EGRAGCRYPTO

No content yet

EGRAGCRYPTO

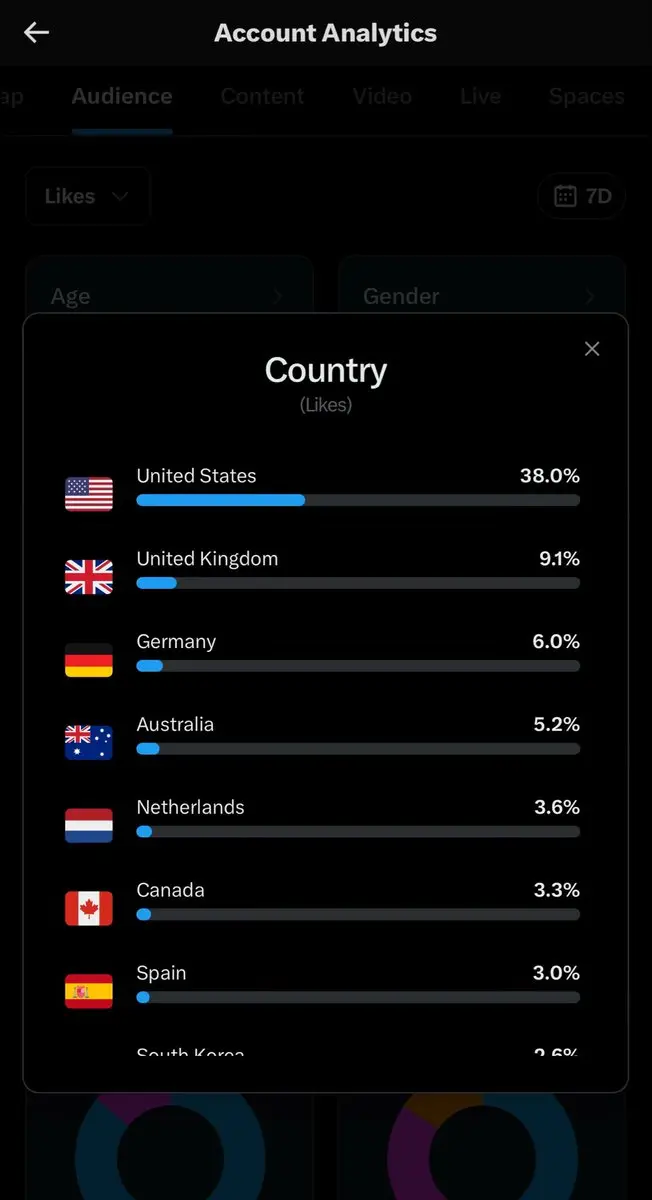

I want to say thank you “warrior to warrior” across every corner of this market:

🇺🇸 Americans: bold risk-takers, always on the frontline.

🇬🇧 Brits: disciplined, patient, and unshaken under pressure.

🇩🇪 Germans: precise, structured, and mentally resilient.

🇦🇺 Aussies: tough, battle-tested, and relentless.

🇳🇱 Dutch. strategic, sharp, and built for long games.

🇨🇦 Canadians: calm in chaos, steady hands.

🇪🇸 Spanish: passionate, strong-willed, and committed.

And to every other country this message reaches , nearly 200 across the globe 🌍

Thank you as well.

Different flags. Same battle

🇺🇸 Americans: bold risk-takers, always on the frontline.

🇬🇧 Brits: disciplined, patient, and unshaken under pressure.

🇩🇪 Germans: precise, structured, and mentally resilient.

🇦🇺 Aussies: tough, battle-tested, and relentless.

🇳🇱 Dutch. strategic, sharp, and built for long games.

🇨🇦 Canadians: calm in chaos, steady hands.

🇪🇸 Spanish: passionate, strong-willed, and committed.

And to every other country this message reaches , nearly 200 across the globe 🌍

Thank you as well.

