# CryptoMarketWatch

221.07K

Recent market volatility has intensified, with growing divergence between bulls and bears. Are you leaning bullish or cautious on what comes next? What signals are you watching and how are you positioning? Share your views.

MingDragonX

#CryptoMarketWatch #CryptoMarketWatch February 2026 Market Snapshot

The crypto market is currently facing significant downward pressure and heightened volatility as we enter early February 2026. Overall sentiment is firmly bearish, with the Crypto Fear & Greed Index hovering in the “Extreme Fear” zone (14–26), reflecting widespread caution, liquidations, and diminished risk appetite among traders and institutions. Market participants are reacting to a combination of macro headwinds, leveraged position unwinds, ETF outflows, and geopolitical uncertainties, creating one of the most challenging t

The crypto market is currently facing significant downward pressure and heightened volatility as we enter early February 2026. Overall sentiment is firmly bearish, with the Crypto Fear & Greed Index hovering in the “Extreme Fear” zone (14–26), reflecting widespread caution, liquidations, and diminished risk appetite among traders and institutions. Market participants are reacting to a combination of macro headwinds, leveraged position unwinds, ETF outflows, and geopolitical uncertainties, creating one of the most challenging t

- Reward

- 2

- 3

- Repost

- Share

Yunna :

:

buy to earnView More

#CryptoMarketWatch

The most important reality of the current cycle is that cryptocurrency has matured from an isolated speculative experiment into a fully connected global macro asset. In earlier years Bitcoin moved mainly on internal narratives such as halvings, exchange hacks, or retail mania. Today its behavior is deeply tied to interest rates, dollar liquidity, equity markets, and geopolitical uncertainty. When the cost of money rises, investors naturally demand safer returns, and speculative assets like crypto suffer. When central banks inject liquidity or signal easing, the same capital

The most important reality of the current cycle is that cryptocurrency has matured from an isolated speculative experiment into a fully connected global macro asset. In earlier years Bitcoin moved mainly on internal narratives such as halvings, exchange hacks, or retail mania. Today its behavior is deeply tied to interest rates, dollar liquidity, equity markets, and geopolitical uncertainty. When the cost of money rises, investors naturally demand safer returns, and speculative assets like crypto suffer. When central banks inject liquidity or signal easing, the same capital

- Reward

- 5

- 5

- Repost

- Share

MrThanks77 :

:

DYOR 🤓View More

#CryptoMarketWatch 📢 Gate Square Daily | Feb 3

Today’s market narrative is shifting from panic to positioning. Let’s break it down:

1️⃣ Institutions Accumulating

Strategy now holds 713,502 BTC at an average price of $76,052.

Big players are not exiting — they’re building long-term exposure.

2️⃣ Ethereum Capital Flow

Bitmine added 41,788 ETH, pushing total ETH holdings to nearly $9.9B.

Quiet accumulation continues while retail hesitates.

3️⃣ Mining Innovation

Tether launched MOS, an open-source Bitcoin mining OS.

Infrastructure development during volatility = long-term confidence signal.

4️⃣ 2

Today’s market narrative is shifting from panic to positioning. Let’s break it down:

1️⃣ Institutions Accumulating

Strategy now holds 713,502 BTC at an average price of $76,052.

Big players are not exiting — they’re building long-term exposure.

2️⃣ Ethereum Capital Flow

Bitmine added 41,788 ETH, pushing total ETH holdings to nearly $9.9B.

Quiet accumulation continues while retail hesitates.

3️⃣ Mining Innovation

Tether launched MOS, an open-source Bitcoin mining OS.

Infrastructure development during volatility = long-term confidence signal.

4️⃣ 2

- Reward

- 1

- 3

- Repost

- Share

MrKing :

:

Buy To Earn 💎View More

#CryptoMarketWatch

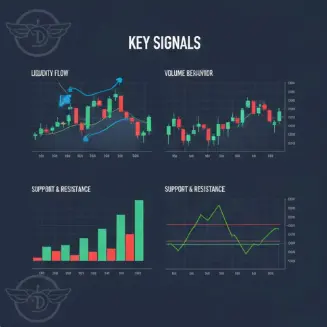

The crypto market is entering a high-sensitivity phase, with price action increasingly driven by macro signals, liquidity flows, and sentiment shifts. Bitcoin remains the primary anchor, while altcoins show selective strength and weakness across sectors.

