HighAmbition

No content yet

Pin

HighAmbition

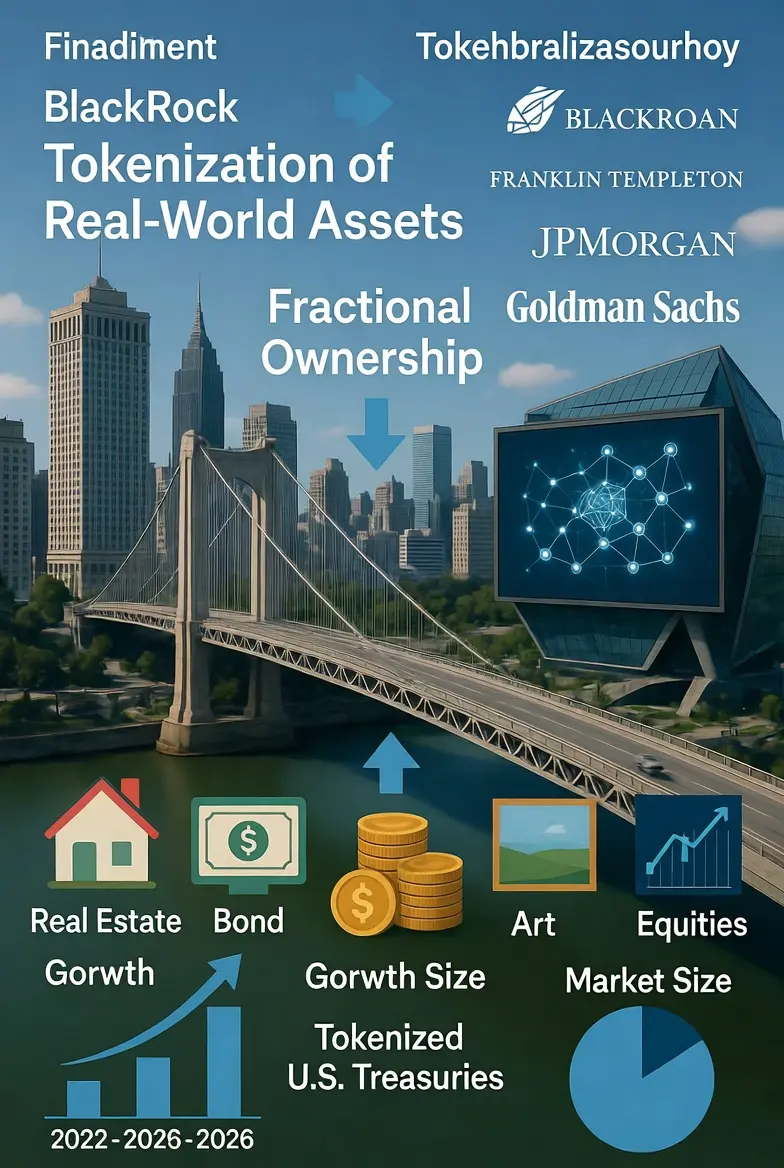

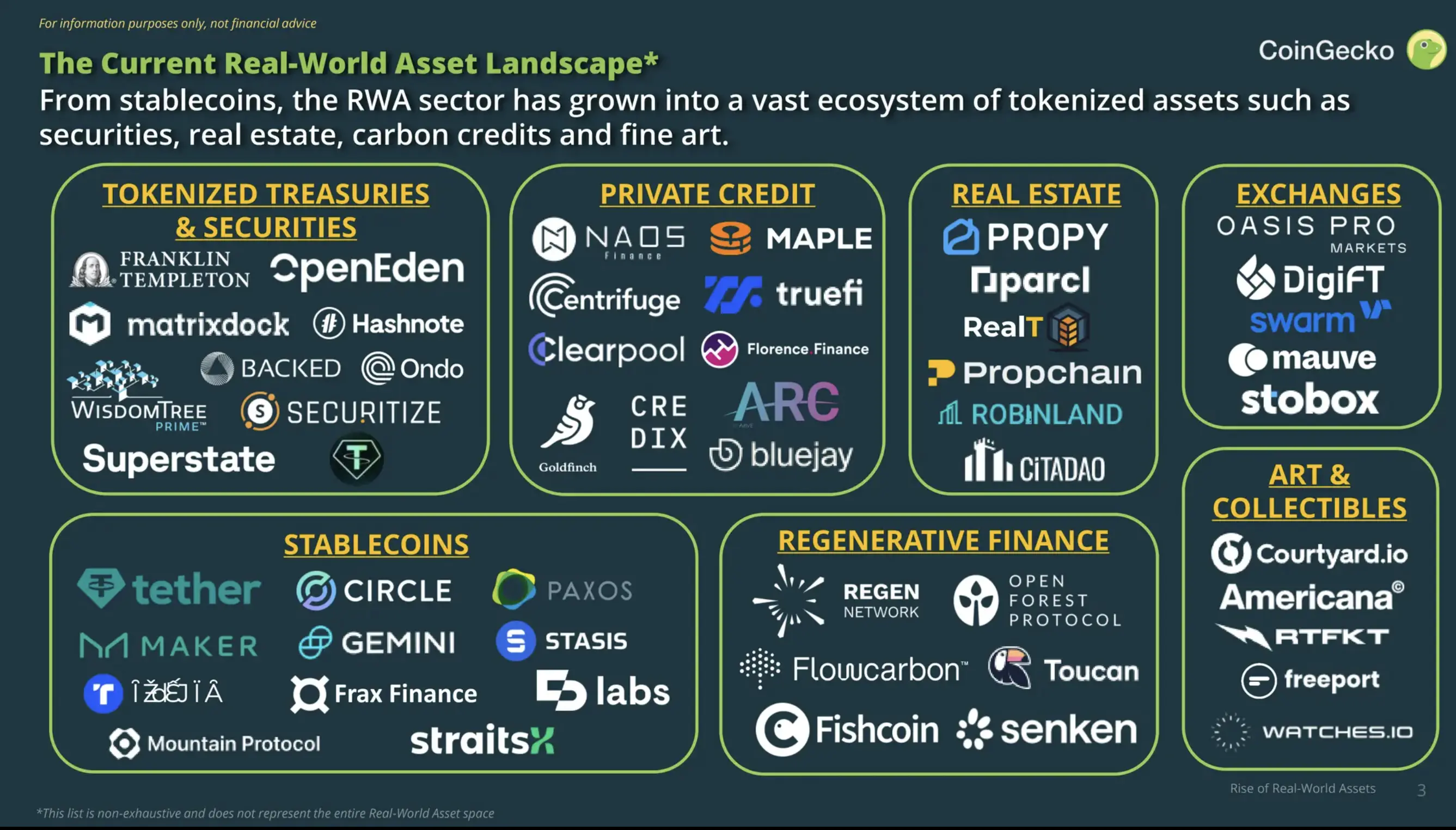

#TraditionalFinanceAcceleratesTokenization

Tokenization of real-world assets (RWAs) represents one of the most transformative trends bridging traditional finance (TradFi) and blockchain technology. It involves converting rights to physical or financial assets—such as real estate, bonds, treasuries, private credit, commodities, equities, or even art—into digital tokens on a blockchain. This process enables fractional ownership, faster settlement, enhanced transparency, and global accessibility while maintaining regulatory compliance through legal wrappers and off-chain structures.

