MingDragonX

No content yet

MingDragonX

Big news! On February 12th, our boss @Han_Gate will be making a special appearance at Consensus HK!

@Han_Gate will not only share Gate’s global perspective and infrastructure insights on stage but also engage in in-depth discussions with industry leaders from around the world on topics like the future of AI and the leadership role of the Asia-Pacific region in global innovation~

Gate will also host various networking sessions and collaboration events on-site, waiting for you to connect!🌍

Want to catch the boss in person? Want to hear real insights?🤔

See you at the Hong Kong Convention and Ex

@Han_Gate will not only share Gate’s global perspective and infrastructure insights on stage but also engage in in-depth discussions with industry leaders from around the world on topics like the future of AI and the leadership role of the Asia-Pacific region in global innovation~

Gate will also host various networking sessions and collaboration events on-site, waiting for you to connect!🌍

Want to catch the boss in person? Want to hear real insights?🤔

See you at the Hong Kong Convention and Ex

- Reward

- 1

- Comment

- Repost

- Share

#GoldAndSilverRebound GoldAndSilverRebound Gold and silver aren’t just metals — they’re macro hedges and long-term safe havens.

After recent pullbacks:

🔹 Gold: Holding key support, positioning for renewed institutional inflows

🔹 Silver: Highly sensitive to industrial demand and global liquidity cycles

Why This Rebound Matters

1️⃣ Macro Context

• Geopolitical tensions and inflation uncertainty continue to support demand

• Central bank policy shifts are creating windows for strategic accumulation

2️⃣ Market Implications

• Investors rotate from high-risk assets into defensive hedges

• ETFs and

After recent pullbacks:

🔹 Gold: Holding key support, positioning for renewed institutional inflows

🔹 Silver: Highly sensitive to industrial demand and global liquidity cycles

Why This Rebound Matters

1️⃣ Macro Context

• Geopolitical tensions and inflation uncertainty continue to support demand

• Central bank policy shifts are creating windows for strategic accumulation

2️⃣ Market Implications

• Investors rotate from high-risk assets into defensive hedges

• ETFs and

- Reward

- 1

- Comment

- Repost

- Share

#GoldAndSilverRebound #GoldAndSilverRebound Gold and silver aren’t just metals — they’re macro hedges and long-term safe havens.

After recent pullbacks:

🔹 Gold: Holding key support, positioning for renewed institutional inflows

🔹 Silver: Highly sensitive to industrial demand and global liquidity cycles

Why This Rebound Matters

1️⃣ Macro Context

• Geopolitical tensions and inflation uncertainty continue to support demand

• Central bank policy shifts are creating windows for strategic accumulation

2️⃣ Market Implications

• Investors rotate from high-risk assets into defensive hedges

• ETFs and

After recent pullbacks:

🔹 Gold: Holding key support, positioning for renewed institutional inflows

🔹 Silver: Highly sensitive to industrial demand and global liquidity cycles

Why This Rebound Matters

1️⃣ Macro Context

• Geopolitical tensions and inflation uncertainty continue to support demand

• Central bank policy shifts are creating windows for strategic accumulation

2️⃣ Market Implications

• Investors rotate from high-risk assets into defensive hedges

• ETFs and

- Reward

- 1

- Comment

- Repost

- Share

#VitalikSellsETH VitalikSellsETH Market Implications and Analysis

Recent transactions by Vitalik Buterin, one of Ethereum’s most high-profile holders, have drawn significant attention across crypto markets. When someone with substantial ETH holdings moves or sells tokens, it inevitably influences sentiment, liquidity dynamics, and trader behavior. However, understanding the context and drivers behind such activity is essential before drawing conclusions.

📌 Hashtag Context

The #VitalikSellsETH tag has become a focal point for discussions around whale movements, liquidity shifts, and market psy

Recent transactions by Vitalik Buterin, one of Ethereum’s most high-profile holders, have drawn significant attention across crypto markets. When someone with substantial ETH holdings moves or sells tokens, it inevitably influences sentiment, liquidity dynamics, and trader behavior. However, understanding the context and drivers behind such activity is essential before drawing conclusions.

📌 Hashtag Context

The #VitalikSellsETH tag has become a focal point for discussions around whale movements, liquidity shifts, and market psy

- Reward

- 1

- Comment

- Repost

- Share

#XAIHiringCryptoSpecialists XAIHiringCryptoSpecialists How xAI’s Recruitment Signals a New Era for Crypto & AI

Elon Musk’s artificial intelligence company xAI has officially begun recruiting crypto-focused specialists to help train its advanced AI systems, including its flagship model Grok. This development is gaining major attention across both crypto and tech communities, highlighting a deeper convergence between artificial intelligence and digital finance.