📊 Market Overview

Bitcoin (BTC): Holding key levels but showing signs of consolidation as traders wait for macro confirmation.

Ethereum (ETH): Stable relative to BTC, supported by network fundamentals and institutional interest.

Altcoins: Mixed performance — rotation is visible rather than broad-based rallies.

Volume: Mode

The crypto market is entering a high-sensitivity phase, with price action increasingly driven by macro signals, liquidity flows, and sentiment shifts. Bitcoin remains the primary anchor, while altcoins show selective strength and weakness across sectors.

📊 Market Overview

Bitcoin (BTC): Holding key levels but showing signs of consolidation as traders wait for macro confirmation.

Ethereum (ETH): Stable relative to BTC, supported by network fundamentals and institutional interest.

Altcoins: Mixed performance — rotation is visible rather than broad-based rallies.

Volume: Mode

- Reward

- 5

- 11

- Repost

- Share

QueenOfTheDay :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch 📉 Crypto Market Snapshot – Early February 2026

Bitcoin (BTC) is struggling below key support levels, trading near $75K–$78K after a major sell-off triggered wide liquidations across the market. The crash wiped out more than $2.5B in BTC positions and has dragged prices to multi-month lows.

Ethereum (ETH) also feels the heat, with prices dipping below $2,200–$2,100 amid market risk-off sentiment.

XRP faces heightened volatility; prediction markets expect it to remain under $2 in the near term.

Crypto stocks and related equities (e.g., Robinhood, Coinbase, MSTR) are underp

Bitcoin (BTC) is struggling below key support levels, trading near $75K–$78K after a major sell-off triggered wide liquidations across the market. The crash wiped out more than $2.5B in BTC positions and has dragged prices to multi-month lows.

Ethereum (ETH) also feels the heat, with prices dipping below $2,200–$2,100 amid market risk-off sentiment.

XRP faces heightened volatility; prediction markets expect it to remain under $2 in the near term.

Crypto stocks and related equities (e.g., Robinhood, Coinbase, MSTR) are underp

- Reward

- 3

- 2

- Repost

- Share

Yunna :

:

2026 gogogoView More

#CryptoMarketWatch

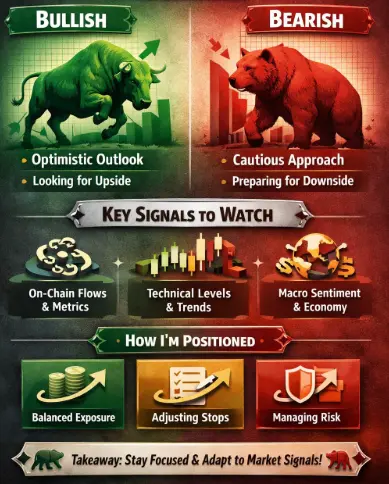

⚡ Crypto Market Volatility — Bulls vs Bears

Recent market swings have intensified, creating clear divergence between bullish and bearish sentiment.

Key Questions:

• Are you leaning bullish or cautious on what comes next?

• Which signals are you watching — on-chain flows, technical levels, or macro trends?

• How are you positioning your portfolio amid volatility?

Considerations:

• Price Action: Watch support/resistance zones for breakout or breakdown confirmation

• Capital Flow: Observe where funds are rotating — BTC, ETH, altcoins, or stablecoins

• On-Chain Metrics: Active

⚡ Crypto Market Volatility — Bulls vs Bears

Recent market swings have intensified, creating clear divergence between bullish and bearish sentiment.

Key Questions:

• Are you leaning bullish or cautious on what comes next?

• Which signals are you watching — on-chain flows, technical levels, or macro trends?

• How are you positioning your portfolio amid volatility?