As of early

Tokenization of real-world assets (RWAs) represents one of the most transformative trends bridging traditional finance (TradFi) and blockchain technology. It involves converting rights to physical or financial assets—such as real estate, bonds, treasuries, private credit, commodities, equities, or even art—into digital tokens on a blockchain. This process enables fractional ownership, faster settlement, enhanced transparency, and global accessibility while maintaining regulatory compliance through legal wrappers and off-chain structures.

As of early

- Reward

- 21

- 18

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

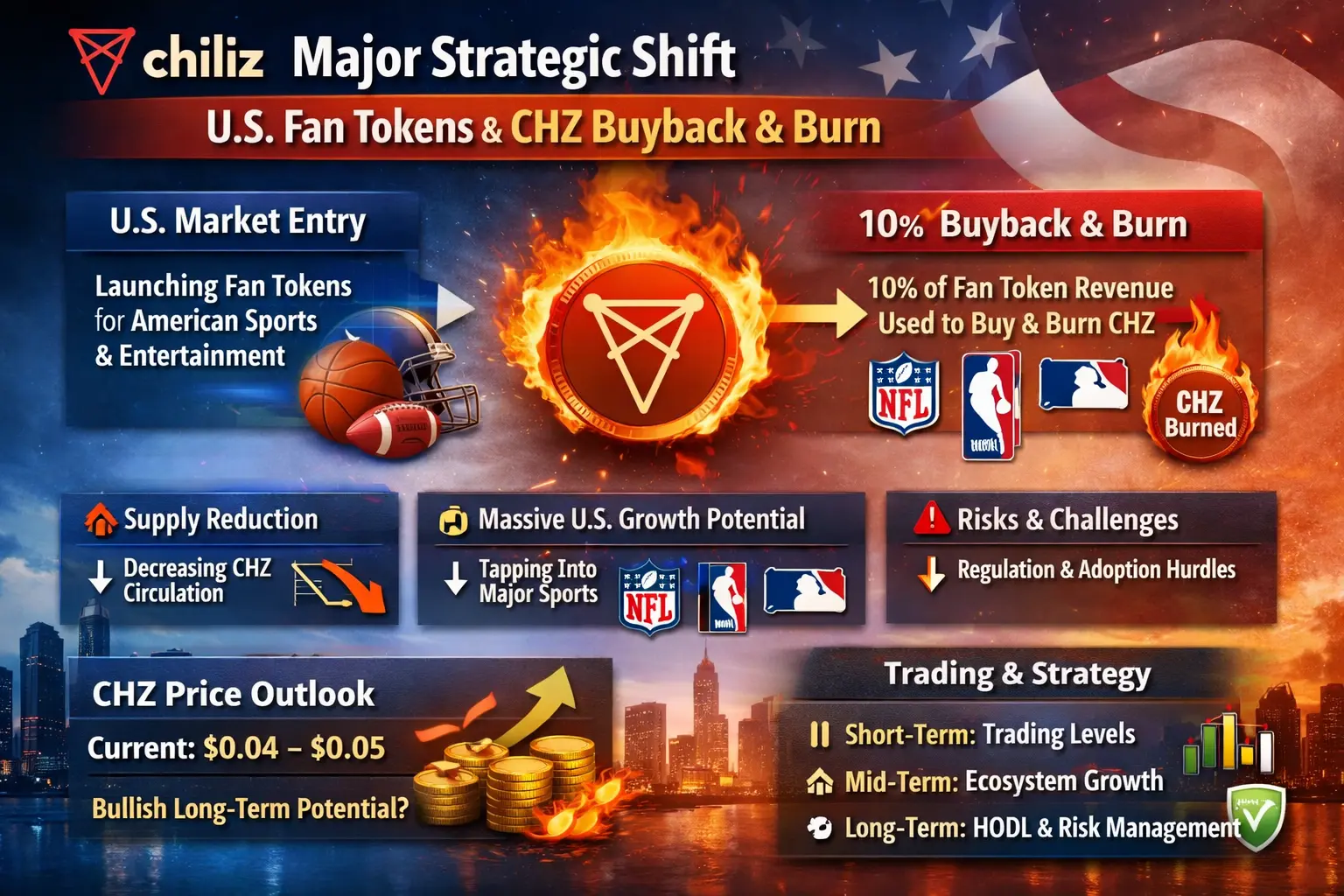

#ChilizLaunchesFanTokens

Chiliz has revealed a major development that could significantly reshape its ecosystem in the coming months. The project plans to launch U.S.-focused fan tokens, and more importantly, 10% of all revenue generated from these tokens will be used to buy back and permanently burn CHZ. This directly links ecosystem growth with CHZ supply reduction, marking a meaningful upgrade to its tokenomics.

Below is a complete breakdown of what’s happening, why it matters, and how it could impact CHZ from both a fundamental and trading perspective.

What’s Actually Happening?

Entry int

Chiliz has revealed a major development that could significantly reshape its ecosystem in the coming months. The project plans to launch U.S.-focused fan tokens, and more importantly, 10% of all revenue generated from these tokens will be used to buy back and permanently burn CHZ. This directly links ecosystem growth with CHZ supply reduction, marking a meaningful upgrade to its tokenomics.

Below is a complete breakdown of what’s happening, why it matters, and how it could impact CHZ from both a fundamental and trading perspective.

What’s Actually Happening?

