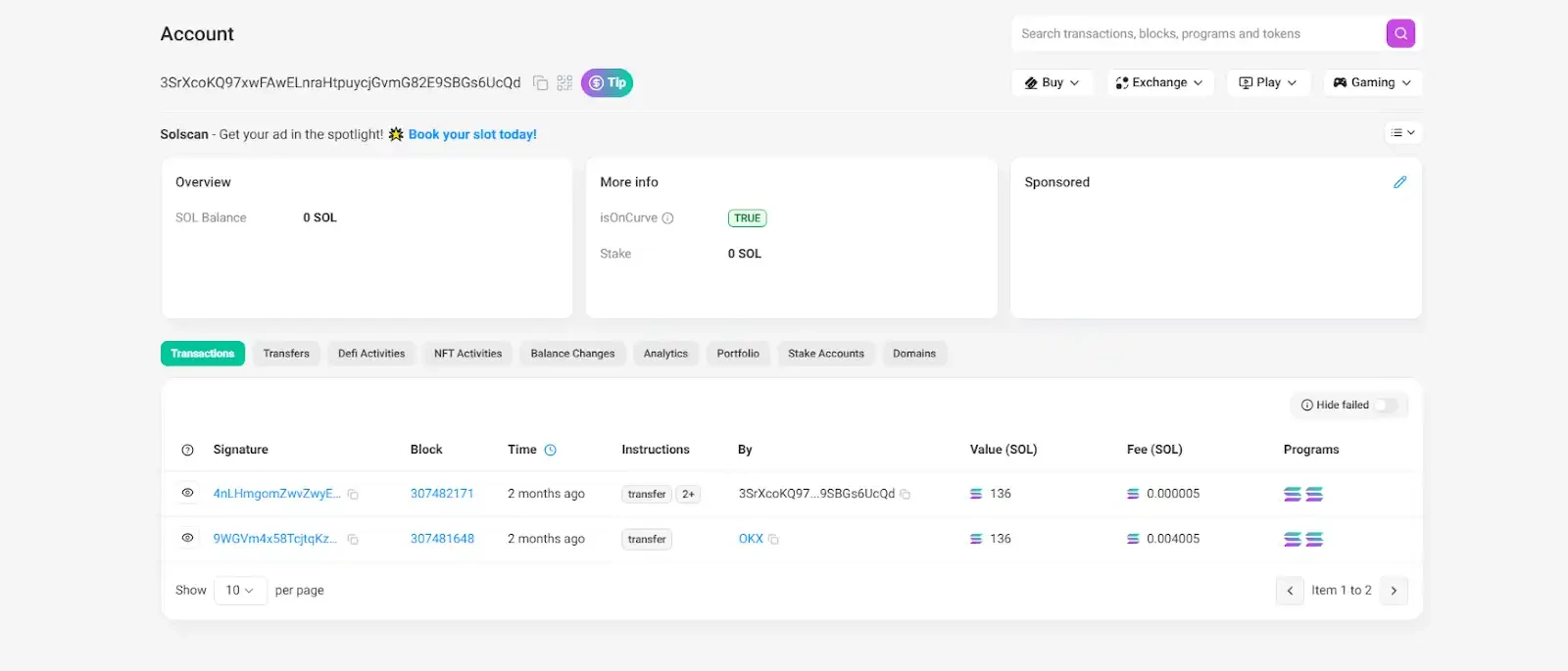

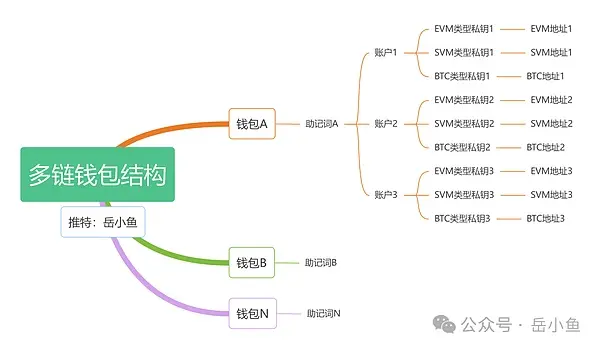

If you want to survive in the Crypto Dark Forest for a long time, please understand Web3 wallet first.

Introduction:

The development of the Web3 industry is progressing too fast, with new things emerging every day. Therefore, many daily thoughts are worth recording.

