📊 #USJoblessClaimsMissExpectations — A Warning Sign for the Market?

The latest U.S. labor data has surprised markets after jobless claims and employment indicators failed to meet expectations, raising concerns about the strength of the economy. When labor market data weakens unexpectedly, it often becomes an early signal that economic momentum may be slowing.

Recent reports indicate that the U.S. economy unexpectedly lost around 92,000 jobs in February, while the unemployment rate climbed near 4.4%, a result that came in significantly worse than forecasts. Such data usually shakes investor confidence because the labor market has been one of the strongest pillars supporting economic growth.

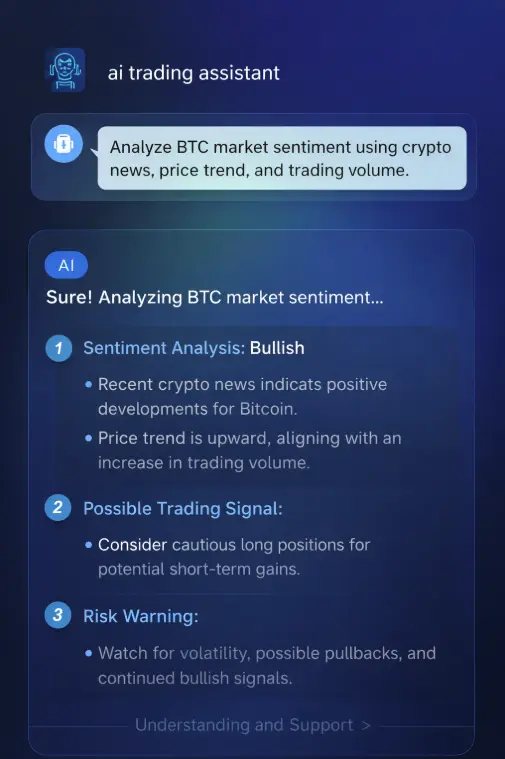

According to Dragon Fly Official, labor statistics like jobless claims are among the fastest indicators traders watch to understand where the economy may be heading next. When claims start missing expectations, it can signal that companies are becoming more cautious about hiring and expansion.

Markets typically react quickly to this type of data. Weak labor numbers can increase speculation about Federal Reserve policy changes, impact the U.S. dollar, and influence global assets ranging from stocks to commodities.

From Dragon Fly Official’s perspective, the key question now is whether this data represents a temporary slowdown or the beginning of a broader shift in the labor market. If upcoming reports show similar weakness, investors may start pricing in slower economic growth.

Another important point highlighted by Dragon Fly Official is that employment data directly affects consumer spending confidence. If unemployment continues rising, household spending could slow down, which would eventually impact corporate earnings and overall market sentiment.

For traders and investors, this situation creates both risk and opportunity. Labor market surprises often trigger short-term volatility, and those who closely follow macroeconomic indicators may find strategic entry points as markets adjust to the new data.

#USJoblessClaimsMissExpectations

The latest U.S. labor data has surprised markets after jobless claims and employment indicators failed to meet expectations, raising concerns about the strength of the economy. When labor market data weakens unexpectedly, it often becomes an early signal that economic momentum may be slowing.

Recent reports indicate that the U.S. economy unexpectedly lost around 92,000 jobs in February, while the unemployment rate climbed near 4.4%, a result that came in significantly worse than forecasts. Such data usually shakes investor confidence because the labor market has been one of the strongest pillars supporting economic growth.

According to Dragon Fly Official, labor statistics like jobless claims are among the fastest indicators traders watch to understand where the economy may be heading next. When claims start missing expectations, it can signal that companies are becoming more cautious about hiring and expansion.

Markets typically react quickly to this type of data. Weak labor numbers can increase speculation about Federal Reserve policy changes, impact the U.S. dollar, and influence global assets ranging from stocks to commodities.

From Dragon Fly Official’s perspective, the key question now is whether this data represents a temporary slowdown or the beginning of a broader shift in the labor market. If upcoming reports show similar weakness, investors may start pricing in slower economic growth.

Another important point highlighted by Dragon Fly Official is that employment data directly affects consumer spending confidence. If unemployment continues rising, household spending could slow down, which would eventually impact corporate earnings and overall market sentiment.

For traders and investors, this situation creates both risk and opportunity. Labor market surprises often trigger short-term volatility, and those who closely follow macroeconomic indicators may find strategic entry points as markets adjust to the new data.

#USJoblessClaimsMissExpectations