# NFPBeatsExpectations

19.39K

repanzal

#NFPBeatsExpectations

When the U.S. Nonfarm Payrolls (NFP) figure beats expectations, it signals that the labor market is stronger than economists predicted. This monthly jobs report, released by the U.S. Bureau of Labor Statistics, is one of the most closely watched economic data points worldwide — and its impact ripples across stocks, bonds, currencies, commodities, and crypto.

Here’s why this matters:

Strong Jobs = Economic Strength

A headline NFP figure that outperforms forecasts suggests employers are hiring more aggressively than expected. That typically points to:

Higher consumer spend

When the U.S. Nonfarm Payrolls (NFP) figure beats expectations, it signals that the labor market is stronger than economists predicted. This monthly jobs report, released by the U.S. Bureau of Labor Statistics, is one of the most closely watched economic data points worldwide — and its impact ripples across stocks, bonds, currencies, commodities, and crypto.

Here’s why this matters:

Strong Jobs = Economic Strength

A headline NFP figure that outperforms forecasts suggests employers are hiring more aggressively than expected. That typically points to:

Higher consumer spend

BTC4,69%

- Reward

- 2

- 5

- Repost

- Share

CryptoSelf :

:

Ape In 🚀View More

#NFPBeatsExpectations

NFPBeatsExpectations 📊🔥

The latest U.S. Non-Farm Payrolls (NFP) data has come in stronger than expected — and markets are reacting fast.

A beat in NFP usually signals:

✔ Stronger labor market

✔ Resilient economic activity

✔ Potentially tighter monetary policy ahead

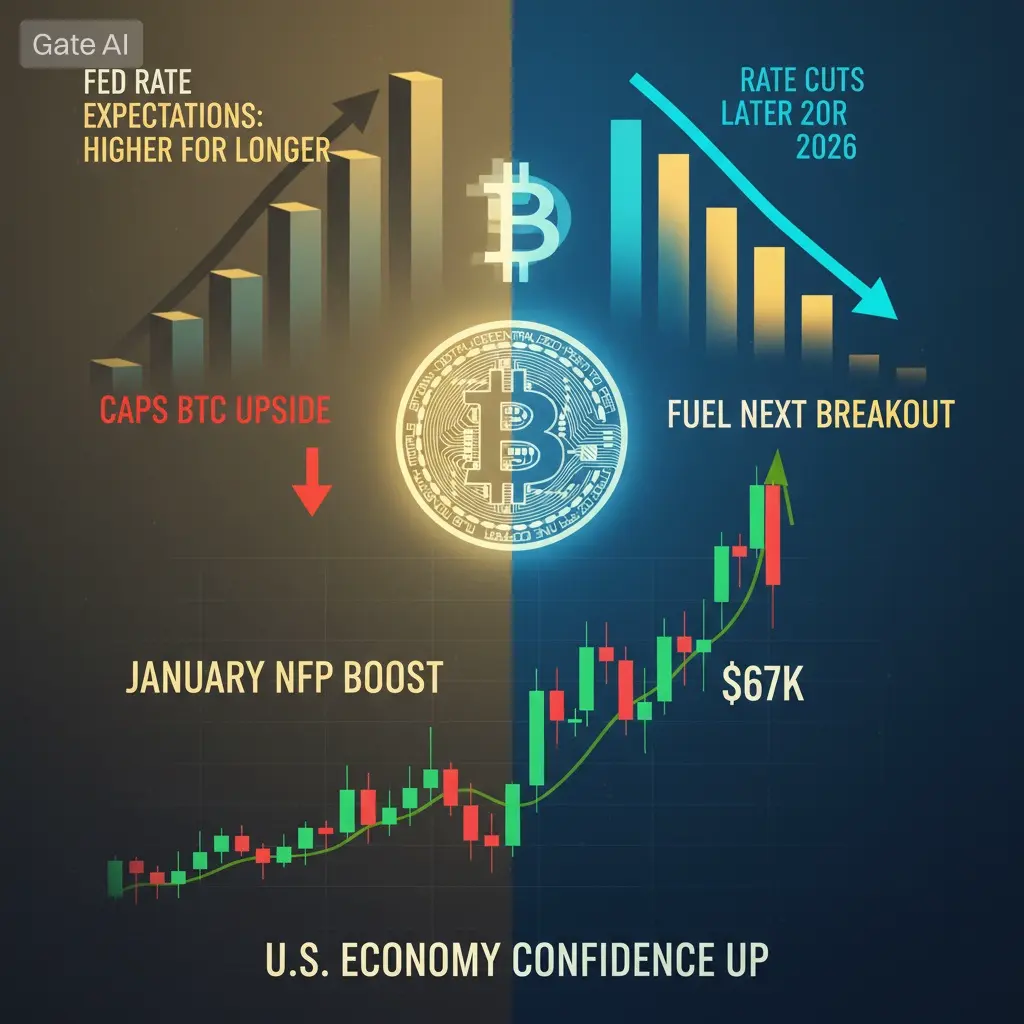

When job growth outperforms forecasts, investors immediately start recalculating what this means for the Federal Reserve. A strong labor market can delay rate cuts — or even revive rate hike expectations if inflation remains sticky.