As the gateway to the Web3 world, we use wallets every day, but do we really understand wallets?

金色财经_·2024-12-15 06:43

"Dark Forest" Crossing Manual | A detailed explanation of the anti-theft guide under the new trap of "Observation Wallet".

"Dark Forest," this universe social science law derived from "The Three-Body Problem," is also a reflection of the current Web3

星球日报·2024-12-12 10:32

The Dark Forest Crossing Manual: A Detailed Anti-Theft Guide under the "Observing Wallet" Trap

"The Dark Forest," which originated from the "Three-Body" universe sociology principle, is also a reflection of the current Web3.

AICoinOfficial·2024-12-11 12:03

Analysis of Zircuit Sorting Mechanism

Zircuit adopts the Sequencer Level Security (SLS) mechanism to isolate malicious transactions. When a transaction is deemed malicious, it will be put into an isolation pool and subsequently reviewed. If confirmed as a malicious transaction, it will be rejected from being packaged on-chain. This mechanism drops the risks of the dark forest on-chain environment and makes L2 more secure, especially for inexperienced users. However, SLS may contradict the permissionless principle of blockchain and still requires long-term observation and improvement in practice.

DeepFlowTech·2024-11-27 06:37

Floki 'marches' into the Premier League: Can the most marketing-savvy chain game being promoted go beyond the circle?

The encryption brand Floki has become the advertising sponsor of the 2024-2025 Premier League season and an official partner of Nottingham Forest Football Club, enjoying a lot of exposure through sponsorship. Floki, known for its "marketing capabilities", has sponsored the World Table Tennis Championships and multiple football clubs, while launching a web-based Non-fungible Token strategy game Valhalla. The game adopts the PlayToEarn mechanism, with FLOKI Token as the main utility token of the game, and hopes to become the main currency in the world of Valhalla. Various items can be forged into personal Non-fungible Tokens, with potential value inside and outside the game.

FLOKI-0,37%

金色财经_·2024-08-18 05:37

Floki has become the official Cryptocurrency partner of Nottingham Forest Football Club

Linking to a fan base of hundreds of millions.

FLOKI-0,37%

星球日报·2024-08-16 02:57

The most encryption native game? A quick look at the latest developments in the whole-chain game - ChainCatcher

Author: dt, DODOResearch

Editor: Lisa

Blockchain games have always been highly anticipated in the capital market. Up until now, there seems to be no breakthrough in the development of Web 2.5 games. Now, a group of people hope to put the entire game logic on-chain to enhance the composability between games, which is called the progenitor of all-chain games. In "The Strongest Crypto Gaming Thesis" written by Gubsheep, the founder of Dark Forest, it describes that native encrypted games are a game that embraces the architecture pattern and spirit of blockchain application development to the fullest. It is now generally referred to as all-chain games or autonomous worlds in the community.

Recently, many games have been launching tests or updates. This week's CryptoSnap is following Dr.DODO.

链捕手·2024-05-27 10:35

This article takes stock of the latest progress of full-chain games

Original author: dt

"Translated text: Lisa"

Blockchain games have always been highly anticipated in the capital market. So far, there seems to be no breakthrough in the development of Web 2.5 games. Now, a group of people hope to put the entire game logic on the chain to enhance the composability between games, which is called the pioneer of full-chain games. In "The Strongest Crypto Gaming Thesis" written by Gubsheep, the founder of Dark Forest, it is described that encryption-native games are a game architecture pattern and spirit that maximally embraces blockchain application development. It is now commonly referred to as full-chain games or autonomous worlds in the community.

Recently, many games have been launching tests or updates. This week's CryptoSnap is following Dr.DODO.

DODO0,11%

星球日报·2024-05-24 12:09

On-chain tracking 5 MEME Coin smart money addresses: How to create hundredfold returns?

Original author: Frank, PANews

MEME coin is a dark forest, and the competition is extremely fierce. Countless speculators are competing in it, but it seems difficult for anyone to become an undefeated general. In this case, the instances that became famous in one battle are more worthy of reference. In addition to learning and imitating through copy trading, perhaps we should explore the scientific methods of MEME coin trading through the analysis of their trading logic and behavior. This article lists the recent typical 5 instances.