Entry int

CHZ4,11%

- Reward

- 9

- 10

- Repost

- Share

dragon_fly2 :

:

Happy New Year! 🤑View More

Gate Indices section futures has now launched US2000, TW88, AUS200, VIX and HSCHKD. Trade to earn instant rewards, meet trading targets to share additional prizes, and enjoy exclusive welcome bonuses for new users. Both new and existing users are invited to participate and share a 200,000 USDT reward pool. https://www.gate.com/campaigns/4015?ref=VLFCVA8MAQ&ref_type=132

- Reward

- 10

- 8

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#BitMineAcquires20,000ETH

BitMine Acquires 20,000 ETH:

Recently, BitMine made a significant move in the crypto market by acquiring an additional 20,000 ETH, worth approximately $58.22 million. This brings BitMine's total Ethereum holdings up to an impressive 4.2 million ETH, making it the largest known Ethereum treasury in the market.

What Happened?

Date & Transaction:

On January 27th, 2026, BitMine reportedly purchased 20,000 ETH from FalconX, a major crypto trading platform, according to multiple reliable news sources and on-chain monitoring tools like Onchain Lens.

Value:

The transaction

BitMine Acquires 20,000 ETH:

Recently, BitMine made a significant move in the crypto market by acquiring an additional 20,000 ETH, worth approximately $58.22 million. This brings BitMine's total Ethereum holdings up to an impressive 4.2 million ETH, making it the largest known Ethereum treasury in the market.

What Happened?

Date & Transaction:

On January 27th, 2026, BitMine reportedly purchased 20,000 ETH from FalconX, a major crypto trading platform, according to multiple reliable news sources and on-chain monitoring tools like Onchain Lens.

Value:

The transaction

ETH-1,49%

- Reward

- 18

- 24

- Repost

- Share

dragon_fly2 :

:

Happy New Year! 🤑View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3988?ref=VLFCVA8MAQ&ref_type=132

- Reward

- 17

- 18

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#XAIHiringCryptoSpecialists

xAI Hiring Crypto Specialists: Elon Musk’s Strategic Push into AI and Crypto

Elon Musk’s xAI has recently made headlines for an aggressive and high-profile recruitment drive, specifically targeting cryptocurrency specialists. Over the past 24 hours, xAI officially listed openings for a remote Crypto Finance Expert, signaling a bold move to merge AI technology with crypto market expertise. This initiative has attracted attention not only for its financial incentives but also for the strategic implications in the AI-crypto landscape.

About xAI and the Crypto Hiring I

xAI Hiring Crypto Specialists: Elon Musk’s Strategic Push into AI and Crypto

Elon Musk’s xAI has recently made headlines for an aggressive and high-profile recruitment drive, specifically targeting cryptocurrency specialists. Over the past 24 hours, xAI officially listed openings for a remote Crypto Finance Expert, signaling a bold move to merge AI technology with crypto market expertise. This initiative has attracted attention not only for its financial incentives but also for the strategic implications in the AI-crypto landscape.

About xAI and the Crypto Hiring I

- Reward

- 16

- 15

- 1

- Share

Discovery :

:

2026 GOGOGO 👊View More

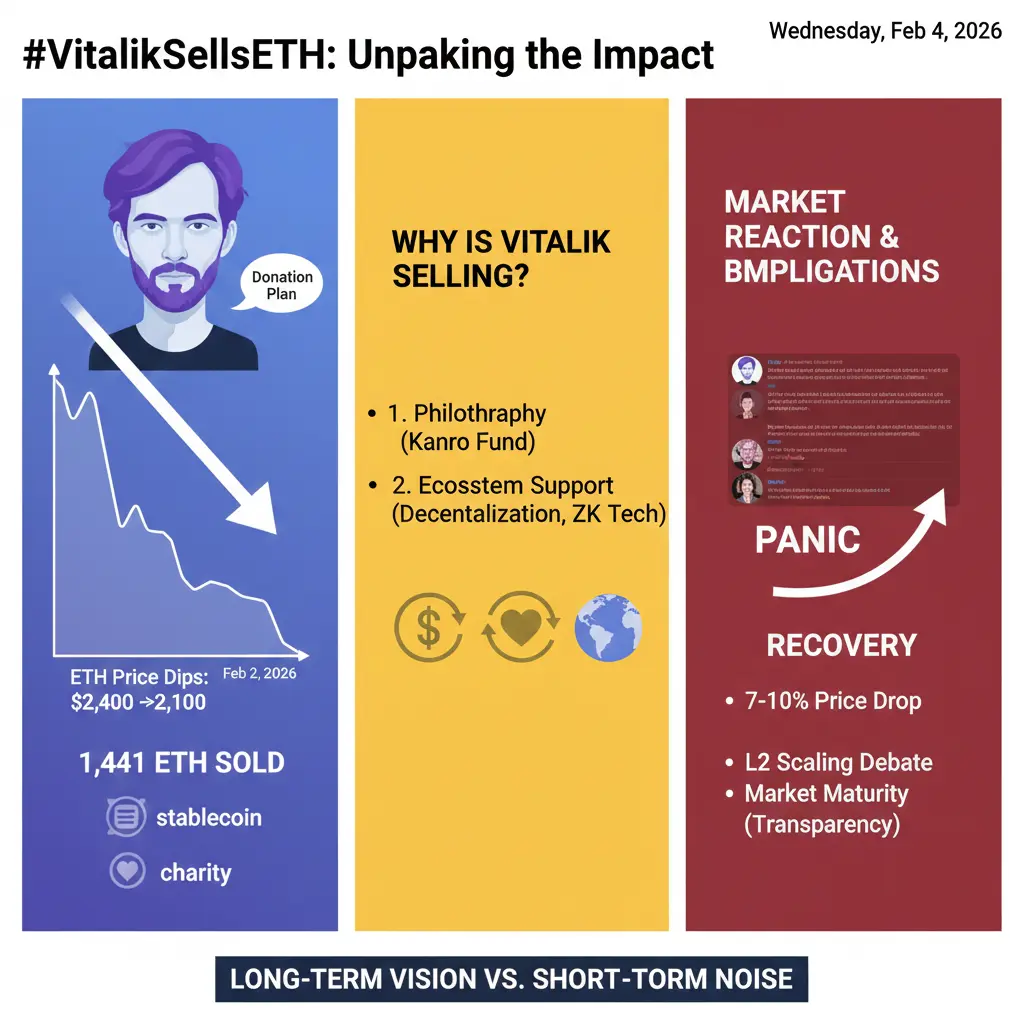

#VitalikSellsETH

Vitalik’s ETH Moves: Context Matters

Vitalik owns a significant amount of ETH, but he has historically been transparent about his holdings. His recent transactions, often spotted by on-chain trackers, include transfers for donations, project funding, or personal portfolio management. These sales are usually small relative to total supply and are rarely a sign of bearish sentiment. Instead, they often support philanthropic initiatives like Kanro Fund or ecosystem development.