Unlike traditional market-related hiring, this initiative is not centered on trading or speculation. Instead, it focuses on teaching AI

Elon Musk’s artificial intelligence company xAI has officially begun recruiting crypto-focused specialists to help train its advanced AI systems, including its flagship model Grok. This development is gaining major attention across both crypto and tech communities, highlighting a deeper convergence between artificial intelligence and digital finance.

Unlike traditional market-related hiring, this initiative is not centered on trading or speculation. Instead, it focuses on teaching AI

- Reward

- 1

- Comment

- Repost

- Share

#BitMineAcquires20,000ETH BitMineAcquires20,000ETH BitMine’s 20,000 ETH Acquisition: Institutional Strategy, Staking Economics, and Ethereum’s Emergence as a Global Reserve Asset

Ethereum’s institutional era is no longer theoretical — it is now observable.

BitMine’s acquisition of 20,000 ETH represents a defining moment in Ethereum’s evolution as a financial asset. This transaction was not driven by short-term price movements or speculative sentiment. It reflects a deeper structural shift in how sophisticated capital views Ethereum: not as a volatile cryptocurrency, but as productive digital i

Ethereum’s institutional era is no longer theoretical — it is now observable.

BitMine’s acquisition of 20,000 ETH represents a defining moment in Ethereum’s evolution as a financial asset. This transaction was not driven by short-term price movements or speculative sentiment. It reflects a deeper structural shift in how sophisticated capital views Ethereum: not as a volatile cryptocurrency, but as productive digital i

ETH-5,91%

- Reward

- 1

- Comment

- Repost

- Share

#ChilizLaunchesFanTokens ChilizLaunchesFanTokens Chiliz Expands Tokenized Fan Engagement in Sports and Entertainment

Chiliz, a leading blockchain platform for sports and entertainment engagement, has officially launched a new series of fan tokens, marking a major step in the evolution of tokenized fan experiences. This initiative strengthens the integration of blockchain technology into mainstream sports ecosystems by transforming fan participation into a digital, interactive, and monetizable asset class.

Fan tokens enable supporters to engage directly with their favorite teams through governa

Chiliz, a leading blockchain platform for sports and entertainment engagement, has officially launched a new series of fan tokens, marking a major step in the evolution of tokenized fan experiences. This initiative strengthens the integration of blockchain technology into mainstream sports ecosystems by transforming fan participation into a digital, interactive, and monetizable asset class.

Fan tokens enable supporters to engage directly with their favorite teams through governa

CHZ-5,76%

- Reward

- like

- Comment

- Repost

- Share

#OvernightV-ShapedMoveinCrypto OvernightV-ShapedMoveinCrypto Understanding the Latest V-Shaped Recovery in Crypto

1️⃣ Market Overview

The crypto futures market has once again demonstrated its highly reactive nature through a sharp V-shaped recovery. After an aggressive overnight sell-off, prices rebounded just as quickly, catching both retail and leveraged traders off guard. These moves are not accidental—they reflect deep interactions between liquidity, derivatives positioning, funding rates, and macro sentiment. In today’s environment, futures markets often move faster than spot, making them

1️⃣ Market Overview

The crypto futures market has once again demonstrated its highly reactive nature through a sharp V-shaped recovery. After an aggressive overnight sell-off, prices rebounded just as quickly, catching both retail and leveraged traders off guard. These moves are not accidental—they reflect deep interactions between liquidity, derivatives positioning, funding rates, and macro sentiment. In today’s environment, futures markets often move faster than spot, making them

- Reward

- like

- Comment

- Repost

- Share

#GoldAndSilverRebound Risk Sentiment

1️⃣ Market Overview — Buyers Regain Control

Gold and silver have started to rebound after recent corrective pullbacks, with strong buying activity emerging near long-term support zones. This recovery reflects renewed confidence among institutional and macro-focused investors who view precious metals as strategic hedges in uncertain environments. The rebound is not just technical—it is rooted in shifting global expectations around inflation, monetary policy, and geopolitical stability.

2️⃣ Interest Rate Expectations Drive Momentum

One of the main catalysts b

1️⃣ Market Overview — Buyers Regain Control

Gold and silver have started to rebound after recent corrective pullbacks, with strong buying activity emerging near long-term support zones. This recovery reflects renewed confidence among institutional and macro-focused investors who view precious metals as strategic hedges in uncertain environments. The rebound is not just technical—it is rooted in shifting global expectations around inflation, monetary policy, and geopolitical stability.

