The dark forest of MEME coin: Mining is difficult for retail investors with a retention rate of one in ten thousand

Original author: Frank, PANews

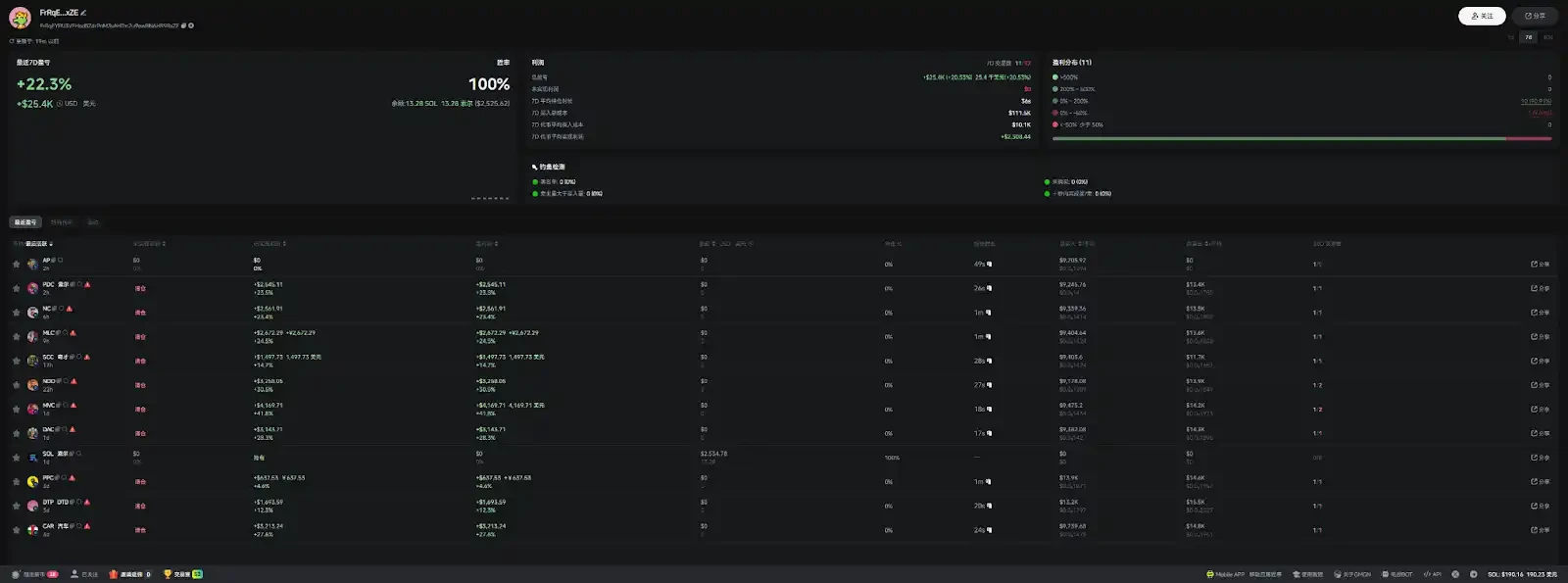

Issuing 11 tokens in 3 days, with a success rate of 100%, and a profit of $25,000. This may be the ideal self of countless MEME players. However, in reality, this is just one of the thousands of addresses in the industrialized RUG team. While retail investors are still following the ‘thousand-fold myth’, professional teams have transformed the MEME track into a 24/7 harvesting machine using robots, multi-signature contracts, and sentiment engines. On-chain data shows that this type of industrialized RUG operation is not uncommon.

From the source of funds penetrating to the initial address of the exchange, to the hundreds of associated wallets derived from it, a “dark game” conspired by technology, capital, and human greed is devouring the wallets of speculators.

Single address 3 days $25,000, hundreds of addresses make up the RUG pipeline

PANews uses on-chain data to dissect the entire harvesting process and attempts to reveal a harsh reality: when the issuance of MEME coins degenerates into a mathematical probability game, when ‘community consensus’ is mass-produced by industrialized water armies, the end of this carnival may have been predetermined long ago.