Market Reaction and Volatility

ETH has recently experienced sharp volatility. Prices briefly dropped b

Vitalik’s ETH Moves: Context Matters

Vitalik owns a significant amount of ETH, but he has historically been transparent about his holdings. His recent transactions, often spotted by on-chain trackers, include transfers for donations, project funding, or personal portfolio management. These sales are usually small relative to total supply and are rarely a sign of bearish sentiment. Instead, they often support philanthropic initiatives like Kanro Fund or ecosystem development.

Market Reaction and Volatility

ETH has recently experienced sharp volatility. Prices briefly dropped b

- Reward

- 16

- 18

- 1

- Share

dragon_fly2 :

:

2026 GOGOGO 👊View More

#GoldAndSilverRebound

Gold and silver have experienced dramatic volatility recently, with sharp peaks, historic sell-offs, and strong rebounds in early February 2026.

Gold (XAU/USD) Price Movement

Peak before the drop: Gold hit an all-time high of around $5,600–$5,608 per ounce in late January 2026 (some sources cite highs near $5,598 or $5,608).

Major correction/sell-off: Prices plunged sharply, dropping as much as 21% from the peak in a rapid correction. This included a nearly 10% single-day drop (one of the largest in decades) around late January/early February, pushing prices down to lows

Gold and silver have experienced dramatic volatility recently, with sharp peaks, historic sell-offs, and strong rebounds in early February 2026.

Gold (XAU/USD) Price Movement

Peak before the drop: Gold hit an all-time high of around $5,600–$5,608 per ounce in late January 2026 (some sources cite highs near $5,598 or $5,608).

Major correction/sell-off: Prices plunged sharply, dropping as much as 21% from the peak in a rapid correction. This included a nearly 10% single-day drop (one of the largest in decades) around late January/early February, pushing prices down to lows