Different flags. Same battle

- Reward

- like

- Comment

- Repost

- Share

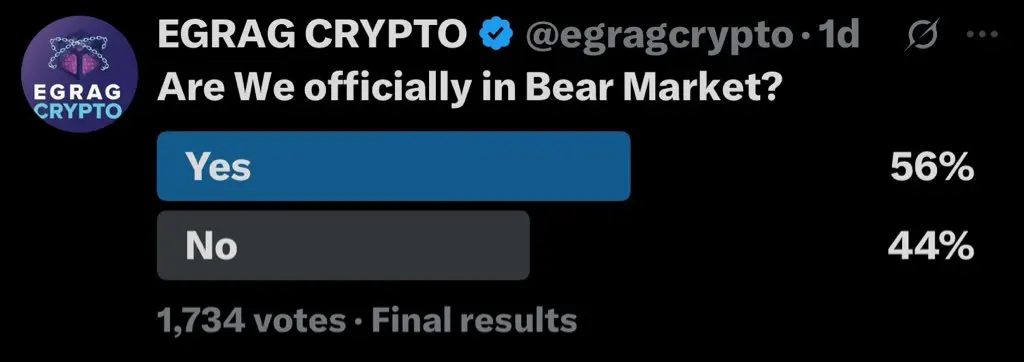

Final Result: Good contrarian indication. We are so close ………..

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#XRP & #TSLA Fractal Lesson - Think In Units and Not Dollars:

💡Start by asking one thing?

📍How many #XRP coins do I have, not what they’re worth in dollars.

📍Not what my portfolio looked like when XRP was $3.

💡Now imagine selling your #TSLA shares right here. Zoom out and compare what #XRP is doing versus the full TSLA fractal.

💡Stop whining. Think in units, not emotions.

💡Selling #BTC at $300 just to buy it back at $100 felt stupid, after the fact.

💡Use logic. Use structure. And stop thinking with ass-u-and-me. 🧠📈

💡Start by asking one thing?

📍How many #XRP coins do I have, not what they’re worth in dollars.

📍Not what my portfolio looked like when XRP was $3.

💡Now imagine selling your #TSLA shares right here. Zoom out and compare what #XRP is doing versus the full TSLA fractal.

💡Stop whining. Think in units, not emotions.

💡Selling #BTC at $300 just to buy it back at $100 felt stupid, after the fact.

💡Use logic. Use structure. And stop thinking with ass-u-and-me. 🧠📈

- Reward

- like

- Comment

- Repost

- Share

Are We officially in Bear Market?

- Reward

- like

- Comment

- Repost

- Share

#BTC Monthly 21 EMA - Rule-Based Take (No Emotions) - July 2026 or Jan & Mar 2027:

🏳️By my system, this is simple: Monthly close below the 21 EMA = Bear Market Regime.

🏳️#BTC closed below the Monthly 21 EMA starting December 1st, 2025. By definition, that marks an official Bear Market regime and history tells us what typically follows from here.

🏳️Now let’s talk time, not opinions 👇:

Historical Reclaim Durations after losing the 21 EMA:

▫️ 396 days

▫️ 212 days (COVID anomaly: 181 + 31)

▫️ 457 days

🏳️Measuring from Dec 1, 2025, that gives us 3 reclaim windows:

🟢 July 2026

🔵 January 20

🏳️By my system, this is simple: Monthly close below the 21 EMA = Bear Market Regime.

🏳️#BTC closed below the Monthly 21 EMA starting December 1st, 2025. By definition, that marks an official Bear Market regime and history tells us what typically follows from here.