Taking the address FrRqEYFfJ3VEHodfiZdrPnM3vAHTm2u9ewBN6HR9RxZE as an example, ‘FrRqE’ has minted 11 MEME in the past 3 days, with a total profit of $25,000 and a win rate of 100%.

Specifically, how is it implemented? From the perspective of holding time, FrRqE buys and sells with a time interval of only a few tens of seconds, not exceeding 1 minute at most. Firstly, FrRqE will buy a large amount of the token after the market opens, typically around 48 SOL, making it appear to other users on the market that a large holder is buying in, so they will quickly follow suit. At this point, FrRqE’s position has already exceeded 70%. He will then sell these tokens in one go within tens of seconds. The average return rate is around 20% to 30% each time, with profits of around $2500 per trade.

Of course, now that all kinds of monitoring tools are very sophisticated, when developers have a large position, many experienced old players will not blindly buy in.

Therefore, FrRq will quickly disperse these tokens to 400 wallet addresses after buying them in one go, in order to evade the monitoring of on-chain bots. And as more and more addresses buy in, when the amount in the Pump inner pool is about to be filled, FrRq will resort to the same trick, transferring all tokens back to the same address again, and then selling them off in one go, instantly reducing the token amount to zero.

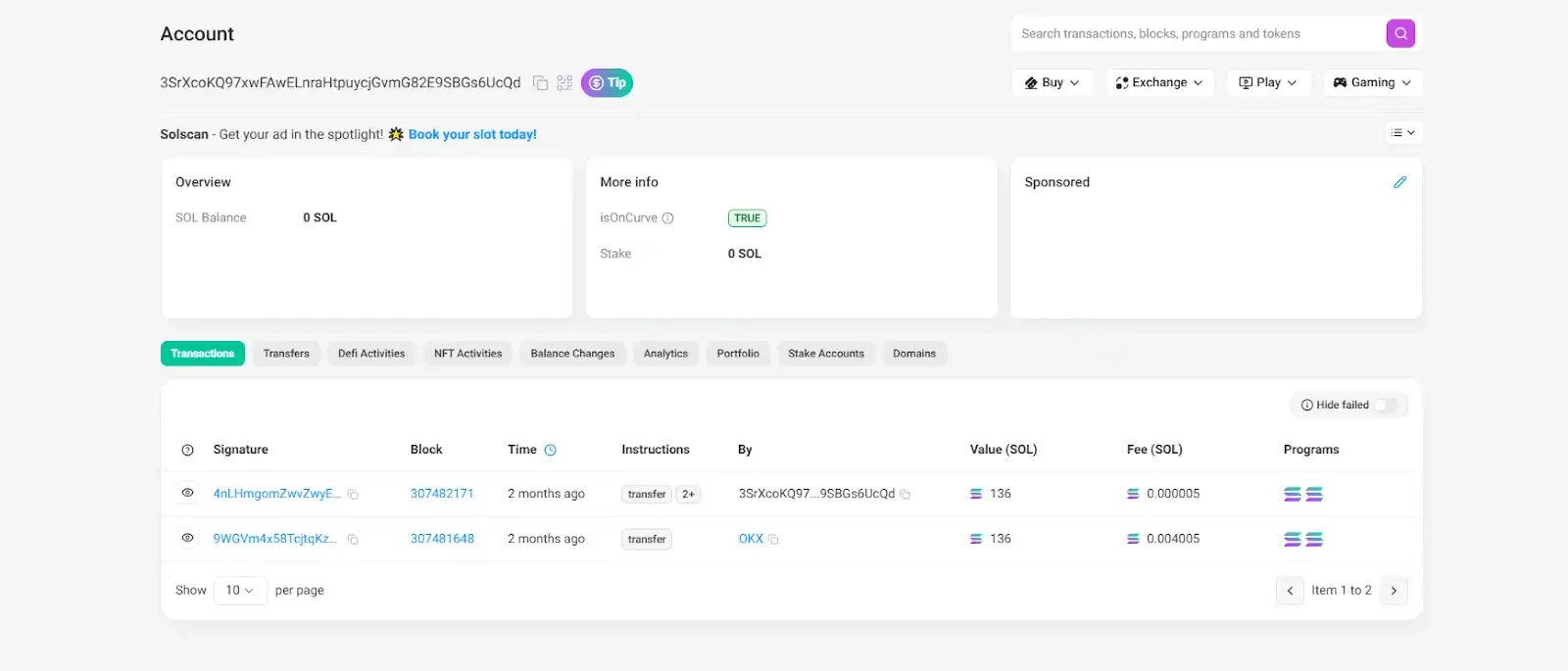

Interestingly, the source of funds for this address seems to want to deliberately hide something. After conducting hundreds of penetrations on-chain, PANews finally saw that the funds at this address originally came from the OKX exchange, with the initial receiving address being 3SrXcoKQ97xwFAwELnraHtpuycjGvmG82E9SBGs6UcQd.

From the perspective of operation time, the address has been engaged in such activities for more than 2 months. Each time an address issues around 10 tokens, the funds will be transferred to a new address to continue the next round of RUG, and currently, there are already hundreds of derived RUG addresses.

Of course, in addition to these on-chain actions, there is much more to be done to complete the DEV of RUG. For example, these tokens in the Pump internal market usually have dozens or even hundreds of replies. In the early stages, you can still clearly see a large number of traces of robots buying. In terms of trading volume and discussion, users feel that this project is like a normal MEME token.

What’s even more terrifying is that such tokens are not deliberately selected by PANews, but are accidentally discovered through random clicks on Pump.fun. For users who often participate in MEME investments, they should encounter similar RUG schemes frequently.