Considerations:

• Price Action: Watch support/resistance zones for breakout or breakdown confirmation

• Capital Flow: Observe where funds are rotating — BTC, ETH, altcoins, or stablecoins

• On-Chain Metrics: Active

- Reward

- 1

- 1

- Repost

- Share

QueenOfTheDay :

:

2026 GOGOGO 👊#BTC has lost the 100-Week EMA

The 100-Week EMA provides ultimate support during the Dead Cat Bounce

Once that MA is lost, we head straight to the 200-Week MA 📉 🎯

(and I believe we’ll break below it eventually)

#CryptoMarketWatch

The 100-Week EMA provides ultimate support during the Dead Cat Bounce

Once that MA is lost, we head straight to the 200-Week MA 📉 🎯

(and I believe we’ll break below it eventually)

#CryptoMarketWatch

BTC2,91%

- Reward

- 2

- Comment

- Repost

- Share

#CryptoMarketWatch February 2026 Update

The crypto market continues to display a mix of volatility and selective strength, emphasizing the importance of careful observation and strategic positioning. Bitcoin, Ethereum, and major altcoins are consolidating after recent rallies, while certain sectors and tokens show divergence, signaling where capital is rotating. Understanding these dynamics is critical for traders and investors looking to capture opportunities without overexposing themselves to risk.

Bitcoin remains the benchmark for the market. Its recent price action shows consolidation near

The crypto market continues to display a mix of volatility and selective strength, emphasizing the importance of careful observation and strategic positioning. Bitcoin, Ethereum, and major altcoins are consolidating after recent rallies, while certain sectors and tokens show divergence, signaling where capital is rotating. Understanding these dynamics is critical for traders and investors looking to capture opportunities without overexposing themselves to risk.

Bitcoin remains the benchmark for the market. Its recent price action shows consolidation near

- Reward

- 7

- 7

- Repost

- Share

Yunna :

:

2026 gogoView More

#CryptoMarketWatch

Crypto Market 2026: Managing Volatility Amid Divergent Sentiment

The crypto market is navigating heightened volatility in early 2026, with bullish optimism and bearish caution pulling in opposite directions. Bitcoin (BTC), Ethereum (ETH), and prominent altcoins are showing amplified swings, driven by macroeconomic uncertainty, institutional flows, and speculative retail behavior. Understanding these dynamics is essential for traders and investors aiming to manage risk and capitalize on opportunities.

Key Market Drivers

Macro Environment: Political developments, U.S. fiscal d

Crypto Market 2026: Managing Volatility Amid Divergent Sentiment

The crypto market is navigating heightened volatility in early 2026, with bullish optimism and bearish caution pulling in opposite directions. Bitcoin (BTC), Ethereum (ETH), and prominent altcoins are showing amplified swings, driven by macroeconomic uncertainty, institutional flows, and speculative retail behavior. Understanding these dynamics is essential for traders and investors aiming to manage risk and capitalize on opportunities.

Key Market Drivers

Macro Environment: Political developments, U.S. fiscal d

- Reward

- 10

- 10

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

#CryptoMarketWatch Market Under Stress: Leverage Flush, Smart Money Control & the Rise of Tokenized Assets

The cryptocurrency market has entered a high-stress, high-volatility phase, driven by aggressive deleveraging, shifting institutional behavior, and evolving capital narratives. Recent price action reflects more than emotional selling—it marks a technically significant breakdown in Bitcoin’s market structure.

🔻 Bitcoin Price Action & Technical Overview

Current Status: Technically fragile after losing multiple critical support levels

Trend Structure:

Short-term: Bearish

Medium-term: Weaken

The cryptocurrency market has entered a high-stress, high-volatility phase, driven by aggressive deleveraging, shifting institutional behavior, and evolving capital narratives. Recent price action reflects more than emotional selling—it marks a technically significant breakdown in Bitcoin’s market structure.

🔻 Bitcoin Price Action & Technical Overview

Current Status: Technically fragile after losing multiple critical support levels

Trend Structure:

Short-term: Bearish

Medium-term: Weaken

- Reward

- 3

- 2

- Repost

- Share

EagleEye :

:

Really inspiring postView More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

2.29K Popularity

1.71K Popularity

5.35K Popularity

167 Popularity

364 Popularity

320 Popularity

14.71K Popularity

13.33K Popularity

9.42K Popularity

10.31K Popularity

8.4K Popularity

2.54K Popularity

85 Popularity

28.73K Popularity

221.07K Popularity

News

View MoreData: The US XRP spot ETF experienced a total net outflow of $400,000 on a single day.

25 m

ETH Breaks Through 2350 USDT

26 m

MetaMask will launch the first season LINEA token reward query feature this week.

34 m

Data: If ETH drops below $2,226, the total long liquidation strength on mainstream CEXs will reach $848 million.

37 m

Tron Inc. increases holdings by 175,900 TRX, with total holdings exceeding 679.6 million TRX

38 m

Pin