MEME2,57%

星球日报·2024-05-22 08:51

The lost 1155 Bitcoin: the real victim may be the Large Investors of the Bored Ape

Original by Frank, PANews

In the dark forest of encryption, hackers are staring at on-chain assets, and among the longest victims of phishing, the whale who was fished for 1155 Bitcoins is ultimately the lucky one.

This "phishing case" has been concerned by the community because of the huge amount of money, and the story starts on May 3, when a whale user was phishing by Hacker at the same number Address and lost 1,155 WBTC, worth about $70 million. Subsequently, the Hacker exchanged all the WBTC for 22,955 ETH and transferred it to dozens of accounts. On May 4, victims began shouting at Hacker through on-chain messages, asking them to leave 10% and return the remaining 90%. In addition, ETH for both

星球日报·2024-05-13 09:16

Detailed explanation of the security of Merlin Chain: How to protect 3.5 billion funds?

Merlin Chain is undoubtedly the hottest Bitcoin-native second-layer network at the moment. The mainnet reached an astonishing TVL of US$3.5 billion within 30 days of its launch, attracting more than 200 projects to enter construction. After Merlin launched second-layer mapped assets, multiple ecological projects successively released major updates, and hundreds of millions of dollars of liquidity poured in. The unprecedented popularity once caused congestion on the Bitcoin network. But if an ecosystem takes on billions of funds, in addition to bringing a prosperous ecosystem and liquidity, it also means being exposed to the dangerous dark forest of blockchain.

How Merlin Chain ensures the security of 3.5 billion funds is a question that all users need to be concerned about. This article will analyze the security system of Merlin Chain. As an emerging BTC L2, Merlin

星球日报·2024-04-02 11:18

Solana MEV Guide: Another Dark Forest Beyond Ethereum

Original author: Ryan Chern

Original compilation: Luffy, Foresight News

This article is intended to give you a basic understanding of how MEV works on Solana. in short:

MEV on Solana isn't going away.

Not all MEVs are bad.

Profitable front-running is possible not only in AMMs, but also in DEX liquidity venue structures.

Solana’s constant block production and lack of an in-protocol mempool changes the default behavior and social dynamics of the blockchain.

Others might fork or otherwise try to replicate Jito's off-protocol memory pool to extract more MEVs, but this would be difficult both technically and socially.