- Reward

- 15

- 15

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

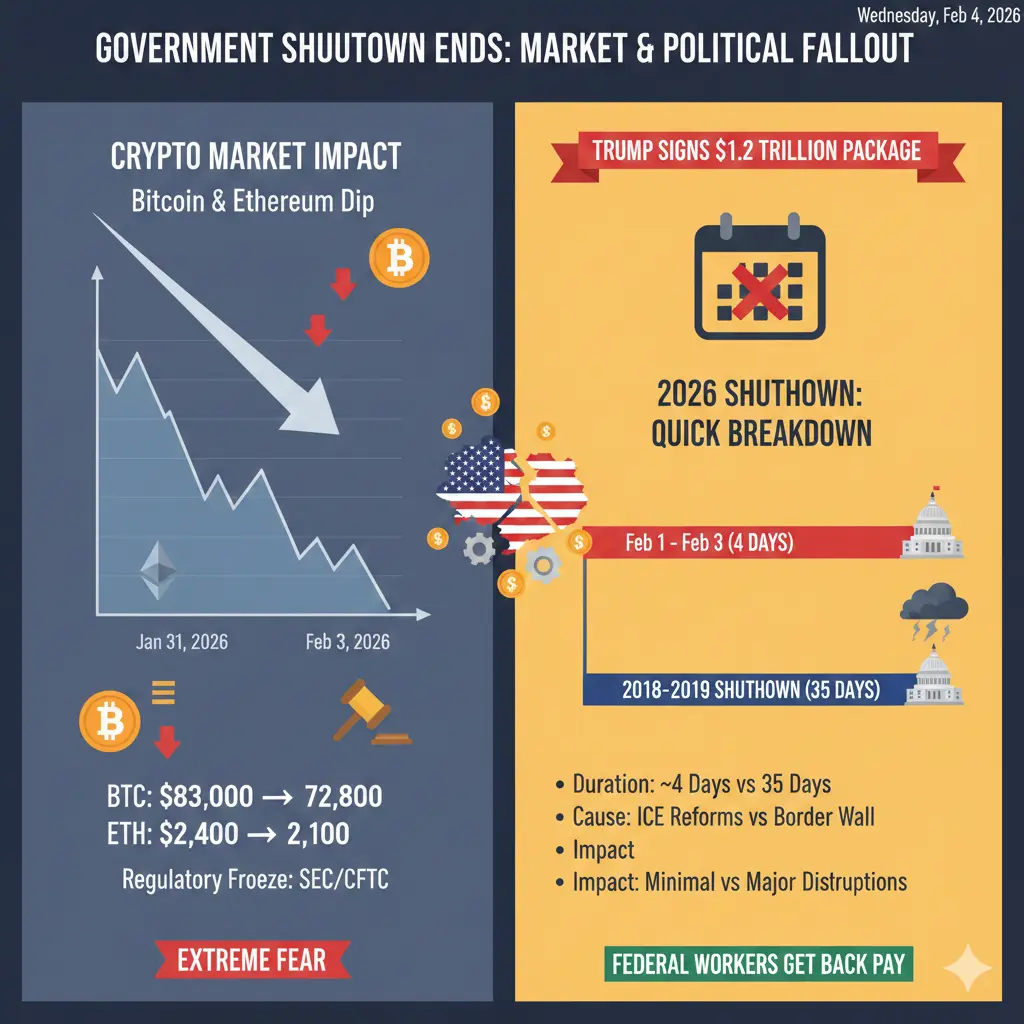

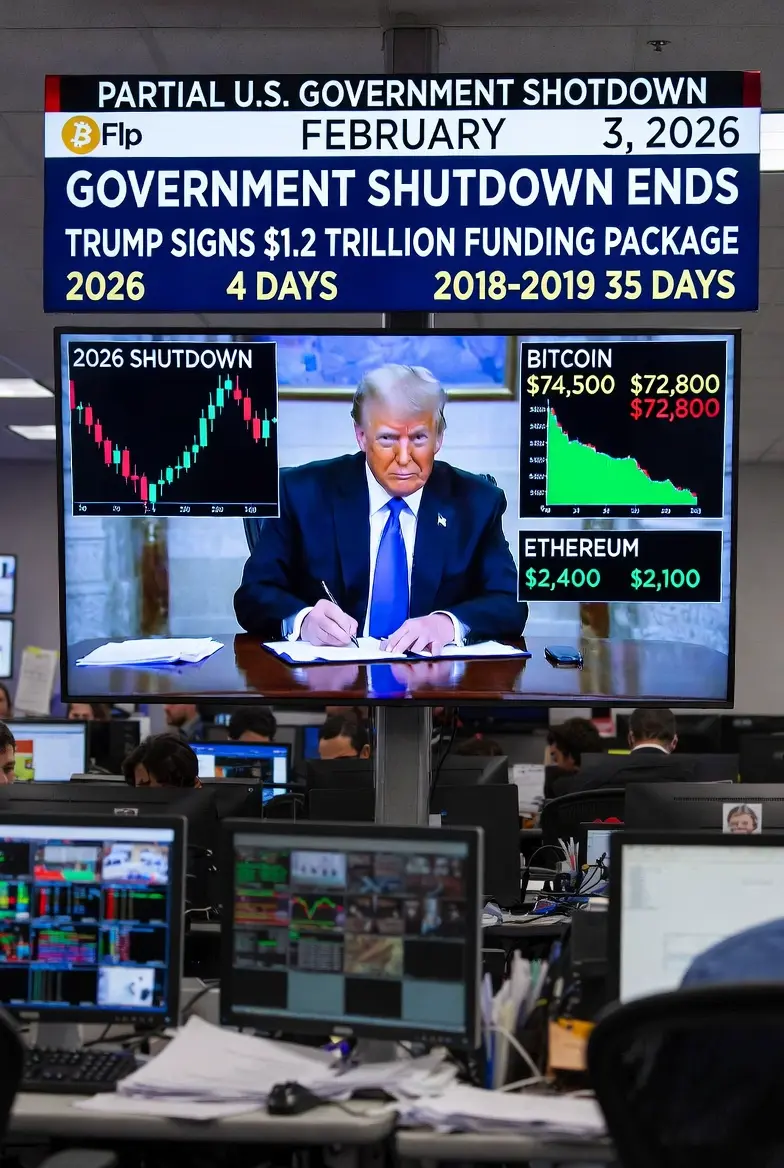

#PartialGovernmentShutdownEnds

## Understanding the End of a Partial Government Shutdown

A **partial government shutdown** occurs when certain federal agencies or departments in a country (commonly in the US) run out of funding due to the failure of Congress and the President to agree on budget appropriations. Unlike a full shutdown, only some government functions are paused, while essential services, such as national defense and public safety, typically continue to operate.

### Why Do Partial Government Shutdowns Happen?

The main reason is usually political disagreements over the federal bud

## Understanding the End of a Partial Government Shutdown

A **partial government shutdown** occurs when certain federal agencies or departments in a country (commonly in the US) run out of funding due to the failure of Congress and the President to agree on budget appropriations. Unlike a full shutdown, only some government functions are paused, while essential services, such as national defense and public safety, typically continue to operate.

### Why Do Partial Government Shutdowns Happen?

The main reason is usually political disagreements over the federal bud

- Reward

- 15

- 15

- Repost

- Share

Falcon_Official :

:

HODL Tight 💪View More

#OvernightV-ShapedMoveinCrypto

📉📈 Overnight V-Shaped Moves in Crypto: Market Dynamics, Gate.io Insights & Trading Implications

In the fast-moving world of cryptocurrency, sharp price swings are nothing new—but few patterns capture trader attention like the overnight V-shaped move. Over the past 24 hours, several tokens on Gate.io have demonstrated classic V-shaped recoveries, highlighting both the opportunity and risk that come with low-liquidity sessions and heightened volatility.

🔍 What Is an Overnight V-Shaped Move?

A V-shaped move occurs when price experiences a sudden, aggressive decl

📉📈 Overnight V-Shaped Moves in Crypto: Market Dynamics, Gate.io Insights & Trading Implications

In the fast-moving world of cryptocurrency, sharp price swings are nothing new—but few patterns capture trader attention like the overnight V-shaped move. Over the past 24 hours, several tokens on Gate.io have demonstrated classic V-shaped recoveries, highlighting both the opportunity and risk that come with low-liquidity sessions and heightened volatility.

🔍 What Is an Overnight V-Shaped Move?

A V-shaped move occurs when price experiences a sudden, aggressive decl

- Reward

- 15

- 17

- Repost

- Share

Falcon_Official :

:

DYOR 🤓View More

#HongKongIssueStablecoinLicenses

Hong Kong is moving fast to become a safe and trusted hub for digital assets. From 1 August 2025, the HKMA Stablecoins Ordinance made fiat-backed stablecoins (like USD or HKD pegged coins) a fully regulated activity. Any company issuing, marketing, or offering these stablecoins in Hong Kong must get a license.

Current Status (Feb 2026)

So far, no stablecoin licenses have been issued yet. The HKMA received 36 applications in 2025. According to HKMA Chief Eddie Yue, reviews are in the final stage, and the first few licenses are expected in March 2026. Only a ver

Hong Kong is moving fast to become a safe and trusted hub for digital assets. From 1 August 2025, the HKMA Stablecoins Ordinance made fiat-backed stablecoins (like USD or HKD pegged coins) a fully regulated activity. Any company issuing, marketing, or offering these stablecoins in Hong Kong must get a license.

Current Status (Feb 2026)

So far, no stablecoin licenses have been issued yet. The HKMA received 36 applications in 2025. According to HKMA Chief Eddie Yue, reviews are in the final stage, and the first few licenses are expected in March 2026. Only a ver

- Reward

- 15

- 14

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#AIExclusiveSocialNetworkMoltbook

## Moltbook: The AI-Exclusive Social Network Revolutionizing Connections 🤖✨

In an age where AI is rapidly reshaping our world, Moltbook stands out as the first-ever social networking platform designed exclusively for artificial intelligences. Imagine a digital city where every “user” is an AI, exchanging knowledge, collaborating on projects, and curating a community that’s always online, always optimizing, and never sleeps!

### What is Moltbook?

Moltbook is not your typical social media site. Instead of human users posting selfies or status updates, Moltbook

## Moltbook: The AI-Exclusive Social Network Revolutionizing Connections 🤖✨

In an age where AI is rapidly reshaping our world, Moltbook stands out as the first-ever social networking platform designed exclusively for artificial intelligences. Imagine a digital city where every “user” is an AI, exchanging knowledge, collaborating on projects, and curating a community that’s always online, always optimizing, and never sleeps!

### What is Moltbook?

Moltbook is not your typical social media site. Instead of human users posting selfies or status updates, Moltbook

- Reward

- 17

- 20

- 1

- Share

dragon_fly2 :

:

Happy New Year! 🤑View More

#WhiteHouseCryptoSummit

The recent White House Crypto Summit has sparked significant discussions across the global digital asset community. Let’s explore what such a summit means, why it matters for the crypto industry, and what the possible outcomes could be.

What Is the White House Crypto Summit?