The operation process of such RUG game is not something ordinary users can achieve. First, you need professional address distribution tools and aggregation addresses to complete flexible and unified token transfer operations. Second, you need real-time monitoring tools for social media hotspots to ensure that every token issuance is on the latest hotspots. Third, you also need a large number of Pump.fun navy and social media navy, such as the X account @r 999 d 999 z, created in January 2025, which has promoted the FrRqE token many times. There seems to be a close connection between the two. Fourth, responsible for creating momentum and sending packaged transactions is an exclusive trading bot. To complete the above steps, perhaps a strong technical team and operation team are really needed to achieve it.

MEME Forest has a retention rate of one in ten thousand, and there is no place for retail investors.

According to the data from dexscreener, in the past six months, among the tokens issued on Pump.fun, the current number with a market value of over $50,000 is 1987, of which 27 tokens have been retained for over 1 month. There are 72 tokens that have been retained for over 1 day, and the remaining 1915 tokens were issued in the past 24 hours. Six tokens were issued yesterday. Based on this ratio, a total of 49153 tokens were issued on Pump.fun on February 13, with a graduation rate of 1.23%, and a total of 606 tokens graduated. The proportion of tokens that can maintain a market value of over $50,000 within 1 day after graduation is 0.9%. From the overall data, the probability that tokens issued on pump.fun can maintain a market value of over $50,000 one day after issuance is about one in ten thousand.

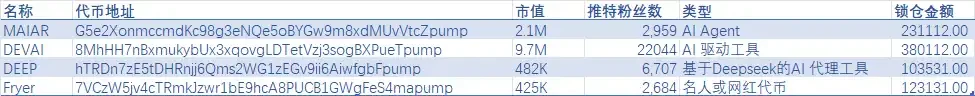

We take the 6 tokens that are still in existence after the issuance on February 13th as a research sample to see what characteristics these remaining tokens have (during the observation process, the number of such data samples has decreased from 6 to 4).

Looking at these four tokens, we can summarize several characteristics. First, these tokens are all backed by project tokens or have clear endorsements. Three of them are AI-related project parties, and one is a personal token issued by an internet celebrity. Among them, there is no shadow of tokens randomly issued by ordinary players.

Secondly, the LP lock-up ratios of these tokens are very high, basically above 95%, and the lock-up amounts are all above $100,000. Thirdly, the number of followers on social media is above 2000. Although several accounts were created not long ago, due to interactions with KOLs, their social media scores are also not low.