2️⃣ Interest Rate Expectations Drive Momentum

One of the main catalysts b

- Reward

- like

- Comment

- Repost

- Share

#VitalikSellsETH VitalikSellsETH Headlines, Psychology, and the Reality Behind the Move

1️⃣ Market Reaction — Influence Still Matters

Once again, headlines around “Vitalik Sells ETH” triggered an immediate emotional response across crypto markets. Even relatively small on-chain movements linked to Ethereum’s co-founder were enough to spark volatility. This highlights how influential key figures remain in shaping short-term sentiment. In fast-moving markets, perception often travels faster than facts, and traders react before understanding full context.

2️⃣ The Psychology of Panic Selling

The f

1️⃣ Market Reaction — Influence Still Matters

Once again, headlines around “Vitalik Sells ETH” triggered an immediate emotional response across crypto markets. Even relatively small on-chain movements linked to Ethereum’s co-founder were enough to spark volatility. This highlights how influential key figures remain in shaping short-term sentiment. In fast-moving markets, perception often travels faster than facts, and traders react before understanding full context.

2️⃣ The Psychology of Panic Selling

The f

- Reward

- like

- Comment

- Repost

- Share

#XAIHiringCryptoSpecialists XAIHiringCryptoSpecialists | AI, Blockchain, and the Next Phase of Digital Innovation

1️⃣ A Strategic Signal from XAI

XAI’s decision to hire crypto specialists marks a major milestone in the convergence of artificial intelligence and blockchain technology. This move reflects a broader industry realization that crypto expertise is no longer optional—it is a strategic necessity. As decentralized finance, tokenization, and on-chain data analytics expand, companies operating at the frontier of AI must integrate blockchain knowledge to remain competitive.

2️⃣ Validation

1️⃣ A Strategic Signal from XAI

XAI’s decision to hire crypto specialists marks a major milestone in the convergence of artificial intelligence and blockchain technology. This move reflects a broader industry realization that crypto expertise is no longer optional—it is a strategic necessity. As decentralized finance, tokenization, and on-chain data analytics expand, companies operating at the frontier of AI must integrate blockchain knowledge to remain competitive.

2️⃣ Validation

XAI-4,48%

- Reward

- like

- Comment

- Repost

- Share

#BitMineAcquires20,000ETH BitMineAcquires20,000ETH Institutional Strategy and Ethereum’s Long-Term Outlook

Institutional Confidence Strengthens Ethereum’s Narrative

BitMine’s acquisition of 20,000 ETH represents far more than a large on-chain transaction. It reflects growing institutional confidence in Ethereum’s long-term value proposition. Such allocations are typically backed by extensive research, risk modeling, and macro analysis, signaling belief in ETH as core digital infrastructure for future financial systems.

Strategic Accumulation During Market Consolidation

This purchase occurred d

Institutional Confidence Strengthens Ethereum’s Narrative

BitMine’s acquisition of 20,000 ETH represents far more than a large on-chain transaction. It reflects growing institutional confidence in Ethereum’s long-term value proposition. Such allocations are typically backed by extensive research, risk modeling, and macro analysis, signaling belief in ETH as core digital infrastructure for future financial systems.

Strategic Accumulation During Market Consolidation

This purchase occurred d

ETH-5,91%

- Reward

- 1

- 1

- Repost

- Share

Yunna :

:

Buy To Earn 💎#ChilizLaunchesFanTokens ChilizLaunchesFanTokens U.S. Expansion, Buyback & Burn, and CHZ’s Long-Term Outlook

Chiliz has announced a major development that could significantly reshape its ecosystem in the coming months. The project plans to launch U.S.-focused fan tokens, with 10% of all generated revenue used to buy back and permanently burn CHZ. This directly links platform growth with supply reduction, representing a meaningful upgrade to Chiliz’s tokenomics and long-term value structure.

This move marks Chiliz’s formal entry into the U.S. market—one of the largest and most commercially powe

Chiliz has announced a major development that could significantly reshape its ecosystem in the coming months. The project plans to launch U.S.-focused fan tokens, with 10% of all generated revenue used to buy back and permanently burn CHZ. This directly links platform growth with supply reduction, representing a meaningful upgrade to Chiliz’s tokenomics and long-term value structure.