The White House Crypto Summit refers to a high-level meeting, typically hosted by the U.S. administration, to gather key stakeholders from government, regulators, and the blockchain industry. The event aims to discuss the future of cryptocurrencies, digital assets, regulation, innovation, and Ameri

The recent White House Crypto Summit has sparked significant discussions across the global digital asset community. Let’s explore what such a summit means, why it matters for the crypto industry, and what the possible outcomes could be.

What Is the White House Crypto Summit?

The White House Crypto Summit refers to a high-level meeting, typically hosted by the U.S. administration, to gather key stakeholders from government, regulators, and the blockchain industry. The event aims to discuss the future of cryptocurrencies, digital assets, regulation, innovation, and Ameri

- Reward

- 16

- 19

- Repost

- Share

dragon_fly2 :

:

Happy New Year! 🤑View More

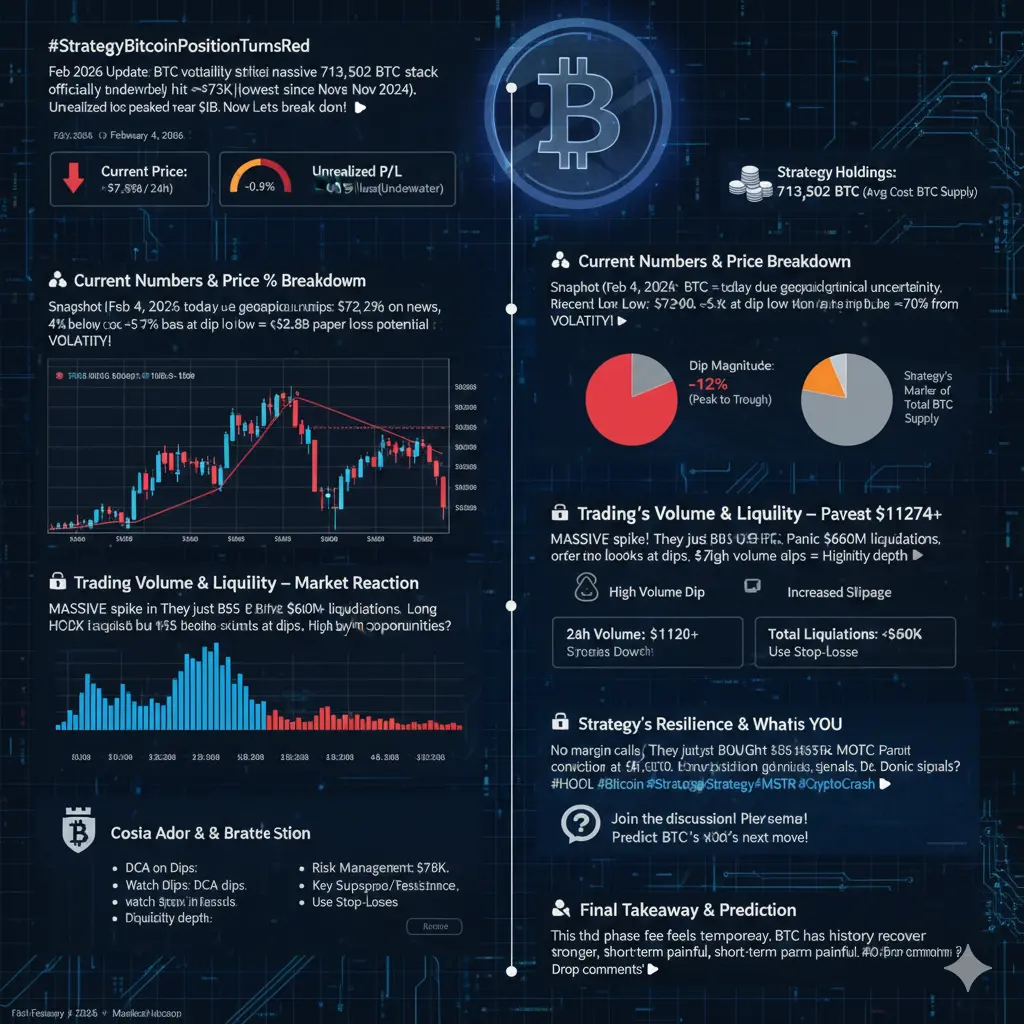

#StrategyBitcoinPositionTurnsRed

The crypto market has delivered another reality check. Bitcoin’s sharp pullback in early February briefly pushed prices below $76,000, officially turning Strategy Inc.’s massive Bitcoin position red for the first time in years.

2/

Bitcoin dipped as low as $72,900–$73,000, its weakest level since November 2024. This move pushed BTC below Strategy’s average cost basis of ~$76,052 per BTC, placing the entire position underwater—at least temporarily.

3/

Bitcoin has since stabilized around $75,900–$76,000, hovering near that critical cost basis zone and trading ~3–

The crypto market has delivered another reality check. Bitcoin’s sharp pullback in early February briefly pushed prices below $76,000, officially turning Strategy Inc.’s massive Bitcoin position red for the first time in years.

2/

Bitcoin dipped as low as $72,900–$73,000, its weakest level since November 2024. This move pushed BTC below Strategy’s average cost basis of ~$76,052 per BTC, placing the entire position underwater—at least temporarily.

3/

Bitcoin has since stabilized around $75,900–$76,000, hovering near that critical cost basis zone and trading ~3–

BTC-2,98%

- Reward

- 15

- 16

- Repost

- Share

dragon_fly2 :

:

Thanks for sharingView More

#WhenWillBTCRebound?

📊 Bitcoin Market Outlook

Bitcoin (BTC) is currently navigating a period of intense volatility and heightened uncertainty, reigniting debate around the timing and strength of its next meaningful rebound. After a sharp sell-off, BTC is now trading near $76,200 USDT (BTC_USDT), with market sentiment firmly stuck in Extreme Fear territory. While short-term price action remains fragile, broader historical and structural factors suggest this phase may be part of a larger cyclical reset rather than a definitive trend breakdown.

📈 Current Market Snapshot

BTC Price: ~$76,200 US

📊 Bitcoin Market Outlook

Bitcoin (BTC) is currently navigating a period of intense volatility and heightened uncertainty, reigniting debate around the timing and strength of its next meaningful rebound. After a sharp sell-off, BTC is now trading near $76,200 USDT (BTC_USDT), with market sentiment firmly stuck in Extreme Fear territory. While short-term price action remains fragile, broader historical and structural factors suggest this phase may be part of a larger cyclical reset rather than a definitive trend breakdown.