📉 Market Impact

• Dollar tends to strengthen

• Bond yields often rise

• Equ

NFPBeatsExpectations 📊🔥

The latest U.S. Non-Farm Payrolls (NFP) data has come in stronger than expected — and markets are reacting fast.

A beat in NFP usually signals:

✔ Stronger labor market

✔ Resilient economic activity

✔ Potentially tighter monetary policy ahead

When job growth outperforms forecasts, investors immediately start recalculating what this means for the Federal Reserve. A strong labor market can delay rate cuts — or even revive rate hike expectations if inflation remains sticky.

📉 Market Impact

• Dollar tends to strengthen

• Bond yields often rise

• Equ

- Reward

- 1

- Comment

- Repost

- Share

⚡ BTRUSDT – $0.13988 (+43.04%)

Still holding bullish structure after recent surge. Higher highs & strong buying pressure suggest dips could be buy opportunities. Keep an eye on volume for confirmation.

$BTR $MON $SIREN #GateSquare$50KRedPacketGiveaway #CelebratingNewYearOnGateSquare #NFPBeatsExpectations #NFPBeatsExpectations

Still holding bullish structure after recent surge. Higher highs & strong buying pressure suggest dips could be buy opportunities. Keep an eye on volume for confirmation.

$BTR $MON $SIREN #GateSquare$50KRedPacketGiveaway #CelebratingNewYearOnGateSquare #NFPBeatsExpectations #NFPBeatsExpectations

- Reward

- 1

- 1

- Repost

- Share

RjHaroon :

:

2026 GOGOGO 👊#NFPBeatsExpectations 🚀 The Future Is Being Written Right Now — Are You Ready?

The next phase of global markets is not coming slowly — it’s accelerating. We are entering an era where technology, digital finance, artificial intelligence, and decentralized systems are reshaping how money moves, how businesses operate, and how individuals build wealth. The future doesn’t belong to the biggest players anymore — it belongs to the smartest and most prepared.

In the coming months, expect volatility to increase across crypto, stocks, and commodities. Liquidity cycles will define the direction. Inflat

The next phase of global markets is not coming slowly — it’s accelerating. We are entering an era where technology, digital finance, artificial intelligence, and decentralized systems are reshaping how money moves, how businesses operate, and how individuals build wealth. The future doesn’t belong to the biggest players anymore — it belongs to the smartest and most prepared.

In the coming months, expect volatility to increase across crypto, stocks, and commodities. Liquidity cycles will define the direction. Inflat

- Reward

- 6

- 8

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#NFPBeatsExpectations

On Feb 11, 2026, the U.S. Non-Farm Payroll (NFP) report came in much stronger than expected — and it shook both macro and crypto markets.

📊 The Key Jobs Data (January 2026)

✅ Jobs Added: +130,000

(Expected: ~55K–70K)

✅ Unemployment: 4.3%

(Expected: 4.4%)

🔁 December 2025 jobs were revised sharply lower to +48K

Big annual revisions show 2025 job growth much weaker than first reported.

So January looked strong on the surface, but the underlying trend was softer than markets thought.

This created a “strong headline, softer reality” vibe in markets — which mattered for cryp

On Feb 11, 2026, the U.S. Non-Farm Payroll (NFP) report came in much stronger than expected — and it shook both macro and crypto markets.

📊 The Key Jobs Data (January 2026)

✅ Jobs Added: +130,000

(Expected: ~55K–70K)

✅ Unemployment: 4.3%

(Expected: 4.4%)

🔁 December 2025 jobs were revised sharply lower to +48K

Big annual revisions show 2025 job growth much weaker than first reported.

So January looked strong on the surface, but the underlying trend was softer than markets thought.

This created a “strong headline, softer reality” vibe in markets — which mattered for cryp

BTC4,69%

- Reward

- 19

- 21

- Repost

- Share

EagleEye :

:

Thanks for sharing this infromative postView More

#NFPBeatsExpectations 📊

The latest Non-Farm Payrolls (NFP) report has once again surprised markets, delivering stronger-than-expected job growth and reinforcing the narrative of a resilient labor market. Whenever employment data beats forecasts, it sends ripples across equities, bonds, commodities, and crypto — and this release is no exception.

The NFP report, published by the U.S. Bureau of Labor Statistics, is widely regarded as one of the most influential macroeconomic indicators. It provides a snapshot of job creation, wage growth, and unemployment trends, offering valuable insight into t

The latest Non-Farm Payrolls (NFP) report has once again surprised markets, delivering stronger-than-expected job growth and reinforcing the narrative of a resilient labor market. Whenever employment data beats forecasts, it sends ripples across equities, bonds, commodities, and crypto — and this release is no exception.

The NFP report, published by the U.S. Bureau of Labor Statistics, is widely regarded as one of the most influential macroeconomic indicators. It provides a snapshot of job creation, wage growth, and unemployment trends, offering valuable insight into t

- Reward

- 5

- 8

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#NFPBeatsExpectations

📊🚨 #NFPBeatsExpectations

The latest U.S. Non-Farm Payrolls (NFP) report has come in stronger than expected, shaking global markets and resetting short-term expectations ⚡

A hotter labor market means one thing for traders:

💵 Rates may stay higher for longer — and risk assets feel the pressure.