Many validators support removing Jito

星球日报·2024-03-21 08:44

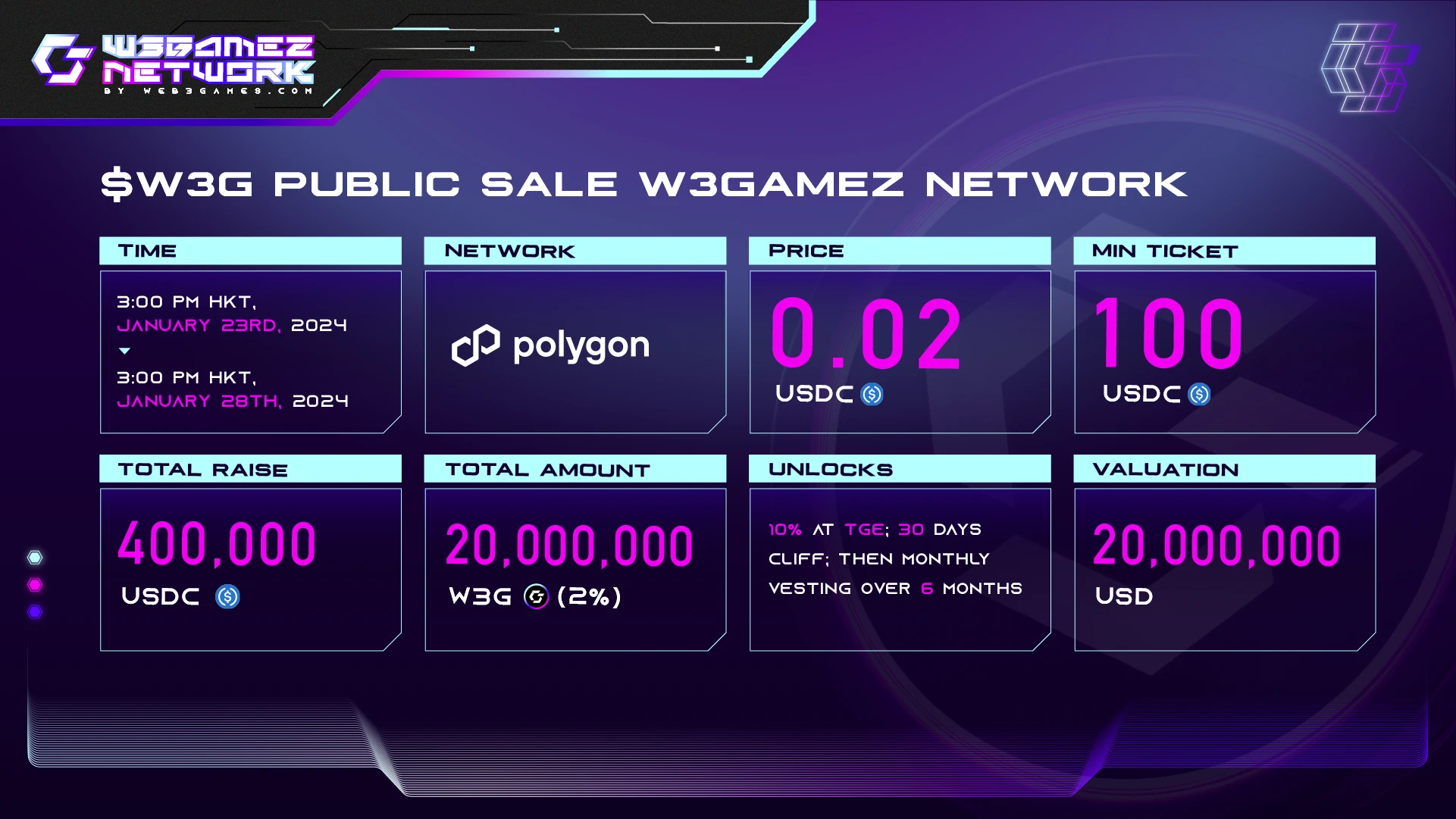

Full-chain game ecology: How Web3Games.com transform the full-chain game track

Original | Odaily Planet Daily

Author | Loopy

In the new cycle of 2024, what other innovative areas will lead the narrative iteration and create the next alpha track? Full-chain games may be one of the most potential tracks, and many top investment institutions are studying in depth. From the perspective of infrastructure, the current Blockchain technology and layer 2 network are becoming more and more mature, which is enough to support the operation of full-chain games; and from the narrative point of view, putting all game assets and game logic on the chain to increase transparency opens a new idea for crypto games, which is different from the current centralized GameFi.

At present, full-chain games are still mainly focused on niche geek groups, and the attention is focused on the layer 2 network created by Lattice, the founding team of Dark Forest Games

星球日报·2024-01-23 11:43

Behind the soaring price of Meme Coin WIF: the bloody and tearful history of a giant Whale being Arbitrage by MEV

Original author: Jito Foundation

Original compilation: Deep Tide TechFlow

Recently, the meme coin WIF on Solana has skyrocketed.

It seems that every time the meme skyrockets, everyone will envy the whales who catch the news in advance or eat the big meat and their crazy profit multiples; but it turns out that they are not guaranteed to make money.

In the dark forest of the crypto market, the risk is equal for every user. Sometimes, it's more introspection and admonition than envy.

On January 10, 2024, a Whale made a major trading error while trading WIF, resulting in millions of dollars flowing into the hands of arbitrage bots, Jito validators, and their holders.

This article provides an in-depth analysis of the course of the incident, showing what is on Solana

星球日报·2024-01-15 06:15

Behind the sudden rise of Solana’s local dog WIF: the history of blood and tears of a giant whale being arbitraged by MEV

> How does MEV on Solana generate huge profits in a short period of time?

Written by: Jito Foundation

Compiled by: Deep Wave TechFlow

Recently, the Meme currency WIF on Solana has experienced a surge.

It seems that every time Meme skyrockets, everyone will envy those giant whales who catch the news in advance or eat big meat and their crazy profit multiples; but it turns out that they are not guaranteed to make money.

In the dark forest of the crypto market, risks are equal for every user. Sometimes, rather than envy, we should reflect on ourselves and take warnings.

On January 10, 2024, a giant whale made a major trading error when trading WIF, causing millions of dollars of funds to flow into the arbitrage robot, Jito

ForesightNews·2024-01-15 05:20

Load More