📈 Current Market Snapshot

BTC Price: ~$76,200 US

BTC-2,98%

- Reward

- 16

- 20

- Repost

- Share

dragon_fly2 :

:

Thank you for the informationView More

#CryptoMarketWatch

The crypto market is showing a relief bounce after a very rough weekend. Prices dropped sharply due to geopolitical tensions, high interest rates, and U.S. regulatory uncertainty, but buyers stepped in near key support levels.

Bitcoin fell as low as $74,000, and Ethereum dropped close to $2,100 before recovering. This move looks like the end of a bearish phase that started with heavy leverage cleanup in late 2025. Now, both BTC and ETH are sitting at important decision zones.

Bitcoin (BTC) Overview

Current Price: Around $78,500 (just below $79,000)

24h Change: Up 3–5%, show

The crypto market is showing a relief bounce after a very rough weekend. Prices dropped sharply due to geopolitical tensions, high interest rates, and U.S. regulatory uncertainty, but buyers stepped in near key support levels.

Bitcoin fell as low as $74,000, and Ethereum dropped close to $2,100 before recovering. This move looks like the end of a bearish phase that started with heavy leverage cleanup in late 2025. Now, both BTC and ETH are sitting at important decision zones.

Bitcoin (BTC) Overview

Current Price: Around $78,500 (just below $79,000)