This move marks Chiliz’s formal entry into the U.S. market—one of the largest and most commercially powe

CHZ-5,76%

- Reward

- 1

- Comment

- Repost

- Share

#WhiteHouseCryptoSummit WhiteHouseCryptoSummit Crypto at the Center of Policy and Market Strategy

The White House Crypto Summit has once again placed digital assets at the forefront of policy discussions, marking a pivotal moment for the crypto ecosystem. By bringing together regulators, industry leaders, and institutional participants, the summit emphasizes the growing importance of collaboration between government frameworks and decentralized innovation. The outcomes could shape regulatory clarity, market adoption, and institutional confidence—impacting both short-term price action and long-

The White House Crypto Summit has once again placed digital assets at the forefront of policy discussions, marking a pivotal moment for the crypto ecosystem. By bringing together regulators, industry leaders, and institutional participants, the summit emphasizes the growing importance of collaboration between government frameworks and decentralized innovation. The outcomes could shape regulatory clarity, market adoption, and institutional confidence—impacting both short-term price action and long-

- Reward

- 1

- Comment

- Repost

- Share

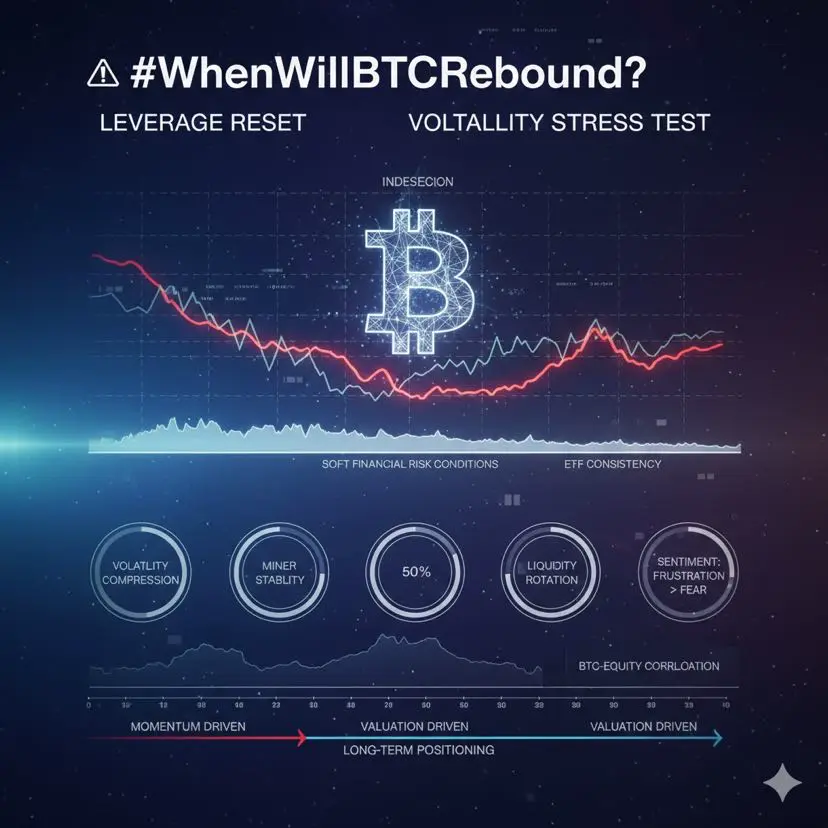

#WhenWillBTCRebound? #WhenWillBTCRebound?

Bitcoin’s next meaningful rebound won’t come from a single candle or a viral headline—it will emerge from a slow shift in structure, liquidity, and behavior. Right now, BTC is transitioning from a momentum-driven phase into a valuation-driven phase, where price discovery is happening under pressure rather than optimism. This is typically where weak hands exit, narratives quiet down, and long-term positioning quietly begins.

One important development is volatility compression. Implied volatility across options markets has been steadily declining, which

Bitcoin’s next meaningful rebound won’t come from a single candle or a viral headline—it will emerge from a slow shift in structure, liquidity, and behavior. Right now, BTC is transitioning from a momentum-driven phase into a valuation-driven phase, where price discovery is happening under pressure rather than optimism. This is typically where weak hands exit, narratives quiet down, and long-term positioning quietly begins.

One important development is volatility compression. Implied volatility across options markets has been steadily declining, which

- Reward

- 2

- 1

- Repost

- Share

CryptoAnalysisS :

:

2026 GOGOGO 👊#StrategyBitcoinPositionTurnsRed StrategyBitcoinPositionTurnsRed

Bitcoin’s early-February pullback quietly marked a rare moment this cycle: Strategy Inc.’s massive Bitcoin position briefly turning red. This isn’t about one company’s PnL—it’s about what happens when price collides with a widely known institutional cost basis. When such levels are tested, psychology, liquidity, and positioning tend to converge into a narrow and reactive zone.

The dip below the mid-$76K area exposed how fragile short-term confidence remains. Once that level failed, selling pressure accelerated—not because long-te

Bitcoin’s early-February pullback quietly marked a rare moment this cycle: Strategy Inc.’s massive Bitcoin position briefly turning red. This isn’t about one company’s PnL—it’s about what happens when price collides with a widely known institutional cost basis. When such levels are tested, psychology, liquidity, and positioning tend to converge into a narrow and reactive zone.