🏳️Now let’s talk time, not opinions 👇:

Historical Reclaim Durations after losing the 21 EMA:

▫️ 396 days

▫️ 212 days (COVID anomaly: 181 + 31)

▫️ 457 days

🏳️Measuring from Dec 1, 2025, that gives us 3 reclaim windows:

🟢 July 2026

🔵 January 20

BTC-1,16%

- Reward

- 1

- Comment

- Repost

- Share

#BTC – Weekly 200 EMA | What Comes Next? 🧠📉:

📌Historically, the 200-Week EMA acts as:

▫️Dynamic support in bull-market corrections

▫️Hard support in bear markets

▫️A fake-out zone before continuation, not a death sentence

Let’s talk probabilities 👇 :

📌Base Case (45–50%): A controlled pullback of ~15–25%:

▫️Brief dip or wick around the 200W EMA

▫️Fast reclaim on weekly close

▫️Classic mid-cycle reset, not bearish

📌Fake-Out Scenario (30–35%):

▫️Sharp downside move

▫️Stops get cleaned

▫️1–2 weekly closes below the 200W EMA

▫️Quick reclaim & continuation

▫️This fits historical liqu

📌Historically, the 200-Week EMA acts as:

▫️Dynamic support in bull-market corrections

▫️Hard support in bear markets

▫️A fake-out zone before continuation, not a death sentence

Let’s talk probabilities 👇 :

📌Base Case (45–50%): A controlled pullback of ~15–25%:

▫️Brief dip or wick around the 200W EMA

▫️Fast reclaim on weekly close

▫️Classic mid-cycle reset, not bearish

📌Fake-Out Scenario (30–35%):

▫️Sharp downside move

▫️Stops get cleaned

▫️1–2 weekly closes below the 200W EMA

▫️Quick reclaim & continuation

▫️This fits historical liqu

BTC-1,16%

- Reward

- like

- Comment

- Repost

- Share

#VRA - Charts Only. No Narratives.

If you think the #VRA chart looks bad, take a step back and compare it with others.

Look at these charts:

#DOT:

#1INCH:

#FIL

This isn’t about stories or sentiment. It’s about structure, cycles, and context.

#VET - Bonus: .........

If you want to see where I’m loading heavily ahead of what I believe is the final bear-market leg and a potential generational setup, the link is below.

If you think the #VRA chart looks bad, take a step back and compare it with others.

Look at these charts:

#DOT:

#1INCH:

#FIL

This isn’t about stories or sentiment. It’s about structure, cycles, and context.

#VET - Bonus: .........

If you want to see where I’m loading heavily ahead of what I believe is the final bear-market leg and a potential generational setup, the link is below.