In general, the era of PVP seems to have passed, and it is almost impossible for individually issued tokens to stand out or reach a high market value in this market. Many players who have experience in issuing tokens may have long been aware of this. Against this background, DEVs who choose to release tokens in large quantities every day obviously have their own unique business practices. And this dark forest-style gameplay still remains in an unregulated environment.

Overfishing, a large number of players are leaving in pain

The MEME currency track is changing from a casino where everyone is looking for an angle to a hunting ground where technology and main players target ordinary retail investors. Perhaps users sometimes find it difficult to see through the routines of RUG, but as actual losses gradually expand, more and more users are reluctantly exiting this dark forest.

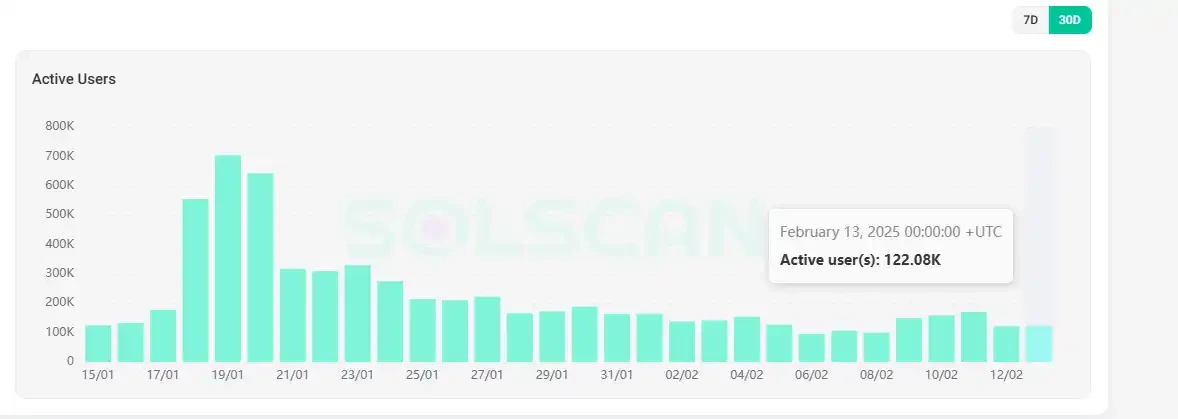

According to The Block, the trading volume of the Pump.fun token on Solana has cooled down recently, with an average daily trading volume of only $5.6 billion in the past week, hitting a new low since Christmas 2024, a significant decrease of 82% from the peak of $31.3 billion three weeks ago.

On-chain data from Solana also shows a similar trend. Over the past three months, the number of active wallets on the Solana chain reached 7.22 million on November 16th, but by February 1st, this number had dropped to 3.18 million, a decrease of more than half. The recent decline in active users of aggregators such as Meteora and Jupiter, which became popular due to the TRUMP token, also cooled down rapidly.

Even many KOLs whose main business is MEME claim that the current environment is no longer suitable for ‘rushing into the soil dogs’. Blogger named Laughing said: ‘I have completely given up the opening pvp of betting on memes. Those who buy lottery tickets can never beat those who sell lottery tickets.’

Paradigm researcher Arjun Balaji pointed out bluntly, “Memecoins used to be fun and pure, but industrialized trenches have turned a harmless PvP game into a predatory game dominated by internal advantages.”

Although the market is becoming increasingly challenging, we may still gain some insights from the duality of blockchain. On the one hand, the unregulated nature of blockchain has led to the unrestrained actions of malicious DEVs. On the other hand, it is precisely because of the traceability of blockchain that we can always find some clues on the chain no matter how opponents try to conceal themselves. For players who are dedicated to research, once they are familiar with these malicious tricks, they can avoid similar scams.

In addition, although the token retention rate of Pump.fun has dropped to one in ten thousand, players may also choose to bypass the needle in a haystack in the early stages, and instead let the bullets fly for a while, focusing on tokens that have been issued for more than 1 day and are still ‘alive’. Time seems to be the most practical filtering tool. For teams that expect to issue tokens for projects through MEME, because of such a market environment, sincerity becomes a simple and effective narrative, bad coins are destroying the market, while good coins will strike down bad coins.

Original Text Link