The dip below the mid-$76K area exposed how fragile short-term confidence remains. Once that level failed, selling pressure accelerated—not because long-te

BTC-6,34%

- Reward

- 1

- Comment

- Repost

- Share

#USGovernmentShutdownRisk CryptoMarketWatch February 2026 Update Strategic Insights for Traders and Investors

The crypto market in February 2026 is defined by a mix of volatility and selective strength, emphasizing the need for careful observation and disciplined positioning. Bitcoin, Ethereum, and major altcoins are consolidating after recent rallies, while certain sectors and tokens diverge, revealing where capital is rotating and highlighting potential opportunities.

Bitcoin continues to serve as the market benchmark. Its price action shows consolidation near key support levels, reflecting

The crypto market in February 2026 is defined by a mix of volatility and selective strength, emphasizing the need for careful observation and disciplined positioning. Bitcoin, Ethereum, and major altcoins are consolidating after recent rallies, while certain sectors and tokens diverge, revealing where capital is rotating and highlighting potential opportunities.

Bitcoin continues to serve as the market benchmark. Its price action shows consolidation near key support levels, reflecting

- Reward

- 5

- 3

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch CryptoMarketWatch February 2026 Update Strategic Insights for Traders and Investors

The crypto market in February 2026 is defined by a mix of volatility and selective strength, emphasizing the need for careful observation and disciplined positioning. Bitcoin, Ethereum, and major altcoins are consolidating after recent rallies, while certain sectors and tokens diverge, revealing where capital is rotating and highlighting potential opportunities.

Bitcoin continues to serve as the market benchmark. Its price action shows consolidation near key support levels, reflecting cautiou

The crypto market in February 2026 is defined by a mix of volatility and selective strength, emphasizing the need for careful observation and disciplined positioning. Bitcoin, Ethereum, and major altcoins are consolidating after recent rallies, while certain sectors and tokens diverge, revealing where capital is rotating and highlighting potential opportunities.

Bitcoin continues to serve as the market benchmark. Its price action shows consolidation near key support levels, reflecting cautiou

- Reward

- 3

- 2

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#WhenWillBTCRebound? WhenWillBTCRebound? Bitcoin Faces Critical Oversold Conditions

Bitcoin is attempting to stabilize after recent sharp declines, with BTC/USDT trading at $78,543 and posting a modest 1.89% gain. The market remains fragile, characterized by low liquidity, wide bid-ask spreads, and extreme fear (F&G Index 17), setting the stage for potential short-term rebounds if conditions improve.

Short-term support sits near $78,513, while daily support at $74,601 remains the key downside threshold. Resistance between $79,104 and $79,169 must be overcome for any sustained relief. Current p

Bitcoin is attempting to stabilize after recent sharp declines, with BTC/USDT trading at $78,543 and posting a modest 1.89% gain. The market remains fragile, characterized by low liquidity, wide bid-ask spreads, and extreme fear (F&G Index 17), setting the stage for potential short-term rebounds if conditions improve.

Short-term support sits near $78,513, while daily support at $74,601 remains the key downside threshold. Resistance between $79,104 and $79,169 must be overcome for any sustained relief. Current p

BTC-6,34%

- Reward

- 5

- 4

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#WhenWillBTCRebound? Bitcoin Market at a Decision Point

Bitcoin is attempting to stabilize after an aggressive sell-off, with BTC/USDT trading near $78,543 and posting a modest 1.89% recovery. Despite the bounce, market structure remains fragile as liquidity is thin, spreads are wide, and sentiment is locked in extreme fear. This creates a market where rebounds are possible, but conviction remains weak.

From a price-structure perspective, Bitcoin is holding just above short-term support near $78,513, while the daily support zone at $74,601 remains the key downside reference. Resistance between

Bitcoin is attempting to stabilize after an aggressive sell-off, with BTC/USDT trading near $78,543 and posting a modest 1.89% recovery. Despite the bounce, market structure remains fragile as liquidity is thin, spreads are wide, and sentiment is locked in extreme fear. This creates a market where rebounds are possible, but conviction remains weak.

From a price-structure perspective, Bitcoin is holding just above short-term support near $78,513, while the daily support zone at $74,601 remains the key downside reference. Resistance between

BTC-6,34%

- Reward

- 5

- 5

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

Trending Topics

View More73.55K Popularity

3.26K Popularity

1.38K Popularity

1.83K Popularity

5.65K Popularity

Pin