- Reward

- like

- Comment

- Repost

- Share

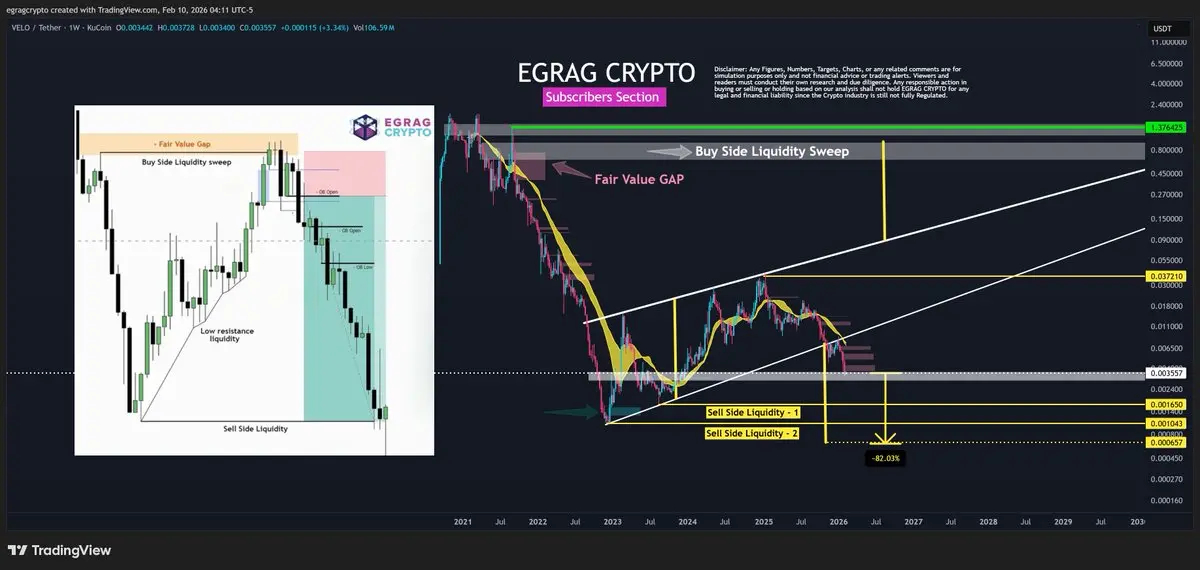

#VELO - Fake-Out or Real Breakdown?

Rising Wedges in general and In crypto markets specifically:

▫️~65%–75% of rising wedges break to the downside

▫️~25%–35% end as fake breakdowns / bear traps

However, those odds shift when:

▫️The wedge forms after a deep drawdown

▫️Price is near HTF support

▫️Sell-side liquidity is obvious

▫️A HTF Fair Value Gap sits above

▫️In those conditions, probabilities move closer to 50/50. 💡

Key rule:

▫️Acceptance below the white support confirms the breakdown.

▫️Fast sweep + Strong reclaim and re-enters the rising wedge confirms the trap.

💡 Pattern bias doesn’t

Rising Wedges in general and In crypto markets specifically:

▫️~65%–75% of rising wedges break to the downside

▫️~25%–35% end as fake breakdowns / bear traps

However, those odds shift when:

▫️The wedge forms after a deep drawdown

▫️Price is near HTF support

▫️Sell-side liquidity is obvious

▫️A HTF Fair Value Gap sits above

▫️In those conditions, probabilities move closer to 50/50. 💡

Key rule:

▫️Acceptance below the white support confirms the breakdown.

▫️Fast sweep + Strong reclaim and re-enters the rising wedge confirms the trap.

💡 Pattern bias doesn’t

VELO0,02%

- Reward

- like

- Comment

- Repost

- Share

#XRPL - Tokenization: The Early Innings: Today, only $20B in assets are tokenized: Yet global markets stand at:☑️Equities: $120T☑️Bonds: $140T☑️Real Estate: $300T ☑️Derivativs Market: $850T ☑️Nostro-Vostro: $27T ☑️Art and Collectibles: $1.7 ☑️Debt Instruments: $250T ☑️Intellectual Property: $5T ☑️Supply Chain Assets: $1T ☑️Insurance Policies: $5T ☑️Music Rights: $20B ☑️Gaming Assets: $200B ☑️Energy Credits: $50B ☑️Healthcare Data: $100B We haven’t even started. 🏁The infrastructure is forming, the scale is inevitable. 🔥

- Reward

- like

- Comment

- Repost

- Share

⚠️ #BTC – Key Levels to Watch: 📌$74K remains critical.If #BTC closes the CME gap near $81K, focus on weekly structure + volume for confirmation that a local low is in.Without that confirmation, yesterday’s lows are still at risk, potentially a final third flush.📌 Strategy:☑️Scale bids in small portions☑️Keep dry powder ready☑️Be prepared to BTFD if major lows are printedPatience > prediction. Structure always confirms first.

BTC-1,16%

- Reward

- like

- Comment

- Repost

- Share

#TMC Total Market Cap - One Way or Another, We’re Near the Final: Men Lie, Women Lie , But charts and numbers don’t lie.Whether it comes through one last flush or a clean base, the structure suggests we’re close to the final shakeout before expansion or simply expansion.

- Reward

- 1

- Comment

- Repost

- Share

#TMC - Worse Case Scenario from 50 EMA: Touching the 50 EMA Bounce or Continue the full retracement?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share