🔎 Market Impact Breakdown:

• 📈 USD strengthens as rate-cut hopes get pushed back

• 📉 Stocks & crypto face pressure on tighter financial conditions

• 🪙 Gold turns volatile as yields rise

• ₿ Bitcoin reacts short-term to macro, not fundamentals

🧠 Key Insight:

Good economic new

📊🚨 #NFPBeatsExpectations

The latest U.S. Non-Farm Payrolls (NFP) report has come in stronger than expected, shaking global markets and resetting short-term expectations ⚡

A hotter labor market means one thing for traders:

💵 Rates may stay higher for longer — and risk assets feel the pressure.

🔎 Market Impact Breakdown:

• 📈 USD strengthens as rate-cut hopes get pushed back

• 📉 Stocks & crypto face pressure on tighter financial conditions

• 🪙 Gold turns volatile as yields rise

• ₿ Bitcoin reacts short-term to macro, not fundamentals

🧠 Key Insight:

Good economic new

BTC4,69%

- Reward

- 1

- 6

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#NFPBeatsExpectations

13 February 2026 Today the market sentiment felt highly dynamic, and the main focus of discussion was clearly . When Non-Farm Payroll data comes in stronger than expected, it signals that the labor market remains resilient and stable. Strong employment numbers suggest that the economy is not slowing down as much as many were anticipating. Because of this, the market reaction was immediate.

Traders were cautious earlier in the day, but once confirmation spread that #NFPBeatsExpectations volatility noticeably increased. Strong jobs data often influences expectations aroun

13 February 2026 Today the market sentiment felt highly dynamic, and the main focus of discussion was clearly . When Non-Farm Payroll data comes in stronger than expected, it signals that the labor market remains resilient and stable. Strong employment numbers suggest that the economy is not slowing down as much as many were anticipating. Because of this, the market reaction was immediate.

Traders were cautious earlier in the day, but once confirmation spread that #NFPBeatsExpectations volatility noticeably increased. Strong jobs data often influences expectations aroun

BTC4,69%

- Reward

- 6

- 7

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#NFPBeatsExpectations 📊 A Signal of Economic Strength and Market Shifts

When Non-Farm Payroll (NFP) data surpasses forecasts, it signals that the labor market in the world’s largest economy remains resilient. This strength extends beyond job creation, reflecting rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise temporarily eases recession concerns and fuels optimism across markets.

Federal Reserve Response and Interest Rate Outlook

The most significant implication of strong NFP data is its influence on Federal Reserve policy. Rapid employmen

When Non-Farm Payroll (NFP) data surpasses forecasts, it signals that the labor market in the world’s largest economy remains resilient. This strength extends beyond job creation, reflecting rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise temporarily eases recession concerns and fuels optimism across markets.

Federal Reserve Response and Interest Rate Outlook

The most significant implication of strong NFP data is its influence on Federal Reserve policy. Rapid employmen

BTC4,69%

- Reward

- 6

- 10

- Repost

- Share

xxx40xxx :

:

LFG 🔥View More

#NFPBeatsExpectations

A Signal of Economic Strength and Market Shifts

When Non-Farm Payroll (NFP) data exceeds forecasts, it sends a powerful message that the labor market in the world’s largest economy remains resilient. This strength goes beyond job creation — it reflects rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise in employment data reinforces optimism and temporarily pushes recession fears into the background.

Federal Reserve Response and Interest Rate Outlook

The most important implication of strong NFP data lies in its impact on

A Signal of Economic Strength and Market Shifts

When Non-Farm Payroll (NFP) data exceeds forecasts, it sends a powerful message that the labor market in the world’s largest economy remains resilient. This strength goes beyond job creation — it reflects rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise in employment data reinforces optimism and temporarily pushes recession fears into the background.

Federal Reserve Response and Interest Rate Outlook

The most important implication of strong NFP data lies in its impact on

BTC4,69%

- Reward

- 3

- 7

- Repost

- Share

Peacefulheart :

:

Buy To Earn 💰️View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

56.71K Popularity

48.53K Popularity

19.39K Popularity

45.68K Popularity

258.18K Popularity

203.73K Popularity

11.17K Popularity

8.9K Popularity

6.42K Popularity

7.92K Popularity

123.55K Popularity

29.27K Popularity

26.1K Popularity

11.01K Popularity

4.37K Popularity

News

View MoreData: 248.34 BTC transferred out from Cumberland DRW, worth approximately 10.36 million USD

2 h

Data: 52,000 SOL transferred to Wintermute, worth approximately $4,435,100.

2 h

Data: If BTC drops below $65,621, the total long liquidation strength on mainstream CEXs will reach $1.322 billion.

3 h

Data: If ETH falls below $1,951, the total long liquidation strength on major CEXs will reach $612 million.

3 h

Daiwa Capital: CPI and employment data support the Federal Reserve to keep interest rates unchanged in March

4 h

Pin