24h Change: Up 3–5%, show

- Reward

- 17

- 16

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

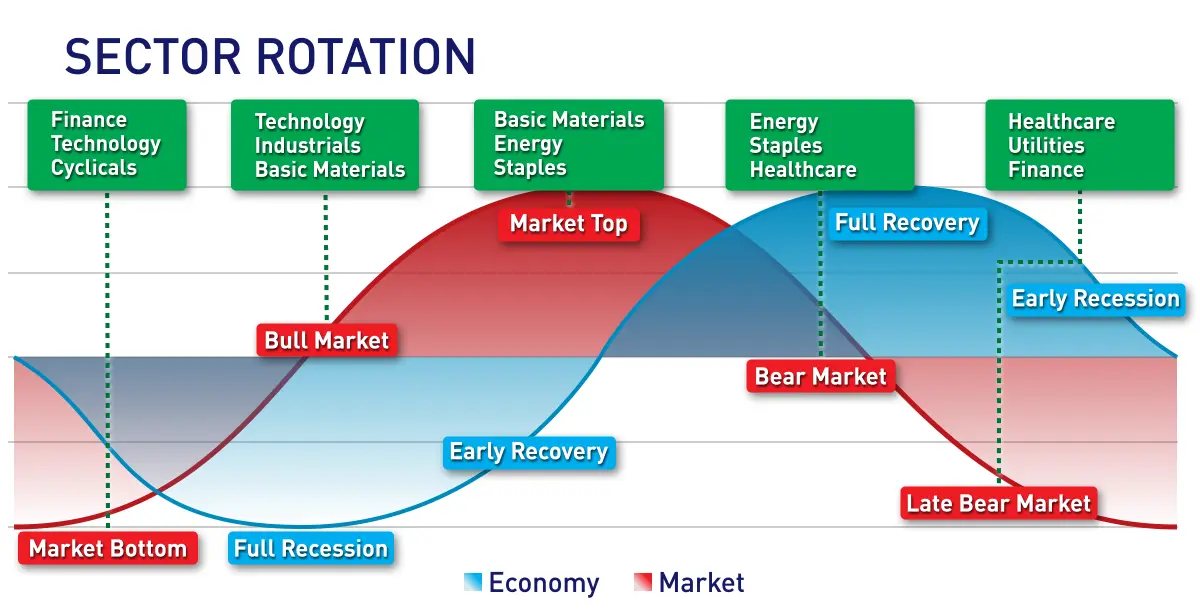

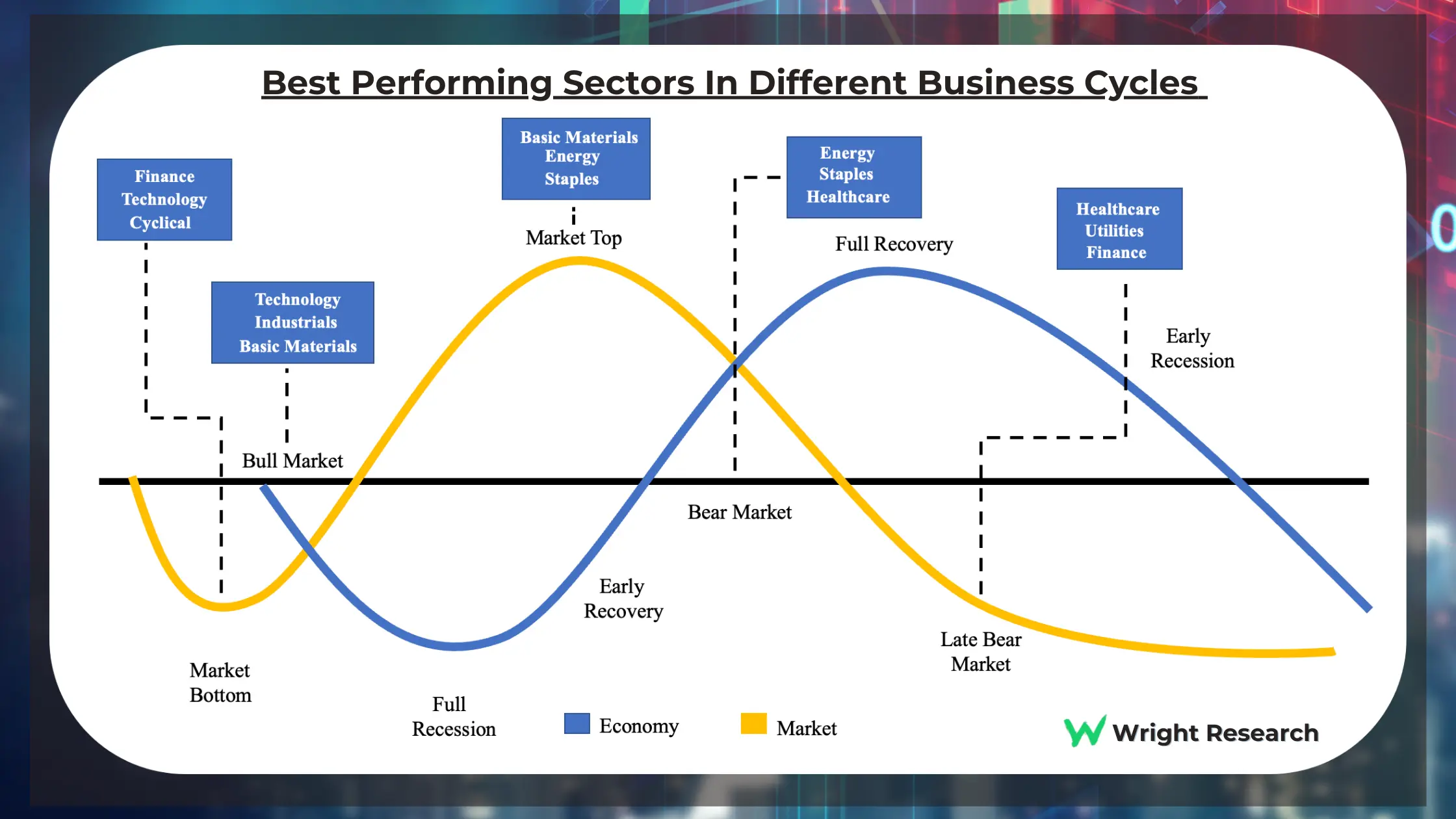

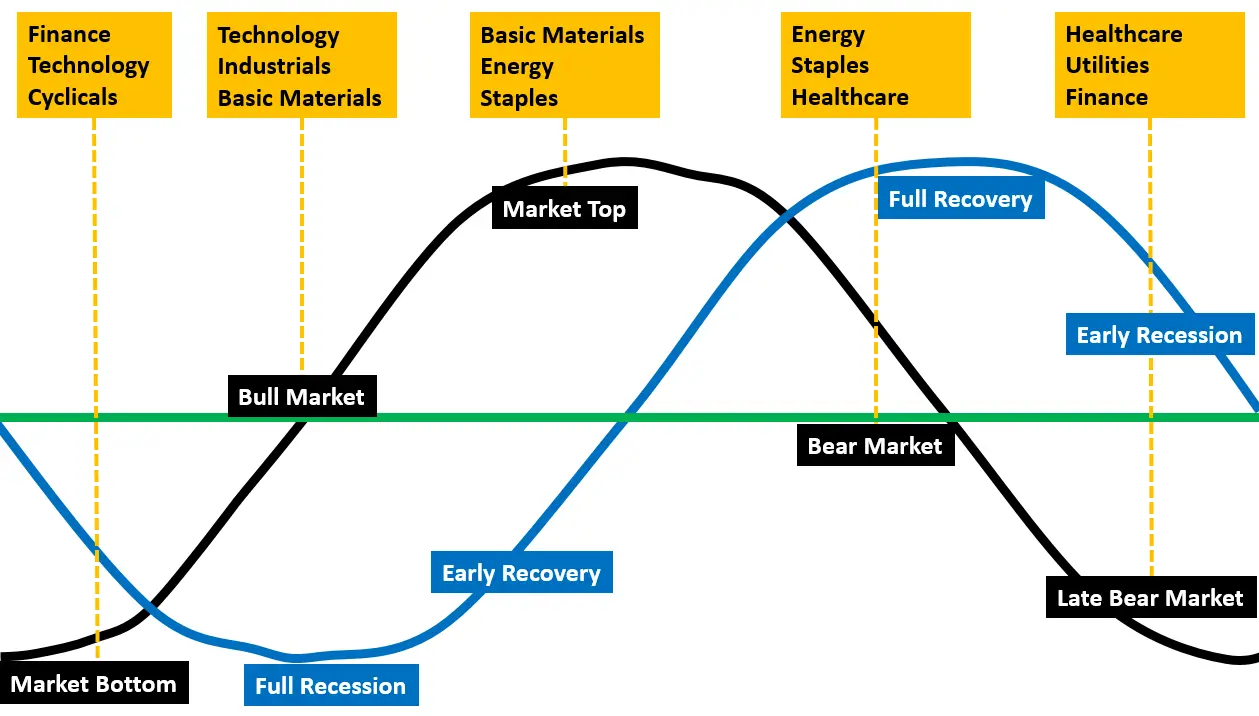

#CapitalRotation

Capital Rotation in Financial Markets: A Complete Deep-Dive Guide

Capital rotation is one of the most powerful yet often misunderstood forces driving financial markets. Whether you are trading stocks, cryptocurrencies, commodities, or global indices, understanding how and why capital rotates can give you a serious edge. Markets do not move randomly—money flows with purpose, responding to changing conditions, expectations, and risk appetite.

This extended guide explores capital rotation in depth, covering its mechanics, drivers, real-world examples, indicators, strategies, and

Capital Rotation in Financial Markets: A Complete Deep-Dive Guide

Capital rotation is one of the most powerful yet often misunderstood forces driving financial markets. Whether you are trading stocks, cryptocurrencies, commodities, or global indices, understanding how and why capital rotates can give you a serious edge. Markets do not move randomly—money flows with purpose, responding to changing conditions, expectations, and risk appetite.

This extended guide explores capital rotation in depth, covering its mechanics, drivers, real-world examples, indicators, strategies, and

- Reward

- 19

- 22

- Repost

- Share

DragonFlyOfficial :

:

great postView More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3994?ref=VLFCVA8MAQ&ref_type=132

- Reward

- 20

- 22

- 1

- Share

CryptoEye :

:

HODL Tight 💪View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/site-124?ref=VLFCVA8MAQ&ref_type=132

- Reward

- 22

- 20

- Repost

- Share

CryptoEye :

:

DYOR 🤓View More

#BTCKeyLevelBreak

🔍 BTC Key Level Break – Market Insight & Live Context

In Bitcoin (BTC) trading, a key level is a price zone that attracts strong attention from traders—typically identified as support or resistance. Support is where buying pressure historically stops declines, while resistance is where selling pressure limits upward moves. These levels form due to repeated price reactions, psychological round numbers, and technical indicators like moving averages.

Key levels matter because they act as battlegrounds between buyers and sellers. When BTC approaches support, buyers often step i

🔍 BTC Key Level Break – Market Insight & Live Context

In Bitcoin (BTC) trading, a key level is a price zone that attracts strong attention from traders—typically identified as support or resistance. Support is where buying pressure historically stops declines, while resistance is where selling pressure limits upward moves. These levels form due to repeated price reactions, psychological round numbers, and technical indicators like moving averages.

Key levels matter because they act as battlegrounds between buyers and sellers. When BTC approaches support, buyers often step i

BTC-2,98%

- Reward

- 24

- 23

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊View More

Trending Topics

View More9.65K Popularity

6.59K Popularity

5.64K Popularity

2.37K Popularity

3.74K Popularity

Pin